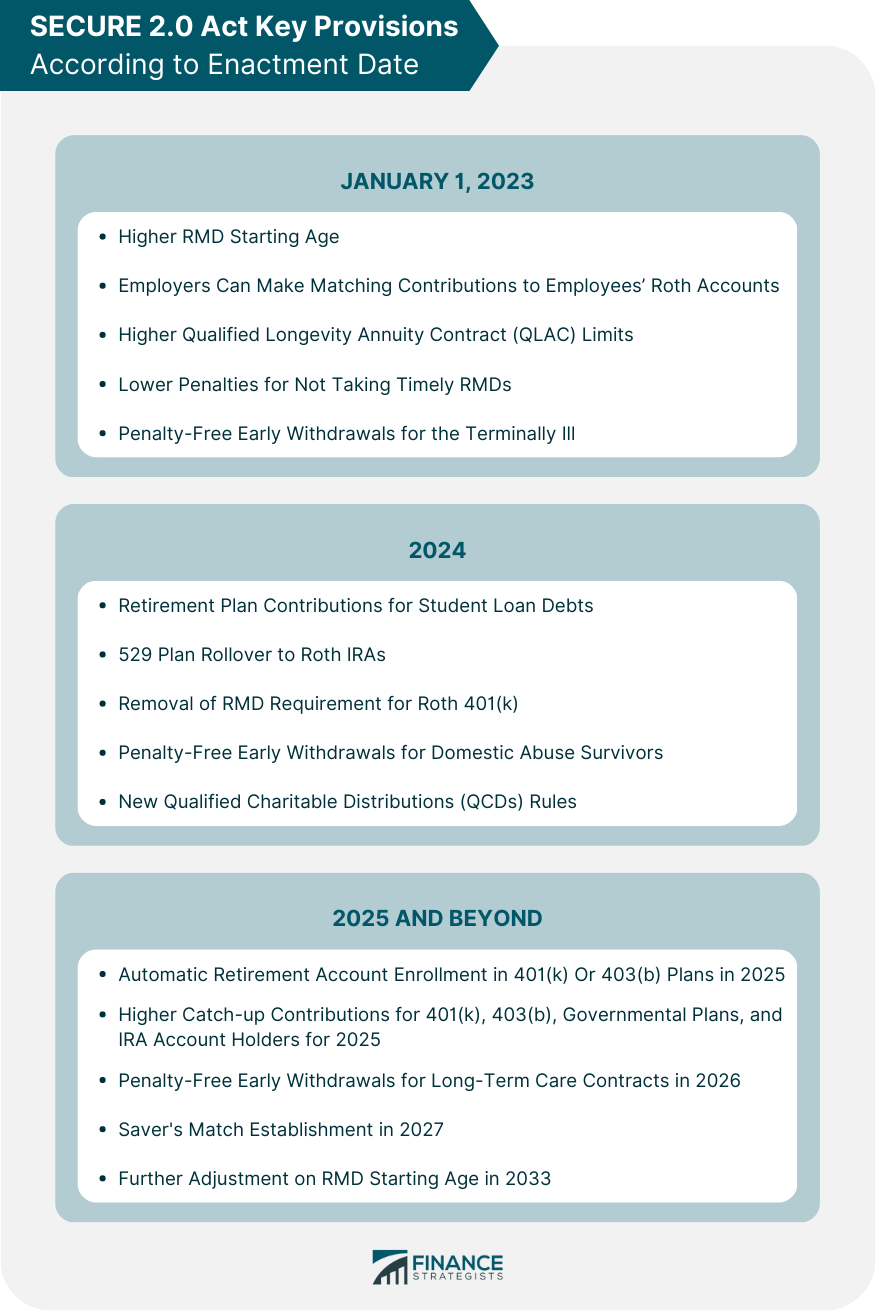

The SECURE 2.0 Act of 2022 makes significant improvements to US retirement savings plans, which include, but are not limited to, 401(k), 403(b), and individual retirement accounts (IRAs). President Biden signed it into law as part of the Consolidated Appropriations Act (CAA) of 2023. It is an amendment to the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 and other laws. It results from consolidated bills from the US Senate (S. 1770) and the House of Representatives (H.R. 2954) and is listed in the CAA as Division T. The Secure 2.0 Act was enacted on December 29, 2022. Some of its provisions took effect at the beginning of 2023, while other changes will be implemented in the years to follow. Generally, the new law aims to decrease employer costs of constructing retirement plans, reform retirement rules, and entice citizens to increase their retirement savings. The Secure 2.0 Act achieves the above goals through the following salient provisions: Effective January 1, 2023, the Secure 2.0 Act increases the required minimum distribution (RMD) starting age from 72 to 73. RMD is set to be raised further to age 75 come January 1, 2033. Additionally, penalties for failing to take an RMD on time are lowered from 50% to 25% of the undistributed amount. The law also includes the possibility of decreasing the penalty further to 10% if corrections are made promptly. These changes allow individuals more time to accumulate retirement savings and increased discretion regarding when they take distributions. A catch-up contribution is a retirement savings option available to individuals aged 50 and older that allows them to contribute more than the standard limit set by their plan. Under the new law, participants in 401(k), 403(b), and 407 plans aged 60 to 63 can contribute $7,500, up from the previous $6,500. For participants of Savings Incentive Match Plan for Employees (SIMPLE) plans, it is raised from $3,500 to $5,000, effective January 1, 2025. The annual deferral limit and catch-up contribution for age 50 participants of SIMPLE IRAs and SIMPLE 401(k) plans are increased by 10% for firms with 25 or fewer employees. Companies with 26 to 100 employees may also raise deferral limits if the employer provides a 4% matching contribution or 3% employer contribution. Another provision requires all catch-up contributions to be made with after-tax dollars for employees with an annual salary greater than $145,000 beginning January 1, 2024. Starting January 1, 2025, Secure 2.0 obligates companies to automatically enroll qualified employees in 401(k) or 403(b) plans, with participation amounts ranging from 3% to 10% of an individual's annual salary. Small businesses with ten or fewer employees, new companies founded within three or fewer years, and church and government plans are exempted. Additionally, employees can opt out of this provision. Some employees fail to save for retirement due to outstanding student loan debts. Secure 2.0 allows companies to make matching contributions for employees' student loan payments under SIMPLE IRA, 401(k), and 403(b) plans. Matching contributions may