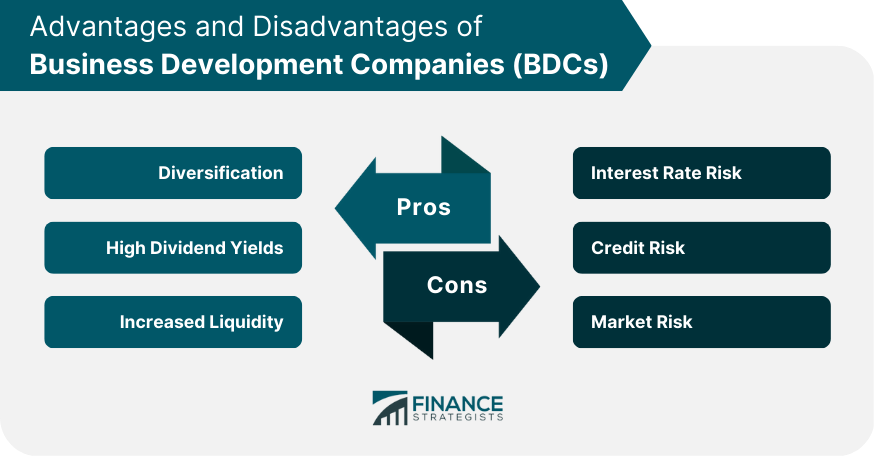

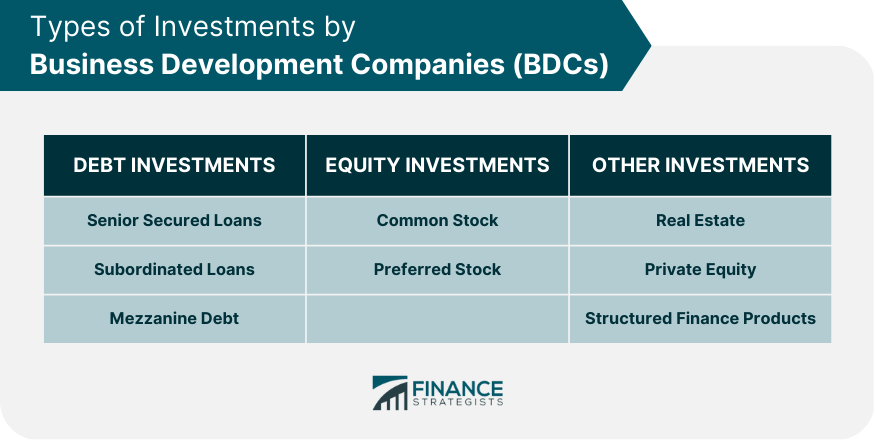

Business Development Companies (BDCs) are a type of closed-end investment company that raises capital through the public offering of securities. They were created by the United States Congress in 1980 to provide small and medium-sized businesses with access to capital. BDCs invest in a variety of debt and equity securities, and they are subject to certain regulatory requirements. BDCs invest in a wide range of companies in the technology, healthcare, and energy sectors. They typically invest in debt and equity securities, and their investment strategy is geared towards providing capital to companies that are not large enough to access traditional sources of financing. BDCs also provide managerial assistance and strategic guidance to the companies they invest in. BDCs raise capital through the public offerings securities, such as common stock, preferred stock, and debt securities. They also borrow money from banks and other financial institutions. BDCs must distribute at least 90% of their taxable income to shareholders in the form of dividends. BDCs are subject to certain regulatory requirements, including registration with the Securities and Exchange Commission (SEC) and compliance with the Investment Company Act of 1940. BDCs must also adhere to certain leverage limits, which dictate the amount of debt they can incur relative to their equity capital. BDCs are managed by a board of directors and an investment adviser responsible for making investment decisions. BDCs must have at least two independent directors and hold annual shareholder meetings. BDCs differ in several ways from other investment vehicles, such as venture capital and private equity. For example, BDCs invest in a broader range of companies, while venture capital and private equity firms typically focus on early-stage companies with high growth potential. BDCs also offer more liquidity to investors as their securities trade on public exchanges. BDCs offer several advantages, including the ability to invest in a diversified portfolio of companies, high dividend yields, and more liquidity than other investment vehicles. However, BDCs also carry certain risks, including exposure to interest rates, credit, and market risks. BDCs are subject to several risks, including interest rate, credit, and market risks. Interest rate risk arises from changes in interest rates, which can affect the value of a BDC's investments. Credit risk arises from the possibility of default by a borrower, while market risk arises from changes in the value of securities held by the BDC. Investors and analysts use a variety of metrics to evaluate BDC performance, including net asset value (NAV), earnings per share (EPS), dividend yield, and price-to-earnings (P/E) ratio. These metrics can help investors assess the financial health of a BDC and determine whether it is a good investment opportunity. BDCs typically invest in a range of debt securities, including senior secured loans, subordinated loans, and mezzanine debt. These investments offer relatively high yields and can provide downside protection in the event of a default. BDCs also invest in equity securities, such as common stock and preferred stock. These investments can offer higher potential returns than debt securities but also carry greater risk. In addition to debt and equity securities, BDCs may invest in a range of other assets, including real estate, private equity, and structured finance products. BDCs play an important role in providing capital to small and medium-sized businesses, which may not have access to traditional sources of financing. By investing in these companies, BDCs can help them grow and create jobs, which can positively impact the overall economy. BDCs can also