Perfect Competition is an idealistic economic theory that asks what a market structure with full equality between sellers and fully informed consumers would look like. It is a theoretical concept where numerous small firms compete against each other. In such a market, sellers offer identical products, and no single seller can influence the prevailing market price. Due to its nature, individual buyers and sellers cannot control the conditions of the market; they simply accept the ongoing market price as the "given." In a perfectly competitive market, since products are identical and there are no barriers to entering or leaving the market, firms are unable to earn supernormal profits in the long run. This is because if one firm earns more than the normal profit, other firms will enter the market to tap into these extra earnings, thereby increasing supply and driving the price down. Conversely, if firms are making a loss, some will exit, leading to a decrease in supply and an upward price movement. This continuous dynamic ensures that in the long run, firms only earn a normal profit. In order for a market to be described as exercising perfect competition, the following characteristics must be present. Businesses sell one product, and every product is the same. Price is not influenced, increased or decreased, by a business or a business's market share. Consumers have expert knowledge of the product being sold and the prices they are being sold at. Entry/Exit into the market is free, and labor resources are perfectly mobile. Meaning workers and other production inputs are easily obtained, and free to move from business to business resulting in an abundance of able sellers. A perfect competition market is of course, as mentioned above, only an ideal and does not exist in the real world. As a result, real markets, those that do exist in this world are rightly classified as imperfect markets. Given that they, in some shape or form, do not comply with one of the above requirements. An example of an imperfect market today is the airline market. In which only a few, government-approved sellers may participate. A hallmark feature of perfect competition is the presence of a multitude of buyers and sellers. This ensures that the actions of any single buyer or seller do not materially impact the market as a whole. With numerous players, no entity has the market power to set prices, and they become mere price takers. The decentralized decision-making of each player contributes to the market's aggregate supply and demand. In a perfectly competitive market, products are undifferentiated and homogeneous. Since every product is a perfect substitute for another, consumers have no preference for any particular brand or producer. This lack of differentiation means that advertising and branding hold no value, as consumers perceive all products to be identical in terms of quality and utility. Another distinctive feature is the absence of barriers to entry and exit. Firms can seamlessly join or leave the market without any substantial costs. This fluidity ensures that if firms are earning excess profits, new firms will join, intensifying competition and restoring the equilibrium. Conversely, if firms incur losses, they can easily exit, reducing supply and aiding in price stabilization. Perfect competition leads to a unique state where market demand equals market supply, resulting in equilibrium. This equilibrium ensures market stability, as prices reflect both the cost of production and the utility derived by consumers. With countless players on both the buying and selling sides, the market swiftly responds to any disequilibrium, restoring balance. The intense competition in such markets pushes firms to operate at maximum efficiency. Since they cannot influence prices and their products are undifferentiated, the only way to sustain in the market is by optimizing production and minimizing costs. This drives firms to adopt best practices, utilize resources efficiently, and operate at the minimum point of their average cost curves. For consumers, perfect competition is a boon. They get products at prices which reflect true value, without any firm enjoying undue market power. Moreover, with an abundance of sellers, consumers have a wide variety of choices. This plethora of options, combined with the assurance of consistent quality, enhances consumer welfare. Since prices in a perfectly competitive market reflect both consumer preferences and production costs, resources are channeled into producing goods and services that society values the most. This dynamic minimizes waste and ensures that societal needs are met optimally. Perfect competition often leads to prices that are beneficial for consumers. Given the high levels of competition and identical products, prices tend to be driven down to the point where they equal the cost of production. This scenario ensures consumers get the best possible price, maximizing their welfare. While it may seem counterintuitive, the cutthroat competition can spur innovation. To remain relevant and sustain in the market, firms are motivated to innovate, streamline their operations, and adopt the latest technology. This continuous strive for betterment benefits society at large, fostering technological and operational progress. In perfectly competitive markets, firms are typically small-scale operators. This scale restriction implies that these firms cannot exploit the benefits of large-scale production or economies of scale, which could further reduce production costs and benefit consumers. The undifferentiated nature of products in this market structure can be viewed as a drawback. With no variation, consumers miss out on the diversity of features, quality, or innovations that differentiated products in other market structures might offer. Since firms in a perfectly competitive market earn just a normal profit in the long run, they lack the financial muscle to invest heavily in research and development. Additionally, the homogeneous nature of products means there's little incentive to improve quality, potentially stunting innovation and product betterment. Markets that do not comply with any of the above requirements, rather than labeled as imperfect, are classified as monopolies. As a result, perfect competition markets and monopolies are often juxtaposed as theoretical opposites. Even though, for all intents and purposes, monopolies have moved beyond the bounds of the theoretical. Prominent examples including Rockefeller's Standard Oil Co. If there is any example of a market that comes close to perfect competition it is found in farming. A market in which there are a large number of buyers and sellers, little difference between products, and prices that remain largely unaffected by market share. However, entry into the market is not free and the labor needed to do so is not entirely mobile since a certain level of experience and expertise is needed in order to be successful. Therefore the market as a whole, is still far from perfect. A perfect competition is a theoretical market structure that embodies the ideal of equality between sellers and informed consumers. The advantages of this model include efficient resource allocation, consumer welfare through low prices, and promotion of innovation. However, there are also drawbacks, such as limited economies of scale and lack of product differentiation, which may hinder long-term growth and research investments. The impact of perfect competition leads to market stability and equilibrium, fostering competitive pressure that drives firms to operate efficiently. Consumers benefit from diverse choices and competitive prices. While no market perfectly fulfills these conditions, understanding perfect competition helps contrast it with real-world imperfect markets and monopolies. Despite its theoretical nature, the study of perfect competition remains relevant for shaping market policies and strategies.Perfect Competition Definition

