A Non-Compete Agreement (NCA), often simply referred to as a "non-compete," is a legal contract between an employer and an employee. Under this contract, the employee agrees not to enter into competition with the employer during or after the termination of their employment. This can include stipulations that prevent the employee from working for competitors or starting a competing business for a specific duration and within a particular geographic area. The foundational principle of an NCA is to protect an employer's legitimate business interests. However, the specifics of these agreements can vary widely based on several factors, including the nature of the business, the role of the employee, and the legal jurisdiction under which the contract is made. Employees, particularly those in strategic or senior roles, often have access to a wealth of confidential data, ranging from client lists to operational procedures, marketing strategies, and beyond. An NCA ensures that this insider knowledge is not used against the company, either by the employee defecting to a competitor or by starting a new competing venture. The modern business landscape, especially in sectors like tech and finance, thrives on information. Leaks or misuse of such proprietary information can give competitors an unfair advantage, thereby undermining a company's position in the market. Beyond just data, companies often invest significantly in developing unique intellectual property (IP) – be it a product, a process, or a brand strategy. Such IP becomes a core part of the company's competitive advantage. An NCA helps ensure that employees, who have been privy to the creation or understanding of this IP, don't replicate or transfer this knowledge elsewhere. This is particularly crucial in industries like pharmaceuticals, tech development, and design, where the line between inspiration and imitation can be thin, but the ramifications of IP theft can be massive. Companies spend years, sometimes even decades, nurturing trust and mutual understanding with their clientele. An NCA ensures that employees, especially those in sales or client relationship roles, do not exploit their position or the relationships they've built on behalf of the company to lure clients away after their departure. This not only protects the company's revenue stream but also ensures that the business landscape remains fair and competitive, where firms compete on merit rather than insider advantages. A standard NCA will clearly define the parties involved, usually the employer and the employee. It's essential to have names and designations explicitly mentioned to avoid any ambiguity later. Sometimes, NCAs can also be made between businesses, particularly during mergers or acquisitions. While this might seem like a simple component, clarity in defining the parties can avoid potential legal loopholes. For instance, an employee might argue that the NCA was with a subsidiary, not the parent company, hence not enforceable under a new role or jurisdiction. The duration of the NCA is crucial. It defines how long the employee must wait before they can engage in competitive activities. This period can vary widely based on the nature of the business and the employee's role. It's worth noting that if the duration is perceived as overly long and restrictive, courts in many jurisdictions might not enforce the NCA. An appropriate duration ensures that while the company's interests are protected, the employee is not indefinitely hindered from pursuing opportunities in their field of expertise. Another key component of an NCA is its geographic scope. This defines where the employee can or cannot engage in competitive activities. For a local business, this might be a particular city or state. For global corporations, it could span multiple countries or continents. However, as with duration, the geographic scope needs to be reasonable. An overly broad geographic restriction might be viewed as excessive and thus be deemed unenforceable in a court of law. An NCA will also spell out the specific activities that the employee is prohibited from engaging in. This could range from working in a particular role at a competing firm to starting a business in the same industry. The clearer these restrictions are defined, the less room there is for misinterpretation or legal challenges later on. It's crucial that the restricted activities are directly relevant to the employee's role and the potential harm