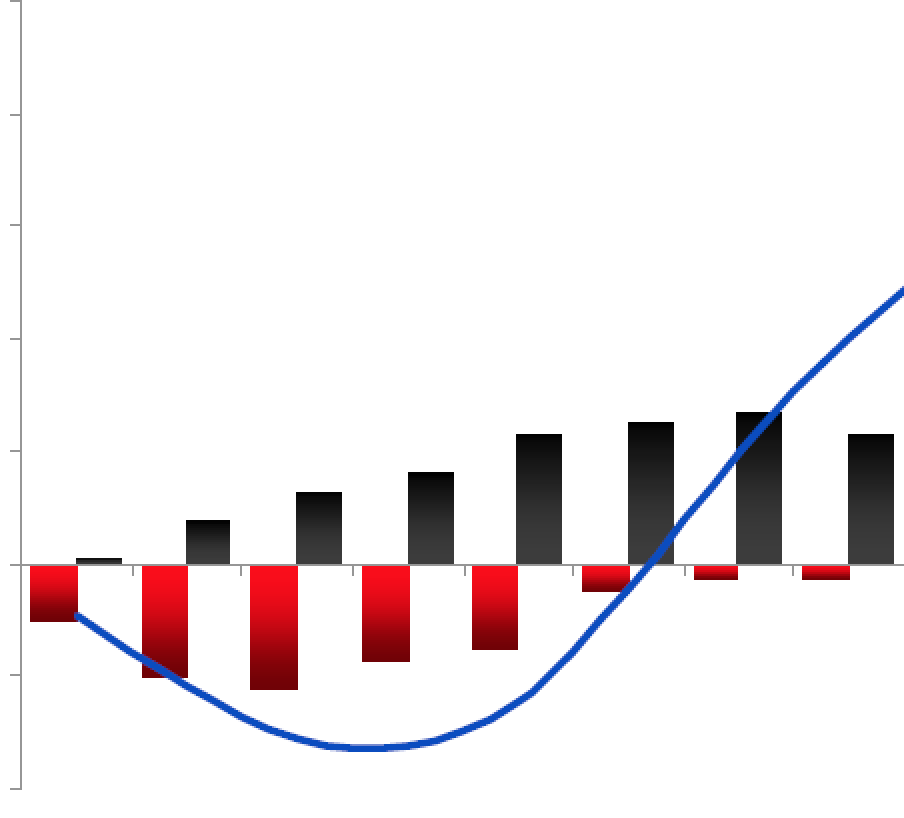

A country's trade balance is the amount of goods it is selling abroad, exporting, minus the amount of goods it is buying from abroad, importing. Basic economic theory says that as a currency becomes weaker compared to its peers, the trade balance will move in a positive direction. This is because a weaker currency makes the country's goods cheaper compared to other countries and, conversely, other countries' goods more expensive compared to domestic products. The J-curve is a theory that states that this trade balance theory is not true in the short and midterm though because there is a lag between devaluation of a currency and the response to it. It takes time for the positive effects to work through the system although the negative effects are felt immediately. For example, existing export contracts must expire and already purchased and imported goods must be used before a response to the currency depreciation happens. In the meantime, the negative effects are noticed immediately. Supply and demand quantity stays the same but the currency depreciation makes that same level of imports more expensive and those exports less profitable; moving the trade balance from position A to position B. The J-Curve is also often applied to private equity funds calculation of return on investment. The rate of return is often lower in the early years of a funds existence because expenses are higher, poor investments are written off and profitable investments not yet matured. Just like for trade-balances, the J-curve in private equity illustrates how the benefits of changes are often not felt until later in time. Similar applications have been found in political science, country economic status and medicine.Trade Balance Definition

Trade Balance Diagram & Formula

J-Curve Definition

J-Curve Diagram

J-Curve Application

J-Curve FAQs

Economic theory says that as a currency becomes weaker, trade balance will move in a positive direction. The J-curve theory states that this takes real-world time. There is a lag between devaluation of a currency and the response to it.

The J-curve diagram is called such because it traces a J shape.

The J-Curve is also often applied to a private equity fund's calculation of return on investment.

The rate of return is often lower in the early years of a funds existence because expenses are higher, poor investments are written off and profitable investments not yet matured.

It takes time for the positive effects to work through the system although the negative effects are felt immediately.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.