also be applied to government employees in section 457(b) plans. Companies can use this provision to attract and retain employees. It is also a great way to help employees take control of their student debt while saving for retirement. Companies can pay retirement savings for employees with student loan debt starting January 1, 2024. Beginning in 2024, SECURE 2.0 allows you to roll up to a lifetime limit of $35,000 leftover funds from your 529 education savings plan into a Roth IRA. Your 529 plan must be at least 15 years old, and transfer the funds directly into your Roth IRA to qualify for the rollover. Remember that any 529 plan contributions and respective earnings within the last five years cannot be rolled over to your Roth IRA. Rollover amounts must be within yearly Roth IRA contribution limits. This provision improves on the prior law, where leftover balances could be taken as a non-qualified distribution, but earnings are subject to income tax and a 10% penalty. The Secure 2.0 Act removes RMD requirements for Roth 401(k) plans beginning on January 1, 2024. It expands on the previous law, which only eliminated RMDs from Roth IRAs. A new provision also allows employers to make matching contributions to employees' Roth accounts. Such contributions will be part of taxable income for the year. This change is effective starting January 1, 2023. Lastly, unlike the previous law that only allowed pre-tax dollars, employers can now open Roth accounts using after-tax dollars for employees' SIMPLE and Simplified Employee Pension (SEP) plans. Secure 2.0 creates Saver's Match. With this new program, lower-income retirement savers can receive a federal government matching contribution of up to 50% of the first $2,000 they contribute each year to their retirement accounts. This provision improves upon and repeals Saver's Credit, where individuals receive credits paid in cash as a tax refund for saving in IRAs or other retirement plans. Saver's Match phases out between $20,500 and $35,500 for single taxpayers or married filing separately and from $30,750 to $53,350 for head-of-household taxpayers. The new program takes effect for taxable years beginning January 1, 2027. With Saver's Match, lower-income individuals may be encouraged to save more money for retirement. Generally, a 10% penalty is imposed on individuals who withdraw funds from their retirement accounts before age 59 ½. The Secure 2.0 Act adds new circumstances when early withdrawals can be penalty-free. For example, effective immediately, the penalty for early withdrawals for terminally ill individuals is waived if the distribution is paid within three years. Domestic abuse survivors are also exempt from penalties for withdrawals of $10,000 or 50% of their retirement account balance, whichever is less, as long as the withdrawal is made within one year of the abuse. This provision starts on January 1, 2024. Effective January 1, 2026, early withdrawals used to pay for specific long-term care contracts of up to $2,500 may also be exempt from the 10% penalty. These and other exemptions encourage individuals facing hardships to use their retirement savings and