The Voluntary Correction Program (VCP) is a component of the Employee Plans Compliance Resolution System (EPCRS) administered by the Internal Revenue Service (IRS). The VCP allows plan sponsors to voluntarily identify and correct certain errors or failures within their retirement plans, thereby preserving the tax-favored status of these plans. The VCP is designed to encourage plan sponsors to proactively identify and correct plan errors, ensuring continued compliance with tax qualification requirements. The program benefits plan sponsors by reducing potential penalties and providing audit protection during the VCP process. The IRS oversees the administration of the VCP under the broader EPCRS framework. The EPCRS is designed to provide plan sponsors with a comprehensive set of guidelines and tools to correct errors and maintain compliance in their retirement plans. Various types of plan sponsors, including private employers, non-profit organizations, and government entities, can participate in the VCP. Retirement plans eligible for the VCP include 401(k), 403(b), and 457(b) plans, as well as other qualified plans. The VCP covers a wide range of plan errors, including operational, demographic, and plan document failures. Examples include improper exclusion of eligible employees, incorrect vesting schedules, or failure to update plan documents to comply with current law. Plan sponsors must not be under audit by the IRS and must fully disclose the identified errors. Additionally, plan sponsors must be willing to correct the errors and pay the associated fees. Identify plan errors: Plan sponsors must thoroughly review their retirement plans to identify any errors or failures. Calculate the correction amounts: Determine the amount required to correct the identified errors, including any additional contributions or adjustments. Develop a correction proposal: Outline a plan for correcting the errors and ensuring ongoing compliance. Gather required documentation: Collect all necessary supporting documentation, such as plan documents, employee records, and calculations. Submit the application and pay the applicable fee: Complete the required forms and submit them to the IRS along with the appropriate fee. Form 8950, Application for Voluntary Correction Program (VCP): This form serves as the primary application for the VCP. Form 8951, Compliance Fee for Application for Voluntary Correction Program (VCP): This form is used to calculate and submit the applicable VCP fee. Other required documentation and supporting materials: Plan sponsors must provide supporting documentation, such as plan documents, calculations, and other relevant records. Correction methods may include plan amendments, additional contributions, reallocation of assets, or distribution adjustments. The IRS generally requires full correction of errors. However, in some cases, reasonable correction may be accepted if full correction is not feasible. Plan sponsors must implement corrections as soon as administratively feasible following the approval of their VCP application. VCP fees are based on the number of participants in the plan and the type of errors being corrected. The IRS provides a fee schedule to help determine the appropriate amount. Plan sponsors can pay VCP fees through various methods, such as electronic payment, check, or money order, depending on the submission method of the application. In certain cases, the IRS may offer fee waivers or reductions, particularly for smaller plans or those sponsored by non-profit organizations and government entities. The IRS will review the submitted VCP application and may request additional information or clarification from the plan sponsor to ensure proper correction and compliance. If the IRS determines that the proposed correction is insufficient or inappropriate, it may work with the plan sponsor to develop an alternative correction method. Once the IRS approves the correction proposal, it will issue a compliance statement outlining the approved corrections and any additional requirements or conditions. Plan sponsors must implement the approved corrections as outlined in the compliance statement and within the specified time frame. Plan sponsors who have submitted a VCP application and are working with the IRS to correct errors receive audit protection, meaning the IRS will not initiate an audit for the issues disclosed in the VCP application. Failure to correct errors or withdrawing from the VCP may result in an IRS audit, potential penalties, and loss of the plan's tax-favored status. If the IRS discovers errors during an audit that were not voluntarily disclosed and corrected, the plan sponsor may face significant penalties, additional taxes, and potential disqualification of the plan. Plan sponsors should establish a system of regular plan reviews and internal controls to ensure ongoing compliance and timely identification of any potential errors. Providing training and education for plan administrators can help prevent future errors and ensure proper administration of the retirement plan. Maintaining open and transparent communication with plan participants can help ensure they are informed about plan provisions and any changes that may affect their benefits. Proactively identifying and correcting plan errors is crucial to maintaining the tax-favored status of retirement plans and avoiding potential penalties. The VCP offers plan sponsors a valuable tool for correcting errors and ensuring continued compliance with tax qualification requirements. Plan sponsors should take advantage of the VCP to correct errors and maintain the tax-favored status of their retirement plans, benefiting both the plan sponsor and plan participants.What is the Voluntary Correction Program (VCP)?