have a positive impact on job creation and economic growth by investing in companies that are poised for growth. BDCs can help these companies expand their operations and create new jobs by providing capital and strategic guidance. BDCs are subject to a range of regulatory and legislative requirements, which can affect their operations and profitability. Changes in regulations or legislation can significantly impact the BDC industry and the companies they invest in. Business Development Companies (BDCs) are a unique investment vehicle providing capital access for small and medium-sized businesses. BDCs invest in a range of debt and equity securities and are subject to certain regulatory requirements. They offer several advantages, including high dividend yields and liquidity, but they also carry certain risks. The BDC industry is highly competitive and faces competition from other financial institutions. Despite these challenges, BDCs play an important role in the economy by providing capital to companies and supporting job creation and economic growth. Investing in Business Development Companies (BDCs) can be a valuable addition to a well-diversified portfolio, offering high dividend yields and exposure to various companies. However, due to the risks associated with BDCs, it is important to consider these investments in the context of an overall wealth management strategy. Seeking the advice of a qualified wealth management professional can help investors determine whether BDCs are a suitable investment for their portfolio and manage risk effectively.What Are Business Development Companies (BDCs)?

Structure of Business Development Companies (BDCs)

Investment Strategy

Sources of Capital

Regulatory Requirements

Governance Structure

Business Development Companies (BDCs) vs. Other Investment Vehicles

Differences between BDCs, Venture Capital, and Private Equity

Advantages and Disadvantages of BDCs

Performance of Business Development Companies (BDCs)

Risks Associated with BDCs

Metrics Used to Evaluate BDC Performance

Types of Investments by Business Development Companies (BDCs)

Debt Investments

Equity Investments

Other Investments

Role of Business Development Companies (BDCs) in the Economy

Impact on Small and Medium-Sized Businesses

Job Creation and Economic Growth

Regulatory and Legislative Landscape

Final Thoughts

Business Development Companies (BDCs) FAQs

A Business Development Company (BDC) is a type of investment company that raises capital through the public offering of securities. BDCs invest in a range of debt and equity securities and provide capital to small and medium-sized businesses.

BDCs differ from other investment vehicles in several ways. For example, BDCs invest in a broader range of companies than private equity and venture capital firms. BDCs also offer more liquidity to investors as their securities trade on public exchanges.

BDCs are subject to several risks, including interest rate, credit, and market risks. Interest rate risk arises from changes in interest rates, which can affect the value of a BDC's investments. Credit risk arises from the possibility of default by a borrower, while market risk arises from changes in the value of securities held by the BDC.

BDCs invest in a range of debt and equity securities, including senior secured loans, subordinated loans, and mezzanine debt. They may also invest in other assets like real estate, private equity, and structured finance products.

BDCs play an important role in the economy by providing capital to small and medium-sized businesses, which may not have access to traditional sources of financing. By investing in these companies, BDCs can help them grow and create jobs, which can positively impact the overall economy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.