Fiduciary rules for 401(k) plans are the legal obligations that plan sponsors, administrators, and trustees must follow to act in the best interests of plan participants. The Employee Retirement Income Security Act (ERISA) sets forth the fiduciary rules for 401(k) plans. ERISA requires plan fiduciaries to act prudently, diversify plan investments, follow the plan documents, monitor the plan, and act solely in the interest of plan participants and beneficiaries. The importance of adhering to fiduciary rules for 401(k) plans cannot be overstated. These rules are intended to protect the interests of plan participants and ensure that the plan is being managed in their best interests. Failure to meet these obligations can result in significant penalties and legal liability. It is essential for plan sponsors, administrators, and trustees to be aware of these rules and to take steps to comply with them. Have questions about 401(k) Plans? Click here. As the companies or organizations that establish and maintain 401(k)s, plan sponsors are primarily responsible for ensuring that the plans are operated in the best interests of its participants and beneficiaries. Under ERISA, plan sponsors have specific fiduciary responsibilities that they must fulfill, which include the following: ERISA requires plan sponsors to act solely in the interest of plan participants or beneficiaries and to avoid conflicts of interest. Plan sponsors must prioritize the plan participants and beneficiaries. They should not make decisions that would benefit themselves or any other party with a financial or other interest in the plan. This duty obligates plan sponsors to act with the care, skill, and diligence that a prudent person would use in similar circumstances. Plan sponsors must conduct a thorough and ongoing review of the plan's investments, fees, and service providers. They must also make changes as needed to ensure that the 401(k) plan is being managed effectively and efficiently. 401(k) plan sponsors are tasked to diversify the plan's investments in order to minimize the risk of large losses. They must ensure that the 401(k) plan offers a variety of investment options that are appropriate for the plan's participants. Sponsors must also establish that the plan's investments are not overly concentrated in any one type of asset or sector. Plan sponsors must regularly monitor the plan's investments, fees, and service providers to ensure that they continue to be appropriate for the plan. They must conduct a thorough review of the plan's investments at least annually and must monitor the performance of plan service providers to ensure that they are meeting the plan's needs. This duty requires sponsors to follow the terms of the plan documents, including the plan's investment policy statement and participant communication materials. 401(k) plan sponsors must ensure that the plan is being administered in accordance with these documents and must make changes as needed to ensure that the plan remains compliant with all applicable federal laws and state regulations. 401(k) plan administrators are responsible for managing the day-to-day operations of a plan. As fiduciaries, they are legally obligated to act solely in the interest of plan participants and beneficiaries. Under ERISA, plan administrators have specific fiduciary duties that they must fulfill, which include the following: This duty charges plan administrators to direct the plan in accordance with the plan documents, including the plan's investment policy statement and participant communication materials. Plan administrators must ensure that the plan is being managed in strict accordance with these documents. They must also modify or revise 401(k) plan documents as needed to ensure that the plan follows all applicable laws and regulations. Similar to plan sponsors, administrators must put the interests of plan participants and beneficiaries ahead of their own interests or those of other parties. 401(k) plan administrators must avoid any conflicts of interest. They must ensure that all decisions are made for plan participants and beneficiaries and no one else. Being a 401(k) plan administrator entails complying with all relevant laws and regulations, including ERISA, the Internal Revenue Code (IRC), and any state laws that apply to the plan. Administrators must ensure that the 401(k) plan is being run according to all applicable laws and that changes are made for continued compliance, if necessary. Plan administrators must provide participants with all pertinent information about the plan, including plan fees, investment options, and other plan features. 401(k) plan administrators must ensure that participants have ready and convenient access to the information they need to make knowledgeable and guided investment decisions about their retirement savings. Plan trustees are mainly responsible for managing 401(k) plan assets prudently and responsibly. This duty includes selecting and monitoring plan investments, reviewing investment performance, and ensuring that plan assets are properly diversified. Plan trustees must ensure that plan investments are appropriate for the plan's participants and beneficiaries, and that investment fees are reasonable. Additionally, plan trustees have the same responsibilities as plan administrators. They should also follow plan documents, act solely in the interests of plan participants and beneficiaries, and abide by relevant federal and state laws. Under ERISA, plan fiduciaries are prohibited from engaging in certain types of transactions that could create conflicts of interest or otherwise harm plan participants and beneficiaries. Consider the following restricted acts: This transaction occurs when a fiduciary, such as a plan sponsor, administrator, or trustee, uses plan assets for their own benefit or for the benefit of a party related to them. For example, a plan sponsor who owns a company that provides services to the plan may be tempted to use plan assets to purchase services from their own company. Self-dealing can result in a conflict of interest and can be a violation of the fiduciary's duty of loyalty to act solely in the interest of plan participants and beneficiaries. It can result in legal liability, penalties, and excise taxes for plan fiduciaries who engage in such activities. These transactions occur when a fiduciary, such as a plan administrator or trustee, receives compensation or any other benefit in exchange for selecting or recommending plan investments or service providers. A kickback can harm the interests of plan participants and beneficiaries. Such activity