they could cause if they were to compete. Overly broad or vague restrictions might not hold up if challenged. Some NCAs come with the provision of a lump-sum payment. This is a financial compensation given to the employee in return for agreeing to the terms of the non-compete. The idea is to compensate them for potential lost opportunities due to the restrictions imposed by the NCA. Such a payment can make the NCA more palatable to the employee, balancing out the restrictions with immediate financial gain. However, it also means an added cost for the employer, and there's always a risk that the employee might challenge the NCA later, despite having accepted the payment. In some situations, particularly in startups or when dealing with very senior executives, the NCA might come with an equity stake in the company. This gives the employee a vested interest in the company's success, making them less likely to compete against it. This can be a double-edged sword. While it can ensure loyalty and commitment, it also means sharing a piece of the company's future profits or sale value. By limiting where, when, and how they can work post-employment, an NCA can make it challenging for employees to find suitable roles, especially if they are specialized in their field. This is a significant consideration for employees when signing an NCA. It also is why many jurisdictions and courts look closely at NCAs to ensure they don't excessively hinder an individual's right to earn a living. Companies often invest heavily in training their employees. This could be in the form of formal training programs, workshops, or on-the-job learning. An NCA ensures that competitors don't immediately benefit from this investment. It gives companies the peace of mind to invest in their employees, knowing that they won't jump ship and take their newly acquired skills directly to a competitor. If every employee who left a company immediately started a competing venture or joined a direct competitor, it would create a chaotic and unstable market. NCAs ensure that competition remains on a level playing field, where businesses compete based on their merit, products, or services, not insider knowledge or relationships. Goodwill, the intangible value associated with a company's brand, reputation, and client relationships, can take years to build. NCAs ensure that this goodwill is preserved, preventing former employees from capitalizing on or tarnishing it. On the flip side, NCAs can be a hurdle for employees. They can hinder career advancement, particularly if the agreement's terms are excessively restrictive in terms of duration or geographic scope. For specialized roles, this could mean waiting out a significant period before being able to work in one's field again. Innovation often thrives when there's cross-pollination of ideas and when individuals can freely move between roles, companies, and industries. Overly restrictive NCAs can stifle this flow of talent and ideas, potentially leading to stagnation in industries or regions where such agreements are prevalent. A flexible labor market is one where individuals can move between roles and companies with relative ease. This not only benefits employees but also employers, who can tap into a broader talent pool. NCAs, especially if widespread, can inhibit this flexibility, making it harder for companies to hire and for individuals to find suitable roles. A Non-Compete Agreement (NCA) is a legally binding contract that restricts an employee from engaging in competitive activities during or after their employment. NCAs are essential tools in protecting employers' legitimate business interests across various industries, including finance. These agreements serve multiple purposes. They safeguard sensitive information, prevent the misuse of intellectual property, and maintain client relationships, ensuring fair competition and upholding a company's reputation. The financial implications of NCAs are significant. Lump-sum payments and equity stakes can balance the restrictions imposed on employees, although they come with their own considerations. However, NCAs can also hinder future job prospects and innovation by limiting career advancement and inhibiting the flow of talent. While they offer benefits like protecting investments in employee training and preserving company goodwill, drawbacks include potential career stagnation and inhibition of labor market flexibility.What Is a Non-Compete Agreement (NCA)?

