A stock warrant is a financial tool that provides the holder with the right to buy or sell a set number of shares of a company's stock at a predetermined price within a specified timeframe but without any obligation to do so. Stock warrants have become increasingly popular with investors as an alternative way to invest in the stock market and diversify their portfolios beyond holding and buying stocks. Need help with Stock Warrants? Click here. Stock warrants can be classified into four types: call warrants, put warrants, covered warrants, and naked warrants. A call warrant provides the holder with the option to purchase a particular quantity of a company's shares at a predetermined price during a specific time frame. Call warrants are often issued by the company whose shares they represent, and they may offer investors a way to profit from an increase in the company's share price. A put warrant gives the holder the right to sell a specific number of shares of a company's stock at a predetermined price, within a certain period. Put warrants are often issued by investment banks, and they may offer investors a way to hedge against a decline in the company's share price. Covered warrants are issued by financial institutions, and they are backed by the institution's own shares or by shares of another company. Covered warrants can be used to speculate on the future price movement of a company's stock, or they can be used as a way to hedge against the risk of holding the company's stock. Naked warrants are similar to covered warrants, except they are not backed by any underlying assets. Naked warrants are considered riskier than covered warrants because they are not backed by any assets, and the investor is relying solely on the issuer's ability to fulfill the terms of the warrant. Stock warrants have several key features that investors need to understand before investing in them. The exercise price, also known as the strike price, is the price at which the holder of a stock warrant can buy or sell the underlying stock. The exercise price is predetermined at the time the warrant is issued and remains fixed for the duration of the warrant. The expiration date is the date on which the stock warrant expires. Once a stock warrant expires, it is no longer valid, and the holder loses the right to buy or sell the underlying stock at the exercise price. The premium is the price paid for a stock warrant. The premium is determined by the market and is based on factors such as the current market price of the underlying stock, the time remaining until expiration, and the exercise price. Stock warrants can lead to the dilution of existing shareholders' equity. This happens because when a warrant is exercised, new shares of stock are issued, which increases the total number of shares outstanding, which in turn reduces the value of existing shares. Stock warrants are traded on exchanges, just like stocks. When a stock warrant is exercised, the settlement process is similar to that of stocks. The buyer of the warrant will receive the underlying shares, and the seller of the warrant will receive the exercise price. Stock warrants offer several advantages and disadvantages that investors need to consider before investing in them. Leverage: Stock warrants can provide investors with leverage, which means that they can control a large number of shares of a company's stock with a relatively small investment. Lower Initial Investment: Stock warrants can be purchased for a fraction of the price of the underlying stock, which means that investors can gain exposure to a company's stock without having to invest a large amount of capital upfront. Higher Potential Return: Stock warrants have the potential to provide higher returns than investing in the underlying stock itself, especially if the stock price increases significantly. Diversification: Stock warrants can provide investors with a way to diversify their portfolios beyond buying and holding stocks. Time Sensitivity: Stock warrants have an expiration date, which means that investors must be able to predict the future movement of the stock price accurately. Otherwise, they risk losing their investment entirely. Risk of Loss: As with any investment, there is a risk of loss when investing in stock warrants. If the stock price does not move in the desired direction, investors may lose their entire investment. Lower Liquidity: Stock warrants are often less liquid than the underlying stock, which means that it may be challenging to sell them at a reasonable price. Complexity: Stock warrants can be complex financial instruments, and investors must fully understand their terms and conditions before investing in them. Investing in stock warrants requires a solid understanding of the market and the specific warrant that an investor is interested in. Here are some steps investors can follow to invest in stock warrants: Research and Analysis: Investors should conduct thorough research and analysis on the warrant's issuer, the underlying stock, and the warrant's terms and conditions. Understanding Market Conditions: Investors should understand the current market conditions and how they may affect the warrant's price and potential return. Choosing the Right Brokerage Firm: Investors should select a brokerage firm that offers trading warrants and has a good reputation for providing reliable market data and research. Identifying the Right Warrants: Investors should identify warrants that meet their investment objectives, such as the warrant's expiration date, exercise price, premium, and potential return. Investing in stock warrants carry several risks that investors should consider before investing: Market Risk: The value of a stock warrant is closely tied to the price of the underlying stock. If the stock price does not move in the desired direction, the investor may lose their investment. Credit Risk: Stock warrants are often issued by financial institutions, and there is a risk that the issuer may default on their obligations. Time Decay: Stock warrants have an expiration date, which means that they lose value as the expiration date approaches, regardless of the underlying stock's price movement. Liquidity Risk: Stock warrants are often less liquid than the underlying stock, which means that it may be challenging to sell them at a reasonable price. Stock warrants offer investors a way to diversify their portfolios and potentially gain exposure to a company's stock without investing a significant amount of capital upfront. However, investors must fully understand the terms and conditions of the warrants they are interested in and be aware of the potential risks associated with investing in them. Thorough research and analysis, understanding market conditions, choosing the right brokerage firm, and identifying the right warrants are all essential steps for investing in stock warrants. It's important to note that investing in stock warrants is not for everyone, and investors should consider their individual investment goals, risk tolerance, and financial situation before investing. For those who are unsure of how to proceed, it may be beneficial to seek the services of a wealth management advisor who can provide expert guidance on investing in stock warrants and other investment options.Definition of Stock Warrants

