Commodity swaps are a financial instrument used by market participants to manage risk and speculate on price fluctuations in commodities such as oil, natural gas, metals, and agricultural products. They involve the exchange of cash flows between two parties based on an agreed-upon notional amount and commodity reference price. This article explores the various aspects of commodity swaps, including their structure, applications, advantages, and disadvantages. There are several types of commodity swaps, each serving a different purpose in the financial market. In this type of swap, one party agrees to pay a fixed price for a commodity, while the other party pays a floating price based on a predetermined reference index. The primary purpose of fixed-for-floating swaps is to hedge against price fluctuations in the commodity market. These swaps involve the exchange of cash flows based on the price of two different commodities. The main objective is to manage risk associated with exposure to a particular commodity or to diversify a portfolio. Differential swaps involve the exchange of cash flows based on the difference between the prices of two related commodities. These swaps are typically used for arbitrage opportunities and speculating on price discrepancies. Commodity swaps consist of three primary components: Swap Agreement: A legally binding contract between two parties outlining the terms and conditions of the swap. Notional Amount: The hypothetical quantity of the commodity upon which the cash flows are based. Payment Frequency: The agreed-upon schedule for exchanging cash flows, typically monthly or quarterly. The price of a commodity swap is influenced by the following factors: Commodity Reference Price: The benchmark price for the commodity, such as the West Texas Intermediate (WTI) for crude oil or the London Metal Exchange (LME) for metals. Market Factors: Supply and demand dynamics, geopolitical events, and other market forces that can impact commodity prices. Commodity swaps can be settled in two ways: Cash Settlement: The parties exchange cash flows based on the difference between the agreed-upon prices. Physical Delivery: The underlying commodity is physically delivered between the parties at the agreed-upon price. Commodity swaps have various applications, including risk management, speculation, and arbitrage. Risk Management Companies exposed to commodity price fluctuations can use commodity swaps to hedge their risks and stabilize their cash flows. Speculation Traders and investors can use commodity swaps to speculate on future price movements in the commodity market, potentially earning profits from accurate predictions. Arbitrage Market participants can exploit price discrepancies between related commodities or markets through commodity swaps, diversifying their portfolios and earning risk-free profits. Below are the advantages and disadvantages of commodity swaps. Flexibility in Managing Commodity Exposure: Commodity swaps allow companies to hedge against price fluctuations and reduce risk. Customization: Swaps can be tailored to the specific needs and risk profiles of the parties involved. Lower Transaction Costs: Compared to futures, commodity swaps generally have lower transaction costs. Counterparty Risk: The risk that one party fails to meet its obligations under the swap agreement. Complexity and Lack of Transparency: Commodity swaps can be complex and difficult to understand, leading to potential mispricing and valuation issues. Limited Liquidity: The commodity swap market may have limited liquidity compared to more standardized financial instruments like futures. Regulators play a crucial role in overseeing the commodity swaps market to ensure its stability, transparency, and protection of market participants. Commodity Futures Trading Commission (CFTC): The CFTC is the primary regulator for commodity swaps in the United States. It enforces rules and regulations governing the trading and clearing of swaps. International Swaps and Derivatives Association (ISDA): The ISDA is a global trade association representing participants in the over-the-counter derivatives market, including commodity swaps. It develops standardized documentation and promotes best practices for the industry. Regulatory bodies impose various requirements and standards for commodity swaps, including mandatory clearing, margin requirements, trade reporting, and capital adequacy standards. Many companies, especially those in the energy and agriculture sectors, have successfully used commodity swaps to hedge against price fluctuations, providing stability and predictability to their cash flows. Some high-profile failures in the commodity swap market, such as the collapse of Metallgesellschaft AG in 1993, have highlighted the potential risks and complexities associated with these financial instruments. These failures underscore the importance of understanding the risks and intricacies of commodity swaps and the need for proper risk management practices and regulatory oversight. Commodity swaps play a vital role in the global financial market, allowing companies to manage risk and capitalize on opportunities in the commodity sector. While offering numerous benefits, such as flexibility and customization, they also present challenges like counterparty risk and limited liquidity. As the market continues to evolve, participants must remain vigilant in understanding and managing the risks associated with these complex financial instruments. An expert in wealth management can help provide guidance in investing in commodity swaps.What Are Commodity Swaps?

