Collateralized Mortgage Obligations are securities that are backed by a pool of mortgage loans. These loans are grouped together, and the cash flows from the mortgage payments are used to create different classes or tranches of securities. CMOs are a type of mortgage-backed security (MBS) that are used to help finance the housing market. The concept of CMOs was first introduced in the 1980s as a way to address the prepayment risk associated with MBSs. Prepayment risk refers to the risk that homeowners will refinance their mortgages or pay them off early, which can cause the cash flows from the MBSs to change. CMOs were designed to help investors manage this risk by creating securities with different maturities and cash flows. CMOs have played an important role in the mortgage market by providing a way to finance the purchase of homes. These securities have helped to make mortgage loans more widely available by allowing banks and other financial institutions to sell their loans to investors. CMOs have also provided investors with an opportunity to invest in the housing market and earn a return on their investment. Pass-through securities are the simplest type of CMO. These securities are created by pooling a group of mortgages together, and the cash flows from the mortgage payments are passed through to the investors. The investors receive a pro-rata share of the principal and interest payments made on the mortgages. PAC bonds are created by dividing the cash flows from the mortgage payments into two separate streams. The first stream is used to pay the principal and interest on the PAC bonds, while the second stream is used to pay the principal and interest on a companion bond. The companion bond is designed to absorb any prepayments that occur on the mortgages. Support bonds are created to protect investors from the prepayment risk associated with the mortgages. These bonds are designed to absorb any prepayments that occur on the mortgages, which helps to protect the cash flows to the other classes of securities. Sequential pay bonds are created by dividing the cash flows from the mortgage payments into a series of tranches, which are paid in a specific order. The first tranche receives all of the principal and interest payments until it is paid off, and then the second tranche receives all of the payments until it is paid off, and so on. The first step in creating a CMO is to pool a group of mortgages together. These mortgages are typically originated by banks or other financial institutions and are sold to investors in the form of securities. Once the mortgages are pooled together, they are divided into different classes or tranches of securities. Each tranche has a different maturity and cash flow structure. The cash flows from the mortgage payments are used to pay the principal and interest on the different tranches of securities. The cash flows are divided among the tranches based on their maturity and cash flow structure. CMOs are assigned credit ratings by rating agencies based on their credit quality. The ratings range from AAA for the highest quality securities to D for the lowest quality securities. Prepayment risk is the risk that homeowners will refinance their mortgages or pay them off early, which can cause the cash flows from the CMOs to change. This can be a significant risk for investors because it can cause the value of the securities to decline. Interest rate risk is the risk that changes in interest rates will affect the value of the CMOs. If interest rates rise, the value of the securities may decline, and if interest rates fall, the value of the securities may increase. Credit risk is the risk that the homeowners who are making the mortgage payments will default on their loans. This can cause the cash flows from the CMOs to decline, which can affect the value of the securities. Liquidity risk is the risk that the CMOs will be difficult to sell in the market. If investors need to sell their securities quickly, they may not be able to find a buyer, which can cause the value of the securities to decline. CMOs provide investors with a way to diversify their investments. Investing in a pool of mortgages can spread their risk across multiple borrowers and properties. CMOs typically offer higher yields than other fixed-income securities with similar credit ratings. This can be attractive to investors who are looking for higher returns on their investments. CMOs can be customized to meet the specific needs of investors. For example, investors can choose securities with different maturities and cash flow structures to match their investment objectives. The market for CMOs includes a range of participants, including banks, financial institutions, hedge funds, and individual investors. The market for CMOs has grown significantly over the past few decades. In 2020, the market for CMOs was estimated to be around $2 trillion. The market for CMOs is regulated by the Securities and Exchange Commission (SEC). The SEC requires issuers of CMOs to provide investors with detailed information about the underlying mortgages, including information about the borrowers and the properties. Collateralized Mortgage Obligations are securities backed by a pool of mortgage loans. These securities have played an important role in the mortgage market by financing the purchase of homes and allowing investors to earn a return on their investment. The future outlook for CMOs is positive, as they continue to be an important part of the mortgage market. However, investors need to be aware of the risks associated with these securities, including prepayment, interest rate, credit, and liquidity risks. CMOs have been an important part of the mortgage market for many years, and they will likely continue to play an important role in the future. These securities allow investors to invest in the housing market and help make mortgage loans more widely available. Collateralized Mortgage Obligations (CMOs) are essential to the mortgage market, allowing investors to diversify their investments, earn higher yields, and customize their portfolios. However, they also carry prepayment, interest rate, credit, and liquidity risks. As the market for CMOs continues to grow, investors must seek guidance from a wealth management professional who can help them navigate the complexities of these securities and make informed investment decisions. By partnering with a skilled wealth manager, investors can achieve their financial goals and secure their future. Therefore, if you want to invest in CMOs, we recommend hiring a wealth management professional today.What Are Collateralized Mortgage Obligations (CMOs)?