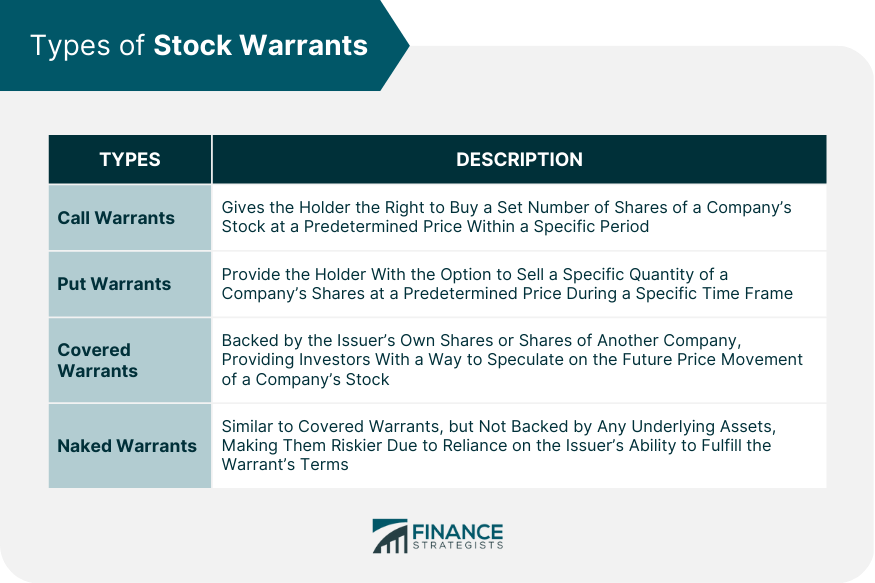

Types of Stock Warrants

Call Warrants

Put Warrants

Covered Warrants

Naked Warrants

How Stock Warrants Work

Exercise Price

Expiration Date

Premium

Dilution

Trading and Settlement

Pros and Cons of Stock Warrants

Pros

Cons

How to Invest in Stock Warrants

Risks and Considerations in Investing in Stock Warrants

The Bottom Line

Stock Warrants FAQs

Stock warrants are a type of financial instrument that grants the holder the right, but not the obligation, to purchase or sell a specific number of shares of a company's stock at a predetermined price, within a certain period. They work by giving the holder the option to buy or sell the underlying stock at a fixed price, regardless of the current market price.

Stock warrants offer several advantages, including leverage, lower initial investment, higher potential returns, and diversification. They can provide investors with exposure to a company's stock without investing a significant amount of capital upfront.

Investing in stock warrants carries several risks, including market risk, credit risk, time decay, and liquidity risk. Investors must be aware of the potential risks associated with investing in stock warrants before making investment decisions.

Investors can invest in stock warrants by conducting thorough research and analysis, understanding market conditions, choosing the right brokerage firm, and identifying the right warrants that meet their investment objectives.

Investing in stock warrants is not for everyone, and investors should consider their individual investment goals, risk tolerance, and financial situation before investing. It may be beneficial to seek the services of a wealth management advisor who can provide expert guidance on investing in stock warrants and other investment options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.