A defaulted participant loan is a type of loan that is taken out from a retirement plan by a participant but is not repaid according to the terms of the loan agreement. A defaulted participant loan occurs when a participant fails to make the required loan payments, resulting in the loan being in default. Defaulted participant loans can have a significant impact on retirement plans, both for the participant who took out the loan and for the plan sponsor who manages the plan. A defaulted participant loan can result in financial consequences for the participant, such as tax penalties and a reduction in retirement savings. For the plan sponsor, defaulted participant loans can lead to increased plan expenses and legal liability. A participant loan is a type of loan that is offered by some retirement plans, such as 401(k) plans, to allow participants to borrow money from their retirement savings. The loan is generally secured by the participant's retirement account balance and must be repaid within a specified time frame, usually five years. To take out a participant loan, a participant must typically apply through their plan sponsor and meet certain eligibility requirements, such as having a minimum account balance or being employed by the plan sponsor for a certain length of time. If the loan is approved, the participant will receive the loan amount as a disbursement from their retirement account. The repayment terms for a participant loan typically include a fixed interest rate and a specified repayment period, usually five years. Repayment of the loan is typically made through payroll deductions, with the amount of the loan payment deducted from the participant's paycheck each pay period. One strategy for preventing defaulted participant loans is to provide education and communication to participants about the consequences of defaulting on a loan and the importance of managing personal finances. Plan sponsors can provide information about alternative borrowing options, such as personal loans or credit cards, and encourage participants to consider the long-term impact on their retirement savings before taking out a loan. Another strategy for preventing defaulted participant loans is to establish loan limits for participants. Setting loan limits can help prevent participants from borrowing more than they can afford to repay and reduce the risk of defaulting on the loan. Plan sponsors can also establish loan eligibility criteria to help ensure that only participants who can afford to repay the loan are approved for a loan. Eligibility criteria may include a minimum account balance, a minimum length of employment, or a maximum loan-to-value ratio. Finally, plan sponsors can establish repayment terms and options that are designed to help participants repay their loans on time and avoid default. For example, plan sponsors can establish flexible repayment options that allow participants to make additional payments or accelerate the repayment schedule. They can also provide reminders and notifications to participants when loan payments are due. When a participant loan goes into default, plan sponsors have several options for dealing with the defaulted loan. One option is to treat the defaulted loan as a distribution, which would result in the participant owing taxes and penalties on the loan amount. Another option is to offset the defaulted loan against the participant's account balance, which would reduce the participant's retirement savings. If plan sponsors fail to take action on defaulted participant loans, they may face legal liability and reputational damage. Plan sponsors have a fiduciary responsibility to manage the plan in the best interest of the participants, and failure to address defaulted loans could be seen as a breach of that responsibility. The Internal Revenue Service (IRS) has established regulations that govern participant loans and defaulted loans. Plan sponsors must ensure that their participant loan programs comply with these regulations, which include limits on loan amounts, repayment terms, and eligibility criteria. The Employee Retirement Income Security Act (ERISA) also provides guidelines for participant loans and defaulted loans. Plan sponsors must ensure that their participant loan programs comply with ERISA guidelines, which include rules related to loan documentation, fees, and disclosures. As mentioned earlier, plan sponsors are fiduciaries responsible to manage the plan in the best interest of the participants. This responsibility includes managing defaulted participant loans and ensuring that appropriate action is taken to minimize the impact on participants and the plan. Plan sponsors can implement several strategies to reduce the risk of defaulted participant loans, including setting loan limits, establishing loan eligibility criteria, providing education and communication to participants, and offering flexible repayment options. Plan sponsors should also establish processes for monitoring and managing defaulted participant loans, including timely communication with participants, establishing a clear process for addressing defaulted loans, and taking appropriate action to minimize the impact on participants and the plan. Finally, plan sponsors should provide ongoing education and communication to participants about participant loans and the risks of defaulting on a loan. Education and communication can help participants make informed decisions about borrowing from their retirement accounts and can encourage responsible borrowing and repayment behavior. Defaulted participant loans can have a significant impact on retirement plans, both for participants and plan sponsors. Plan sponsors have a responsibility to manage defaulted loans and take appropriate action to minimize the impact on participants and the plan. Plan sponsors and employers should consider several key factors when managing participant loans, including establishing loan limits and eligibility criteria, providing education and communication to participants, and establishing processes for managing defaulted loans. By taking a proactive approach to managing participant loans, plan sponsors can help minimize the impact of defaulted loans on participants and the plan.What Is a Defaulted Participant Loan?

