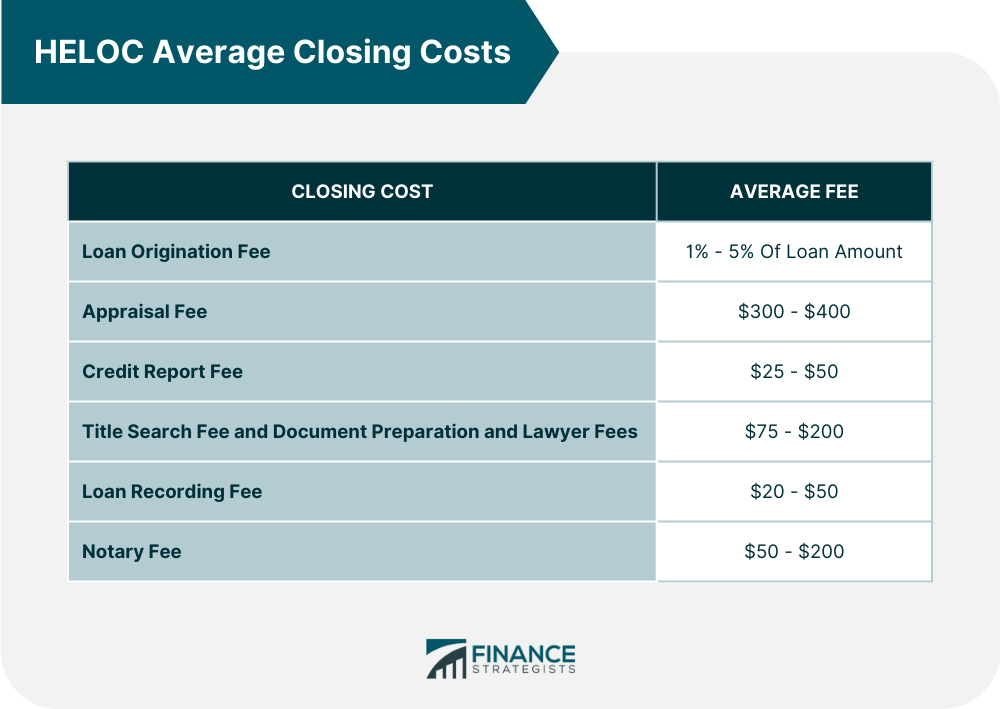

Closing costs are fees that come with purchasing a new home, such as bank fees and title searches. They are typically paid at the end of the closing process when the paperwork is signed and you own the new property. Closing costs are not only due when buying a house, but also when refinancing a mortgage or taking out a loan to build additional structures on your property. These costs can vary widely from purchase to purchase, depending on things like local taxes, insurance premiums, lender fees, title fees, and surveyor fees. It’s important to factor in closing costs when budgeting for a home purchase or refinance because they add significantly to the amount of money you need upfront. Although negotiations can reduce some of these costs (like lawyer's fees), it’s wise to save a few extra thousand dollars extra just in case. Home Equity Lines Of Credit (HELOCs) are a popular form of borrowing that can provide you with access to credit using the value of your home as collateral. However, like any other loan, there are closing costs involved in taking out a HELOC. Closing costs vary depending on the type of loan and lender you use. For a HELOC, common fees include appraisal fees, loan origination fees, title search fees, and attorney's fees. The lender may also charge additional fees such as an annual fee for maintaining the line of credit or an upfront fee for transferring money from the line into your bank account. When applying for a HELOC, it is vital to read through all the details carefully so that you understand exactly what the closing costs entail. It is also crucial to ask questions about any fees that you don't understand - for example, if there is an annual fee or any hidden charges associated with taking out or maintaining the loan. The good news is that some lenders offer HELOCs with no closing costs attached. That means you don't have to worry about paying anything upfront when opening the loan and instead just pay interest on the outstanding balance over time. If this isn't something offered by your lender, however, it's essential to factor in closing costs when budgeting for your new debt so that you don't get hit with unexpected expenses at the end of your transaction. When taking out a Home Equity Line of Credit, there are several closing costs associated with the loan that can add up quickly. This fee covers the lender's cost of processing the loan paperwork. The amount charged differentiates from one lender to another but typically falls between 1% and 5% of the total loan amount. The appraisal fee pays for an appraisal of your home to determine its current market value. This figure will be used by your lender to decide how much they will lend you against the value of your property. Typical appraisal fees range from around $300 - $400. A credit report is required by lenders as it provides information such as payment history and account balances, which helps them assess a borrower's ability to repay the loan. The average credit report fee varies depending on the lender. Generally, the fee is around $25 to $50, but some lenders may charge more or less. These fees cover any legal work needed to analyze paperwork related to your home ownership in order to protect their interests in making a loan. These typically range from $75 to $200 depending on which documents need to be researched or prepared for closing day. When you close on a HELOC, this needs to be recorded with your local county recorder's office in order for it to become public record as proof that you took out the loan agreed upon terms. The average loan recording fee usually ranges from $20 to $50, but some states may have higher fees. This fee is required to verify and authenticate all loan documents and may vary depending on state laws and lenders. Expect to pay somewhere between $50 and $200. In addition to closing costs, there are other expenses that may be involved in a HELOC, such as annual fees, inactivity charges, and early termination fees. Many lenders charge an annual fee to maintain a HELOC account. It is important to ask about this upfront so that you know what kind of expense you're dealing with down the line. Some lenders may also charge a fee if your HELOC account has not been used in any activity within a certain period of time. This can vary by lender but it is usually billed on an annual basis, so make sure you know what their policy is and keep track of when you’re making payments or withdrawing funds from your line in order to avoid any surprise charges. If you decide to close out your HELOC loan early, some lenders will charge a fee for doing so. This also varies by lender and agreement, but it is something that should always be taken into consideration when making financial decisions related to your HELOC. There are closing costs that come with taking out a home equity line of credit, including loan origination fees, appraisal fees, credit report fees, title search fee and document preparation and lawyer fees, loan recording fees, and notary fees. It is essential to understand the various costs associated with taking out a HELOC in order to make sure you are budgeting for the right amount and getting the best deal possible. By researching closing costs and understanding the different fees involved, you can ensure that you are making an informed decision about your home equity line of credit and setting yourself up for success.What Are Closing Costs?

Are There Closing Costs on HELOCs?

HELOC Average Closing Costs

Loan Origination Fee

Appraisal Fee

Credit Report Fee

Title Search and Document Preparation Fee

Loan Recording Fee

Notary Fee

Other HELOC Expenses

Annual Fees

Inactivity Charges

Early Termination Fees

The Bottom Line

Closing Costs on HELOCs FAQs

Closing costs related to a Home Equity Line of Credit (HELOC) may include, but are not limited to, fees for the appraisal and title search, document preparation and recording, surveys, insurance premiums, and other fees.

In addition to closing costs, other expenses that may be involved in a HELOC include annual fees, inactivity charges, and early termination fees.

Some lenders may offer discounts or incentives on closing costs if you meet certain requirements or shop around for different offers from various lenders. It's always a good idea to compare different offers before making a final decision about which one is best for you.

In order to avoid any unexpected fees, it is important to know your lender's policy regarding inactivity on a Home Equity Line of Credit (HELOC) account and to keep track of payments or withdrawals being made from the line.

Yes, some lenders will charge a fee if you decide to close out your loan early, so it's crucial to consider this when making financial decisions related to your home equity line of credit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.