A coupon rate is the interest attached to a fixed income investment, such as a bond. The coupon rate is fundamentally established when the bond is issued and remains fixed for the life of most bonds. It’s an essential component because it dictates the annual income an investor can expect to receive for the duration they hold the bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer. The interest payment is equivalent to the bond's coupon rate, which is a percentage of the bond's "principal" also known as its "face value" or "par value". Interest payments continue to be paid to the bondholder until the bond matures, and the face value of the bond is returned to the bondholder. Coupon rates play a pivotal role in the world of finance, particularly in the context of bonds. A coupon rate is essentially the annual interest rate that a bondholder receives as a percentage of the bond's face value. Here's how it works: When an investor purchases a bond, they are essentially lending money to the bond issuer (typically a corporation or government entity). In return, the issuer promises to pay periodic interest payments to the bondholder, known as coupons. These coupons are usually paid semi-annually or annually. The coupon rate directly affects the bond's market price. When the market interest rates rise above the coupon rate, existing bonds with lower coupon rates become less attractive to investors. As a result, their prices may decrease. Conversely, when market rates fall, bonds with higher coupon rates become more appealing. Bondholders rely on the coupon payments as a steady source of income. The coupon payments are independent of the bond's market price fluctuations. This predictability is particularly beneficial for investors seeking consistent income, such as retirees. Understanding the relationship between the coupon rate and prevailing market interest rates is crucial. If a bond's coupon rate is higher than current market rates, the bond is considered more attractive since it offers a higher yield. Conversely, if the coupon rate is lower, the bond may be less appealing. The coupon rate plays a crucial role in setting the income stream for bond investors. For instance, a $1,000 bond with a 5% coupon rate will pay bondholders $50 annually. The actual income received is a straightforward multiplication of the face value of the bond and the coupon rate. For investors looking for predictable income, particularly retirees or those with fixed income needs, the coupon rate provides clarity on the returns they can expect from the bond. The coupon rate has a direct bearing on bond pricing. When the coupon rate of a bond is higher than prevailing market interest rates, the bond tends to be priced at a premium because it offers better returns than other available investments. Conversely, if the coupon rate is lower than the current market rates, the bond is likely to be priced at a discount because its returns are less attractive compared to newer bonds or alternative investments. Comparing the coupon rate with prevailing market interest rates can offer insights into the bond's relative value. If market interest rates rise above the bond's coupon rate, new bonds will be more appealing since they offer higher returns. Consequently, existing bonds with lower coupon rates might be sold at a discount. The opposite holds true when market rates fall below the coupon rate, rendering existing bonds more valuable. A fixed coupon rate bond is the most traditional type, where the interest payment remains constant throughout the bond's life. Once set at the time of issuance, this rate doesn't change, ensuring that bondholders receive the same interest payment at each interval, usually semi-annually, until maturity. Unlike fixed-rate bonds, floating coupon rate bonds have interest payments that vary based on some underlying benchmark, often a well-known index like LIBOR. The coupon rate for these bonds is recalculated periodically, ensuring that the bond's interest payments are more in line with current market conditions. Zero-coupon bonds, as the name suggests, do not have a coupon rate. Instead of periodic interest payments, these bonds are issued at a significant discount to their face value. The investor realizes the bond's yield as the difference between the discounted purchase price and the full face value received at maturity. Prevailing market interest rates are the foremost factor influencing the coupon rates of newly issued bonds. When market rates are high, newly issued bonds must offer comparable rates to attract investors. In a low-rate environment, issuers can afford to offer bonds with lower coupon rates and still find willing buyers. The