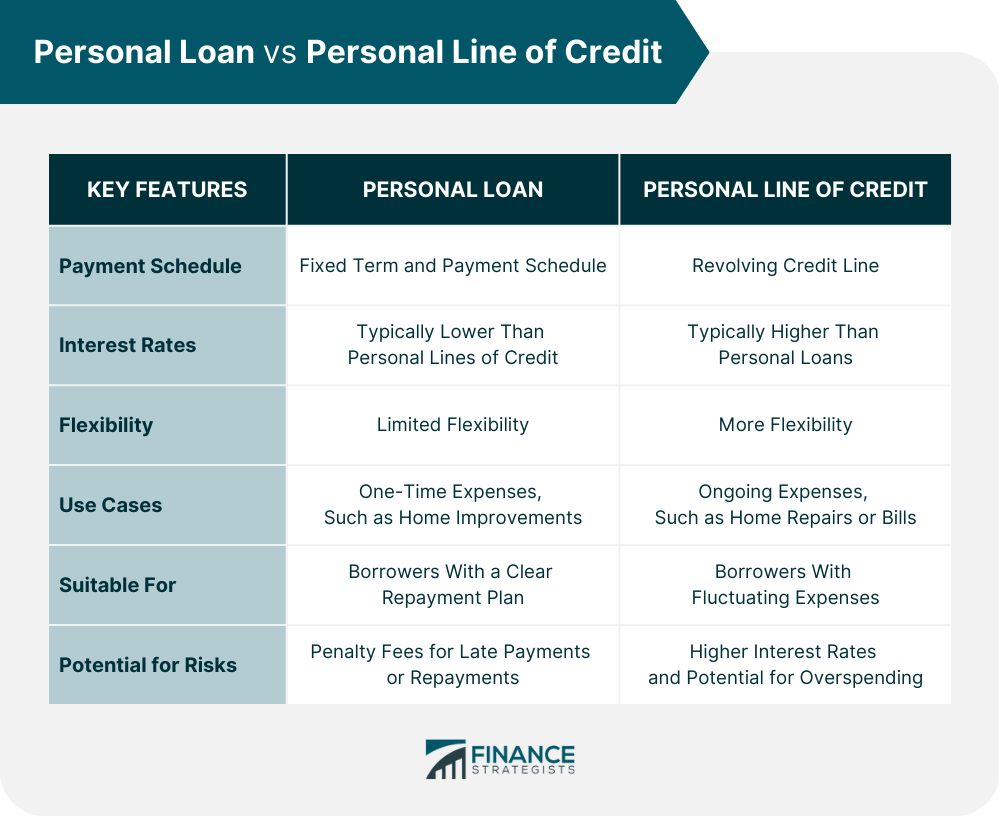

These are well-known types of unsecured financing, each with unique characteristics and aptness for diverse financial requirements. When considering which option is best for your financial needs, there are several factors to consider. Personal loans offer predictable payments and lower interest rates, making them a good option for one-time expenses. Personal lines of credit offer more flexibility when it comes to borrowing and repayment, making them a good option for ongoing expenses. Additionally, personal loans may be a better option for those with a clear repayment plan, while personal lines of credit may be better for those with fluctuating expenses. The Federal Trade Commission (FTC) provides guidance on personal loans and lines of credit, including their features, costs, and risks. The FTC also offers advice on how to avoid scams and make informed borrowing decisions. A personal loan is a lump-sum loan that you receive from a lender, which you then pay over a set period of time with fixed monthly payments. This type of loan is usually unsecured, which means that you do not need to put up any collateral to qualify for it. Personal loans are often used for a variety of purposes, such as consolidating debt, making home improvements, or paying for a major expense like a wedding or medical procedure. One of the key features of a personal loan is that it has a fixed term and payment schedule. This means that you will know exactly how much to pay each month and for how long. Personal loans also typically come with fixed interest rates, which means that your monthly payments will remain the same over the life of the loan. Typically, having a good credit score, a steady income, and a low debt-to-income ratio are prerequisites to becoming eligible for a personal loan. The application process usually involves filling out an application and providing documentation such as proof of income and identification. The timeframe for approval and disbursement can vary depending on the lender, but it typically takes a few days to a week. When selecting a personal loan, it is vital to take into account factors like interest rates, fees, and repayment terms. You should also compare different lenders to find the best deal. Some lenders may offer better rates or terms than others, so it is important to do your research before committing to a loan. One advantage of personal loans is that they have predictable payments, which makes it easier to budget your expenses. Furthermore, personal loans generally have lower interest rates than other credit types, such as credit cards. This could potentially result in long-term cost savings, particularly if you are consmolidating debt with high-interest rates. However, personal loans also have some disadvantages. For example, they may have limited flexibility when it comes to repayment terms. In the event that you're unable to make a payment, you might incur a penalty fee or experience a negative impact on your credit score. Additionally, personal loans may not be the best option if you need ongoing access to credit. A personal line of credit works by allowing you to borrow funds as needed, where you are authorized for a maximum credit limit and can borrow any amount up to that limit whenever required. Typically, this form of financing is unsecured, implying that collateral is not required to become eligible for it. Personal lines of credit are used for ongoing expenses, like home repairs or medical bills. These are more flexible than personal loans as you can withdraw funds as and when needed. Additionally, personal lines of credit often come with variable interest rates, which means that your monthly payments can fluctuate based on changes in the interest rate. To qualify for a personal line of credit, you will typically need to have a good credit score, a stable income, and a low debt-to-income ratio. The application process is similar to that of a personal loan, and the timeframe for approval and disbursement can vary depending on the lender. When choosing a personal line of credit, it is important to consider factors such as interest rates, fees, and credit limits. You should also compare different lenders to find the best deal. Some lenders may offer a lower interest rate or a higher credit limit than others, so it is important to do your research before committing to a line of credit. One advantage of personal lines of credit is that they offer more