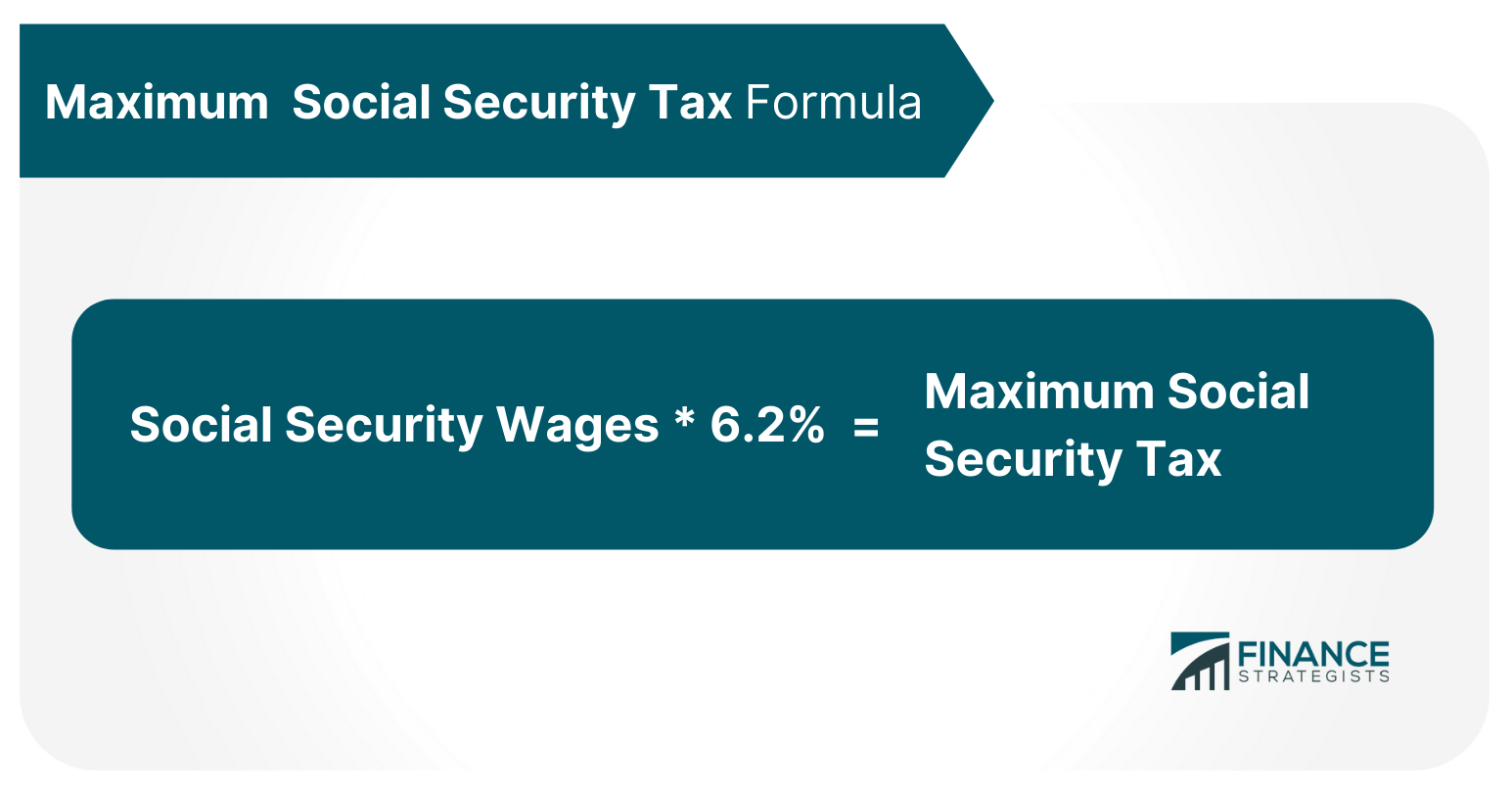

Social security tax is the tax that employers and employees contribute to the social security program, also known as OASDI. This is collected by the Social Security Administration for social security benefits in the form of payroll taxes. This also provides a foundation of income for retirees, disabled workers and their dependents, and survivors of deceased workers. In 2024, the maximum social security tax is $168,600. Any income earned above that amount is not subject to social security tax. The official name of the social security tax is OASDI, or Old-Age, Survivors, and Disability Insurance. It was created for the social security program. This program provides benefits to eligible participants based on their previous work history. Each social security recipient pays social security tax, which is used to determine social security benefits. The social security tax limit is determined by wages, which are calculated annually by the social security administration. These calculations determine social security benefits paid to all recipients in addition to wages received for employment, self-employment, or other earnings that fall under social security tax. In order to accurately determine the maximum social security tax in 2024, it's best to understand how much salary falls under the taxable limit. This can be calculated by using this formula: For example, social security wages of $100,000 x 6.2% = social security tax of $6,200. Another example is when someone who makes $150,000 in social security wage will have social security tax of $9,300. Since social security benefits are taxable above certain income levels and social security wages fall under a specific threshold, $168,600 social security wages and social security benefits determine the maximum social security tax. However, this is not the actual social security tax amount. This value only accounts for social security taxes and does not factor in Medicare's additional tax. The social security tax is collected annually and used to provide benefits for its recipients. However, security taxes go beyond providing social benefits; they also work as an employment incentive and reduce federal income tax. According to the social security administration, this is because social security payments are not considered social security benefits for tax purposes. Another social security incentive is the wage base limit, which affects social wages that are subject to social security taxes. This amount is adjusted annually. Even though social security taxes only account for 6.2% of social security wages below this threshold, they can raise up to 15.3% of social security wages that exceed this limit. This wage base limit is currently set at $168,600 for 2024 and affects social security taxes paid by employers and employees. This is because social security taxes do not go beyond a specific threshold. Individuals who earn social security benefits or social security wages between $128,400 and $256,000 are affected by this new law. However, social security taxes only affect beneficiaries with wages that exceed social security tax limits. The maximum social security tax continues to take effect in 2024. As social security wages are adjusted annually, social security tax limits are also adjusted. This wage limit has increased since its establishment in 1984. It was initially set at $25,900 and was the only social security threshold until 1994 when it rose to $51,300. Then in 2017, it rose again to $127,200. Currently, the social security tax increased by another 3.7%. So wages that fall under social