A 501(c)(3) organization is a nonprofit organization or corporation that has been recognized by the Internal Revenue Service (IRS) as exempt from federal income tax. This type of organization must be organized and operated for religious, charitable, scientific, literary, or educational purposes, or to promote organizations dedicated to public safety. 501(c)(3) organizations are prohibited from carrying out political activities such as campaigning for candidates for public office. Donations made to 501(c)(3) organizations may be tax deductible and can be used as a deduction on individual income taxes. The IRS also offers certain grants and other benefits to these types of organizations. A 501(c)(3) organization is not required to hold open board meetings unless the organization in question is a governmental institution. Governmental institutions include things like school boards, state educational institutions, state universities, and quasi-governmental organizations like public libraries. However, some organizations may choose to do so as a way to demonstrate their commitment to transparency and accountability. The Sunshine Law is a set of regulations that require governmental bodies to conduct their meetings in public and make any decisions or records pertaining to government activities open to the public. The exact laws may vary by jurisdiction, but they generally require public access to all meetings, recordings of these meetings, and records of all documents related to the meeting. This includes documents such as agendas and minutes, which are often made available on the organization's website for easy access. By ensuring transparency in decision-making processes and using open records laws, citizens can stay informed about the actions of their local governments and hold them accountable for their actions. Depending on the type of organization and its relationship with the government, there could be opportunities for citizens to view or participate in some meetings. Governmental institutions usually have some form of public access or transparency laws that require them to conduct their board meetings in accordance with the Sunshine Law. This means that any board meetings for a governmental institution like a city council or school board would be open to members of the public. Quasi-governmental groups may also make their meetings open to the public either voluntarily or through local requirements depending on their location. These organizations include things like utilities and housing authorities, which may operate under different rules than other 501(c)(3)s but still need to abide by state law when it comes to their board meetings. Private entities are not subject to any special Sunshine Laws, so they do not typically hold their board meetings in public or allow members of the public to attend or view them. This means that if you are looking for an organization’s meeting minutes, you will likely need to get permission from the organization itself before being able to view any documents related to those meetings. Open board meetings of 501(c)(3)s provide several important benefits to both the organization and its community. Promotes Transparency: Open board meetings of 501(c)(3)s provide greater transparency, which can lead to better decision-making as well as greater trust and participation from stakeholders. Citizen Participation: Allowing members of the public to observe how decisions are made in their community provides them with a unique insight into how the government works and puts pressure on board members to be more thoughtful when deliberating on issues. Strengthens Public Trust in Government: The increased transparency also serves to strengthen public trust in government institutions by showing citizens exactly what is happening behind closed doors. Opportunity for Involvement: Open 501(c)(3) board meetings offer a great opportunity for those interested in getting involved with their local institutions but have no idea where to start. Hosting an open board meeting for a 501(c)(3) organization can have some drawbacks. Pressure on Board Members: Open board meetings can add pressure to board members, who may feel the need to not make risky decisions due to the public scrutiny they will be under. Time-Consuming: Open board meetings may take more time than closed ones, as members consider potential criticisms from observers and entertain questions from the public. Legal Limitations: Depending on the location, there may be legal restrictions in terms of what kind of information can or cannot be discussed or shared during open board meetings. Privacy Issues: People attending board meetings may not always want their presence known by others and might feel uncomfortable discussing personal matters in front of those outside of a typically closed meeting setting. While there certainly are pros and cons to having open board meetings, it ultimately depends on the organization's particular circumstances and goals. Open board meetings can be a great way to promote transparency and strengthen public trust in government institutions, but might not work for every situation due to potential legal or privacy issues. Ultimately, each 501(c)(3) organization should carefully consider its unique needs before deciding whether or not to embrace open board meetings.501(c)(3) Overview

Are 501(c)(3) Board Meetings Open to the Public?

The Sunshine Law

501(c)(3) Board Meetings Open to the Public

Governmental Institutions

Quasi-Governmental Groups

Private Entities

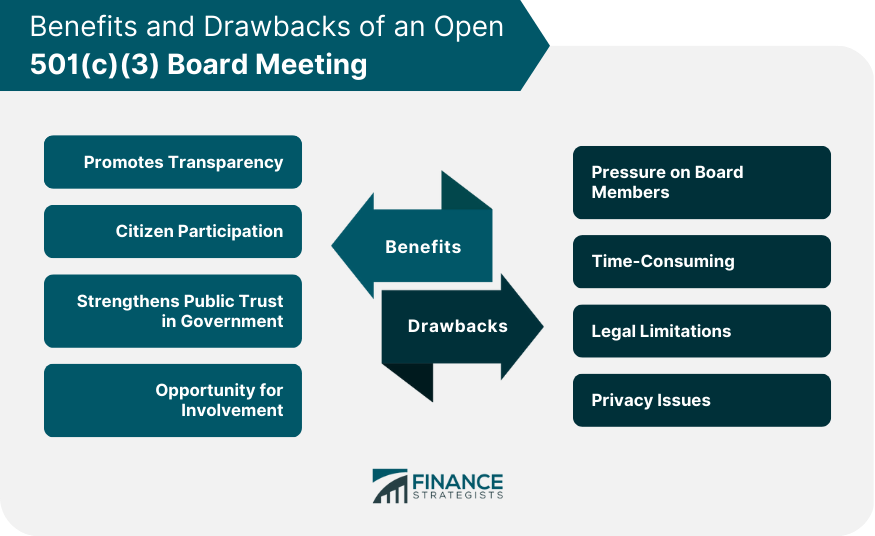

Benefits of an Open 501(c)(3) Board Meeting

Drawbacks of Open 501(c)(3) Board Meetings

Final Thoughts

Are 501(c)(3) Board Meetings Open to the Public? FAQs

Generally speaking, 501(c)(3) organizations are not mandated to hold open board meetings. The specific legislation may vary depending on location and other factors, but in many cases, organizations can choose whether or not they want to host open board meetings.

Open board meetings offer several advantages, including increased transparency of operations, greater opportunities for public engagement, and improved public trust in government institutions.

Open board meetings may add pressure on board members, be time-consuming, have legal limitations on what can be discussed, and create privacy issues for those attending the meeting.

Yes. Allowing members of the public to present thoughts or views before or during the meeting is one way to ensure that all voices are adequately heard. Other ideas include dedicated times during the meeting for audience questions and dedicating a portion of meeting minutes for audience discussion points.

It depends on how extensive you decide your open board meetings should be. Generally speaking, preparation may include setting up rules about attendance and conduct for guests, as well as preparing written materials for anyone attending regarding rules of procedure and the organizations policies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.