Eligibility for the Voluntary Correction Program

Types of Plan Sponsors and Retirement Plans

Eligible Plan Errors

Conditions and Limitations for Participation

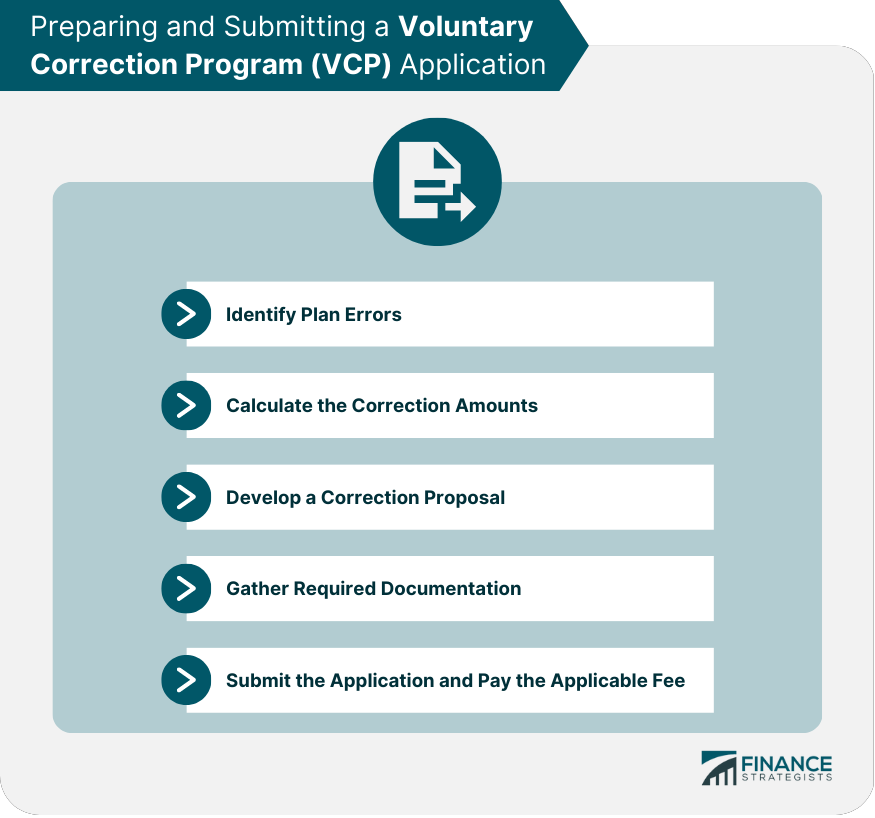

VCP Application Process

Preparing and Submitting a VCP Application

Forms and Documentation

Correction Methods and Principles

Overview of Common Correction Methods

Full Correction and Reasonable Correction

Timing and Implementation of Corrections

VCP Fees and Payment

Fee Structure and Applicable Fees

Methods of Payment

Fee Waivers and Reductions

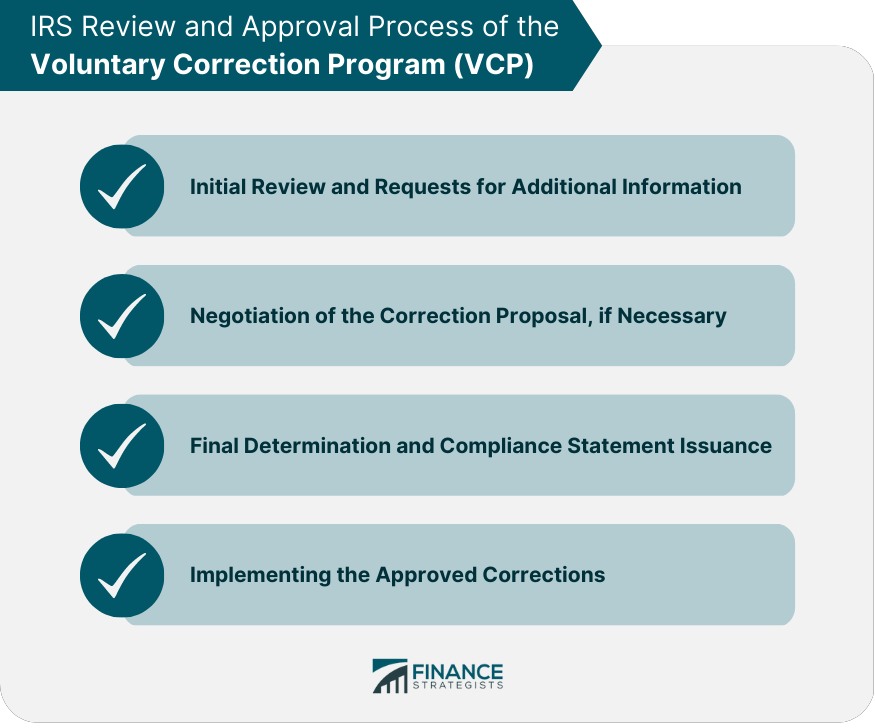

IRS Review and Approval Process

Initial Review and Requests for Additional Information

Negotiation of the Correction Proposal, if Necessary

Final Determination and Compliance Statement Issuance

Implementing the Approved Corrections

Audit Considerations and VCP

Audit Protection During the VCP Process

Consequences of Not Correcting Errors or Withdrawing From VCP

Audit Findings and Potential Penalties

Maintaining Compliance After VCP

Regular Plan Reviews and Internal Controls

Training and Education for Plan Administrators

Ongoing Communication With Plan Participants

Conclusion

Voluntary Correction Program (VCP) FAQs

The Voluntary Correction Program is a program offered by the Internal Revenue Service (IRS) that allows plan sponsors to voluntarily correct certain errors or failures in their qualified retirement plans.

The VCP allows plan sponsors to correct a variety of errors or failures in their qualified retirement plans, including plan document failures, operational failures, and demographic failures.

Plan sponsors who participate in the VCP can avoid potentially costly penalties and fees for plan failures. In addition, correcting plan errors can help ensure that the plan remains qualified and eligible for tax benefits.

The VCP process involves submitting a written application to the IRS, along with payment of a user fee based on the plan's assets. The plan sponsor must provide detailed information about the plan failure and proposed corrective action. The IRS will review the application and, if approved, issue a compliance statement.

Yes, there are certain limitations and restrictions on using the VCP. For example, the program cannot be used to correct certain types of plan failures, such as failures that result in the loss of plan assets or benefits. In addition, the VCP cannot be used for plan failures that are currently under audit or investigation by the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.