501(c)(3) organizations are nonprofit organizations that are recognized by the United States Internal Revenue Service (IRS) as tax-exempt. These organizations are organized and operated exclusively for charitable, religious, scientific, literary, or educational purposes. They must meet specific eligibility requirements and comply with certain regulations and reporting requirements to maintain their tax-exempt status. Examples of 501(c)(3) organizations include charities, educational institutions, churches, and scientific organizations. Nonprofit organizations play a crucial role in society by addressing various needs and providing community services. They can participate in various activities, including providing social services, conducting scientific research, promoting the arts, and supporting education programs. Nonprofits are also subject to a specific tax code known as the 501(c)(3) tax code. This tax code provides tax-exempt status to non-profit organizations that meet certain requirements. 501(c)(3) organizations are tax-exempt under the Internal Revenue Code (IRC). This means that they are not required to pay federal income tax on their income, and donors to these organizations may be eligible for tax deductions for their contributions. However, not all 501(c)(3) organizations are automatically tax-exempt. They must apply for and receive recognition of their tax-exempt status from the IRS. Some states may have their own requirements for tax-exempt status that organizations must meet. The IRS has strict eligibility requirements for organizations seeking 501(c)(3) status. These requirements include Organizational Structure. To qualify for 501(c)(3) status, an organization must be structured as a corporation, trust, or unincorporated association. Charitable Purpose. A nonprofit organization must have a charitable purpose that falls under one of the categories outlined in the tax code. Charitable purposes include religious, educational, scientific, and charitable activities that benefit the community. Prohibited Activities. Nonprofits seeking 501(c)(3) status are prohibited from engaging in certain activities. Public Support. A nonprofit must receive significant funding from public sources to qualify for 501(c)(3) status. This ensures that the organization is supported by the community it serves and not just a small group of individuals. Operational and Record-Keeping Requirements. Nonprofits must comply with various operational and record-keeping requirements, including filing an annual Form 990 with the IRS and maintaining adequate financial records. To obtain 501(c)(3) status, an organization must submit a Form 1023 application to the IRS. This application includes detailed information about the organization's structure, activities, finances, and governance. 501(c)(3) organizations enjoy several tax benefits that are not available to for-profit businesses. The most significant tax benefit is the federal tax exemption. This exemption means that qualifying nonprofits do not have to pay federal income tax on their earnings, including donations and other forms of revenue. 501(c)(3) organizations are also eligible for state tax exemptions in most states. These exemptions vary by state but generally include exemptions from state income, sales, and property taxes. Additionally, donations to 501(c)(3) organizations are tax-deductible for donors. This means that donors can deduct their donations from their federal income taxes, which can incentivize individuals and businesses to donate to nonprofit organizations. Maintaining 501(c)(3) tax-exempt status requires compliance with IRS regulations and reporting requirements. Nonprofits must file an annual Form 990 with the IRS, which provides detailed financial information about the organization's activities and governance. Failure to file this form can result in penalties and the loss of tax-exempt status. 501(c)(3) organizations must also disclose certain information to the public, such as their annual tax filings and the names of their key officers and directors. This transparency ensures that nonprofits are accountable to the public and operate ethically and responsibly. Nonprofits seeking to maintain their tax-exempt status must also comply with certain activity limitations. One of the most important limitations is the prohibition of political campaign intervention. 501(c)(3) organizations cannot support or oppose political candidates or parties. Violating this rule can result in severe penalties, including the loss of tax-exempt status. 501(c)(3) organizations are also limited in lobbying activities. While they can engage in some lobbying activities, the amount of lobbying cannot be a substantial part of the organization's activities. A nonprofit may lose its tax-exempt status if it exceeds the lobbying limits. Losing tax-exempt status can have significant implications for nonprofit organizations. Nonprofits that lose their tax-exempt status must pay federal income taxes on all their earnings, including donations and other forms of revenue. This can be a significant financial burden for nonprofits, especially those that rely heavily on donations. Additionally, losing tax-exempt status can harm a nonprofit's reputation and credibility. Donors and supporters may be hesitant to continue supporting an organization that has lost its tax-exempt status, as it may raise questions about its financial management and governance. Nonprofits that lose their tax-exempt status can apply for reinstatement. The reinstatement process involves submitting a new Form 1023 application to the IRS and demonstrating that the organization meets all the 501(c)(3) status eligibility requirements. The organization must also pay any back taxes owed and provide additional documentation, such as financial statements and governance documents. Nonprofit organizations qualifying for 501(c)(3) status can enjoy significant tax benefits, such as federal and state tax exemptions and tax-deductible donor donations. Qualifying for and maintaining tax-exempt status requires compliance with strict regulations and reporting requirements. Nonprofits seeking 501(c)(3) status must meet eligibility requirements, including having a charitable purpose, receiving public support, and complying with operational and record-keeping requirements. Maintaining tax-exempt status requires compliance with IRS regulations, including filing annual Form 990, avoiding political campaign intervention, and limiting lobbying activities. Nonprofits that lose their tax-exempt status can face significant consequences, such as financial burdens and damage to their reputation. Nonprofits can apply for reinstatement, but the process can be lengthy and require substantial documentation. Nonprofit organizations may benefit from availing of a professional’s tax services to ensure compliance with IRS regulations and maximize tax benefits. Financial advisors can help nonprofits navigate the application process, maintain compliance with IRS regulations, and develop strategies to maximize donations and funding opportunities. Consider hiring a financial advisor to help your nonprofit organization achieve its financial goals and continue serving your community.What Are 501(c)(3) Organizations?

