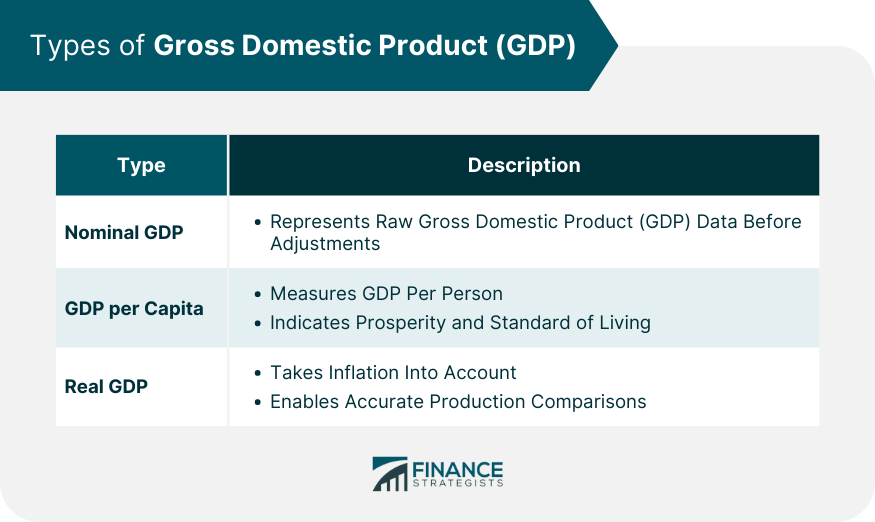

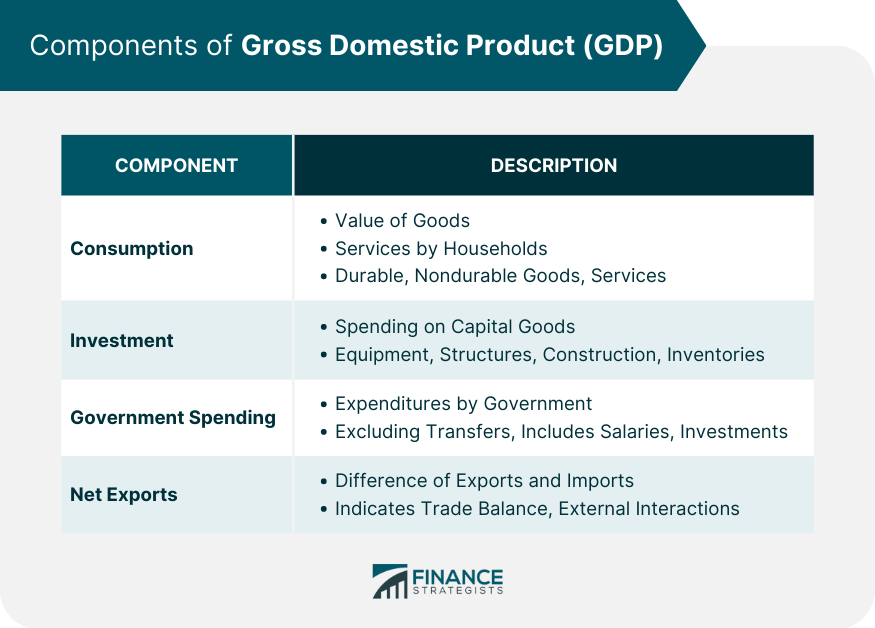

A country's Gross Domestic Product, or GDP, is the total monetary or market value of all the goods and services produced within that country's borders during a specified period of time. GDP is usually calculated annually, but it can be calculated per quarter as well. The US government, for example, releases both a GDP estimate for each quarter as well as the entire year. Because GDP provides a broad measurement of a country's production, it is often thought of as being a scorecard for a country's economic health. When GDP is growing, especially if inflation is not a major concern, workers can find jobs, businesses can sell more, and the country is generally prospering. Conversely, when it contracts, it can be a sign of economic downturn, indicating potential troubles for the labor market and businesses. There are a few different types of GDP measurements: Nominal GDP is the simplest representation of GDP. This is just the raw data before any adjustments. GDP per Capita measures the GDP per person in a country. This metric approximates the level of prosperity in a country. A high GDP per capita generally correlates with a high standard of living. Real GDP takes into account inflation to allow for more accurate comparisons of production over time. GDP Growth Rate is the increase or decrease in GDP from quarter to quarter. Consumption is the total value of goods and services consumed by households. It encompasses expenditures on durable goods (like cars and appliances), nondurable goods (such as food and clothing), and services. Being the largest component of GDP in many economies, consumption provides insights into consumer behavior and prevailing economic conditions, as confident consumers tend to spend more. Investment in the GDP context refers to the spending on capital goods that will be used in future production. This includes business investments in equipment and structures, residential construction, and changes in business inventories. A rise in investment often signals confidence in future economic growth, while a decline can indicate pessimism toward future demand. This component encompasses all government expenditures on goods and services. It excludes transfer payments like pensions and unemployment benefits, as these are not payments for goods or services. Instead, it covers things like salaries of public servants, purchase of weapons for the military, or any investment expenditure by a government. High government spending can be an instrument to combat economic downturns, but if not managed sustainably, it could lead to long-term economic challenges. Net exports represent the difference between what a country sells to the rest of the world (exports) and what it buys (imports). If a country exports more than it imports, it has a trade surplus; if it imports more than it exports, it has a trade deficit. This component of GDP reflects a country's external economic interactions and the competitiveness of its goods and services on the global stage. Economists, policymakers, and investors closely monitor GDP figures to assess the health of an economy. It provides a comprehensive snapshot, revealing whether the economy is expanding or contracting. Trends in GDP can indicate the direction of economic travel, providing valuable information to everyone from government agencies to private businesses. When GDP growth is sluggish or negative, governments might implement expansionary fiscal policies, like tax cuts or increased public spending, to stimulate economic activity. Conversely, if the economy is overheating, contractionary policies might be applied. The cyclical nature of economies requires timely and informed decisions, with GDP being a primary indicator guiding these choices. GDP figures are pivotal in comparing the economic performance of different countries. By assessing GDP on a per capita basis (dividing GDP by the population of a country), we gain insights into the relative economic prosperity of nations. This kind of international comparative analysis helps in understanding global economic dynamics, trade relationships, and competitive positioning. While GDP measures the monetary value of goods and services produced within a country, it doesn't account for non-market activities. Activities such as household chores, volunteering, or