A Venture Capitalist is a private investor that provides early capital to new companies that exhibit a strong potential for growth and success. This is typically in exchange for a significant equity stake. Venture Capitalists can provide funding for startups or small businesses in need of capital that do not have access to equities markets because the companies are too new. The projects they invest in are usually high risk / high reward ventures. As such they are unappealing investments to most investors, especially those who are risk averse, but prime targets for venture capitalists who are willing to accept a greater risk for a potentially greater payout. Venture capital investors usually come together to create limited partnerships, or LPs, where members contribute to a pool of funds. These funds will often be overseen by a committee tasked with identifying companies with emerging growth potential, making investment decisions, and deploying investor capital. VCs possess a keen eye for spotting potential. They sift through thousands of startup pitches, seeking out those golden ideas with disruptive potential. Once they identify a promising startup, they don't just provide funds; they nurture these companies, guiding them through the treacherous waters of the business world. Not all startups are created equal. It's the VC's role to pinpoint those with the best chances of success, often relying on a combination of market analysis, intuition, and experience. They then help these startups refine their vision and strategy, setting them on a path to success. While funding is essential, VCs offer more than just capital. They bring a wealth of experience, industry contacts, and strategic insight to the table. This support can be invaluable for a fledgling company, providing mentorship and opening doors to partnership opportunities. Venture capitalists can also play a pivotal role in guiding a startup's growth trajectory. From organizational structure to hiring decisions, the strategic support offered by VCs can help startups navigate complex decisions and avoid common pitfalls. As startups mature, they face the challenge of scaling — growing their operations to meet increasing demand without compromising on quality or efficiency. VCs play a crucial role here, leveraging their resources and network to help these businesses expand responsibly and sustainably. Furthermore, venture capitalists may introduce startups to potential partners, clients, or even future employees. These introductions can propel a startup's growth, helping them reach new markets and tap into larger customer bases. Angel investors are affluent individuals who provide capital to startups in exchange for ownership equity or convertible debt. Often, they're the first external investors in a new business, stepping in when the risk is highest. While they invest smaller amounts than other types of VCs, angel investors can offer invaluable mentorship and guidance. Many are seasoned entrepreneurs themselves, eager to give back to the next generation of innovators. Corporate Venture Capitalists (CVCs) are subsidiaries of larger corporations that invest in startups. They often seek startups that align with the parent company's strategic goals, providing not just funds but also access to resources, distribution channels, and a vast network. CVCs differ from traditional VCs in that they typically prioritize strategic returns over financial ones. Their investments are a way to foster innovation, explore emerging markets, and maintain a competitive edge. Venture capital firms are professional groups that manage pooled funds from many investors to invest in startups and small businesses. They come with a team of professionals experienced in various aspects of business, from technology to marketing. Such firms typically have a more extended investment horizon and can provide larger amounts of capital compared to angel investors or CVCs. They also bring rigorous due diligence processes and a vast network of resources and contacts to their portfolio companies. VCs constantly search for promising startups, attending pitch events, networking sessions, or even tapping into their networks. Once potential deals are sourced, they're screened to shortlist the most promising candidates. During the screening process, VCs look for startups that fit their investment criteria. This could be based on the startup's industry, stage of development, market potential, or any other specific criteria the VC prioritizes. Once a startup is shortlisted, VCs dive deep into due diligence. They assess the startup's business model, financial projections, management team, market potential, and more. This rigorous evaluation is crucial to determine the startup's valuation and potential return on investment. It's during this phase that VCs might consult industry experts, conduct market research, or even visit the startup's operations. The goal is to ascertain the potential risks and rewards of the investment. If a VC decides to move forward, they draft a term sheet. This document outlines the terms of the investment, including the amount of capital, the equity offered in return, and other conditions of the investment. It serves as a blueprint for the official investment contract. Negotiating the term sheet can be intricate, as both parties work to protect their interests. Common points of contention include valuation, equity stake, and clauses related to governance or exit strategies. With the term sheet agreed upon, the VC makes the official investment decision. If the decision is positive, funds are transferred to the startup in exchange for equity or other agreed-upon terms. This capital injection often serves as a lifeline for startups, allowing them to scale operations, hire key personnel, invest in marketing, or develop new products. The VC's role doesn't end with funding. They continually monitor their investments, often taking board positions to influence the startup's direction. They also seek to add value, providing mentorship, opening networking opportunities, and guiding the startup through challenges. For VCs, this active involvement maximizes the chances of a successful exit, be it through an initial public offering (IPO), a merger, or an acquisition. Seed funding is the initial capital that startups raise, often used to validate their business idea or develop a prototype. It's a small amount of capital, provided when the risk is high but the potential for growth is evident. This