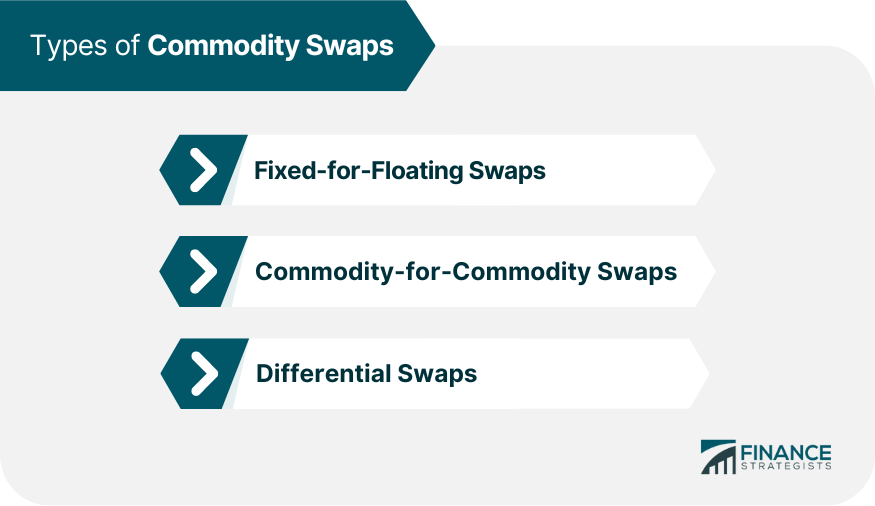

Types of Commodity Swaps

Fixed-for-Floating Swaps

Commodity-for-Commodity Swaps

Differential Swaps

Structure of Commodity Swaps

Pricing of Commodity Swaps

Settlement of Commodity Swaps

Applications of Commodity Swaps

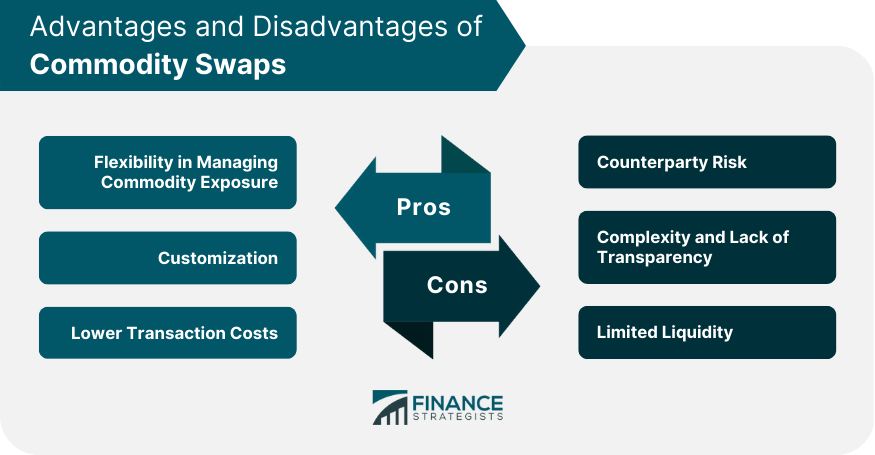

Advantages and Disadvantages of Commodity Swaps

Advantages

Disadvantages

Regulatory Environment and Compliance

Role of Regulators in the Commodity Swaps Market

Major Regulatory Bodies

Regulatory Requirements and Standards

Case Studies and Real-World Examples

Successful Use of Commodity Swaps in Risk Management

Notable Commodity Swap Failures

Lessons Learned and Best Practices

Conclusion

Commodity Swaps FAQs

Commodity swaps are financial instruments that allow market participants to manage risk and speculate on price fluctuations in commodities. They involve the exchange of cash flows between two parties based on an agreed-upon notional amount and commodity reference price. They are important for helping companies hedge against price volatility and providing stability in the commodity market.

Commodity swaps are over-the-counter (OTC) derivatives, customized to the specific needs of the parties involved, while futures and options are standardized contracts traded on exchanges. Swaps involve the exchange of cash flows based on the difference in commodity prices, whereas futures and options involve the buying and selling of the underlying commodity at a predetermined price on a future date.

There are three main types of commodity swaps: fixed-for-floating swaps, commodity-for-commodity swaps, and differential swaps. Fixed-for-floating swaps are used to hedge against price fluctuations; commodity-for-commodity swaps help manage risk associated with exposure to a particular commodity or diversify a portfolio; and differential swaps are used for arbitrage and speculation on price discrepancies.

Advantages of using commodity swaps include flexibility in managing commodity exposure, customization to meet specific needs, and lower transaction costs compared to futures. Disadvantages include counterparty risk, complexity and lack of transparency, and limited liquidity in the market.

Commodity swaps are regulated by various regulatory bodies, including the Commodity Futures Trading Commission (CFTC) in the United States and the International Swaps and Derivatives Association (ISDA) globally. These organizations enforce rules and regulations governing the trading and clearing of swaps, as well as promote best practices and standardized documentation for the industry.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.