childcare, which do not have a market transaction, are not reflected in the GDP. This can lead to an underrepresentation of economic activity, especially in economies with substantial informal sectors or where family roles dominate certain activities. GDP quantifies economic production but does not necessarily reflect the well-being or quality of life of citizens. A country might have a high GDP but significant disparities in income distribution, leading to social inequality. Similarly, nations with strong GDP growth might face issues like pollution or deteriorating mental health, which the GDP figure does not capture. The pursuit of GDP growth often comes with environmental costs. GDP does not account for the depletion of natural resources or environmental degradation resulting from economic activity. As the global discourse shifts toward sustainable development, the limitations of GDP in this realm become more evident. A country might register robust GDP growth while causing irreversible environmental damage, prompting concerns about the true 'progress' being made. Balance of trade is a key element in the GDP formula. When a country sells more domestic products to foreign nations than it buys, its GDP increases. When it buys more products from foreign nations than it sells (called a trade deficit), GDP decreases. The balance of trade refers to the difference between the value of a nation's exports and imports of goods over a specific period. This balance can have a notable influence on a country's GDP and overall economic performance. A trade surplus occurs when a country exports more goods than it imports. This surplus has a positive impact on the GDP. When a country is able to sell more of its domestic products to foreign nations, it generates additional revenue, which contributes to the increase in GDP. The revenue earned from exports directly adds to the economy's output and, consequently, the GDP. This additional income can lead to increased investment and consumption within the domestic economy, further stimulating economic growth. Conversely, a trade deficit occurs when a country imports more goods than it exports. This situation can have a negative effect on the GDP. When a country buys more products from foreign nations than it sells, it results in a net outflow of money, which can reduce the GDP. The reduction in GDP occurs because the money spent on imports does not directly contribute to the domestic economy's production. A persistent trade deficit can lead to decreased economic growth as money leaves the country, potentially affecting domestic industries and employment. The balance of trade is closely connected to a nation's aggregate demand—the total demand for goods and services in an economy. A trade surplus can contribute to higher aggregate demand as it adds to domestic production and income. This can lead to increased economic activity and potential GDP growth. On the other hand, a trade deficit can impact aggregate demand negatively by draining money from the economy, potentially causing economic slowdowns. Governments often consider the balance of trade when formulating economic policies and trade strategies. A trade deficit might lead to policy adjustments aimed at boosting exports or reducing imports. These policies can influence economic growth and impact the overall GDP. For instance, a government might implement measures to enhance domestic industries, encourage innovation, or negotiate trade agreements to improve the trade balance and consequently contribute to GDP growth. Gross Domestic Product is a fundamental measure of a country's economic activity, reflecting the total market value of goods and services produced within its borders. GDP not only functions as an economic scorecard but also provides valuable insights into a nation's well-being and progress. Components of GDP, including consumption, investment, government spending, and net exports, collectively shape economic trends and guide policy decisions. However, GDP has its limitations. It excludes non-market activities, overlooks quality of life indicators, and sidesteps environmental considerations. Its nexus with the balance of trade underscores how international interactions influence economic health. GDP informs policy formulation, helping governments navigate expansion or contraction, and enables cross-country comparisons.What Is GDP?