flexibility than personal loans. You can borrow as much or as little as you need, up to your credit limit. Additionally, some personal lines of credit allow you to make interest-only payments, which can be helpful if you are trying to manage your cash flow. However, personal lines of credit often come with higher interest rates than personal loans, and the potential for overspending can lead to financial instability. When deciding between a personal loan and a personal line of credit, there are several key features to consider. Personal loans offer a fixed term and payment schedule, which makes them a good option if you need to borrow a specific amount for a one-time expense. Additionally, personal loans typically come with lower interest rates than personal lines of credit. Personal lines of credit, on the other hand, offer more flexibility when it comes to borrowing and repayment. You can borrow as much or as little as you need, up to your credit limit, and make interest-only payments if necessary. However, personal lines of credit often come with higher interest rates than personal loans, and the potential for overspending can lead to financial instability. Below is a detailed comparison of personal loan and personal line of credit. There are several situations where a personal loan may be the better option. For example, if you need to borrow a specific amount for a one-time expense, such as a home renovation or a wedding, a personal loan with a fixed term and payment schedule may be the best choice. Additionally, if you have a good credit score and can qualify for a low-interest rate, a personal loan can help you save money in the long run. On the other hand, if you need ongoing access to credit for expenses such as home repairs or medical bills, a personal line of credit may be the better option. With a personal line of credit, you can borrow as little or as much as you require, up to the maximum credit limit, and have the option to make interest-only payments if required. Additionally, a personal line of credit can be a good option if you have a variable income and need the flexibility to borrow when you need it. When deciding between a personal loan and a personal line of credit, it is important to consider your specific financial needs and goals. Personal loans offer predictable payments and lower interest rates, making them a good option for one-time expenses. Personal lines of credit offer more flexibility when it comes to borrowing and repayment, making them a good option for ongoing expenses. To choose the right option, consider factors such as interest rates, fees, repayment terms, and credit limits, and compare different lenders to find the best deal. Additionally, it may be helpful to consult with a financial advisor to get a professional opinion and guidance on which option would be best for your specific financial situation.Personal Loan vs Line of Credit: An Overview

What Is a Personal Loan?

Eligibility and Application

Choosing the Right Personal Loan

Pros and Cons

What Is a Personal Line of Credit?

Eligibility and Application

Choosing the Right Personal Line of Credit

Pros and Cons

Personal Loan vs Line of Credit: Comparison of Key Features

When to Choose a Personal Loan vs a Line of Credit

Final Thoughts

Personal Loan vs Line of Credit FAQs

A personal loan is a lump-sum loan that you pay over a set period of time with fixed monthly payments, while a personal line of credit is a revolving credit line that you can draw from as needed.

The answer depends on your specific financial needs and goals. Personal loans offer predictable payments and lower interest rates, making them a good option for one-time expenses. Personal lines of credit offer more flexibility when it comes to borrowing and repayment, making them a good option for ongoing expenses.

To qualify for either type of financing, you will typically need to have a good credit score, a stable income, and a low debt-to-income ratio. The exact requirements can vary depending on the lender.

When choosing the right option, consider factors such as interest rates, fees, repayment terms, and credit limit, and compare different lenders to find the best deal.

Personal loans offer predictable payments and lower interest rates but may have limited flexibility. Personal lines of credit offer more flexibility but often come with higher interest rates and the potential for overspending.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.