Classic car investments involve purchasing and holding vintage or collectible automobiles to profit from their value appreciation over time. These vehicles are often considered valuable due to their rarity, historical significance, or unique design features. Investing in classic cars can offer several advantages, including the potential for high returns, the joy of owning a piece of automotive history, and the opportunity to diversify one's investment portfolio. Before diving into the world of classic car investments, it is essential to understand the factors that influence their value and investment potential. Understanding the classic car market is essential for making informed investment decisions. Factors influencing the value of classic cars include rarity, provenance, condition, and market demand. Staying updated on market trends can help investors identify potentially profitable opportunities. Not all classic cars are equally valuable or likely to appreciate in value. Researching specific models and their historical performance can help investors identify cars with the most potential for profit. Investing in classic cars is not without risk. Below are the risks associated with classic car investments and how to balance them with potential rewards. As with any investment, classic car investments carry certain risks. These may include market fluctuations, unexpected maintenance or restoration costs, and challenges related to storage and insurance. To maximize returns and minimize risk, investors should carefully weigh the potential rewards and risks of each classic car investment opportunity. This may involve considering factors such as market trends, vehicle conditions, and the investor's own expertise. Diversification is a key strategy for reducing risk in any investment portfolio. By investing in a variety of classic cars, investors can protect themselves from fluctuations in the value of specific models or market segments. Investors should consider factors such as vehicle age, make, model, and rarity to build a diverse classic car investment portfolio. Additionally, investors may want to include both high-risk, high-reward opportunities and more stable, lower-risk investments. Successful classic car investors typically possess extensive knowledge of the market, individual car models, and the history of the automotive industry. Developing this expertise can help investors make more informed decisions and increase their chances of success. Leveraging the expertise of classic car experts, such as appraisers, restorers, and auction houses, can provide valuable insights and help investors make better-informed decisions. Additionally, online resources, forums, and classic car clubs can be invaluable sources of information. The buy-and-hold strategy involves purchasing classic cars and holding onto them for an extended period, typically several years or more. This approach allows investors to benefit from the long-term appreciation of the value of their classic car investments. Flipping classic cars involves purchasing vehicles, making necessary improvements, and selling them relatively quickly for a profit. This strategy can offer higher short-term returns but also carries greater risks and often requires more hands-on involvement from the investor. Investing in classic cars involves various costs beyond the initial purchase price, such as maintenance, restoration, storage, insurance, and transportation. Being aware of these expenses is crucial for accurately assessing the potential profitability of a classic car investment. Investors should look for ways to minimize expenses to maximize returns on classic car investments. Strategies may include negotiating better purchase prices, partnering with skilled restorers, or seeking cost-effective storage and insurance solutions. Classic car investments can have various tax implications, including capital gains tax and sales tax. Understanding the relevant tax laws and regulations is crucial for compliant and tax-efficient investment strategies. Investors can optimize tax benefits by considering factors such as the holding period, the use of the vehicle, and the structure of the investment. Consulting with a tax professional can help investors develop tax-efficient strategies tailored to their specific circumstances. Choosing the right time to sell a classic car investment is crucial for maximizing returns. Investors should consider factors such as market trends, vehicle condition, and their own financial goals when deciding when to sell. To ensure a successful sale, investors should present their classic cars in the best possible condition, market them effectively, and leverage their network of classic car enthusiasts and experts. Additionally, investors may consider using auction houses or consignment dealers to facilitate sales. Classic car investments offer a unique and potentially lucrative alternative to traditional investment vehicles. With a thorough understanding of market trends, risk management, diversification, investment strategies, and tax implications, investors can capitalize on the growing classic car market. As the market continues to evolve, new opportunities and challenges will emerge, making it essential for investors to stay informed and adapt their strategies accordingly. Investing in classic cars can offer significant rewards, but it also carries inherent risks. To succeed, investors should develop a deep understanding of the market, carefully evaluate each investment opportunity, and employ strategies to minimize risks and costs. As interest in classic cars continues to grow, new investment opportunities and challenges will undoubtedly arise. Staying informed about market trends, regulations, and emerging technologies will help investors adapt and thrive in the ever-evolving classic car investment landscape. To ensure the best possible outcomes in your classic car investments and other wealth management endeavors, consider seeking the guidance of professional wealth management services. These experts can help you navigate the complexities of the classic car market, develop personalized investment strategies, and optimize your financial growth. What Are Classic Car Investments?