is in violation of the fiduciary's duty of loyalty to act in the best interests of the plan participants and beneficiaries. For example, a plan administrator who receives a fee or compensation from a service provider for recommending their services to the plan would be considered to have received a kickback. It is a type of prohibited transaction that involves a plan fiduciary lending money or assets from the 401(k) to parties related to the plan. This prohibition can include the fiduciary themselves or other parties related to the plan, such as the plan sponsor or its affiliates. For example, if a plan trustee lends plan assets to a business that the trustee owns, this would be considered lending plan assets and would create a conflict of interest that could harm the interests of the plan participants and beneficiaries. To protect the interests of plan participants and beneficiaries, ERISA sets limits on the amount of employer securities that can be held in a plan's portfolio. These limits ensure that plan fiduciaries do not engage in excessive risk-taking and prioritize the interests of the plan participants and beneficiaries. If a fiduciary uses plan assets to purchase employer securities in excess of certain limits, they may be tempted to prioritize the interests of the employer, breaching the duty of loyalty. Engaging in prohibited transactions can have serious consequences for plan fiduciaries, including legal liability, penalties, and excise taxes. Plan fiduciaries who engage in prohibited transactions may be personally liable for any losses that result from the transaction. For example, if the plan loses money as a result of a prohibited transaction, the fiduciary who engaged in the transaction may be held liable for those losses. The fiduciary may be required to restore any losses to the plan that were caused by the transaction. In addition to legal liability, plan fiduciaries who engage in prohibited transactions may be subject to penalties. Under ERISA, the Department of Labor has the authority to assess penalties for prohibited transactions. These penalties can be significant and can include fines, fees, and other charges. The amount of the penalty will depend on the nature and severity of the prohibited transaction. Plan fiduciaries who engage in prohibited transactions may also be subject to excise taxes. These taxes are levied on the amount of the transaction and can be as high as 100% of the amount involved in the prohibited transaction. For example, if a plan fiduciary engages in a prohibited transaction that involves $100,000, they may be subject to an excise tax of $100,000. For severe cases, a violation can also result in the disqualification of the plan. It means that the plan will lose its tax-qualified status and may result in the plan participants and beneficiaries losing their tax benefits. Disqualification can also result in significant penalties, including the loss of tax deductions for contributions to the plan. Fiduciaries have significant responsibility for the success of a 401(k) plan, and with that responsibility comes potential liability. In order to protect themselves from liability, plan fiduciaries can take advantage of various protections available to them. Fiduciaries can be held personally liable for any losses that result from a breach of their fiduciary duties. It means that if the fiduciary breaches their duty of loyalty or duty of prudence and the plan suffers losses, the fiduciary may be held personally liable for those losses. However, there are two types of fiduciary liability: personal liability and plan liability. It refers to the fiduciary's personal liability for losses incurred by the plan as a result of a breach of fiduciary duty. For example, if a plan trustee engages in self-dealing and the plan loses money as a result, the trustee may be personally liable for those losses. Personal liability can also extend to the fiduciary's co-fiduciaries, if they were involved in the breach of fiduciary duty. It refers to the plan's liability for losses incurred by the plan as a result of a breach of fiduciary duty. For example, if a plan sponsor breaches their duty of prudence by selecting high-cost investments, the plan may be liable for any losses incurred as a result of those investments. To protect themselves from fiduciary liability, plan fiduciaries can take advantage of various protections available to them. Two common types of protections are fiduciary insurance and indemnification. Also known as fiduciary liability insurance, it is a type of insurance that provides protection to plan fiduciaries against personal liability for losses incurred by the plan as a result of a breach of fiduciary duty. This type of insurance can cover legal fees, damages, and other costs associated with defending against claims of fiduciary breach. It is a provision in a plan document that provides for the reimbursement of plan fiduciaries for any losses or expenses they incur as a result of their fiduciary duties. Indemnification can protect fiduciaries against personal liability for losses incurred by the plan as a result of a breach of fiduciary duty. However, it is important to note that indemnification is not a guarantee of protection, and there are limits to the extent of indemnification that may be provided. Fiduciary rules for 401(k) plans are critical to protecting the interests of plan participants and ensuring that the plan is being managed in their best interests. Plan sponsors, administrators, and trustees have a legal obligation to adhere to these rules, which include responsibilities such as acting prudently, diversifying investments, following plan documents, and avoiding conflicts of interest. In addition, plan fiduciaries are prohibited from engaging in certain types of transactions that could create conflicts of interest or otherwise harm plan participants and beneficiaries. These include self-dealing, kickbacks, lending plan assets to parties of interest, and over-the-limit purchase of employer securities. Failure to meet these 401(k) fiduciary obligations can result in significant penalties and legal liability. It is essential for plan sponsors, administrators, and trustees to be aware of these rules and to take steps to comply with them, including obtaining fiduciary insurance and seeking indemnification from the plan. Adhering to fiduciary rules is crucial for the success of a 401(k) plan and for ensuring that plan participants can achieve their retirement goals. Consult a financial advisor or retirement planning expert for further guidance.What Are Fiduciary Rules for 401(k) Plans?

