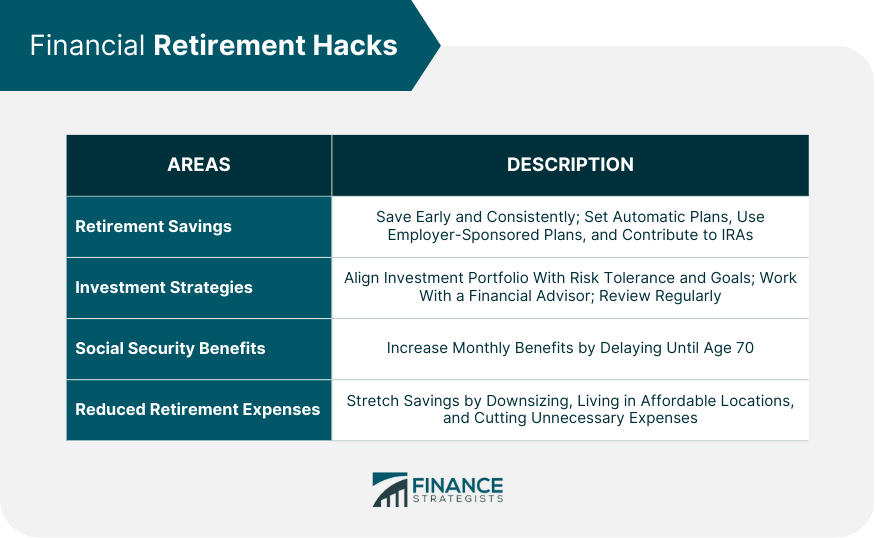

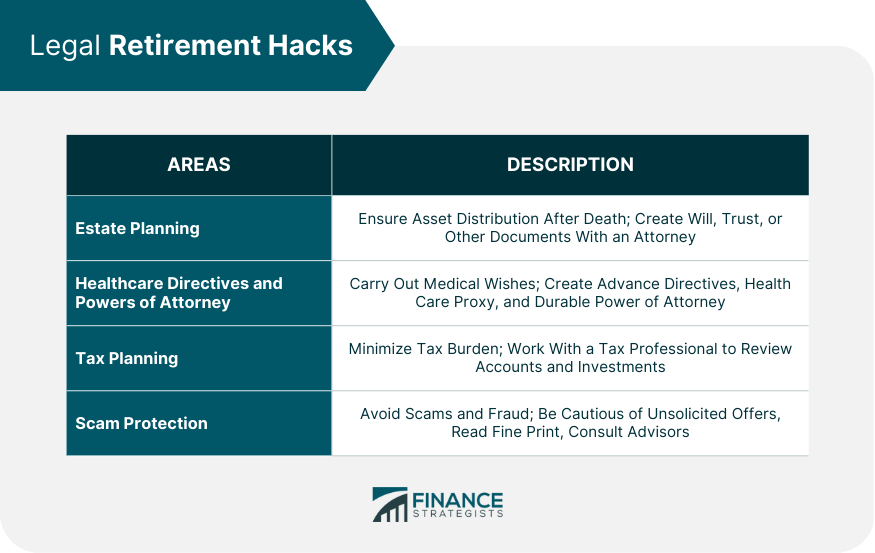

Retirement hacks are strategies, tips, and ideas to help individuals achieve their retirement goals with minimal stress and financial burden. Retirement is a major life milestone that requires careful planning to ensure a comfortable and enjoyable retirement experience. Retirement hacks can help individuals save for retirement, invest wisely, maximize social security benefits, reduce expenses, stay healthy, pursue passions, and simplify their lives using technology. Additionally, legal retirement hacks such as estate planning, healthcare directives and powers of attorney, tax planning, and avoiding financial scams and fraud can help individuals protect their assets and minimize their financial risks in retirement. Incorporating these hacks into retirement planning can help individuals maximize their retirement years and live the life they deserve. Here are some tips on financially preparing for your retirement: Saving for retirement is one of the most critical retirement hacks. To ensure a comfortable retirement, you need to start saving early and consistently. Consider setting up automatic savings plans, taking advantage of employer-sponsored retirement plans, and contributing to Individual Retirement Accounts (IRAs) or other investment accounts. Proper investment strategies are essential for growing your retirement savings. Consider working with a financial advisor to create an investment portfolio that aligns with your risk tolerance and retirement goals. Be sure to review your portfolio regularly to ensure it continues to meet your needs and goals. Social security benefits can be a significant source of income in retirement. Consider delaying your benefits until age 70, which can increase your monthly benefit amount by as much as 32%. Reducing your expenses in retirement can help stretch your retirement savings. Consider downsizing your home, living in a more affordable location, or decreasing your monthly costs by cutting back on unnecessary expenses. Consider these lifestyle changes during retirement: It can help reduce your housing costs and simplify your life. Consider moving to a smaller home, renting an apartment, or living in a retirement community. If you live in an expensive city or state, consider relocating to a more affordable area. Research states and cities that offer a lower cost of living, affordable housing, and a high quality of life. Part-time work or freelance opportunities can provide a source of income in retirement and allow you to pursue your passions and interests. Consider working part-time in your current field or starting a freelance business. Pursuing your hobbies or passions can make your retirement years fulfilling and enjoyable. Consider volunteering, taking up a new hobby, or pursuing a passion project. You should also prioritize your health during retirement. Staying active and healthy in retirement is crucial for maintaining a high quality of life. Consider incorporating regular exercise, eating a healthy diet, and getting enough sleep into your daily routine. Healthcare costs can be a significant expense in retirement. To reduce your healthcare costs, consider enrolling in Medicare and supplemental insurance, taking advantage of preventative care, and shopping around for affordable healthcare services. It can help you stay healthy and prevent costly medical expenses in retirement. Schedule regular check-ups, screenings, and immunizations to stay on top of your health. Planning for long-term care can help protect your retirement savings and ensure you receive the care you need. Consider purchasing long-term care insurance or researching Medicaid eligibility requirements. You can still maintain your social life during retirement. Maintaining and developing relationships in retirement is essential for staying engaged and connected. Consider staying in touch with family and friends, joining social clubs or organizations, or attending community events. Volunteering is an excellent way to give back to your community and stay engaged in retirement. Consider volunteering at a local charity or nonprofit organization. Joining social clubs or organizations can provide opportunities to meet new people, pursue your interests, and participate in group activities. Traveling is a popular retirement activity that can provide a sense of adventure and fulfillment. Consider planning trips to places you’ve always wanted to visit or exploring your local area. Technology can simplify your retirement years and make everyday tasks more manageable. Consider using online financial tools and resources, digital communication