A 401(k) plan is a retirement savings vehicle that allows individuals to contribute pre-tax dollars to an account and make investments with the potential to earn tax-deferred returns. A 401(k) plan is commonly offered by an employer and includes features such as matching contributions made by the employer, tax incentives for participants, and withdrawal restrictions. The 401(k) savings build wealth over time and can help provide financial security in retirement. Need help with advisor compensation on your 401(k) plans? Click here. Retirement plan advisors provide invaluable services to their clients, helping them make informed decisions and develop strategies that will prepare them for retirement. While the responsibilities vary among advisors, the average compensation of a 401(k) advisor is a vital consideration in selecting a reliable professional. The average compensation for a 401(k) advisor is 0.5%-1%. However, the rate charged by advisors varies significantly, with some charging up to 7% and as little as 0.05%. They charge a percentage of the amount charged trending down as advisors oversee more. The median salary for a 401(k) advisor in the United States is $59,374 per year. The midpoint salary range data reported by the user community should be taken as an average, and may not reflect accurate figures due to other influences such as geographic location and individual customer requirements. The complexity and time-intensity of the strategic advice given by a professional also impacts earning potential; advisors with more experience or specialties could command higher fees. Moreover, many advisors choose to move away from traditional fee structures by offering different options tailored to specific clients’ needs. These can include setup fees, flat rates, hourly rates, commission-based compensation models based on assets under management (AUM), or performance-based incentives. Additionally, employers may offer additional benefits like health insurance and retirement contributions, which can add significantly to a retirement plan advisor’s total earnings. For these reasons, prospective clients should research their options thoroughly before deciding on an advisor who meets their requirements and budget constraints. Doing so can make all the difference when it comes to pursuing successful financial goals in retirement planning. 401(k) plans are one of the most popular retirement savings options, with more and more individuals taking advantage of their benefits. However, having an experienced financial advisor on board to ensure that your plan works in the best way possible is essential. An advisor can help create a customized retirement plan tailored specifically to meet the individual investor’s needs and goals. Advisors will typically assess the current financial situation and future expected earnings to determine what contributions need to be made and when they should be made, as well as provide advice on investment options, tax strategies, and other fiscal considerations. Advisors play a key role in helping clients manage their accounts by monitoring investments, making adjustments as needed, and helping them stay on track with their long-term objectives. This includes providing important information about market changes or new regulations that could affect your portfolio and regularly reviewing accounts for optimal performance. Many experts agree that investors should not rely solely on advisors for advice, but use them instead as an educational resource. Advisors can provide beneficial information about different types of retirement funds available, diversification techniques, tax implications of various investments, etc., so that investors can make informed decisions about their money. With their knowledge and experience in the investment field, advisors have access to top-tier professionals who may not otherwise be available or accessible to the average consumer who doesn’t know whom or where to turn for advice. By leveraging these professional contacts through advisors, individuals can often receive better pricing than going at it alone in today's highly competitive retirement industry. A good advisor will also be able to assist clients in developing risk management strategies based on factors such as age and life expectancy. They can also advise on health risks associated with investing activities, investment horizons, and return expectations for any given market condition or event scenario. While some people may view advisor fees as unnecessary, there are many valid reasons why it is important to consider this factor when making a decision. First and foremost, having an understanding of how much advisors charge helps potential clients avoid costly mistakes that can lead to significant losses later on. A good advisor should be transparent about their fee structure so that clients can get an idea of what they are getting in terms of services and advice for their money. Additionally, knowing how much advisors make ensures that clients are not overpaying for services they don’t need or underpaying for services they do need. Another reason why advisor compensation matters is because it can serve as a barometer of how well an advisor is performing. A higher rate of compensation may indicate that the advisor is providing more comprehensive and tailored advice than their counterparts who charge lower fees. Additionally, fee structures can also serve as an incentive for advisors to keep up with industry trends and provide ongoing management of portfolios in order to ensure continued growth and success for clients. Finally, understanding the economics behind working with a financial advisor can help in negotiating terms if needed. For example, if a person has significant assets under management, they may be able to negotiate lower rates or additional services from their advisor based on the potential revenue stream associated with their portfolio size. When it comes to understanding average advisor compensation on 401(k) plans, there are several factors that should be taken into consideration. Overall, it is important to take all of these factors into account when considering working with a financial advisor so that the best possible outcome can be achieved when planning for retirement.Overview of a 401(k) Plan