security thresholds will change accordingly. As of 2024, social security taxes no longer apply to social security benefits that exceed $168,600. The calculation for social security tax in 2024 is much easier when compared to previous years because it only factors in social security wages and social security benefits. The social security tax limit will affect your paycheck in two ways. First, social security benefits are not subject to social security taxes once they exceed the wage limit of $168,600.Second, wages are taxable under social security tax limits. This means that social wages below this limit will contribute six percent towards social security taxes. There are countless social security benefits that can reduce your social security tax max. One way to reduce social security tax is by making social security benefits taxable. However, beneficiaries should keep in mind that increasing taxes will only affect wages that exceed social security limits. Another way to reduce social security tax is through increasing social wages below the maximum social limit. To do this, employers may increase allowances and bonuses that fall below tax limits. However, it is important to note that social income wages may not be substantial enough for benefits to become taxable. The social security tax max has increased over the years. Currently, social security taxes are calculated in a way that takes social wages into consideration. In 2024, social security taxes will no longer be calculated on social wages that exceed $168,600. With social wages and social benefits factored into social security taxes, it is easier to calculate social taxes. If social security wages are increased annually, social security tax will also follow the trend accordingly. While social security taxes are slightly burdensome to beneficiaries who earn wages that exceed tax limits, social benefits remain unaffected. However, increasing wages below this wage limit may be a way to reduce benefits subject to security taxes. There are always social benefits that can reduce social security tax max. The social security tax limit will continue to increase wages and benefits in the future. It's important to stay informed about changes in social security law so you're able to intelligently analyze your social situation throughout retirement. Calculating the Maximum Social Security Tax

Why Is There a Maximum Social Security Tax Limit

Who Is Affected by the New Law

When Does the Maximum Social Security Tax Take Effect

How Will This Affect My Paycheck

However, social wages that exceed social security limits will contribute 12.4% towards social security tax.Ways to Reduce Your Maximum Social Security Tax

Final Thoughts

Maximum Social Security Tax FAQs

The 2024 Social Security tax rate is 12.4%, with 6.2% paid by both employers and employees, up to a maximum taxable earning of $168,600.

Yes, the maximum taxable earning for Social Security tax in 2024 is $168,600. Any income earned above this amount will not be subject to the Social Security tax.

You are required to pay Social Security Tax if your income is above the maximum taxable earning of $168,600 and you meet other criteria set by the Internal Revenue Service. Consult with a tax professional for more details.

If you make more than the maximum taxable amount of $168,600, you will not be subject to Social Security tax for any income above this amount.

Yes, depending on your individual income, you may be required to pay other state and federal taxes. Consult with a tax professional for more information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.