financing helps entrepreneurs bridge the gap between ideation and creating a market-ready product. For VCs, seed funding offers an opportunity to invest early, securing a larger equity stake for a smaller investment. As startups grow, their capital requirements evolve. Series A, B, C, and so on represent successive rounds of financing, each catering to a specific growth phase. Series A typically focuses on optimizing the business model and scaling operations. By Series B, the startup has a proven track record, and funds might go towards expanding into new markets. Series C and beyond often target further scaling, acquisitions, or even preparations for an IPO. Mezzanine financing is a hybrid of debt and equity financing, typically used by startups preparing for an IPO. It provides immediate capital without diluting ownership, as the funds are structured as debt that can convert to equity if not repaid by a specified date. For VCs, mezzanine financing offers a final opportunity to invest before a company goes public. It comes with higher risks but can offer substantial returns if the IPO proves successful. Bridge financing is a short-term loan that provides immediate capital to startups facing a temporary cash crunch. It's called "bridge" financing because it bridges the gap between immediate financing needs and long-term funding solutions, such as the next round of equity financing. For VCs, bridge loans can be a way to support their existing investments, ensuring that the startup remains solvent and continues to grow until the next financing round. Different VCs have distinct areas of expertise and interest. Some may focus exclusively on technology startups, while others may be drawn to the healthcare or clean energy sectors. This specialization allows VCs to harness their expertise and network, maximizing the potential for successful investments. Having a sector focus also means VCs can offer targeted support to their portfolio companies, guiding them through industry-specific challenges and trends. Just as VCs may specialize in sectors, they can also have a geographic focus. Some might prioritize local startups, believing in the potential of their home market. Others might have an international focus, seeking out the best opportunities worldwide. This geographic strategy shapes a VC's investment decisions, deal sourcing methods, and post-investment support. For instance, a VC focused on international investments might have a network that spans multiple countries, aiding startups in global expansion. Different startups require different support. Early-stage startups might need guidance refining their product, while late-stage ones might seek help navigating the complexities of an IPO. VCs often have a stage focus, aligning their expertise with startups at a particular development phase. This focus dictates the size and type of investments a VC makes, as well as the kind of support and mentorship they provide to their portfolio companies. Like all investors, VCs aim to diversify their portfolios. By investing in a mix of sectors, geographies, and stages, they spread their risk, increasing the chances of a few high-performing investments offsetting any underperformers. Diversification isn't just about spreading risk. It's also a way for VCs to tap into various markets, trends, and opportunities, ensuring they're always at the forefront of innovation. Venture capitalists operate in a world of uncertainty. Market volatility can significantly affect a startup's prospects, with economic downturns, geopolitical events, or industry shifts turning a promising investment sour. VCs must constantly monitor these factors, adjusting their strategies and providing guidance to their portfolio companies on navigating these turbulent waters. The harsh reality is that many startups fail. Whether it's due to market conditions, poor management, or simply a product that doesn't resonate, VCs face the risk of their investments not yielding returns. This inherent risk is why VCs conduct rigorous due diligence before investing and remain actively involved post-investment. However, even with these measures, the failure rate remains a persistent challenge. Venture capital investments are typically illiquid, meaning VCs can't easily convert them into cash. They rely on exit strategies like IPOs, mergers, or acquisitions to realize their returns. However, successful exits aren't guaranteed. An IPO might underperform, acquisition offers might be lower than expected, or a merger might fall through. These challenges highlight the importance of a VC's strategic guidance, ensuring their portfolio companies are positioned for successful exits. Venture capitalists must navigate a complex web of regulations and legal considerations. From ensuring compliance with investment laws to navigating international regulations when investing abroad, VCs face constant legal challenges. Moreover, as the regulatory landscape evolves, VCs must adapt, ensuring their investments remain compliant and that they're aware of any new opportunities or constraints these changes might bring. Contrary to popular opinion, venture capitalists do not commonly fund startups from the onset. Rather, they look for companies that are at the point of preparing to commercialize their idea, when they have the highest potential for growth. When evaluating a company, venture capitalists look for strong management, a significant potential market, and unique products or services that have a competitive edge. Venture Capitalists are private investors who provide early capital to new companies in exchange for significant equity stakes. By identifying and nurturing promising startups, venture capitalists ensure that innovative ideas get the financial backing and strategic support needed to succeed. They offer more than just capital, their vast experience, industry contacts, and strategic insight guide startups through the challenges of the business world. Moreover, venture capitalists facilitate growth and scaling opportunities, leveraging their resources and network to help businesses expand responsibly. However, venture capital investing comes with its challenges, such as market volatility, startups' failure rate, illiquidity, and regulatory risks. Nonetheless, by employing diversified investment strategies and thorough due diligence, venture capitalists aim to generate attractive returns while supporting the growth of the next generation of innovators.Venture Capitalist Definition

