A bond is a certificate of debt that an investor buys from a company in exchange for interest payments as well as an eventual repayment of the principal. A junk bond is a bond that carries a high risk of default, or a high risk that the issuing company will not be financially able to pay back its investors. These could be issued by small start-ups as well as larger companies that are struggling financially. To compensate for the increased risk to investors, these bonds also usually offer higher interest payments. Because of this they are sometimes referred to as "high-yield bonds" Have questions about Bonds? Click here. The credit rating is determined by independent rating agencies like Standard & Poor's, Moody's, and Fitch. These agencies evaluate the issuer's financial health, business stability, and ability to repay debt. The ratings scale begins with 'AAA' (the highest quality) and ends with 'D' (default). Bonds rated 'BB' or below are considered speculative or junk. These lower ratings indicate that the issuer has a higher risk of defaulting on their debt payments compared to more creditworthy issuers. Junk bonds are known for their higher yields, which is a reflection of the risk-return tradeoff. Due to their higher risk of default, issuers need to offer higher potential returns to attract investors. This high yield can provide a substantial income stream, making them an attractive investment for those seeking higher returns and willing to accept greater risk. In addition to higher yields, the price volatility of junk bonds can also be higher than that of investment-grade bonds. This volatility can create opportunities for significant price appreciation, albeit with increased risk. Companies that issue junk bonds typically have a riskier profile. This can be due to a variety of factors, such as having a significant amount of debt, operating in a volatile industry, or facing financial difficulties. Additionally, younger or smaller companies that lack a solid financial history may also issue junk bonds to raise capital. Government entities with strained financial positions can also issue junk bonds. Although this is less common, certain municipalities or state agencies with financial difficulties have issued junk bonds in the past. While buying junk bonds is significantly more risky for investors than buying historically safe bonds (so called "investment grade bonds" ), if the issuing company's financial state improves, investors stand to see good returns. The interest rate on a bond, also called its coupon rate, doesn't change once issued. If a company issues a junk bond with, say, a 15% coupon rate while the prevailing rate is 5%, and the company survives, then an investor holds a significantly valuable bond. Investors who buy junk bonds don't always do so just for the interest payments. If the issuing company is financially sound, high coupon rate bonds can be sold for well above the price originally paid. Investors who buy junk bonds don't always do so just for the interest payments. If the issuing company is financially sound, high coupon rate bonds can be sold for well above the price originally paid, providing potential capital gains. As mentioned earlier, junk bonds offer higher yields compared to investment-grade bonds. This can make them an attractive option for income-seeking investors. The higher income can also help cushion the impact of price fluctuations, providing a level of income stability even in volatile markets. Additionally, the higher income stream can also contribute to a higher total return when combined with potential price appreciation. However, investors must remember that these attractive yields come with a higher risk of default. They tend to have a low correlation with other asset classes, such as stocks and investment-grade bonds. This means that they may not move in the same direction or to the same extent as other assets in the portfolio. This characteristic can help spread risk and potentially enhance returns. When other assets are underperforming, the high yields and potential price appreciation of junk bonds can help offset these losses. If the issuer's financial condition improves or the market's perception of the issuer's risk decreases, the price of the junk bond can increase. This appreciation, combined with the high yield, can result in a substantial total return. Moreover, in the event of a corporate takeover or restructuring, junk bond holders may see significant price appreciation. This potential return can make junk bonds attractive to investors seeking both income and growth. Default risk is the primary concern with junk bonds. This is the risk that the issuer will be unable to make interest or principal payments, leading to a default. As previously noted, junk bond issuers typically have less stable financial conditions, making them more likely to default compared to investment-grade bond issuers. When a default occurs, bondholders may receive less than the bond's face value, or in some cases, nothing at all. To mitigate default risk, investors often rely on credit ratings, diversification, and careful analysis of the issuer's financial condition. Like all bonds, junk bonds also face interest rate risk. This is the risk that changes in interest rates will negatively affect the bond's price. As interest rates rise, bond prices fall, and vice versa. However, due to their higher yields, junk bonds can be less sensitive to interest rate changes than investment-grade bonds. Nonetheless, interest rate risk is an important factor to consider when investing in junk bonds. Market liquidity risk refers to the ease with which an investment can be bought or sold without significantly impacting its price. Junk bonds often have less liquidity than investment-grade bonds. This means that there may be fewer buyers or sellers at any given time, which can lead to price volatility and make it harder to buy or sell bonds without affecting their prices. Lack of liquidity can be especially problematic in times of financial stress, when many investors may be trying to sell their bonds simultaneously. Therefore, investors need to consider their ability to hold onto junk bonds during such periods. The junk bond market has grown significantly over the past few