methods, and smart home technology for aging in place. Online financial tools and resources can help you manage your finances, monitor your investments, and plan for retirement. Consider using budgeting apps, investment calculators, and retirement planning tools. Digital communication methods can help you stay in touch with loved ones who live far away or cannot visit in person. Consider using video chat, social media, or messaging apps to stay connected. Smart home technology can help you age in place and live independently. Consider installing devices like smart thermostats, voice-activated assistants, and fall detection systems to increase safety and convenience. You should prepare the legal requirements and other documents you may need in retirement. Estate planning is essential for ensuring that your assets are distributed according to your wishes after you pass away. Consider working with an attorney to create a will, trust, or other estate planning documents. These can help ensure that your medical wishes are carried out if you cannot make decisions for yourself. Consider creating advance directives, appointing a healthcare proxy, and naming a durable power of attorney. Tax planning is essential for minimizing your tax burden in retirement. Consider working with a tax professional to review your retirement accounts, investment portfolio, and other sources of income to determine the most tax-efficient strategies. Financial scams and fraud are common in retirement and can result in significant financial losses. To avoid financial scams and fraud, be wary of unsolicited offers, always read the fine print, and consult with a trusted advisor before making any financial decisions. Retirement can be an exciting and fulfilling time of life, but it requires careful planning to ensure a comfortable and enjoyable experience. You can maximize your retirement through financial strategies such as saving, investing, maximizing social security benefits, and reducing expenses. Lifestyle hacks include downsizing, relocating, pursuing passions, and staying healthy. Social hacks include maintaining relationships, volunteering, and travel opportunities. Technological hacks include utilizing online financial tools, digital communication, and smart home technology. Legal hacks include estate planning, healthcare directives, tax planning, and avoiding financial scams and fraud. By incorporating these retirement hacks into retirement planning, you can get the most out of your retirement years and live the life you deserve. Consult a retirement planning professional for further guidance.What Are Retirement Hacks?

Financial Retirement Hacks

Retirement Savings

Investment Strategies

Social Security Benefits

Reduced Retirement Expenses

Lifestyle Retirement Hacks

Downsize Your Home

Relocate

Do Part-Time Work

Pursue Hobbies or Passions

Health and Wellness Retirement Hacks

Stay Active and Healthy

Reduce Healthcare Costs

Take Advantage of Preventative Care

Plan for Long-Term Care

Social Retirement Hacks

Maintain and Develop Relationships

Volunteer

Join Clubs or Organizations

Travel

Technological Retirement Hacks

Online Financial Tools and Resources

Digital Communication

Smart Home Technology

Legal Retirement Hacks

Estate Planning

Healthcare Directives and Powers of Attorney

Tax Planning

Scam Protection

Final Thoughts

Retirement Hacks FAQs

Retirement Hacks are tips and strategies that help maximize your retirement years. The most critical Retirement Hacks include saving for retirement, investing wisely, maximizing social security benefits, reducing expenses, and maintaining good health.

You can use online financial tools and resources, digital communication methods, and smart home technology for aging in place. These retirement hacks can help you manage your finances, stay connected with loved ones, and maintain your independence.

Estate planning is a critical retirement hack that ensures your assets are distributed according to your wishes after your death. Proper estate planning can help minimize tax burdens, protect assets from legal challenges, and provide peace of mind for you and your loved ones.

You can incorporate regular exercise, eat a healthy diet, get enough sleep, take advantage of preventative care, and plan for long-term care. These Retirement Hacks can help you stay healthy and prevent costly medical expenses.

Several retirement hacks can help reduce expenses during retirement. You can consider downsizing your home, relocating to a more affordable location, cutting back on unnecessary expenses, and pursuing part-time work or freelance opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.