Yield on cost, or YOC, is a measure of dividend return arrived at by dividing a stock's current dividend yield by the price an investor originally paid for it. Yield on Cost (YOC) is a financial metric that calculates the annual dividend or interest income of an investment relative to its original cost or initial purchase price. In other words, YOC represents how much an investor earns from their original investment, disregarding any changes in the market price of the asset. By evaluating the YOC, investors can understand the effectiveness of their investment decisions and monitor the growth of their income over time. YOC shines when assessing investments from a long-term perspective. It demonstrates how the income from an investment grows over the years, independent of its current market price. It allows investors to monitor the growth of their income, highlighting the compound effect of reinvesting dividends or interest. It showcases the real impact of incremental increases in income over time. Across Investments Investors can use YOC to compare different investments' income performance based on their original costs, making it a useful tool to evaluate and prioritize investments based on income generation. Dividend or interest growth stands as the linchpin of YOC. Consistent and steady growth in dividends or interest payments directly bolsters the YOC. Companies that have a track record of increasing dividends annually can greatly enhance the yield an investor receives on their initial cost. Similarly, bonds or fixed income securities that offer incrementally increasing interest rates can also boost YOC. The initial investment isn't always a static number. Investors might choose to average down by purchasing more of an asset during a price dip, or there might be additional charges and fees associated with holding an investment over time. Such changes to the initial cost basis can significantly influence YOC. A higher cost basis without a corresponding increase in income would reduce the YOC, while additional purchases at lower prices could enhance it if the dividend or interest income remains steady or grows. Prevailing market conditions can affect a company's profitability, and in turn, its ability to pay or grow dividends. For instance, during economic downturns, companies might slash dividends to conserve cash, which would lead to a drop in YOC. On the flip side, during prosperous times, companies might increase dividend payouts, enhancing the YOC for investors. Similarly, interest rate changes can impact bonds and other fixed-income securities. A rising interest rate environment might make newer bonds more attractive than older ones, potentially pressuring issuers to adjust interest payments. While not a direct component of YOC, it's worth noting that when companies engage in stock buybacks, reducing the number of shares in circulation, this can lead to increased earnings per share. In some scenarios, a company might then be more positioned to increase its dividend payout. An enhanced dividend, thanks to buybacks, can increase the YOC for long-term holders of the stock. The financial health of the entity behind the investment can significantly influence its ability to maintain or increase dividends or interest payments. A company with strong financials, low debt, and consistent revenue growth is more likely to sustain and grow its dividends, positively impacting YOC. Conversely, a company facing financial distress might cut dividends, leading to a decrease in YOC for investors. The industry or sector in which the investment operates can also play a role in determining YOC. Some sectors, like utilities or consumer staples, are renowned for consistent dividend payouts. In contrast, tech or growth-oriented sectors might prioritize reinvesting profits over dividends. Recognizing these sectoral trends can help investors anticipate potential changes to their YOC over time. For long-term investors, YOC is a figure that may change drastically over time. For example, an investor may purchase stock in Company A at $10 per share, with dividend payments of $0.50 per share. Here, the YOC and dividend yield are equal, at 5%. However, say that over the next 20 years, Company A adds $0.10 in dividend payments per year, but increases their share price to $50. After 20 years, the dividends will reach $2.50 per share. The dividend yield will still be 5%, but the investor's YOC will be 25%. Yield on Cost prioritizes the income component of an investment, making it particularly useful for those investors who are income-oriented, such as retirees. By emphasizing the dividends or interest received relative to the initial cost, YOC provides a clearer picture of the income return on the initial investment, irrespective of current market valuations. This perspective can be reassuring for those who rely on their investments for regular income, offering a sense of stability. One of the unique attributes of YOC is its ability to capture the effect of time on an investment’s return. For long-term investors, the YOC can steadily rise if the income component (like dividends) grows over the years. This illustrates the compounding power and the benefits of a long-term investment strategy. The YOC can serve as a testament to the benefits of patience in investing. YOC can serve as a guidepost for decisions regarding dividend reinvestments. If