Participant Loan Basics

Definition of Participant Loan

How Participant Loans Work

Repayment Terms

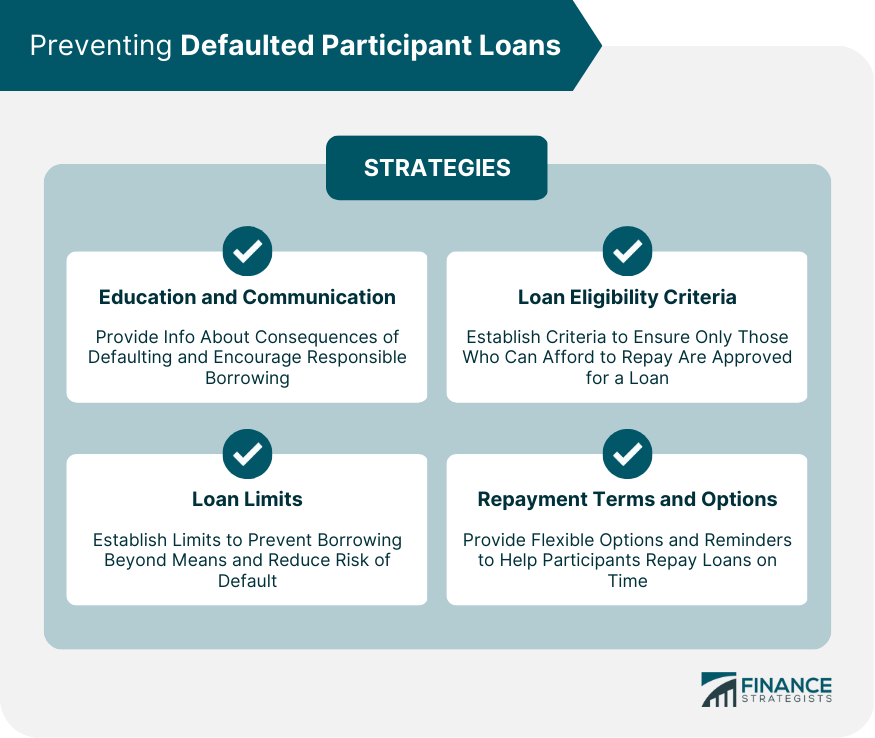

Preventing Defaulted Participant Loans

Education and Communication

Loan Limits

Loan Eligibility Criteria

Repayment Terms and Options

Dealing With Defaulted Participant Loans

Available Options for Plan Sponsors

Consequences of Non-action

Legal Considerations

IRS Regulations

ERISA Guidelines

Fiduciary Responsibility

Best Practices for Plan Sponsors

Using Strategies for Reducing Defaulted Participant Loans

Monitoring and Managing Defaulted Participant Loans

Employee Education and Communication

Conclusion

Defaulted Participant Loan FAQs

When a participant loan goes into default, the plan sponsor has several options for dealing with the defaulted loan. One option is to treat the defaulted loan as a distribution, which would result in the participant owing taxes and penalties on the loan amount. Another option is to offset the defaulted loan against the participant's account balance, which would reduce the participant's retirement savings.

Once a participant loan has been approved, it cannot be canceled or modified, except in certain limited circumstances. For example, if the participant experiences a qualifying event, such as a divorce or death of a spouse, the loan may be canceled or modified.

Defaulting on a participant loan can have significant consequences for the participant, including tax penalties, a reduction in retirement savings, and damage to their credit score. Defaulted participant loans can also result in increased plan expenses, legal liability, and reputational damage for the plan sponsor.

No, a plan sponsor cannot waive the repayment of a defaulted participant loan, as this would be considered a prohibited transaction under IRS regulations. Plan sponsors must follow established procedures for managing defaulted loans and take appropriate action to minimize the impact on participants and the plan.

Yes, plan sponsors have the right to take legal action to collect on defaulted participant loans, although this is generally considered a last resort. Plan sponsors should establish clear processes for addressing defaulted loans and take appropriate action to minimize the impact on participants and the plan before resorting to legal action.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.