Foreclosure is the legal process of a lender repossessing a mortgaged property from a borrower due to non-payment. The process begins with notifications sent to borrowers that they are in arrears and if payment is not made, foreclosure proceedings will commence. Upon initiating foreclosure proceedings, lenders file documents with local courts or registries and proceed with repossession efforts. Homeowners can attempt to minimize their losses by negotiating terms or deferring payments, though ideally, preventing foreclosure is ideal. Bankruptcy is a form of debt relief available to individuals and businesses who are struggling with their debts. Individuals or couples filing for bankruptcy may choose to pursue either chapter 7 or chapter 13. Both of these bankruptcy chapters have the potential of stopping the foreclosure process, but it depends on the individual’s circumstances and state laws. When filing for chapter 7, a debtor will have all of their eligible debts discharged as soon as possible. This means that they are no longer legally obligated to pay them back, except in certain cases such as student loans, taxes, and child support payments. Although this type of bankruptcy can provide immediate relief from creditors calling and demanding payment, it does not guarantee that a stopped foreclosure will remain so permanently. In most cases, lenders can continue the process once the case is over if they have not received payment by then. Filing for Chapter 13 bankruptcy allows debtors to catch up on their mortgage payments over a three to five-year period, with lenders having to pause any foreclosure proceedings until it is completed. Even if there is an outstanding balance after all payments have been made, it must be treated as unsecured debt and lenders cannot repossess any property used as collateral. Bankruptcy may provide homeowners with some relief when dealing with delinquent mortgage payments, although the rules may differ depending on the area of residence and legal advice should be sought before filing. Foreclosure proceedings can be a stressful and overwhelming experience for those struggling with mounting debt. Fortunately, filing for bankruptcy may be an option to halt the process and free up extra funds to help pay off the debt. Filing for bankruptcy is not a decision that should be taken lightly, but if done correctly, it can provide relief from foreclosure. Here are some important steps to take when considering filing for bankruptcy in order to stop a foreclosure: Before you begin the process of filing for bankruptcy, discuss your situation with your lender. They may have other solutions or plans available outside of foreclosure proceedings. There are two main types of personal bankruptcy that you may be eligible for—Chapter 7 and Chapter 13. Depending on your income and assets, one may better suit your needs than the other. Learn more about each type before deciding which route is best for you. To file any type of bankruptcy, certain documents are required, such as current income statements, proof of residency or homeowner status, tax returns from the last two years, and most recent bank statements. Consult with attorneys and financial advisors who specialize in filing bankruptcies in order to get advice tailored to your individual needs and avoid further complications down the line. Known as an “automatic stay”, this motion will prevent additional collection efforts against you while also stopping any ongoing court actions related to debts, such as foreclosures or repossessions of the property, until after the process has been completed. After automatic stay has been enacted, creditors cannot proceed with collections until they receive notice that their rights must resume normal activity again (usually after 90 days). This gives a debtor enough time to negotiate loan modification plans to help manage their finances better going forward. By following these steps carefully, individuals struggling with debt have options available that can halt foreclosure proceedings and provide much-needed relief during difficult times. Filing for bankruptcy can be a difficult decision, but those considering it in order to stop foreclosure may find comfort in knowing that there are several potential benefits. A key advantage of filing for bankruptcy is the automatic stay that frees debtors from additional collection efforts and any ongoing court actions such as foreclosures or repossessions until after the process has been completed. After the automatic stay has been enacted, creditors cannot proceed with collections until they receive notice that their rights must resume normal activity again (usually after 90 days). This gives debtors enough time to negotiate loan modification plans to manage their finances better. By filing for bankruptcy and halting foreclosure proceedings, debtors are essentially putting their financial problems on hold while they seek relief solutions such as loan modifications or payment plans. In doing so, they can avoid additional late fees or penalties associated with continuing with the foreclosure process and potentially start rebuilding their credit score going forward. Filing for bankruptcy also provides an opportunity to refresh your finances by discharging qualified debts and providing access to more funds that can help you make payments on remaining debts and other possessions like homes or cars. Bankruptcy filings provide a moratorium on creditor calls and lawsuits during the process, offering much-needed peace of mind during an otherwise stressful situation. Filing for bankruptcy is a difficult decision and shouldn’t be taken lightly. Fortunately, there are other alternatives that may provide relief from foreclosure without having to resort to filing for bankruptcy. Here are some of the most effective strategies for halting foreclosure proceedings: Debt consolidation involves taking out a new loan and using it to pay off existing debts such as credit cards, student loans, medical bills, or car loans. This can help by combining all of your payments into one single monthly payment, making it easier to manage your debt load. Additionally, consolidating debts could potentially lower interest rates, resulting in lower overall payments. If creditors are willing to work with you, you may be able to negotiate a payment plan that includes reduced or delayed payments while also extending the amount of time you have before any remaining balance is due. You should never agree to any deal that you know you won’t be able to keep up with, and make sure that any terms are clearly stated in writing so that both parties can understand their responsibilities going forward. Credit counseling helps individuals who are struggling financially to manage their money better by providing advice on budgeting and financial literacy education, along with helping them create customized plans based on their own individual situations. Working closely with an expert will help ensure that debtors make educated choices when it comes time to decide how best to move forward with their finances. Another viable alternative is restructuring current debts, which involve negotiating new terms through refinancing loans or extending repayment plans. This can include longer repayment periods and lowered interest rates, depending on the creditor's discretion. This option can also result in lower overall payments, making it more likely that debtors will be able to stay current on their mortgages going forward. Overall, filing for bankruptcy should not necessarily be seen as the only way out during times of financial hardship since there are many other options available, such as debt consolidation, settling/negotiating with creditors, credit counseling, and restructuring existing debts. These options may provide relief without the hassle of filing for bankruptcy. Ultimately, it is important to remember that filing for bankruptcy is a big decision and should not be taken lightly. While it may seem like the only solution when facing foreclosure, there are several alternatives that can provide relief without having to resort to filing for bankruptcy. Debtors should explore all options before making any final decisions and work closely with experts to ensure that they make the best choices possible for their individual situations.What Is Foreclosure?