the YOC is robust and the investor believes in the future prospects of the investment, they might opt to reinvest the dividends, thereby benefiting from compound growth. Conversely, a declining YOC might prompt an evaluation of whether the dividends would be better utilized elsewhere. While many investors focus on capital appreciation, YOC offers a fresh lens, emphasizing the return in terms of income generation. This can be a beneficial metric for those who prioritize dividends and interest income over mere price appreciation, offering a comprehensive view of an investment’s performance. By focusing purely on the income aspect, YOC might not capture the full return picture. An investment might have a high YOC due to growing dividends, but simultaneously, it might be underperforming in terms of price appreciation when compared to other investments. While dividends or interest rates can increase, they can also be cut or eliminated. If a company faces financial distress or if a bond issuer defaults, the dividends or interest payments can decrease, significantly affecting the YOC. This sensitivity means that YOC can be volatile and not always representative of future income. YOC doesn’t factor in the effects of market timing. An investor might have a high YOC because they purchased during a market downturn, not necessarily because the investment was fundamentally sound. Similarly, YOC doesn’t capture the volatility or risks associated with an investment. An asset with a high YOC might also be highly volatile, which could be unsuitable for conservative investors. YOC, by its very nature, looks backward. It considers the dividends or interest received based on the initial cost. However, past performance isn’t always indicative of future results. Investors might be lulled into a false sense of security seeing a high YOC, ignoring warning signs about an investment’s future prospects. Consistency can be a powerful tool in the world of investing. By regularly allocating funds to an investment or portfolio, an investor takes advantage of dollar-cost averaging. This approach can lower the average cost of the investment over time. Moreover, reinvesting dividends allows investors to purchase more shares without additional out-of-pocket expenses. As these reinvested dividends generate their dividends, a compounding effect takes place, which can substantially enhance the YOC over the long run. This strategy emphasizes the importance of patience and a long-term vision. A rising dividend or consistent interest payment is a significant factor in increasing the YOC. Therefore, selecting investments known for their consistent and sustainable growth can be strategic. Researching and investing in companies with a strong track record of dividend growth or bonds with stable interest payments can lead to an appreciating YOC over time. Companies that have a history of increasing their dividends annually or bonds from issuers with strong credit ratings often fall into this category. It's essential, however, to ensure that the growth is sustainable and not at the expense of the company's or issuer's financial health. Diversification, or spreading investments across various asset classes or sectors, is a tried and true strategy to manage risk. When it comes to enhancing YOC, diversification plays a crucial role. Not all sectors or asset classes will perform similarly at any given time. By diversifying, investors ensure that a downturn in one area might be offset by gains in another. This approach can protect the income stream and, by extension, the YOC. For example, if one stock in a portfolio cuts its dividend, but others raise theirs, the overall impact on the portfolio's YOC might be neutralized. Yield on cost has been criticised as a metric that holds little relevance, and may even mislead investors. For example, it does not provide an accurate representation of the current benefit of investing in a stock, only the benefit that would have been realized had an investor bought the stock in the past. YOC also ignores the effects of inflation, which may bloat the figure but not represent any actual gain in value. YOC also ignores any additional costs incurred since the purchase of the stock, such as if the investor had reinvested any dividends back into their stock. Some investors may also be reticent to sell their high YOC shares and buy stocks with a higher dividend yield, mistakenly believing that a high YOC indicates better performance. Yield on Cost (YOC) is a financial metric that assesses the annual dividend or interest income of an investment relative to its initial purchase price. YOC emphasizes income generation and provides insights into long-term investment performance. It shines when evaluating investments over time, tracking income growth, and comparing income performance across investments. However, YOC has limitations, including its exclusive focus on income, sensitivity to changes in dividends or interest rates, and its inability to account for market timing and volatility. To enhance YOC, investors can consider regular investment and dividend reinvestment, select investments with consistent growth, and diversify to manage risk. While YOC offers valuable insights, it can also mislead investors by not reflecting current benefits, ignoring inflation effects, and overlooking additional costs. Yield on Cost (YOC) Definition