Fiduciary Responsibilities for 401(k) Plan Sponsors

Duty of Loyalty

Duty of Prudence

Duty to Diversify

Duty to Monitor

Duty to Follow Plan Documents

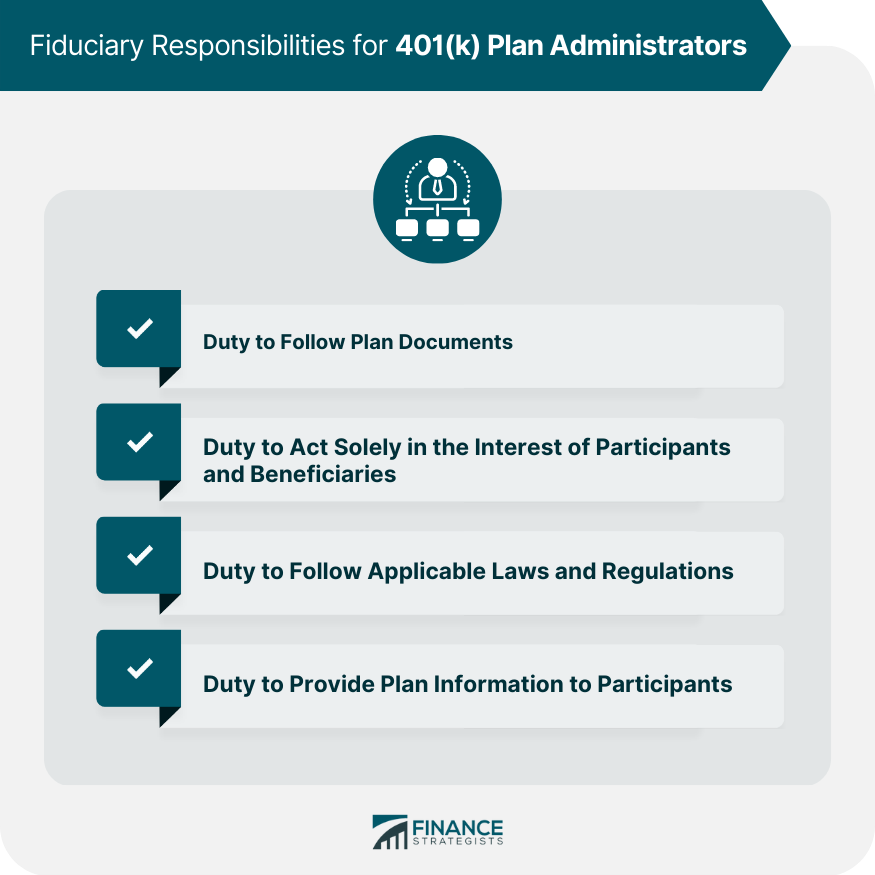

Fiduciary Responsibilities for 401(k) Plan Administrators

Duty to Follow Plan Documents

Duty to Act Solely in the Interest of Participants and Beneficiaries

Duty to Follow Applicable Laws and Regulations

Duty to Provide Plan Information to Participants

Fiduciary Responsibilities for 401(k) Plan Trustees

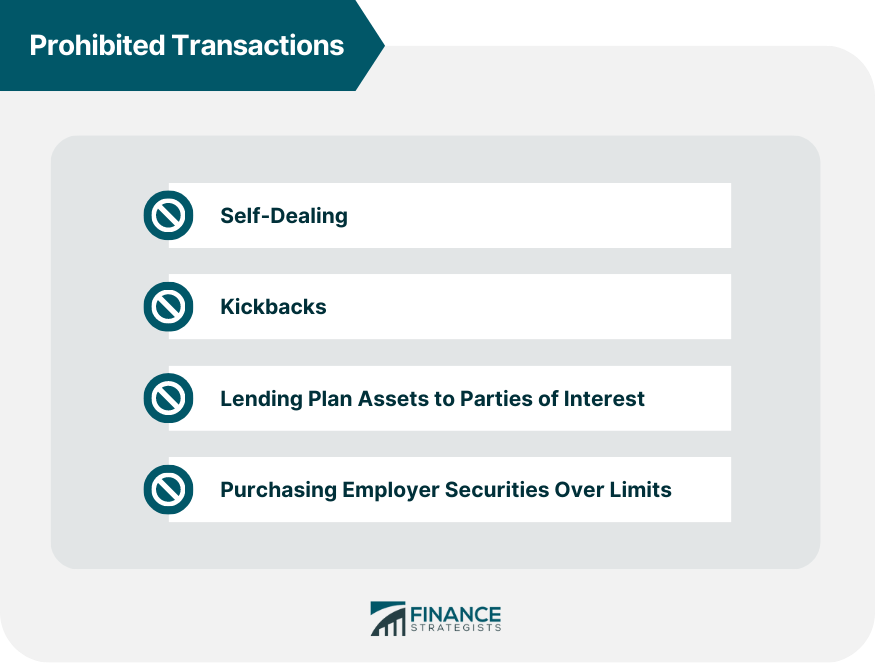

Prohibited Transactions and 401(k) Fiduciary Responsibility

Self-Dealing

Kickbacks

Lending Plan Assets to Parties of Interest

Purchasing Employer Securities Over Limits

Consequences of Engaging in Prohibited Transactions

Legal Liability

Penalties

Excise Taxes

Disqualification of the Plan

Fiduciary Liability and Protections

Fiduciary Liability

Personal Liability

Plan Liability

Fiduciary Protections

Fiduciary Insurance

Indemnification

Final Thoughts

kiFiduciary Rules for 401(k) Plans FAQs

Fiduciary rules for 401(k) plans are the legal obligations that plan sponsors, administrators, and trustees must follow in managing and overseeing the plan's operations and assets. These rules are intended to protect the interests of plan participants and ensure that the plan is being managed in their best interests.

Engaging in prohibited transactions can result in significant penalties, including excise taxes, fines, and legal fees. In some cases, plan fiduciaries can be personally liable for any losses that result from prohibited transactions. It is important for plan sponsors, administrators, and trustees to be aware of these rules and to take steps to avoid engaging in prohibited transactions.

Fiduciary duties for 401(k) plan sponsors, administrators, and trustees include the duty of loyalty, the duty of prudence, the duty to diversify, and the duty to monitor. Each of these duties requires plan fiduciaries to act in the best interests of plan participants and to manage the plan assets in a responsible and prudent manner.

Fiduciary liability is the legal responsibility that plan sponsors, administrators, and trustees have for ensuring that the plan is being managed in the best interests of plan participants. Plan fiduciaries can protect themselves from liability by obtaining fiduciary insurance and by seeking indemnification from the plan.

Adhering to fiduciary rules is essential for the success of a 401(k) plan. Failing to meet these obligations can result in significant penalties and legal liability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.