Operating income, also called income from operations, is an accounting metric that tells how much profit a business has made from regular operations. It is recorded after deducting depreciation, amortization, and the cost of goods sold. Operating income is also known as operating profit, and is sometimes referred to as EBIT, or Earnings Before Interest and Taxes. Operating income and income from operations are synonymous. Operating income is the amount of profit a company has after paying for all expenses related to its core operations. Operating income is calculated by taking a company's revenue, then subtracting the cost of goods sold and operating expenses. To calculate income from operations, just take a company's gross income and subtract the operating expenses. The remaining value is the operating income. Operating income is recorded as a figure on a company's income statement. The income statement structure tends to list items from the most inclusive (total revenue) down to the most exclusive (net income), so operating income will be somewhere nearer the top. Operating income is the amount of profit a company has after deducting operating expenses from total revenue. Operating expenses include any costs associated with running a business, such as wages and COGS. As an example of how to calculate operating income, imagine a company that has a gross profit of $1 million and operating expenses of $250,000. The company's operating income would be $1 million minus $250,000, or $750,000. Gross operating income is an accounting term in real estate that refers to the value of gross profit minus credit and vacancy losses. GOI may also be referred to as Effective Gross Income, or EGI. Vacancy loss refers to theoretic income that is not being made while a unit sits unoccupied. Credit loss occurs when a tenant either does not deliver a rent check or the check does not clear.Operating Income Definition

Define Operating Income in Simple Terms

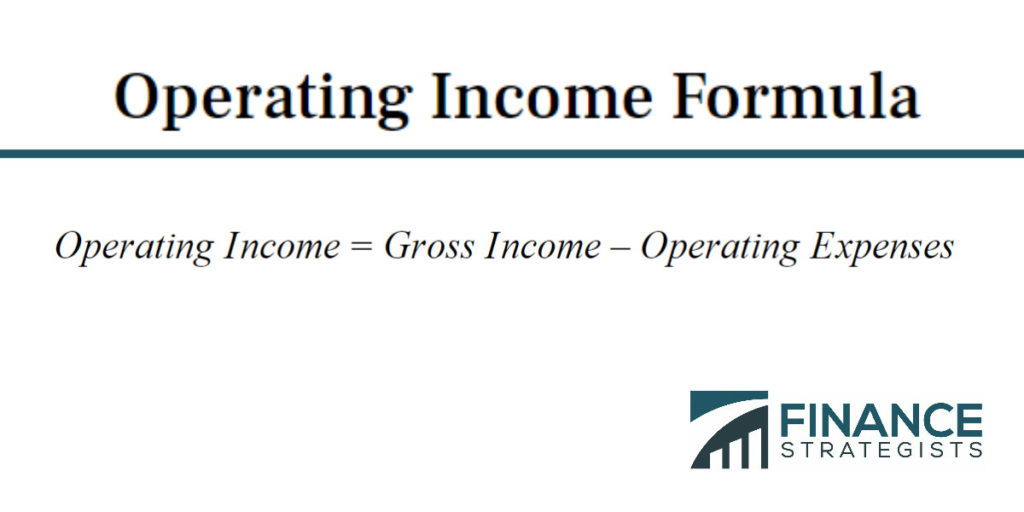

Operating Income Formula

How to Find Operating Income

Operating Income Meaning

Operating Income Examples

Gross Operating Income

What Is Vacancy Loss?

Operating Income FAQs

Operating income, also called income from operations, is an accounting metric that tells how much profit a business has made from regular operations.

To calculate income from operations, just take a company’s gross income and subtract the operating expenses.

Operating income is also known as operating profit, and is sometimes referred to as EBIT, or Earnings Before Interest and Taxes.

Operating income is recorded as a figure on a company’s income statement. The income statement structure tends to list items from the most inclusive (total revenue) down to the most exclusive (net income), so operating income will be somewhere near the top.

Imagine a company has a gross profit of $1 million and operating expenses of $250,000. The company’s operating income would be $1 million minus $250,000, or $750,000.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.