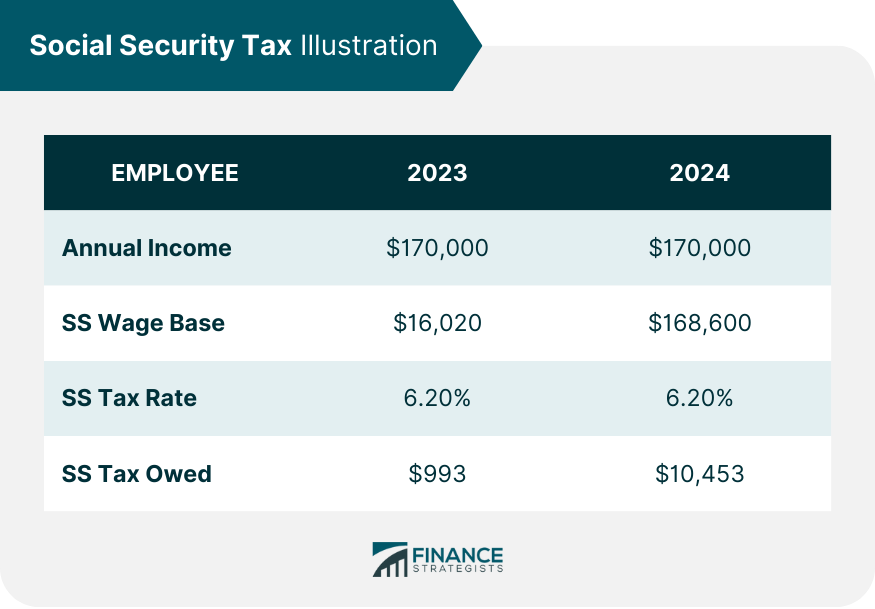

The Social Security tax is a percentage of gross salaries that most employees, employers, and self-employed individuals must pay to fund the Social Security program. The employer is responsible for withholding the correct amount of Social Security tax from each paycheck and remitting it to the federal government on time. Failure to do so may result in severe sanctions. Self-employed individuals are accountable for paying both the employee and employer share of the Social Security tax and must make sure to remit their payments on time. Certain taxpayer groups are exempted from paying social security taxes. The Social Security tax limit is the maximum wage due to the Social Security tax. The Social Security wage base for 2023 is $160,200, and $168,600 in 2024. Salaries earned above that amount are no longer subject to additional Social Security taxes for the calendar year. The Social Security tax is also known as the Old Age, Survivors, and Disability Insurance (OASDI) tax. The OASDI tax is a payroll tax paid by both employees and employers. In 2023, the OASDI tax rate for salaries paid is 6.2% for both employees and businesses. An individual earning $160,200 would contribute $9,032 (0.062 x $160,200) to the OASDI program. In 2024, the OASDI tax rate for salaries paid is 6.2% for both employees and businesses. An individual earning $168,600 or more would contribute $10,453 (0.062 x $168,600) to the OASDI program. And their employer would contribute the same amount. In 2023 and 2024, the OASDI tax rate on self-employment income is 12.4%. Employees' contribution rate is 6.2% of their wages up to the wage base. An employer contributes an equal amount for a total combined contribution rate of 12.4%. Below is an illustration of the Social Security tax owed by an employee earning $170,000 in 2023 and 2024: The wage base limits and rates are adjusted annually. The Social Security tax was first implemented in 1937 at a rate of 1% for the employee and 1% for the employer, with no wage base limit. Over the years, it has been raised to 12.4%. Below is a table that shows the increase in Social Security tax limits since 1937: The majority of the money for Social Security benefit programs comes from payroll taxes paid by American workers and their employers. In 2023, 12.4% of income up to $160,200 was contributed to the Social Security system. Employees and their employers contribute 6.2 percent each; self-employed people pay both portions. This tax is often deducted from employee paychecks and sent to the government. This money is transferred to two Social Security trust funds: Old-Age and Survivors Insurance and Disability Insurance. The first provides retirement, spousal, and survivor benefits, while the second includes disability benefits. There is a maximum income at which the tax rate applies. Earnings above the minimum wage base are not subject to Social Security tax. The cap for 2024 is $168,600. Self-employed individuals must pay for the employer and employee portions of the Social Security tax if their annual net earnings exceed $400. All self-employed net earnings up to the wage cap are subject to Social Security tax. They pay a 12.4% Social Security tax on net earnings of $160,200 in 2023 and $168,600 in 2024. It is important to note that self-employed workers are responsible for paying the 15.3% self-employment tax, a combination of the Social Security (12.4%) and Medicare taxes (2.9%). Only 92.35% of net company earnings are subject to self-employment tax. This rate is obtained from the fact that self-employed taxpayers can deduct the 7.65% employer component of the tax. Self-employed people can deduct the employer's tax contribution of 7.65%. Take an example of a business owner with $100,000 net business income in 2023. The self-employment tax is in addition to the earned income tax. It is also a regressive tax because it burdens lower-income taxpayers more. Only refundable tax credits, such as the earned income tax credit, additional child tax credit, adoption credit, health insurance premium tax credit, and 40% of the American Opportunity credit, can reduce the self-employment tax burden. Most tax credits are nonrefundable; they cannot offset the self-employment tax. Exemptions on the Social Security tax system would minimize the regressivity and boost work incentives for low-income workers. Religious groups are exempt if their earnings are related to the organization’s activities, and the organization is exempt from paying taxes. Additionally, they must be a verified organization that can provide their members with adequate food, shelter, and medical care. At the same time, they are recognized as being officially opposed to Social Security benefits. Full-time students and workers under 21 are exempt from Social Security taxes. This exemption also covers students whose job is at the same institution where they are enrolled. Their employment is based on their continuous