Pension buy-ins refer to a financial arrangement where a pension plan or scheme purchases an insurance policy to cover the pension benefits of its members. This is typically done to reduce risk and secure the pension fund against market volatility or other uncertainties, by transferring the risk of paying out pensions to an insurance company. The policy premium is paid for by the pension fund and the insurance company is responsible for paying out the pensions to the members covered by the policy. Before discussing pension buy-ins, it is essential to understand the different types of pension plans. Defined benefit pension plans provide participants with a predetermined retirement benefit based on factors such as years of service, salary, and age. These plans are funded by employer contributions, and the investment risk lies with the plan sponsor. In a defined contribution pension plan, participants contribute a portion of their salary into an individual account. Employers may also make contributions to these accounts. The retirement benefit depends on the investment performance of the funds in the account, with the investment risk borne by the individual participant. Hybrid pension plans combine elements of both defined benefit and defined contribution plans, often providing a base level of guaranteed benefits with an additional variable component tied to investment performance. Pension buy-ins involve a series of steps, including: The first step in the buy-in process is to evaluate the pension plan's liabilities, typically with the help of actuaries and consultants. This assessment helps determine the extent of the plan sponsor's financial risk and the potential benefits of a pension buy-in. Once the plan sponsor has a clear understanding of their pension liabilities, they can identify potential insurance providers who specialize in pension buy-ins. These providers should have a strong financial rating and a proven track record in managing pension risk. The plan sponsor negotiates the terms and conditions of the pension buy-in agreement with the insurance provider, including factors such as coverage, premium rates, and guarantees. Once both parties have agreed on the terms and conditions, they sign a legally binding contract, and the pension buy-in is finalized. The insurance provider assumes responsibility for the covered pension liabilities, paying the agreed-upon benefits directly to the pension plan, which in turn pays the participants. There are several alternatives to pension buy-ins for plan sponsors seeking to manage their pension risk: In a pension buyout, the plan sponsor transfers all of their pension liabilities to an insurance provider, effectively terminating the plan. The insurance provider then assumes responsibility for paying benefits directly to plan participants. Liability-Driven Investing (LDI) involves aligning a pension plan's investment strategy with its liabilities, often by investing in fixed-income securities that match the plan's cash flow needs. Longevity swaps are financial instruments that allow pension plan sponsors to hedge their exposure to longevity risk by swapping fixed payments for variable payments linked to the actual longevity experience of the plan's participants. Plan sponsors can choose to self-insure their pension liabilities, retaining the responsibility for paying benefits and managing the associated risks. Plan sponsors can merge or consolidate their pension plans with other plans to pool resources, reduce costs, and better manage risk. Several entities are involved in the pension buy-in market, including: Insurance providers play a central role in the pension buy-in market, offering products and services designed to help plan sponsors manage their pension risk. Plan sponsors, typically employers or other organizations, are responsible for funding and managing pension plans and may choose to enter into pension buy-in agreements to reduce their financial risk. Actuaries and consultants provide specialized expertise to help plan sponsors assess their pension liabilities, evaluate potential buy-in options, and navigate the buy-in process. Financial regulators and government agencies oversee the pension buy-in market, ensuring compliance with relevant laws and regulations and protecting the interests of plan participants. Pension buy-ins offer several benefits, including: By transferring some or all of their pension liabilities to an insurance provider, plan sponsors can reduce their exposure to financial risks, such as longevity risk and investment risk. Pension buy-ins help stabilize funding levels by ensuring that the plan sponsor's liabilities are matched by assets managed by the insurance provider. By reducing financial risk and stabilizing funding levels, pension buy-ins can help ensure the long-term sustainability of pension plans, providing greater security for plan participants. Pension buy-ins can improve retirement security for plan participants by transferring the responsibility of paying benefits to an insurance provider with a strong financial position and expertise in managing pension risk. With the transfer of pension liabilities to an insurance provider, plan sponsors can simplify their plan management, allowing them to focus on other aspects of their business. Despite their benefits, pension buy-ins also have some drawbacks and risks: Pension buy-ins typically involve significant upfront costs, which may be prohibitive for some plan sponsors. Once a pension buy-in agreement is in place, the plan sponsor may have less flexibility in managing their pension plan, as certain aspects of the plan will be controlled by the insurance provider. In a pension buy-in, plan sponsors rely on the financial strength and stability of the insurance provider. If the insurance provider experiences financial difficulties, it could affect their ability to fulfill their obligations under the buy-in agreement. The implementation of a pension buy-in can change the investment strategy and asset allocation of a pension plan, as the plan sponsor must adjust their portfolio to match the liabilities transferred to the insurance provider. Pension buy-ins are subject to various regulatory and compliance requirements, which may create additional administrative burdens for plan sponsors. Several trends and developments may shape the future of the pension buy-in market: As the global population ages, plan sponsors may face increased pressure to manage their pension liabilities and ensure the long-term sustainability of their pension plans. New financial instruments and risk management techniques may emerge to help plan sponsors more effectively manage their pension risk. Advancements in technology and data analytics may enable plan sponsors and insurance providers to better understand pension risk and develop more tailored solutions for managing it. Changes in the regulatory environment may influence the pension buy-in market, potentially creating new opportunities or challenges for plan sponsors and insurance providers. As plan sponsors become increasingly aware of the benefits of pension buy-ins and the importance of securing retirement benefits, the pension buy-in market is likely to continue its growth trajectory. Pension buy-ins can offer significant advantages to plan sponsors seeking to reduce their financial risk and ensure the long-term sustainability of their pension plans. By understanding the intricacies of pension buy-ins, as well as their potential drawbacks and risks, plan sponsors can make informed decisions about whether a pension buy-in is a right choice for their organization. As the pension landscape continues to evolve, pension buy-ins are likely to remain an important tool for managing pension risk and securing retirement benefits for millions of people around the world.What Are Pension Buy-Ins?