financial health and creditworthiness of the bond issuer play a significant role in determining the coupon rate. Issuers with excellent credit ratings, such as most national governments, can issue bonds with lower coupon rates. In contrast, entities with lower credit ratings, whether corporations or municipalities, must offer higher coupon rates to compensate investors for the added risk. Broad economic conditions can also influence coupon rates. In a booming economy, there's a higher demand for capital, possibly driving up interest rates. Conversely, in a recession, central banks might slash interest rates to spur borrowing and investment, impacting the coupon rates of newly issued bonds. A bond's coupon rate is affected by the issuer's credit rating and the time to maturity. Credit rating refers to an estimation of how likely the issuer is to be able to pay the dues of a bond. Poor credit rating is an indicator that a bond issuer has a higher chance of "defaulting", or being financially unable to pay back the loan. Bond issuers with a poor credit rating should have a higher coupon rate to compensate for the additional risk. For example, an investor purchases a $10,000 bond with a coupon rate of 4%. The bondholder will therefore earn interest payments of $400 annually, or 4% of $10,000, until the bond matures. On its maturity date, the bondholder will receive the $10,000 principal back. It's important to note that bonds may trade at a premium or discount on the open markets. However, the coupon rate is a percentage of the bond's face value, not the amount the bond was purchased for. Time to maturity is the length of time a bond is issued for. All else being equal, a bond with a longer maturity will usually have a higher coupon rate than a shorter-term bond. It signifies the timeline within which the bond issuer borrows funds from bondholders and agrees to repay the principal amount along with periodic interest payments. Bonds can have varying maturity periods, ranging from short-term to long-term. A key principle in bond investing is that, generally, bonds with longer maturities tend to offer higher coupon rates as compensation to investors for tying up their funds for an extended period. The relationship between bond maturity and coupon rate is influenced by several factors. One of the primary factors is the prevailing interest rate environment. If interest rates are expected to rise in the future, new bonds issued in the market will likely have higher coupon rates to attract investors. This is because investors would demand a higher return on their investments to account for the anticipated increase in interest rates. Conversely, if interest rates are expected to decrease, new bonds may have lower coupon rates. The term "coupon rate" comes from a physical coupon on bond certificates which was clipped and presented for payment on the day the interest payments were due. In the past, when investors purchased a bond, the bond certificates often had attached coupons, similar to those found on retail discount coupons. These bond coupons represented the periodic interest payments that the bondholder was entitled to receive. On the specified dates when the interest payments were due, bondholders would physically detach the coupons from the bond certificates and present them for payment. The issuer's agent would then process the coupon and provide the bondholder with the agreed-upon interest payment. This process of "clipping" the coupon and presenting it for payment gave rise to the term "coupon rate," which directly referred to the interest rate specified on the coupon itself. The coupon rate signifies the fixed annual interest rate attached to a bond, forming the basis for the income investors can expect over the bond's lifespan. This interest payment is a vital component, representing the profit bondholders make by lending funds to the bond issuer. The coupon rate influences bond pricing, impacting whether bonds are priced at a premium or discount relative to market rates. By comparing coupon rates with prevailing market interest rates, investors can gauge a bond's attractiveness and value. Fixed, floating, and zero-coupon rates provide different structures for interest payment, accommodating diverse investor preferences. Market interest rates, issuer creditworthiness, and economic conditions are pivotal factors influencing coupon rates, shaping their levels. Additionally, a bond issuer's credit rating affects the coupon rate, as it reflects the issuer's ability to meet bond obligations. Understanding coupon rates empowers investors to make informed decisions in the dynamic landscape of financial markets.Coupon Rate Definition