Types of GDP

Components of GDP

Consumption

Investment

Government Spending

Net Exports

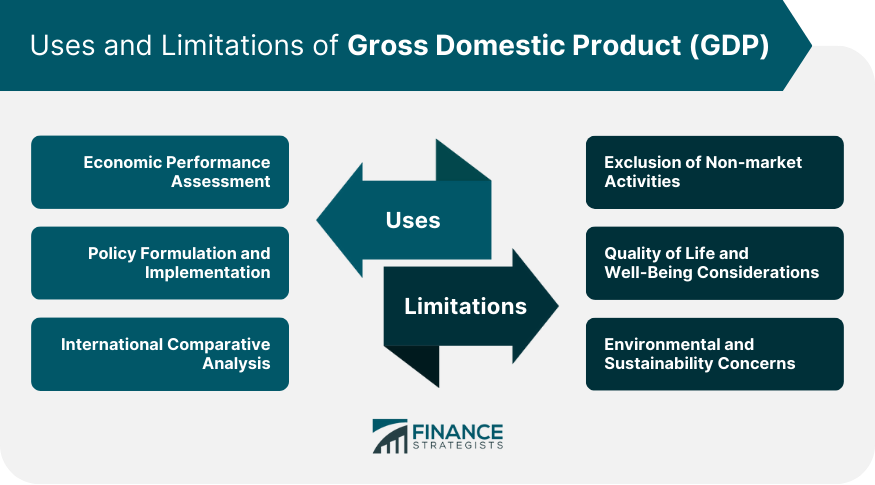

Uses of Gross Domestic Product (GDP)

Economic Performance Assessment

Policy Formulation and Implementation

International Comparative Analysis

Limitations of GDP as an Economic Indicator

Exclusion of Non-market Activities

Quality of Life and Well-Being Considerations

Environmental and Sustainability Concerns

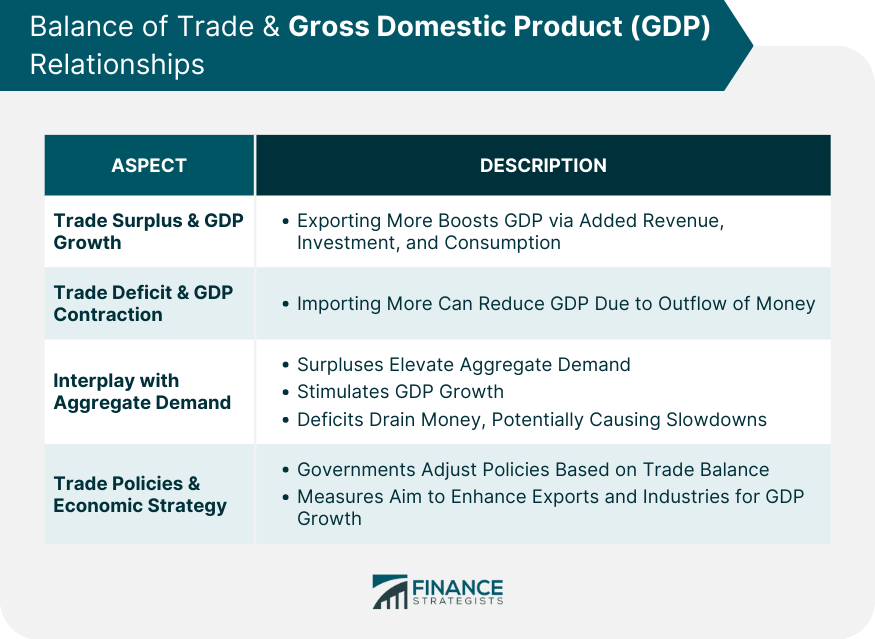

Balance of Trade & GDP

Trade Surplus and GDP Growth

Trade Deficit and GDP Contraction

Interplay With Aggregate Demand

Trade Policies and Economic Strategy

Conclusion

Gross Domestic Product (GDP) FAQs

GDP is an acronym for Gross Domestic Product.

A country’s Gross Domestic Product, or GDP, is the total monetary or market value of all the goods and services produced within that country’s borders during a specified period of time.

Because GDP provides a broad measurement of a country’s production, it is often thought of as being a scorecard for a country’s economic health.

Balance of trade is a key element in the GDP formula. When a country sells more domestic products to foreign nations than it buys, its GDP increases.

The different types of GDP measurements are Nominal GDP, GDP per capita, real GDP, and GDP growth rate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.