A 501(c)(3) application is a formal request to the Internal Revenue Service (IRS) by a nonprofit organization seeking to be recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code. This designation allows organizations to be exempt from federal income tax, opening up the opportunity to receive tax-deductible charitable contributions. The process of becoming a 501(c)(3) involves completing and submitting Form 1023 to the IRS, along with required attachments and fees. This comprehensive form involves providing detailed information about the organization, including its structure, governance, financial data, and specific activities. The organization must demonstrate its purpose falls under the exempt purposes outlined in the code: charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, or preventing cruelty to children or animals. The cost of applying for 501(c)(3) status for your organization depends largely on its size. Sufficiently small organizations that are eligible to fill out the abridged form may only have to pay a $275 user fee. Larger organizations will have to pay $600 plus the cost of an attorney, which may cost up to $15,000. The cost of applying for 501(c)(3) status goes beyond just the application fee. There are often legal and professional fees associated with the preparation and submission of the application. The IRS sets the application fee for 501(c)(3) status based on the organization's projected gross receipts. The fee structure is tiered, making it more affordable for smaller nonprofits and more expensive for larger ones. This tiered structure is designed to reduce the financial burden on smaller, fledgling nonprofits, allowing them to access the benefits of tax-exempt status. The application fee becomes part of the organization's initial expenses and should be budgeted for accordingly. While the application fee can be a significant expense, there are ways for some organizations to reduce this cost. In some circumstances, the IRS offers fee waivers or reduced fees. Eligibility for these reductions or waivers often depends on the organization's financial situation and its projected gross receipts. For instance, smaller organizations may qualify for reduced fees, providing a much-needed break to these fledgling entities. It's important to research current IRS regulations to determine if your organization qualifies for any fee waivers or reductions. The complex nature of the 501(c)(3) application can often necessitate legal assistance. An experienced attorney can ensure the application is complete, accurate, and compliant with IRS regulations, increasing the chances of a successful application. Fees for legal assistance can vary widely based on factors such as the attorney's experience, the organization's complexity, and the geographic location. Regardless of the cost, many organizations find that the expertise of a legal professional is invaluable in navigating the application process. Accountants also play a crucial role in the 501(c)(3) application process. They prepare financial statements and Form 990, which provides the IRS with information about the organization's financial activities. The cost of accounting services can vary based on the complexity of the organization's finances and the accountant's expertise. Despite the cost, having an accountant's assistance can ensure accuracy in financial reporting, thus increasing the likelihood of a successful application. In addition to the application fee and professional services, there are also administrative costs associated with applying for 501(c)(3) status. One such expense is printing and mailing costs. Depending on the size of the organization and the complexity of its activities, the application package may run hundreds of pages long, including supplementary materials. Costs associated with printing these materials and mailing them to the IRS add to the total application cost. Organizations may also incur travel expenses for meetings and consultations related to the application process. For instance, if the organization's leadership needs to meet with an attorney or accountant, there may be travel costs associated with these meetings. Furthermore, if the organization's leadership is not located in the same geographical area, there may be travel costs associated with convening leadership meetings. These costs should be factored into the budget for the application process. One way to mitigate the costs associated with the 501(c)(3) application is through volunteer support and pro bono services. Experienced volunteers or board members may be able to assist with parts of the application process, reducing the need for paid professionals. Additionally, some attorneys and accountants may offer pro bono services or reduced rates for nonprofit organizations. Leveraging these services can significantly decrease the financial burden associated with the application process. Various nonprofit support organizations and websites offer resources, including step-by-step guides, sample narratives, and checklists that can help streamline the application process. Utilizing these resources can save time and effort, reducing the need for extensive professional services. While these resources should not replace legal or accounting advice, they can provide useful guidance and help organizations prepare for the application process. Applying for 501(c)(3) status can be a significant endeavor for nonprofit organizations, involving various fees and expenses. The cost of the application primarily depends on the size of the organization, with smaller nonprofits having lower fees compared to larger ones. The application fee can be reduced or waived in certain circumstances, providing relief to fledgling entities. In addition to the application fee, legal and professional fees can add to the overall cost. Administrative expenses, including printing, mailing, and travel costs, should also be considered when budgeting for the application process. Leveraging volunteers and pro bono services reduces the need for paid professionals, easing the financial burden. Using online resources and templates from nonprofit support organizations streamlines the application process and reduces reliance on extensive professional services.What Is a 501(c)(3) Application?

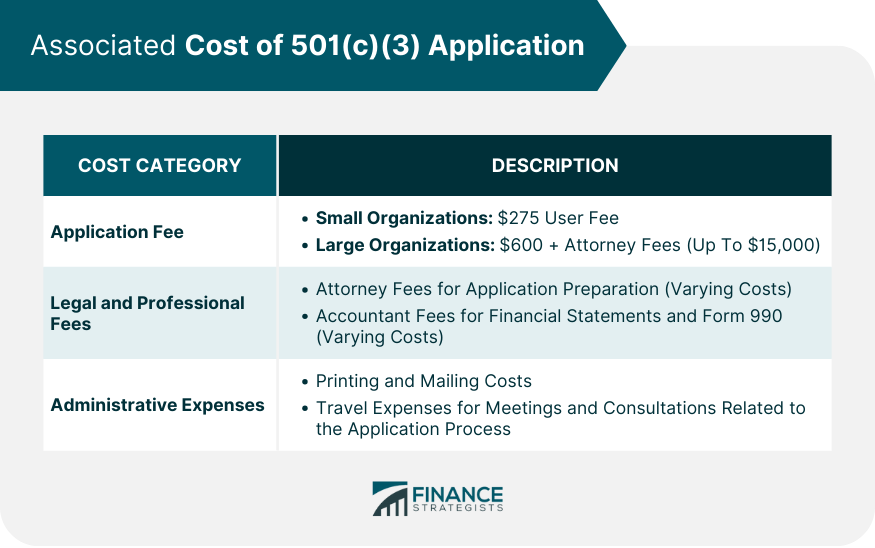

Cost of 501(c)(3) Application

Application Fee

Legal and Professional Fees

Administrative Expenses

Application Fee Breakdown

Fee Structure Based on Organization's Annual Gross Receipts

Fee Waiver and Reduced Fee Options

Legal and Professional Fees

Attorney Fees for Application Preparation

Accountant Fees for Financial Statements and Form 990

Administrative Expenses

Printing and Mailing Costs

Travel Expenses for Meetings and Consultations

Strategies to Minimize Application Costs

Volunteer Support and Pro Bono Services

Utilizing Online Resources and Templates

The Bottom Line

How Much Does the 501(c)(3) Application Cost? FAQs

A 501(c)(3) organization is a non-profit organization with tax exempt status that is dedicated to the general well-being of society.

The cost of applying for 501(c)(3) status for your organization depends largely on its size. Sufficiently small organizations that are eligible to fill out the abridged form may only have to pay a $275 user fee.

A 501(c)(3) organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

501(c)(3) is the internal revenue code (IRC) section for organizations with tax exempt status. 501(c)(3) falls under internal revenue code 501(c).

Depending on the nature of your organization, you may need to provide documents such as a business plan, Articles of Incorporation, Bylaws, and certain financial statements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.