decades. Despite their high-risk nature, these bonds have attracted many investors due to their potential for high returns. The growth of the junk bond market has been fueled by a variety of factors, including low interest rates, increased investor risk tolerance, and the need for companies to raise capital. This growth has led to a wider range of investment opportunities, as well as increased market liquidity. However, the market's size and growth should not be the only factors considered when investing in junk bonds. Historically, junk bonds have provided higher returns than many other fixed-income securities, mainly due to their higher yields. However, these higher returns have come with higher volatility and increased risk of loss, particularly during periods of economic downturn. When examining historical returns, it's important to consider the time period being analyzed. Longer-term returns can provide a more accurate picture of the potential risks and rewards of investing in junk bonds. Risk-adjusted performance is a measure of the return earned relative to the risk taken on. Given their higher risk compared to other bonds, it's critical to evaluate the risk-adjusted performance of junk bonds. Historically, the risk-adjusted returns of junk bonds have been favorable compared to other fixed-income securities. However, there have also been periods where the risk-adjusted returns have been less attractive. Therefore, investors should consider both the potential return and the associated risk when investing in junk bonds. Several factors can influence the price of junk bonds. Understanding these factors can help investors make more informed decisions when investing in this asset class. An issuer's credit quality can deteriorate due to factors such as weak financial performance, increased debt levels, or unfavorable business conditions. If the issuer's credit quality declines, the likelihood of default increases, and the price of the junk bond may fall. Conversely, if the issuer's credit quality improves, the default probability decreases, potentially leading to price appreciation. Therefore, monitoring the credit quality of the issuer is crucial when investing in junk bonds. Economic conditions can greatly affect junk bond prices. In a robust economy, companies are generally more profitable, which can improve their creditworthiness and lead to price appreciation of their bonds. On the other hand, during an economic downturn, companies may face financial stress, leading to increased default risk and potential price depreciation of their bonds. Therefore, understanding the broader economic environment and the issuer's business performance is crucial for junk bond investors. Changes in interest rates can significantly affect junk bond prices. As previously mentioned, when interest rates rise, bond prices generally fall. However, the impact of interest rate changes on junk bonds can be mitigated by their higher yields. The yield spread, or the difference between the yield of a junk bond and a risk-free bond, also influences junk bond prices. When the yield spread widens, it indicates increased perceived risk, which can lead to price depreciation. Conversely, when the yield spread narrows, it suggests decreased perceived risk, which can result in price appreciation. Junk bonds play an important role in corporate financing, particularly for companies with riskier profiles or those undertaking ambitious projects. Companies often issue junk bonds to raise capital for risky projects or expansions that may not be funded through traditional means. By offering high yields, these companies can attract investors willing to take on more risk for the potential of higher returns. These risky projects may include new product development, geographic expansion, or other initiatives that could potentially enhance the company's profitability. If these projects are successful, the company's financial position may improve, leading to potential price appreciation of their bonds. Junk bonds can also play a crucial role in corporate restructuring and mergers & acquisitions (M&A). Companies going through financial distress may issue junk bonds to raise the necessary capital to restructure their operations and return to profitability. In the case of M&A, the acquiring company may issue junk bonds to finance the transaction. If the merger or acquisition leads to improved financial performance, the bonds may appreciate in price. However, these scenarios also come with significant risk, as the restructuring or M&A might not yield the expected benefits. Leveraged buyouts (LBOs) are another area where junk bonds play a key role. In an LBO, an investor or group of investors acquires a company using a significant amount of borrowed funds. These funds are often raised through the issuance of junk bonds. The acquired company's assets are used as collateral for the bonds, and its cash flows are used to service the debt. If the LBO is successful and the company's financial performance improves, the junk bonds can appreciate in price. However, LBOs can also be risky, and if the company struggles to service the debt, the junk bonds may decline in value. Junk bonds are high-risk debt instruments that offer attractive yields to investors willing to accept greater risk. They are issued by companies with riskier profiles, struggling financially, or seeking funds for ambitious projects. While they can provide higher returns and diversification benefits, investors must also consider the risks associated with default, interest rate fluctuations, and market liquidity. Junk bonds have historically outperformed many other fixed-income securities, but their risk-adjusted performance should be carefully assessed. Economic conditions, business performance, and credit quality significantly influence junk bond prices. When companies improve financially or undergo restructuring, there is potential for price appreciation, offering investors capital gains. In corporate financing, junk bonds play a crucial role in raising capital for risky projects, funding mergers & acquisitions, and facilitating leveraged buyouts. Investors must conduct thorough analysis and due diligence before considering junk bonds in their investment portfolios. Junk Bond Definition