attendance at their school. Those hired by foreign governments working in the United States are likewise free from Social Security taxes. Under the condition that they undertake official government activities on behalf of their employer. Non-resident or non-immigrant aliens who work temporarily in the U.S. are exempt from Social Security taxes. Anyone who enters the country in less than five years is included. Local, state, and federal employees are exempt from Social Security taxes. They were typically already contributing to government pension plans when the Social Security program began. Consequently, they will not be taxed again for Social Security. Significantly higher benefit checks have become increasingly rare in recent years. With inflation expected to spike in 2024, the extra cash will assist seniors and others in making ends meet. Suppose you claim your retirement benefits before reaching full retirement age. In that case, Social Security will deduct some benefits from your check if you earn more than a specified amount. It is known as the retirement earnings test exempt amounts, and it can claim a significant portion of your benefits if you are still working. Suppose you begin receiving Social Security benefits before reaching full retirement age. In that case, you can earn up to $1,860 per month ($22,320 per year) in 2024 before the SSA begins withholding benefits at a rate of $1 for every $2 over the limit. The maximum exempt wages in 2023 were $1,770 per month ($21,240 per year). In 2024, Social Security payouts will increase by 3.2%. As a result of the cost-of-living adjustment, the average Social Security payment for retired workers is estimated to rise by $49 to $1,907 per month. Married couples receiving benefits from both spouses will experience a $98 increase to an average payment of $3,814 per month in 2024. In 2024, the maximum possible Social Security income for someone of full retirement age will be $3,822, up $195 from 2023. The maximum Social Security payout for a worker retiring at full retirement age will rise from $3,627 to $3,822 in 2024. It is worth noting that this ceiling applies only to individuals who retire at the full retirement age, which is 67 for everyone born after 1960. Benefits are lowered for people who retire before reaching the full retirement age. Therefore the maximum will be different. The same is true for those who retire after reaching full retirement age, a plan that can maximize your benefit check. Employees and employers pay the Social Security tax to fund the Social Security program. The Social Security tax rate in 2023 is 12.4%. The employer is responsible for half of the tax, or 6.2%, while the employee pays the other half. Typically, this tax is withheld from employee paychecks and paid to the government. The tax rate applies to a maximum income level of $160,200 per year in 2023 and $168,600 in 2024. Earnings beyond this wage base are not subject to Social Security tax. Taxpayer categories like religious groups, young workers, students, foreign government employees, and public sector employees are exempt from this tax burden. The Social Security tax was introduced in 1937. Every year adjustments are made to match the rising cost of living. Even retirement earnings test-exempt amounts increase along with the national average wage index. The annual cost-of-living adjustment increases to keep up with the increasing prices. Social Security recipients are able to maintain their standard of living even as prices rise due to these adjustments.What Is the Social Security Tax?

Social Security Tax Limits for 2023 and 2024

History of Social Security Tax Limits

How the Social Security Tax Works

Social Security Tax for Self-Employed

Exemptions for Social Security Tax

Religious Groups

Young Workers and Students

Foreign Government Employees

Non-resident Aliens

Public Sector Employees

Other Social Security Changes

Retirement Earnings Test Exempt Amounts

Cost-of-Living Adjustment (COLA)

Maximum Social Security Payout

The Bottom Line

Social Security Tax FAQs

Any income above the Social Security salary base level. The wage base for 2023 is $160,200 and will increase to $168,600 in 2024.

If your earnings exceed the taxable maximum, no additional Social Security tax is withheld from your paycheck. The maximum taxable earnings for 2023 and 2024 are $160,200 and $168,600 respectively.

Specific taxpayer categories are exempt from Social Security taxes, such as religious groups, young workers, students, foreign government employees, and public sector employees.

The Social Security tax limit for 2024 is $168,600. Any earnings exceeding this amount will not be subject to the Social Security tax.

The Social Security tax is imposed to fund the Social Security program, which benefits retired workers and their families. The tax benefits people with disabilities and survivors of workers who have passed away.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.