How Does Perfect Competition Work

Perfect Markets

Imperfect Markets

Market Structure of a Perfect Competition

Large Number of Buyers and Sellers

Homogeneous Products

Free Entry and Exit

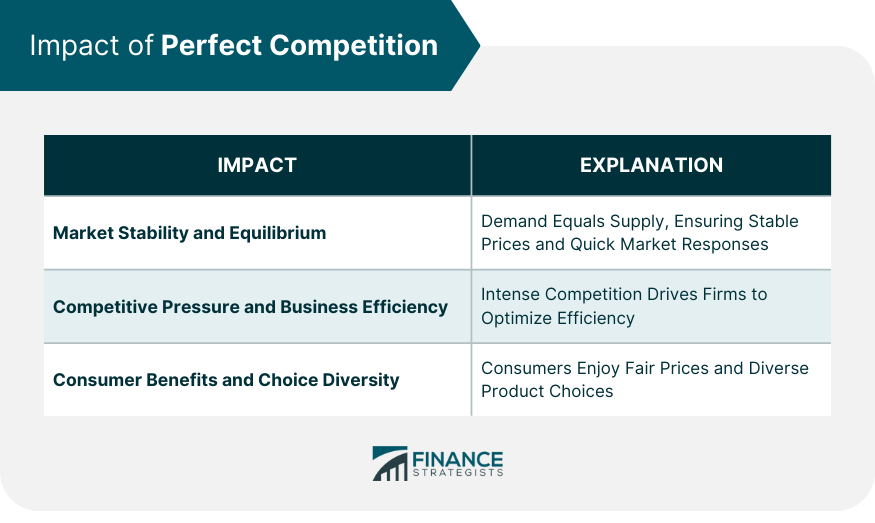

Impact of Perfect Competition

Market Stability and Equilibrium

Competitive Pressure and Business Efficiency

Consumer Benefits and Choice Diversity

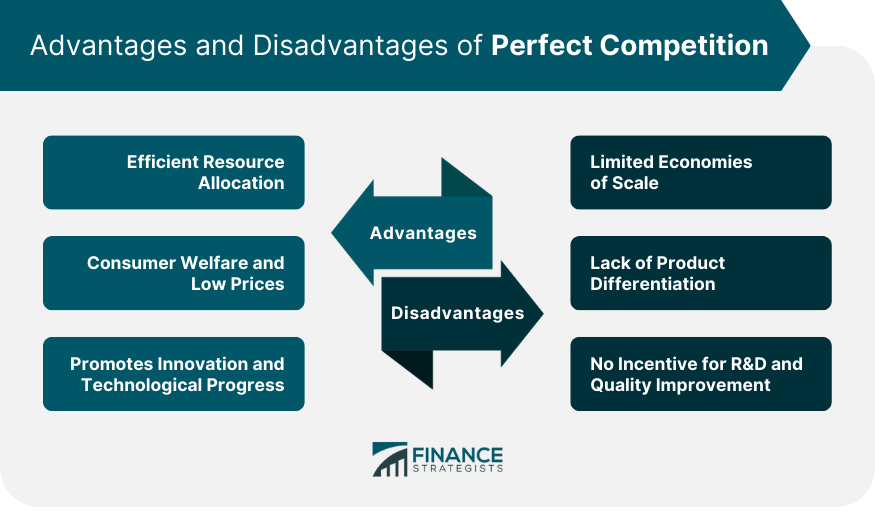

Advantages of Perfect Competition

Efficient Resource Allocation

Consumer Welfare and Low Prices

Promotes Innovation and Technological Progress

Disadvantages of Perfect Competition

Limited Economies of Scale

Lack of Product Differentiation

No Incentive for R&D and Quality Improvement

Monopolies

Example of Perfect Competition

Conclusion

Perfect Competition FAQs

Perfect Competition is an idealistic economic theory that asks what a market structure with full equality between sellers and fully informed consumers would look like.

A perfect competition market is of course, as mentioned above, only an ideal and does not exist in the real world.

Real markets, those that do exist in this world are rightly classified as imperfect markets.

Perfect competition markets and monopolies are often juxtaposed as theoretical opposites.

If there is any example of a market that comes close to perfect competition it is found in farming. A market in which there are a large number of buyers and sellers, little difference between products, and prices that remain largely unaffected by market share.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.