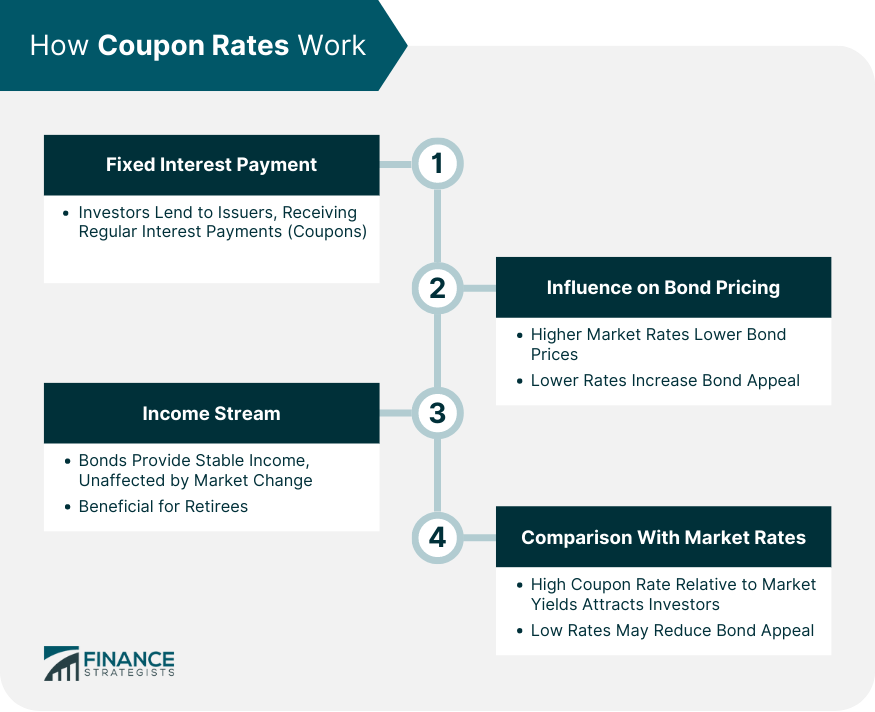

How Coupon Rates Work

Fixed Interest Payment

Influence on Bond Pricing

Income Stream

Comparison With Market Rates

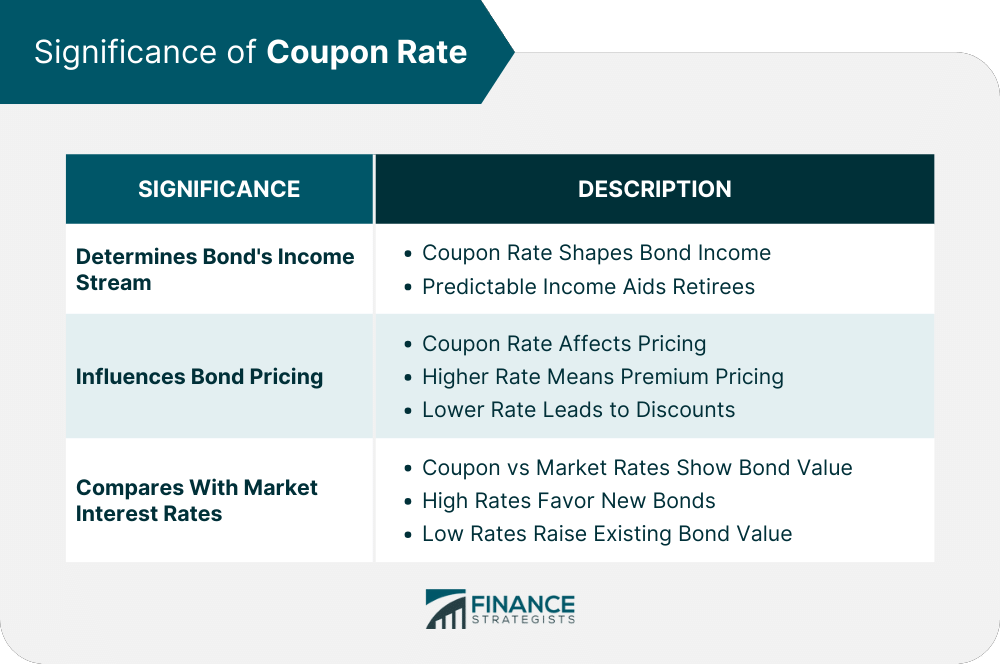

Significance of Coupon Rate

Determines Bond's Income Stream

Influences Bond Pricing

Compares With Market Interest Rates

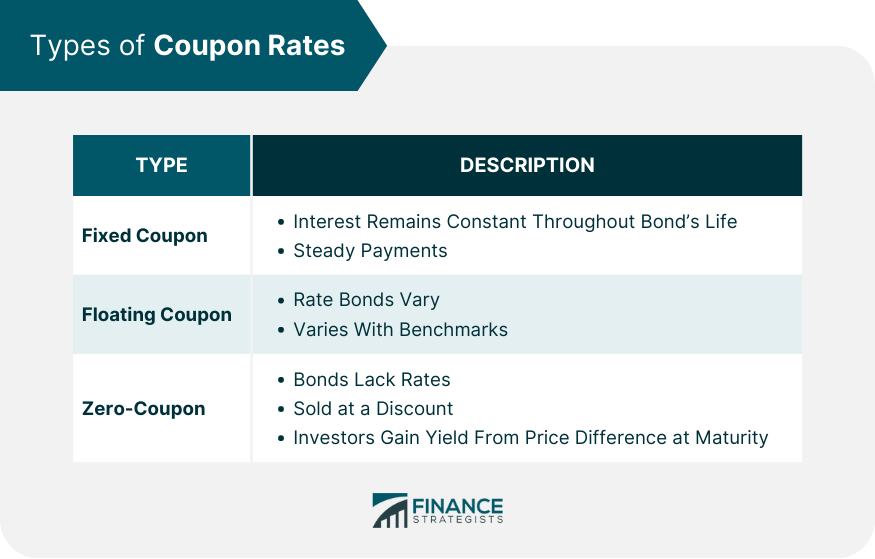

Types of Coupon Rates

Fixed Coupon Rate

Floating Coupon Rate

Zero-Coupon Rate

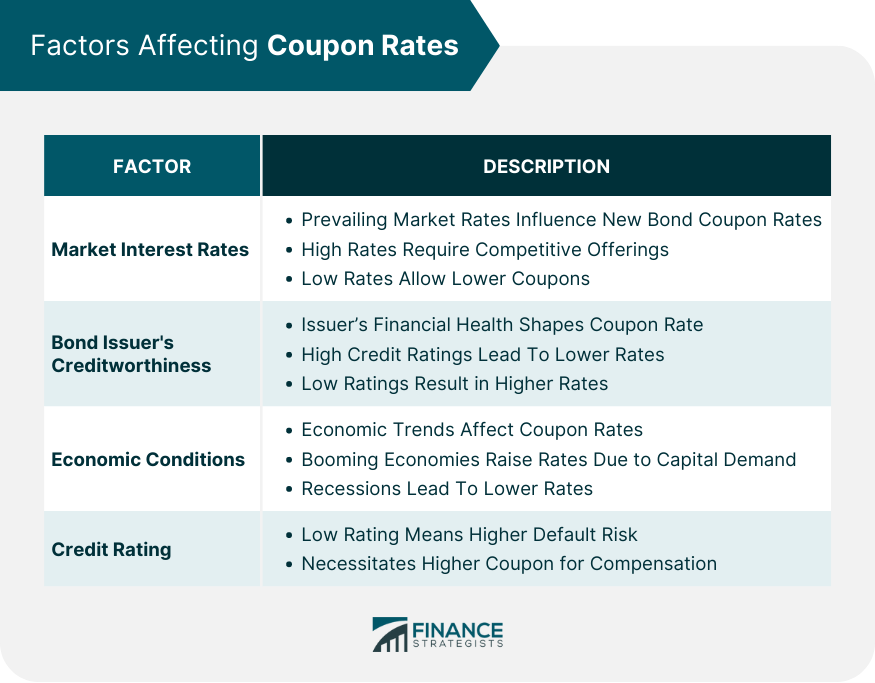

Factors Affecting Coupon Rates

Market Interest Rates

Bond Issuer's Creditworthiness

Economic Conditions

How Credit Rating Affects Coupon Rate

Coupon Rate Example

Bond Maturity

Coupon Rate Fun Fact

Conclusion

Coupon Rate FAQs

A coupon rate is the interest attached to a fixed income investment, such as a bond.

The interest payment is equivalent to the bond’s coupon rate, which is a percentage of the bond’s “principal,” also known as its “face value” or “par value.”

All else being equal, a bond with a longer maturity will usually have a higher coupon rate than a shorter-term bond.

The term “coupon rate” comes from a physical coupon on bond certificates which was clipped and presented for payment on the day the interest payments were due.

Poor credit rating is an indicator that a bond issuer has a higher chance of “defaulting,” or being financially unable to pay back the loan. Bond issuers with a poor credit rating should have a higher coupon rate to compensate for the additional risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.