Can Bankruptcy Stop Foreclosure?

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

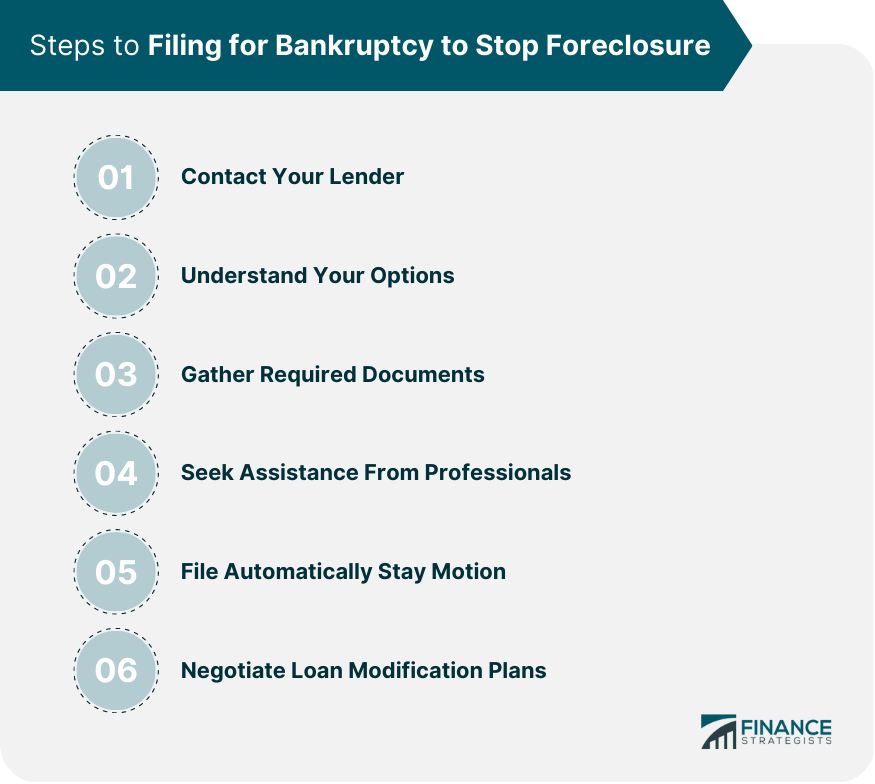

How to File Bankruptcy to Stop Foreclosure

Contact Your Lender

Understand Your Options

Gather Required Documents

Seek Assistance From Professionals

File Automatically Stay Motion

Negotiate Loan Modification Plans

Advantages of Filing Bankruptcy to Stop Foreclosure

Automatic Stay

Negotiating Loan Modification Plans

Avoiding Additional Fees

Opportunity to Refresh Finances

Moratorium on Creditor Calls and Lawsuits

Alternatives to Filing Bankruptcy to Stop Foreclosure

Debt Consolidation

Negotiating Reduced Payment Plans and Extensions

Credit Counseling

Restructuring

Final Thoughts

Can Bankruptcy Stop Foreclosure? FAQs

Yes, filing for bankruptcy can help stop the foreclosure process. Chapter 13 bankruptcy gives debtors the opportunity to catch up on their mortgage payments over a period of three to five years. This allows them to keep their home and restructure their debt payments.

Once the filing is complete, an automatic stay will be put in place which will delay or prevent any further proceedings from taking place including any potential foreclosures. Depending on individual situations, this stay may last anywhere between three and five years.

Yes, if you have filed for Chapter 13 bankruptcy you may be able to negotiate with your lender and reinstate your loan by paying back all of your past-due payments plus any additional fees or penalties that may have occurred during the foreclosure process.

Yes, there are several alternatives that could provide relief from foreclosure without having to resort to filing for bankruptcy such as settling/negotiating with creditors, credit counseling, restructuring existing debts, and debt consolidation which can potentially lower interest rates resulting in lower overall payments.

Chapter 7 Bankruptcy provides some immediate relief from creditors and bills by eliminating most types of consumer debt such as credit card bills, medical bills, and unsecured personal loans while still allowing individuals the ability to keep certain properties such as homes or cars that they may need in order to continue their lives normally.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.