Types of Pension Plans

Defined Benefit Pension Plans

Defined Contribution Pension Plans

Hybrid Pension Plans

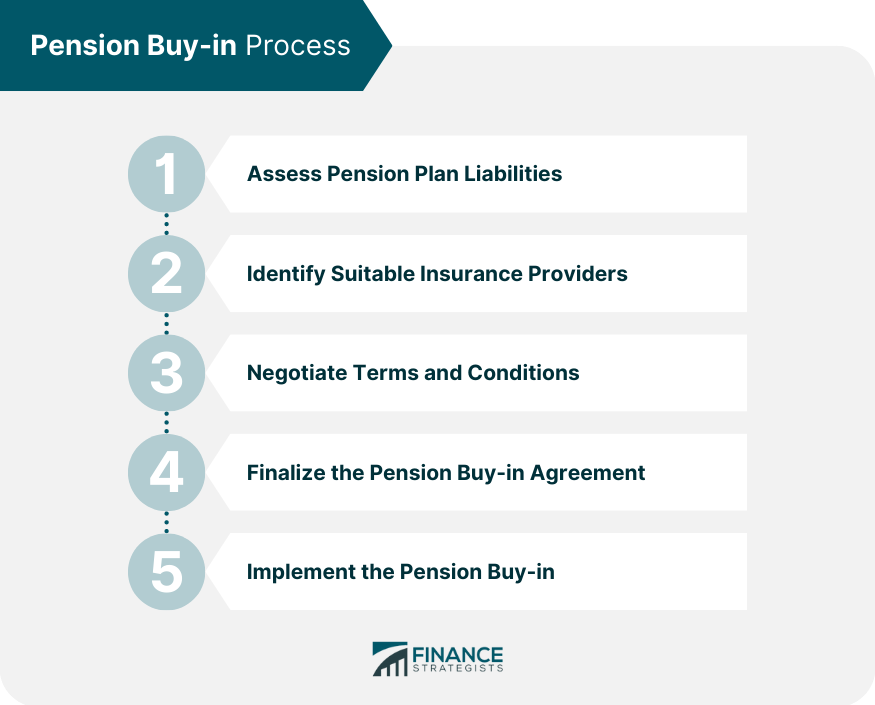

Pension Buy-in Process

Assessing Pension Plan Liabilities

Identifying Suitable Insurance Providers

Negotiating Terms and Conditions

Finalizing the Pension Buy-in Agreement

Implementing the Pension Buy-in

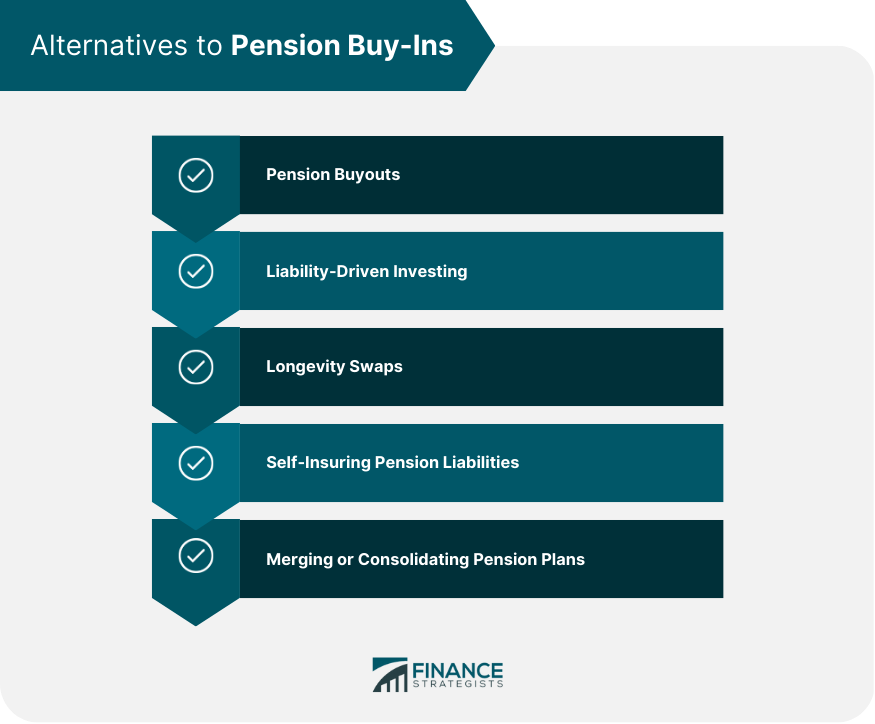

Alternatives to Pension Buy-Ins

Pension Buyouts

Liability-Driven Investing

Longevity Swaps

Self-Insuring Pension Liabilities

Merging or Consolidating Pension Plans

Key Players in the Pension Buy-In Market

Insurance Companies

Pension Plan Sponsors

Actuaries and Consultants

Financial Regulators and Government Agencies

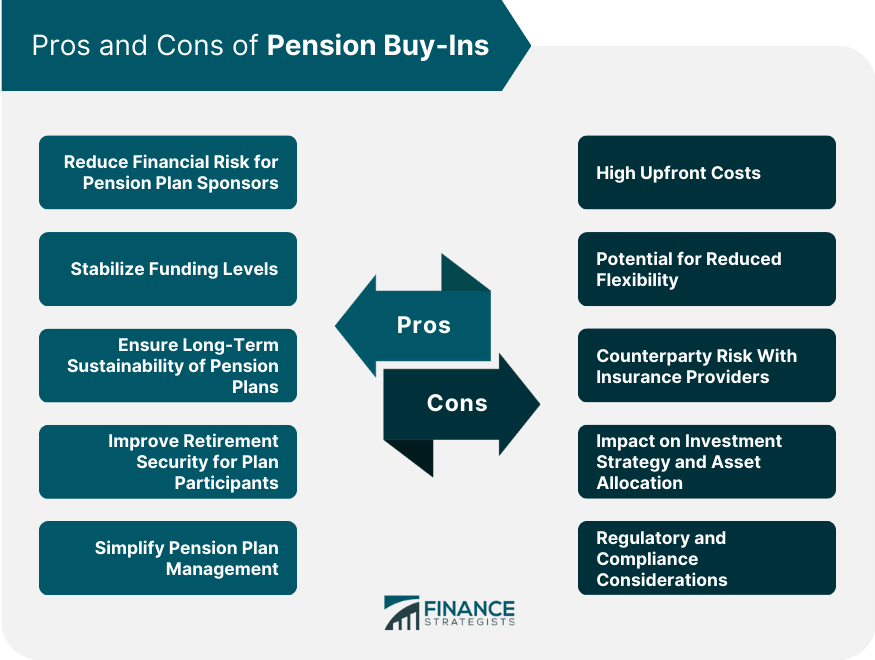

Pros of Pension Buy-Ins

Reducing Financial Risk for Pension Plan Sponsors

Stabilizing Funding Levels

Ensuring Long-Term Sustainability of Pension Plans

Improving Retirement Security for Plan Participants

Simplifying Pension Plan Management

Cons and Risks of Pension Buy-Ins

High Upfront Costs

Potential for Reduced Flexibility

Counterparty Risk With Insurance Providers

Impact on Investment Strategy and Asset Allocation

Regulatory and Compliance Considerations

Future Trends and Developments

Impact of Demographic Changes on Pension Liabilities

Innovations in Pension Risk Management

Role of Technology and Data Analytics

Evolving Regulatory Landscape

Growth of the Pension Buy-in Market

The Bottom Line

Pension Buy-Ins FAQs

Pension buy-ins are risk management tools in which a pension plan sponsor transfers a portion of its pension liabilities to an insurance provider. They help plan sponsors reduce financial risk, stabilize funding levels, ensure the long-term sustainability of pension plans, improve retirement security for plan participants, and simplify pension plan management.

Pension buy-ins involve the transfer of a portion of a pension plan's liabilities to an insurance provider while maintaining the plan itself. In contrast, pension buyouts involve the transfer of all pension liabilities to an insurance provider, effectively terminating the pension plan. With buy-ins, the plan sponsor continues to pay benefits to participants, while in buyouts, the insurance provider takes over paying benefits directly to the participants.

Pension buy-ins are generally most suitable for defined benefit pension plans, as these plans involve a higher level of financial risk for plan sponsors. However, they may also be considered for hybrid pension plans that have a defined benefit component. Pension buy-ins are typically not applicable to defined contribution pension plans, as the investment risk in these plans is borne by the individual participants.

Some risks associated with pension buy-ins include high upfront costs, reduced flexibility for plan sponsors, counterparty risk with insurance providers, the potential impact on investment strategy and asset allocation, and regulatory and compliance considerations.

Pension buy-ins are one of several options available to plan sponsors seeking to manage their pension risk. Other options include pension buyouts, liability-driven investing, longevity swaps, self-insuring pension liabilities, and merging or consolidating pension plans. Each option has its own advantages and disadvantages, and plan sponsors should carefully consider their specific needs and circumstances when choosing a risk management strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.