provide more financial security during difficult times. Under the Protecting Americans from Tax Hikes (PATH) Act of 2015, individuals aged 70 ½ and older can donate a maximum of $100,000 per year from a traditional IRA to qualified 501(c)(3) charitable organizations. Starting on January 1, 2024, the maximum donation amount will be updated based on the inflation rate. Additionally, individuals may use QCD to create a Charitable Remainder Unitrust (CRUT), Charitable Remainder Annuity Trust (CRAT), or Charitable Gift Annuity (CGA). Individuals can make a one-time withdrawal of up to $50,000 to use in these trusts beginning in 2023. These updated provisions help individuals plan charitable giving to align with their retirement and tax planning goals. The Secure 2.0 Act raises the maximum amount you can direct to a QLAC from $145,000 to $200,000 and allows for an annual adjustment of the limit based on inflation. It also abolishes the 25%-of-account-balance restriction for use in QLAC premium payments. This provision, which took effect on January 1, 2023, may help qualifying individuals obtain more income security in retirement by providing them with more options for a steady income stream during their later years. The Secure 2.0 Act of 2022 implements several changes that may help you enjoy more retirement savings, security, and tax benefits. Individuals have more options for charitable giving, early withdrawals, and longevity income in their later years. Employers can take advantage of new provisions like Roth RMD removal and matching contributions for student loan debts to encourage employees to save more. Overall, Secure 2.0 helps provide financial relief and security for current and future retirees. It is essential to review its provisions carefully to determine how they might affect your long-term financial plans. Consulting with a qualified financial advisor or retirement planning professional is also beneficial in understanding how each provision impacts you specifically.What Is the SECURE 2.0 Act of 2022?

Secure 2.0 Act Key Provisions

Higher RMD Starting Age

Higher Catch-up Contributions

Automatic Retirement Plan Enrollment

Retirement Plan Contributions for Student Loan Debts

529 Plan Rollover to Roth IRAs

Roth Employer Plans Changes

Saver's Match Establishment

Penalty-Free Early Withdrawals

New Qualified Charitable Distributions (QCDs) Rules

Higher Qualified Longevity Annuity Contract (QLAC) Limits

Final Thoughts

SECURE 2.0 Act of 2022 FAQs

The Secure 2.0 Act was signed into law as part of the Consolidated Appropriations Act of 2023 on December 29, 2022. Some of its provisions take effect in 2023, while others are set to start in later years.

As comprehensive as the Secure 2.0 Act is, it has almost nothing to do with Social Security. It does not address the problem of the Social Security Trust Fund.

In 2023, the RMD age limit is set at 73. It will be raised to 75 in 2033.

Yes. If you have a Roth 401(k), the RMD requirements are removed beginning in 2024.

No. RMD rules for inherited IRAs are not revised by the Secure 2.0 Act of 2022.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.