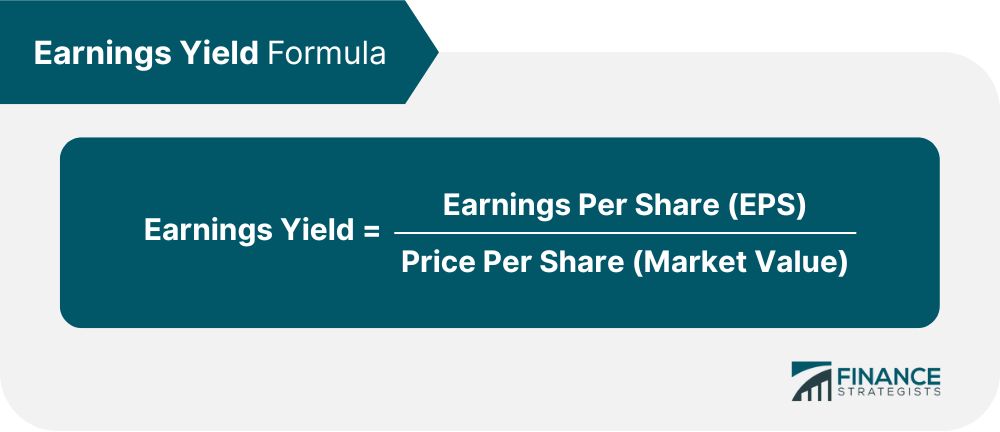

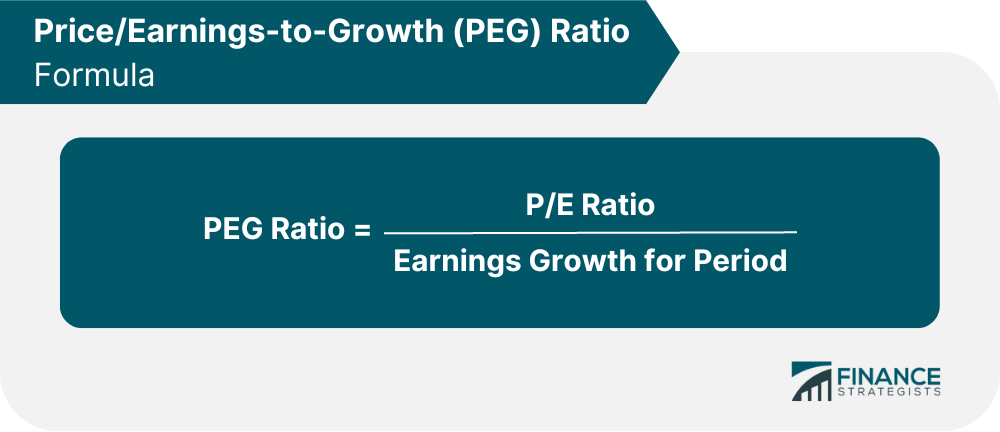

If a company reports either no earnings for a period, or reports a loss, then its EPS will be represented by a negative number. Since EPS goes in the denominator of the P/E ratio, it is possible to calculate a negative value. Conventionally, however, companies will report such ratios as "N/A" rather than a negative value. Some investors also prefer to use N/A, or else report a value of 0 until the EPS is positive. P/E ratio, or the Price-to-Earnings ratio, is a metric measuring the price of a stock relative to its earnings per share (EPS). The P/E ratio is derived by taking the price of a share over its estimated earnings. As such, a higher value generally indicates a greater cost for a lower return, and a lower value generally indicates a greater return for a lower cost. The trailing P/E ratio measures the EPS of a stock for the previous 12 months whereas the forward P/E ratio forecasts the future projected EPS of a stock. Trailing P/E ratios are derived from the earnings per share of a stock over the last 12 months, rather than future projections. Many investors prefer this valuation method because it is more objective; based on already recorded figures rather than predicted figures. Cautious investors don't always trust the calculations of analysts or the figures published by a company. However, this method has some drawbacks as well. Namely, past earnings do not always correlate with future earnings. The stock market fluctuates constantly, and so the price of a stock yesterday is not always a good indication of the price tomorrow. Forward P/E ratio refers to a P/E ratio that is derived from projected future earnings. It is necessarily an estimate, and as such is sometimes called an "estimated P/E ratio". Forward P/E ratios can be useful for comparing current earnings with future earnings to estimate growth. As well, if the projections are accurate, it can give investors an insight into stocks that are likely to soon experience growth. Companies often report their own forward P/E ratio. The meaning of a P/E ratio is largely dependent on context. The industry of the company, the state of the overall market, and the investor's own interpretation can all affect how they evaluate a particular P/E ratio. Some industries, such as the utility industry, have historically high P/E ratios. As such, when looking at the stock of a particular company, it is more useful to evaluate the P/E ratio of that company against the industry average rather than the market average. A good P/E ratio is one that is consistent or shows consistent growth. The actual number that this may be for a particular company may vary. P/E ratios can be misleading if looked at without considering a company's recent history. A company whose P/E ratio seems to accurately value the stock is generally the safer option, rather than risking money on a stock that seems over or undervalued. A company's P/E ratio is calculated by dividing the stock price with earnings per share (EPS). A high P/E ratio indicates that the price of a stock is estimated to be relatively high compared to its earnings. This may or may not necessarily be a problem. A high P/E ratio could mean that the market is undervaluing a particular stock. If this is the case, then the value could soon increase. High P/E ratios must also be interpreted within the context of the entire industry. A high P/E ratio for, say, a particular utility company