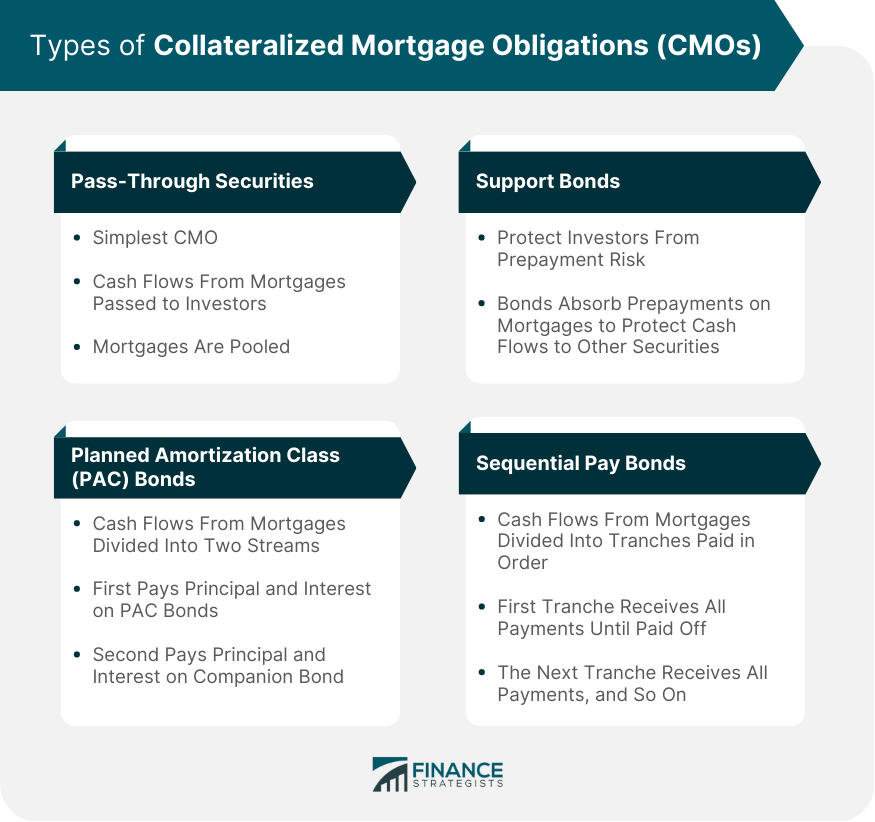

Types of Collateralized Mortgage Obligations

Pass-Through Securities

Planned Amortization Class (PAC) Bonds

Support Bonds

Sequential Pay Bonds

Structure of Collateralized Mortgage Obligations

Pooling of Mortgages

Tranches

Cash Flows

Credit Ratings

Risks and Benefits of Collateralized Mortgage Obligations

Risks

Prepayment risk

Interest Rate Risk

Credit Risk

Liquidity Risk

Benefits

Diversification

Higher Yields

Customization

Market for Collateralized Mortgage Obligations

Participants

Market Size and Growth

Regulation

Conclusion

Collateralized Mortgage Obligations (CMOs) FAQs

Collateralized Mortgage Obligations (CMOs) are securities backed by a pool of mortgage loans. They are mortgage-backed security (MBS) used to finance the housing market.

CMOs can be divided into four types: Pass-through securities, Planned amortization class (PAC) bonds, Support bonds, and Sequential pay bonds.

CMOs provide investors with diversification, higher yields, and customization of their portfolios.

The risks associated with investing in CMOs include prepayment, interest rate, credit, and liquidity risks.

The market for CMOs is regulated by the Securities and Exchange Commission (SEC). Issuers of CMOs are required to provide investors with detailed information about the underlying mortgages.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.