It is different from the dividend yield, which is taken by dividing the current dividend payment by the current share price.Importance of Yield on Cost (YOC)

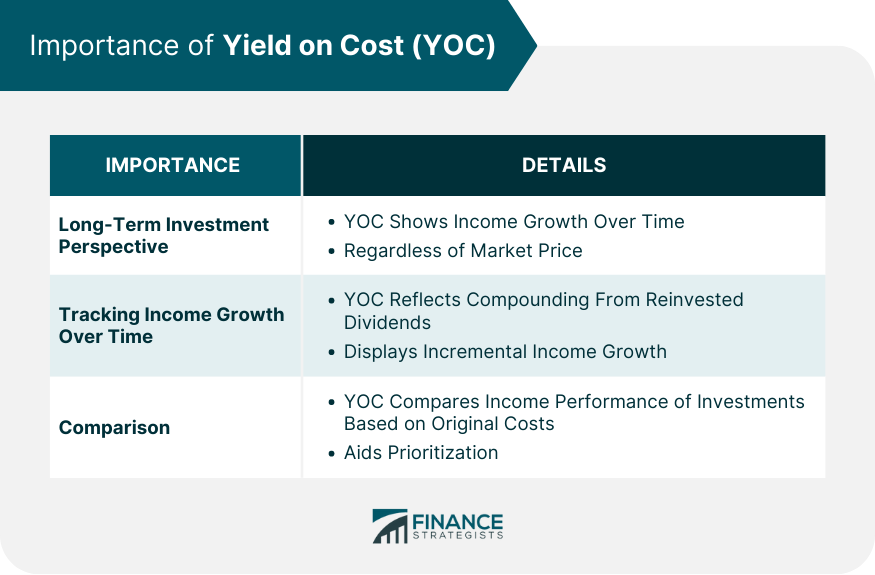

Long-Term Investment Perspective

Tracking Income Growth Over Time

Comparison

Factors Influencing Yield on Cost

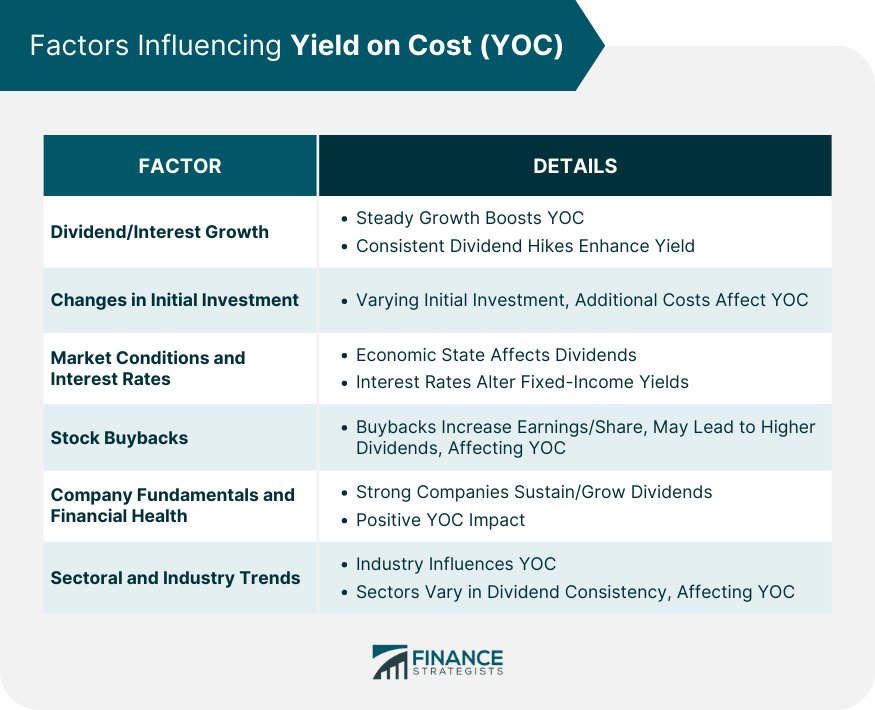

Dividend/Interest Growth

Changes in Initial Investment

Market Conditions and Interest Rates

Stock Buybacks

Company Fundamentals and Financial Health

Sectoral and Industry Trends

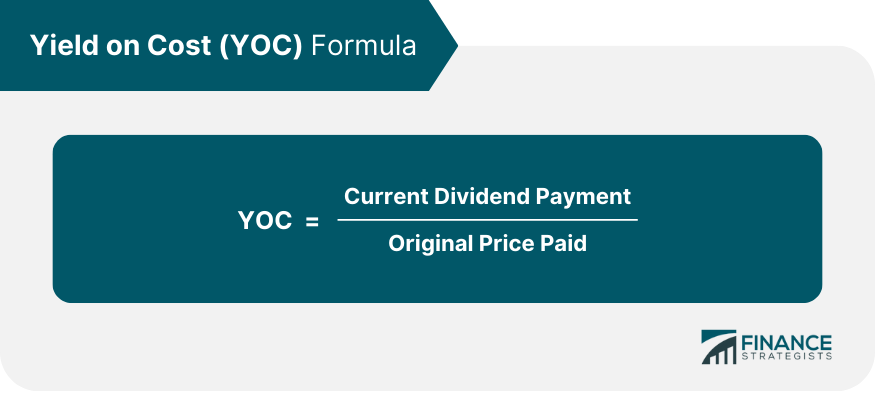

Formula for Yield on Cost (YOC)

Example of Yield on Cost

Advantages of Yield on Cost

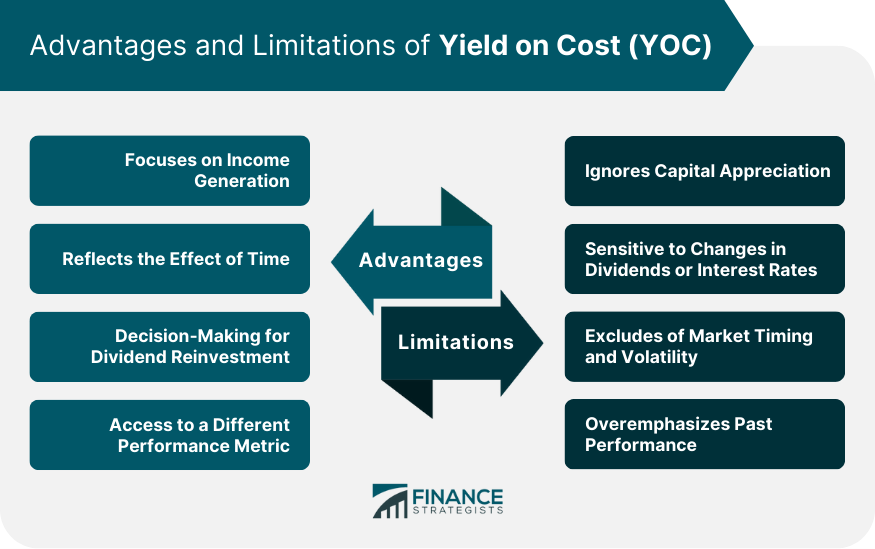

Focuses on Income Generation

Reflects the Effect of Time

Decision-Making for Dividend Reinvestment

Access to a Different Performance Metric

Limitations of Yield on Cost

Ignores Capital Appreciation

Sensitive to Changes in Dividends or Interest Rates

Excludes of Market Timing and Volatility

Overemphasizes Past Performance

Strategies to Enhance Yield on Cost

Invest and Reinvest Dividend Regularly

Select Investments With Consistent Growth

Diversify to Manage Risk

How Yield on Cost Can Mislead Investors

Conclusion

Yield on Cost (YOC) FAQs

YOC stands for Yield on Cost.

Yield on cost, or YOC, is a measure of dividend return arrived at by dividing a stock’s current dividend yield by the price an investor originally paid for it.

it does not provide an accurate representation of the current benefit of investing in a stock, only the benefit that would have been realized had an investor bought the stock in the past.

Yield on cost is calculated by dividing a company's current dividend payment by the original price an investor originally paid for it.

YOC shouldn't be used to compare current dividend yields between companies. This would be an apples-to-oranges comparison.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.