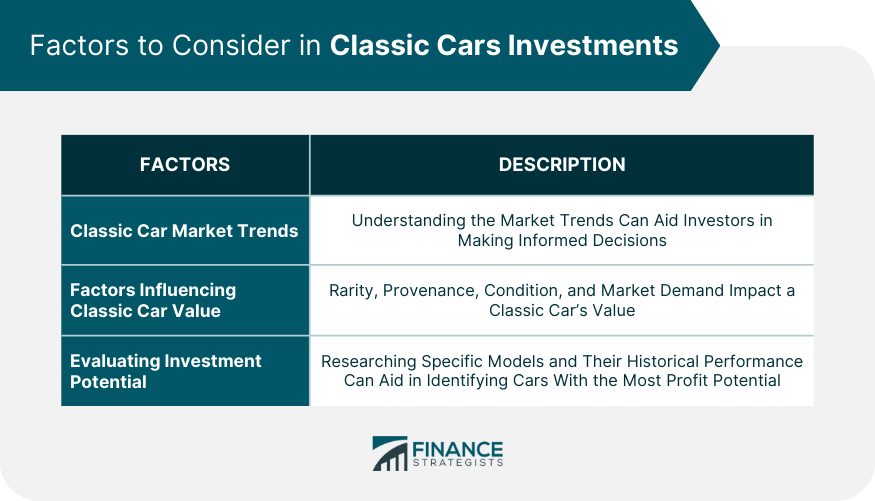

Factors to Consider in Classic Cars Investments

Classic Car Market Trends and Factors Influencing Value

Evaluating the Investment Potential of Specific Classic Car Models

Classic Cars Investments: Assessing Risk and Reward

Understanding the Risks Associated with Classic Car Investments

Balancing Risk and Reward for Optimal Classic Car Investment Strategies

Building a Diverse Classic Cars Investment Portfolio

The Role of Expertise in Classic Cars Investments

Developing and Leveraging Knowledge for Successful Classic Car Investments

Utilizing Classic Car Experts and Resources to Enhance Investment Decisions

Classic Cars Investment Strategies

Buy-And-Hold Strategy for Long-Term Classic Car Investments

Flipping Classic Cars for Short-Term Investment Gains

Classic Cars Investment Costs and Expenses

Understanding the Costs Associated with Classic Car Investments

Strategies for Minimizing Expenses in Classic Car Investments

Tax Implications of Classic Cars Investments

Selling and Liquidating Classic Cars Investments

Final Thoughts

Classic Cars Investments FAQs

A classic car investment refers to the purchase and ownership of vintage or antique automobiles with the intention of selling them later for a profit. These vehicles are often valued for their rarity, historical significance, or unique design features.

Important factors to consider when investing in classic cars include market trends, rarity, provenance, vehicle condition, and market demand. Researching specific car models and their historical performance can also help you identify cars with the best potential for profit.

Risks associated with classic car investments include market fluctuations, unexpected maintenance or restoration costs, storage and insurance challenges, and potential difficulty in selling the vehicle. Diversifying your classic car investment portfolio can help mitigate these risks.

To build a diverse classic car investment portfolio, consider factors such as vehicle age, make, model, and rarity. Aim to include a mix of high-risk, high-reward opportunities and more stable, lower-risk investments. Leveraging the expertise of classic car experts and utilizing online resources can also help you make informed decisions.

Classic car investments can have various tax implications, including capital gains tax and sales tax. It is essential to understand the relevant tax laws and regulations for compliant and tax-efficient investment strategies. Consulting a tax professional can help you develop tax-efficient strategies tailored to your specific circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.