Purpose of Non-Compete Agreements

Protection of Sensitive Information

Safeguarding Intellectual Property

Maintaining Client Relationships

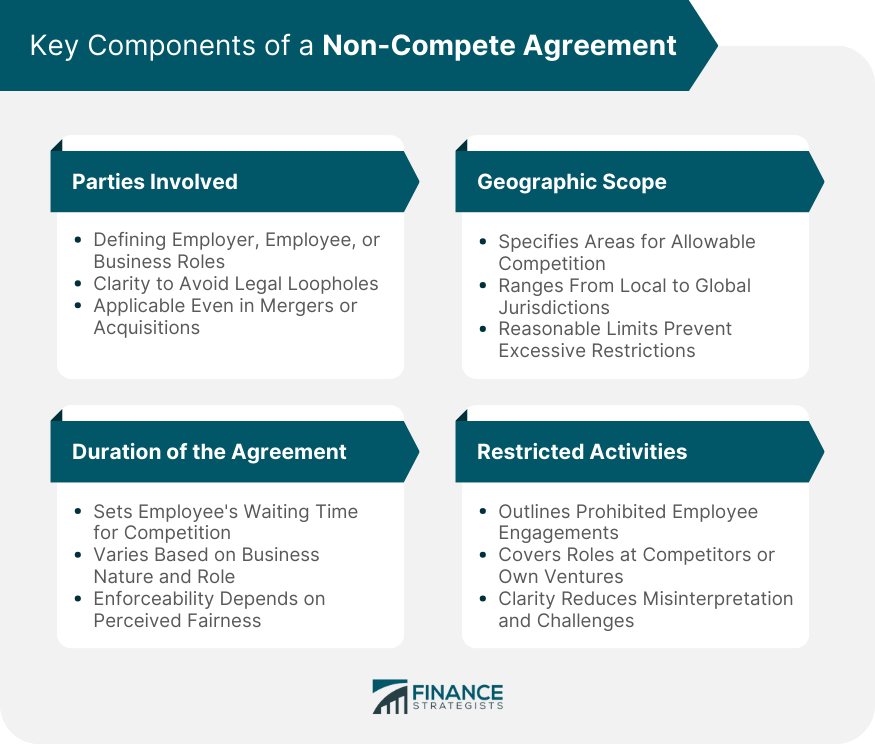

Key Components of a Non-Compete Agreement

Parties Involved

Duration of the Agreement

Geographic Scope

Restricted Activities

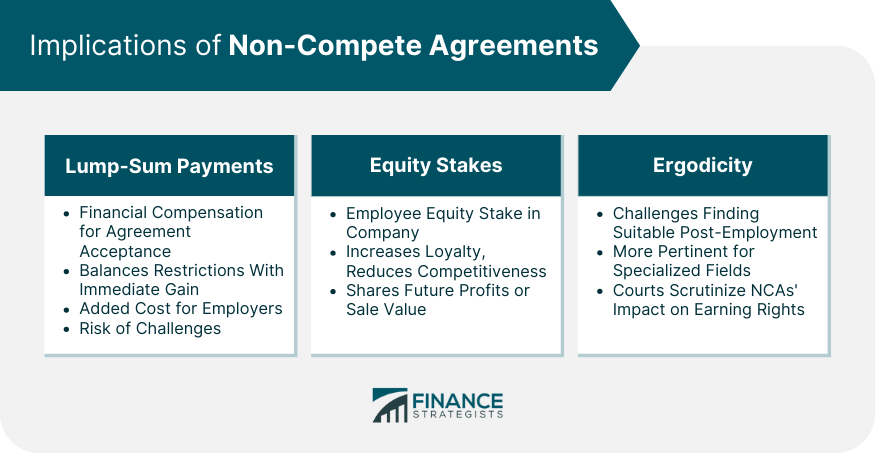

Implications of Non-Compete Agreements

Lump-Sum Payments

Equity Stakes

Future Job Prospects

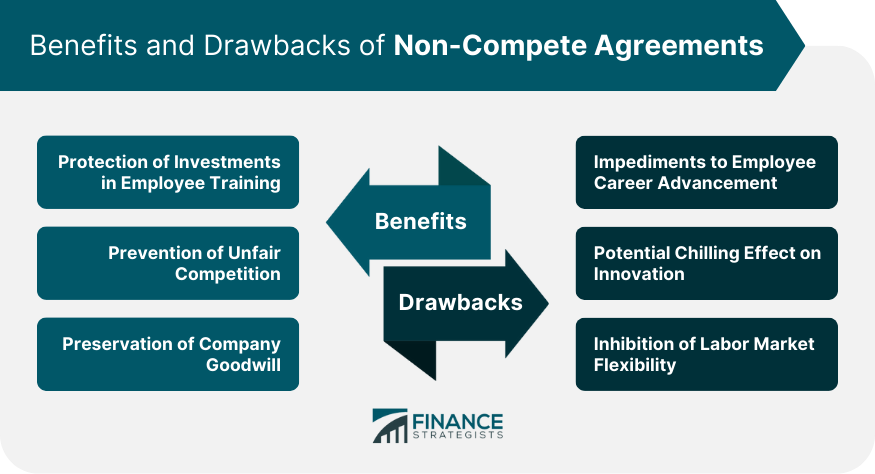

Benefits of Non-Compete Agreements

Protection of Investments in Employee Training

Prevention of Unfair Competition

Preservation of Company Goodwill

Drawbacks of Non-Compete Agreements

Impediments to Employee Career Advancement

Potential Chilling Effect on Innovation

Inhibition of Labor Market Flexibility

Conclusion

Non-Compete Agreement FAQs

The primary purpose of an NCA is to protect a company's legitimate business interests, such as its intellectual property, client relationships, and proprietary information, by preventing employees from competing against the company after their employment ends.

The enforceability of NCAs varies by jurisdiction. Some places, like California, are known for their strong stance against NCAs, deeming them largely unenforceable, while others might uphold them if they're deemed reasonable in scope and duration.

The duration varies based on the agreement and jurisdiction. However, most NCAs last between 6 months to 2 years. If deemed excessively long, a court might not enforce it.

Yes, like any contract, the terms of an NCA are negotiable. However, the leverage an employee has depends on their role, the industry, and the specific situation.

If an NCA is breached, the employer can take legal action, seeking remedies like injunctions (to stop the employee from continuing the breach) or damages (compensation for any loss caused by the breach).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.