Average Compensation of a 401(k) Advisor

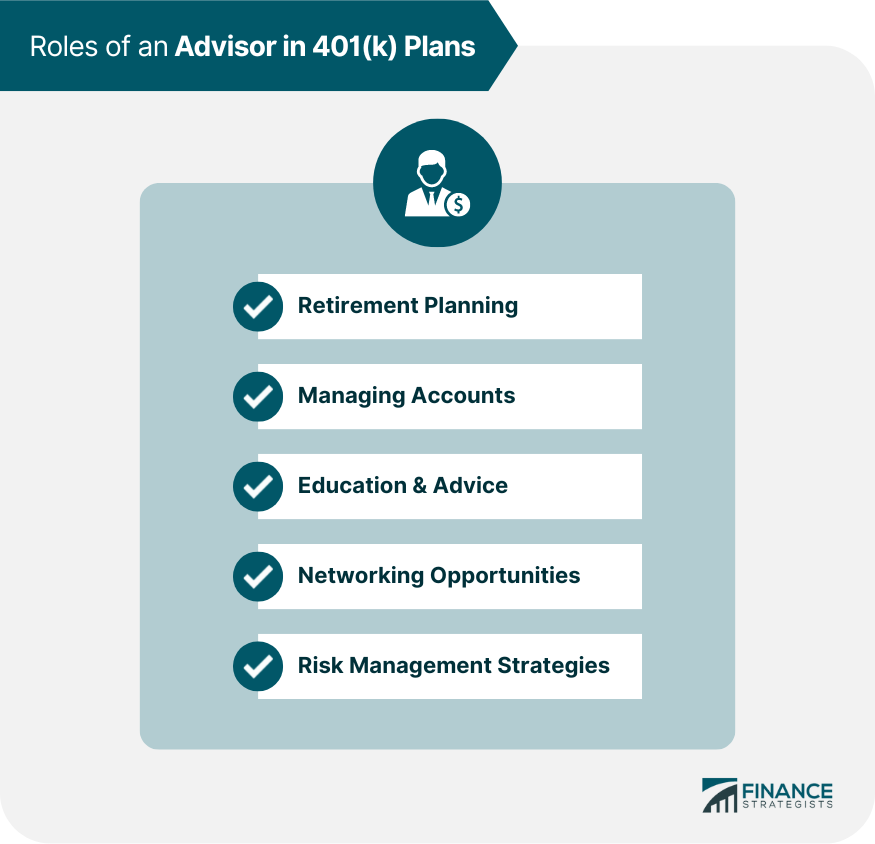

Roles of an Advisor in 401(k) Plans

Retirement Planning

Managing Accounts

Education & Advice

Networking Opportunities

Risk Management Strategies

Why Advisor Compensation Matters

Final Thoughts

Average Advisor Compensation on 401(k) Plans FAQs

Advisors can customize fee structures to meet a client's individual needs. These fees may include setup charges, fixed rates, hourly rates, commission-based fees based on assets under management, or performance-based incentives.

Employers may provide supplemental benefits such as health insurance and contributions to retirement plans which can significantly increase a retirement plan advisor's overall income.

It is significant to understand how much advisors make before hiring one so that potential clients can know whether the potential advisor is a good fit for their financial situation and know what kind of fee structure is involved.

Yes, knowing about the compensation structure for a financial advisor serves as an incentive for advisors to provide ongoing management of portfolios for their clients’ continued growth.

When making this decision, individuals should be sure to research reputable advisors who are transparent about fees and have a proven track record of success.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.