What Does a Venture Capitalist Do?

Identify and Nurture Promising Startups

Provide Capital and Strategic Support

Facilitate Growth and Scaling Opportunities

Types of Venture Capitalists

Angel Investors

Corporate Venture Capitalists (CVCs)

Venture Capital Firms

Venture Capital Process

Deal Sourcing and Screening

Due Diligence and Evaluation

Term Sheet Negotiation

Investment Decision and Funding

Post-investment Monitoring and Value Addition

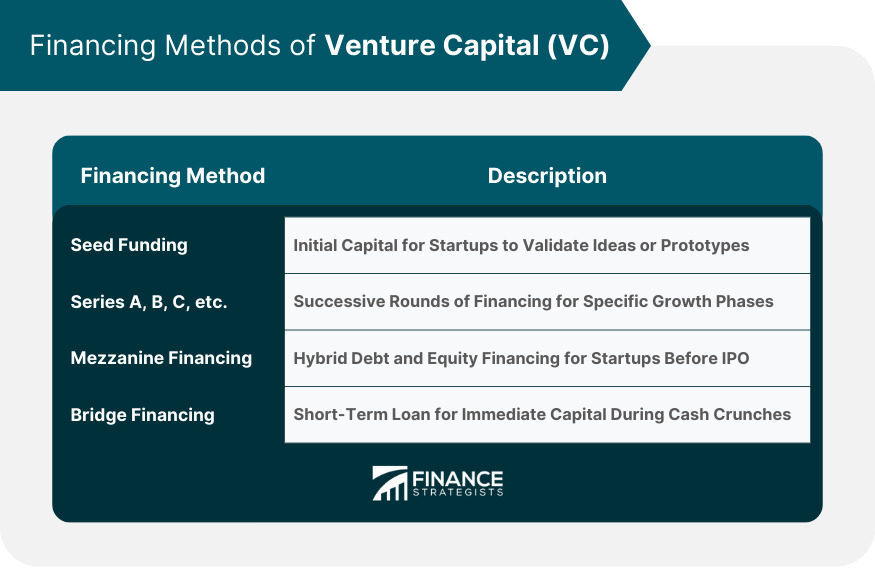

Financing Methods of Venture Capital

Seed Funding

Series A, B, C, etc.

Mezzanine Financing

Bridge Financing

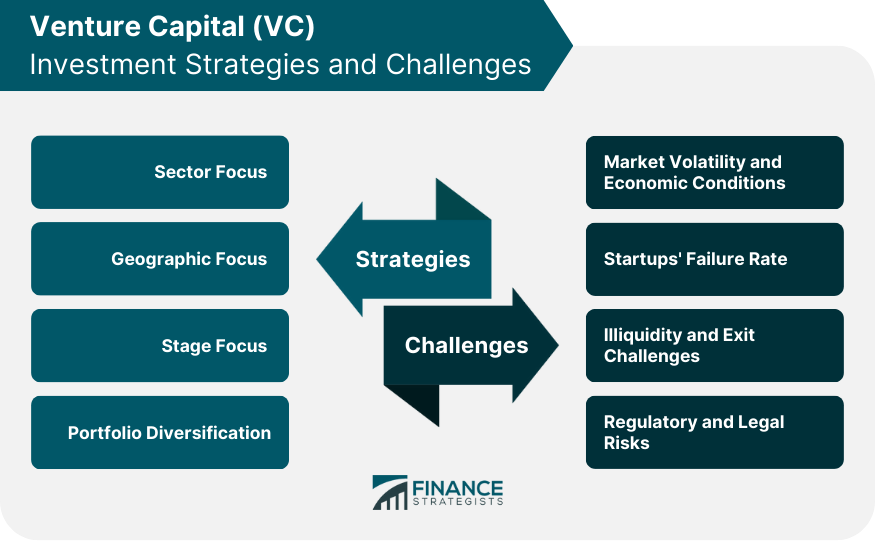

Venture Capital Investment Strategies

Sector Focus

Geographic Focus

Stage Focus

Portfolio Diversification

Challenges Faced by Venture Capitalists

Market Volatility and Economic Conditions

Startups' Failure Rate

Illiquidity and Exit Challenges

Regulatory and Legal Risks

Common Misconception About Venture Capitalists

Conclusion

Venture Capitalist (VC) FAQs

A venture capitalist is a private investor who provides early capital to new companies that exhibit a strong potential for growth and success.

Venture capital investors usually come together to create limited partnerships, or LPs, where members contribute to a pool of funds that are used to invest in companies with emerging growth potential.

Contrary to popular opinion, venture capitalists look for companies that are at the point of preparing to commercialize their idea, when they have the highest potential for growth.

Investments from venture capitalists are usually high risk/high reward. As such they are unappealing investments to most investors, especially those who are risk averse,. These are prime targets for venture capitalists who are willing to accept a greater risk for potentially greater payout.

When evaluating a company, venture capitalists look for strong management, a significant potential market, and unique products or services that have a competitive edge.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.