isn't necessarily a problem if many other utility companies in the industry tend to have high P/E ratios. A simple way to think about the P/E ratio is how much you are paying for one dollar of earnings per year. A ratio of 10 indicates that you are willing to pay $10 for $1 of earnings. This is why the P/E ratio is also sometimes called the "P/E multiple". In this case, it shows that investors are willing to pay ten times the earnings for this stock. One limitation of the P/E ratio is that it is difficult to use when comparing companies across industries. Additionally, different industries can have wildly different P/E ratios (high-tech industries and startups often have negative or 0 P/E while a retailer like Walmart may have 20 or more). Earnings yield is simply the inverse of the P/E ratio, expressed as: Earnings yield is sometimes used to evaluate return on investment, whereas the P/E ratio is largely concerned with stock valuation and estimating changes. The Price-to-Earnings-to-Growth ratio, also called the PEG ratio, measures a company's current P/E ratio against its estimated growth potential to more accurately determine if a stock is under or overvalued. The PEG ratio uses trailing P/E ratio and divides it by a company's earnings growth over a specified period of time. While there is no meaningful average P/E ratio across the entire stock market, the S&P 500, which has historically been used as a stock market benchmark, has an average P/E ratio of 13-15. As a point of interest, the lowest P/E ratio recorded for the S&P 500 occurred in December of 1917 when it traded for a mere 5.31 times earnings. The highest occurred in May of 2009 when it traded for 123.73 times earnings.Negative P/E Ratio Summary

Define P/E Ratio In Simple Terms

Trailing vs Forward P/E Ratio

Trailing P/E Ratio

Forward P/E Ratio

P/E Ratio Meaning

What Is a Good P/E Ratio?

P/E Ratio Formula

High P/E Ratio

How Do You Interpret P/E Ratio?

Limitations of P/E Ratio

P/E Ratio vs Earnings Yield

Price/Earnings-to-Growth (PEG) Ratio

Average P/E Ratio

What Is a Negative P/E Ratio? FAQs

A negative P/E ratio occurs when the price of a stock is lower than its per-share earnings. This can happen if the company's profits are declining or if there is an oversupply of the stock in the market, causing investors to lose confidence in it.

A negative P/E ratio indicates that the stock may be undervalued or that there is an oversupply of the stock in the market which is causing investors to lose confidence. It is important to investigate further before making any decisions about investing in such a situation.

No, not all negative P/E ratios are necessarily bad. It is important to investigate further before making any decisions about investing in such a situation. A company with a negative P/E ratio could potentially become profitable in the future and the stock could become undervalued.

A number of factors can contribute to a negative P/E ratio, including declining profits, oversupply of the stock in the market, or investor pessimism. It is important to investigate further before making any decisions about investing in such a situation.

Yes, it is possible to turn a negative P/E ratio into a positive one. This can be accomplished by increasing the company's profits or reducing the supply of stock in the market. In either case, further investigation should be done before making any decisions about investing in such a situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.