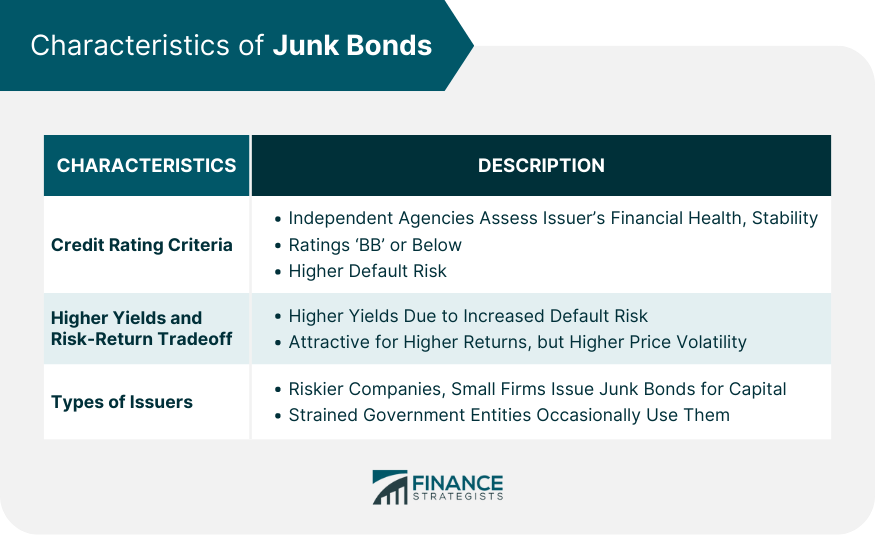

Characteristics of Junk Bonds

Credit Rating Criteria

Higher Yields and Risk-Return Tradeoff

Types of Issuers

Buying Junk Bonds

Junk Bond Interest Rates

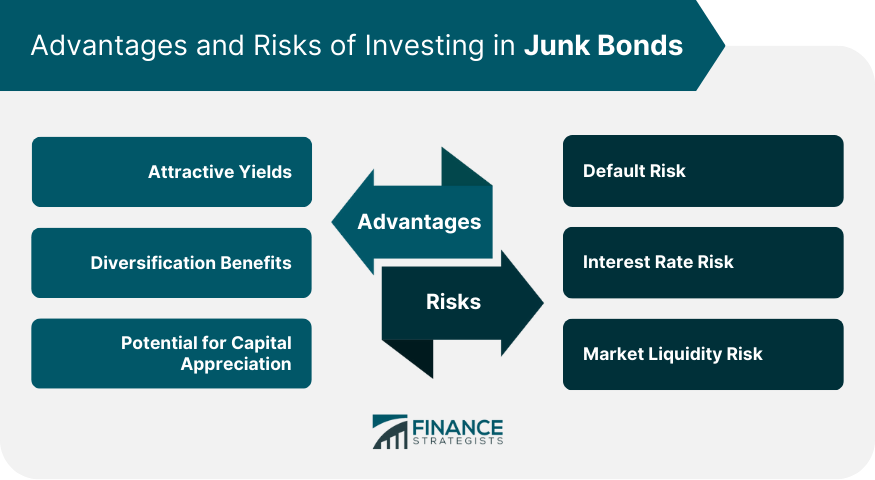

Advantages of Investing in Junk Bonds

Attractive Yields

Diversification Benefits

Potential for Capital Appreciation

Risks Associated With Junk Bonds

Default Risk

Interest Rate Risk

Market Liquidity Risk

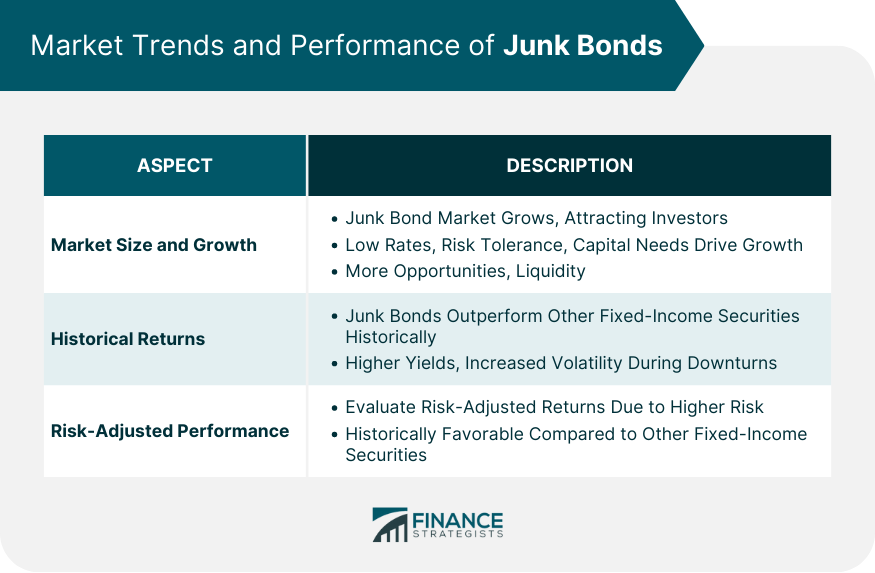

Market Trends and Performance of Junk Bonds

Market Size and Growth

Historical Returns

Risk-Adjusted Performance

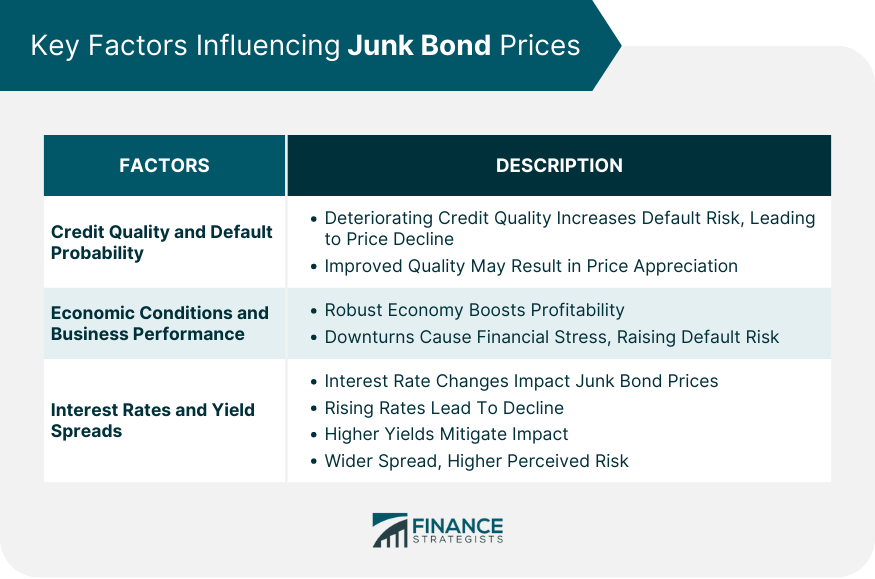

Key Factors Influencing Junk Bond Prices

Credit Quality and Default Probability

Economic Conditions and Business Performance

Interest Rates and Yield Spreads

Role of Junk Bonds in Corporate Financing

Raising Capital for Risky Projects

Restructuring and Mergers & Acquisitions

Leveraged Buyouts (LBOs)

Conclusion

Junk Bond FAQs

A junk bond is a bond that carries a high risk of default, or a high risk that the issuing company will not be financially able to pay back its investors.

A bond is a certificate of debt that an investor buys from a company in exchange for interest payments as well as an eventual repayment of the principal.

These could be issued by small start-ups as well as larger companies that are struggling financially.

While buying junk bonds is significantly more risky for investors than buying historically safe bonds (so called “investment grade bonds”), if the issuing company’s financial state improves, investors stand to see good returns.

Since most brokers don’t deal in such low-grade bonds, they became known as junk bonds. But since they typically offer high interest rates, some refer to them as high-yield bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.