Are 501(c)(3) Organizations Tax Exempt?

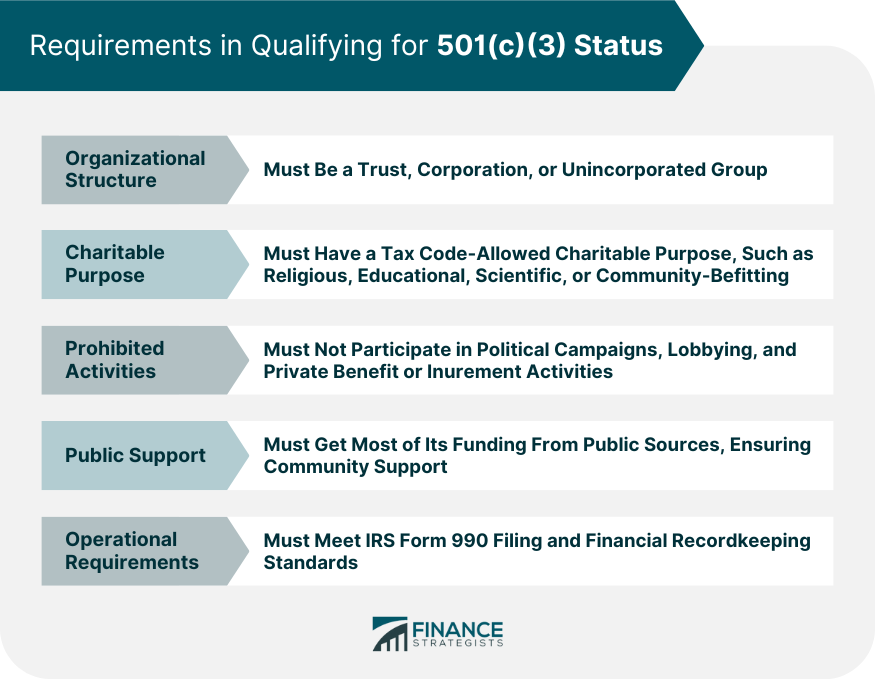

Qualifying for 501(c)(3) Status

The organization's articles of incorporation or bylaws must include specific language that complies with the requirements of 501(c)(3) organizations.

These activities include participating in political campaigns, lobbying, and engaging in activities that generate private benefit or inurement.

Tax Benefits of 501(c)(3) Organizations

Maintaining 501(c)(3) Tax-Exempt Status

Consequences of Losing 501(c)(3) Tax-Exempt Status

Reinstatement of Tax-Exempt Status

Conclusion

Are 501(c)(3) Organizations Tax Exempt? FAQs

A 501(c)(3) organization is a nonprofit organization recognized by the IRS as tax-exempt. These organizations are organized and operated exclusively for charitable, religious, scientific, literary, or educational purposes.

To qualify for 501(c)(3) status, a nonprofit organization must meet eligibility requirements, including having a charitable purpose, receiving public support, and complying with operational and record-keeping requirements. The organization must also submit Form 1023 application to the IRS.

501(c)(3) organizations enjoy several tax benefits, including federal and state tax exemptions and tax-deductible donations for donors. These benefits can help nonprofits maximize donations and funding opportunities.

Nonprofits that lose their tax-exempt status must pay federal income taxes on all their earnings, including donations and other forms of revenue. Additionally, losing tax-exempt status can harm a nonprofit's reputation and credibility.

Nonprofit organizations may benefit from working with a financial advisor to ensure compliance with IRS regulations and maximize tax benefits. Financial advisors can help nonprofits navigate the application process, maintain compliance with IRS regulations, and develop strategies to maximize donations and funding opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.