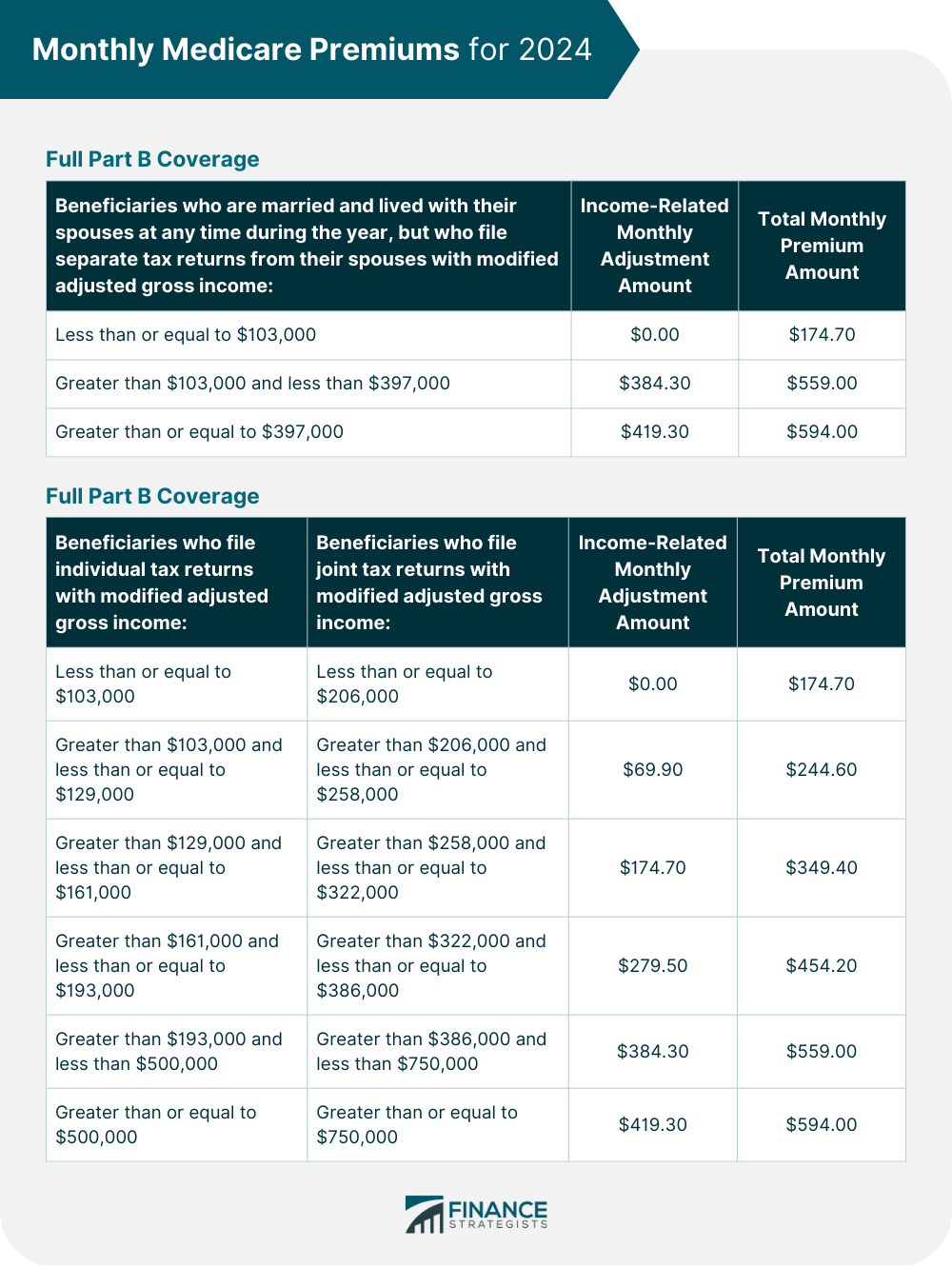

Form SSA-44 can be used to request a decrease in an individual's income-related monthly adjustment amount (IRMAA). Such a request can be triggered when an individual encounters a significant life change that results in a decrease in income. Your monthly Medicare Part B (medical insurance) and Medicare prescription drug coverage premiums are adjusted following the legislation if your income is in a higher bracket. The additional amount is referred to as the income-related monthly adjustment amount or IRMAA. Suppose you are required to pay higher premiums. In that case, the Social Security Administration (SSA) sends you a letter with your premium amount due and the justification for such a decision. Anyone who experiences life-changing events that reduce their income can use Form SSA-44 to request a decrease in their IRMAA. Such events include individuals who just got married or divorced. Death of a spouse, work stoppage or reduction, or lost pension income can cause income reduction. Also, cases of employer settlement can qualify for this form. Those not required to pay the IRMAA do not need to use this form. The SSA makes use of the most current IRS-provided federal tax return. The SSA determines the adjustments using a sliding scale depending on modified adjusted gross income (MAGI). By computing your MAGI, you can establish if you must pay an IRMAA. The MAGI is the total of all adjusted gross income plus interest from tax-exempt sources. Below are tables for 2024 that determine if an individual needs to pay the IRMAA based on their MAGI. Below are steps to help fill out Form SSA-44: Individuals who use the form should check one life-altering incident and provide the date it occurred. In cases where many life-altering events occur, they should contact Social Security. Indicate the amount of the adjusted gross income for that year, the tax-exempt interest income, and their tax filing status. Both income figures are found in their IRS Form 1040. Estimate the impact of the life-changing event on the individual's MAGI for the following year. Provide the anticipated adjusted gross income, tax-exempt interest income, and filing status for the upcoming tax year. The estimated MAGI must be lower than the amount in step 2. Otherwise, skip this step. Provide evidence of MAGI and life-changing events. The original or documentation copies must be sent to the SSA by mail or shown to an SSA employee. Sign the form and provide contact information for the perusal of SSA. Submit the form to the local SSA office, along with any other information needed. It is advisable to send these papers via certified mail. It is also possible to submit the form in person, which allows you to get confirmation that the request was received. Form SSA-44 is used to account for life-changing events that have an effect on individuals’ Medicare Part B premiums and their prescription drug coverage. Those who have to pay their income-related monthly adjustment amount and have experienced significant life changes can use this form to request a recalculation of their monthly premium. When submitting the form, the life-changing event must be declared, the reduction in their income, their MAGI. They have to provide documentation, their contact number, and signature. The form can be submitted in person at the local SSA office or by sending it by certified mail. This guarantees that the form was received and processed in due time.What Is Form SSA-44?

Who Needs to Fill Out Form SSA-44?

How to Fill Out Form SSA-44

Step 1: Indicate Life-Changing Event

Step 2: Fill in Reduction in Income

Step 3: Input Your MAGI Information

Step 4: Provide Documentation

Step 5: Sign & Provide Contact Information

Where to Submit Form SSA-44

Final Thoughts

Form SSA-44 FAQs

Form SSA-44 is a document used to report life changes that can affect an individual's Medicare Part B premiums and prescription drug coverage in order to request a recalculation of their monthly premium.

Form SSA-44 can be filed in person at the local Social Security office or sent by certified mail.

Form SSA-44 should be submitted as soon as possible after the life-changing event has occurred.

No, form SSA-44 must be submitted in person or by certified mail. It cannot be filed online.

Form SSA-44 should not be completed by individuals who are not liable for income-related monthly adjustment amounts. These individuals typically have a limited income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.