Digital assets refer to any digital resources or data that hold value and can be owned, transferred, or used in financial transactions. These assets include cryptocurrencies, digital investment platforms, digital businesses, intellectual property, and non-fungible tokens (NFTs). As the world becomes increasingly digital, incorporating digital assets into retirement planning is becoming more critical. These assets can offer diversification, potential for growth, and passive income opportunities for investors looking to build a comprehensive retirement strategy. Cryptocurrencies, such as Bitcoin and Ethereum, are digital currencies that utilize blockchain technology to enable secure, decentralized transactions. They can be used as a form of investment or as a means to generate passive income through staking or lending. Digital investment platforms, such as robo-advisors and online brokerages, provide investors with access to a wide range of investment products, including stocks, bonds, and exchange-traded funds (ETFs). These platforms can simplify the investment process and help investors manage their retirement portfolios more efficiently. Digital businesses, such as e-commerce stores, blogs, and online courses, can generate income for investors during retirement. These businesses may provide passive income or require ongoing management, depending on their nature. Intellectual property and digital content, such as copyrighted works, software, and digital art, can be valuable assets in a retirement portfolio. Investors can generate income from these assets through licensing agreements, royalties, or sales. Non-fungible tokens (NFTs) are unique digital assets that represent ownership of a specific digital item, such as digital artwork, collectibles, or virtual real estate. While NFTs are relatively new and speculative, they may provide potential investment opportunities for investors willing to take on higher risks. Incorporating digital assets into a retirement portfolio can provide diversification, potentially reducing overall portfolio risk and increasing the potential for higher returns. Some digital assets, such as cryptocurrencies and digital businesses, have demonstrated significant growth potential in recent years. While past performance is not indicative of future results, these assets may offer opportunities for investors seeking long-term growth. Digital assets can provide passive income streams through staking, lending, royalties, or licensing agreements, supplementing traditional sources of retirement income. Investing in digital assets can provide investors with access to innovative investment products and strategies, allowing them to stay ahead of the curve and potentially capitalize on new trends and opportunities. Many digital assets, such as cryptocurrencies and NFTs, are known for their high price volatility, which can lead to significant fluctuations in portfolio value and pose risks for investors relying on these assets for retirement income. The regulatory landscape for digital assets is constantly evolving, creating uncertainties for investors and potentially impacting the value of their investments. Investing in digital assets may expose investors to security and privacy risks, such as hacking, identity theft, or loss of access to their assets due to forgotten passwords or lost private keys. Investing in digital assets often requires a certain level of technological knowledge and understanding, which can be a barrier for some investors looking to incorporate these assets into their retirement planning. Before incorporating digital assets into a retirement portfolio, investors should assess their risk tolerance and financial goals to determine if these assets are a suitable addition to their overall retirement strategy. Investors should thoroughly research and understand the various types of digital assets, their potential benefits, and risks before making any investment decisions. Diversifying digital asset investments across different asset types and platforms can help mitigate some of the risks associated with these assets and potentially enhance overall portfolio performance. Investors should regularly review and adjust their digital asset portfolio to ensure it remains aligned with their risk tolerance, financial goals, and changing market conditions. Digital assets may be subject to unique tax implications, such as capital gains taxes on cryptocurrency transactions. Investors should consult with a tax professional to ensure they are compliant with all applicable tax laws and regulations. Proper estate planning is essential for ensuring that digital assets are appropriately managed and transferred to heirs and beneficiaries upon the investor's death. This may involve creating a digital asset inventory, designating a digital executor, and providing clear instructions for accessing and managing digital assets. Investors should take steps to ensure their heirs and beneficiaries can access their digital assets upon their death, such as sharing private keys, passwords, and other necessary information with a trusted individual or using digital asset custody services. Investors should consider working with financial advisors who are knowledgeable about digital assets and can provide guidance on incorporating these assets into a comprehensive retirement strategy. Navigating the tax implications of digital asset investments can be complex, and investors may benefit from working with tax professionals who are familiar with the unique tax considerations associated with these assets. Estate planning for digital assets can be challenging, and investors may wish to consult with estate planning attorneys who can help them develop a comprehensive plan that addresses their unique digital asset holdings. As the world becomes increasingly digital, incorporating digital assets into retirement planning is becoming more critical. These assets can offer diversification, potential for growth, and passive income opportunities, but they also come with unique risks and challenges. Investors should carefully consider the benefits and risks of digital assets and determine if they align with their risk tolerance and financial goals before incorporating them into their retirement planning. Given the complex and rapidly evolving nature of digital assets, investors should seek professional advice and stay informed about the latest developments in the digital asset landscape to make informed decisions about their retirement planning.Digital Assets in Retirement Planning: Overview

Types of Digital Assets Relevant to Retirement Planning

Cryptocurrencies

Digital Investment Platforms

Digital Businesses and Income Streams

Intellectual Property and Digital Content

Non-fungible Tokens (NFTs)

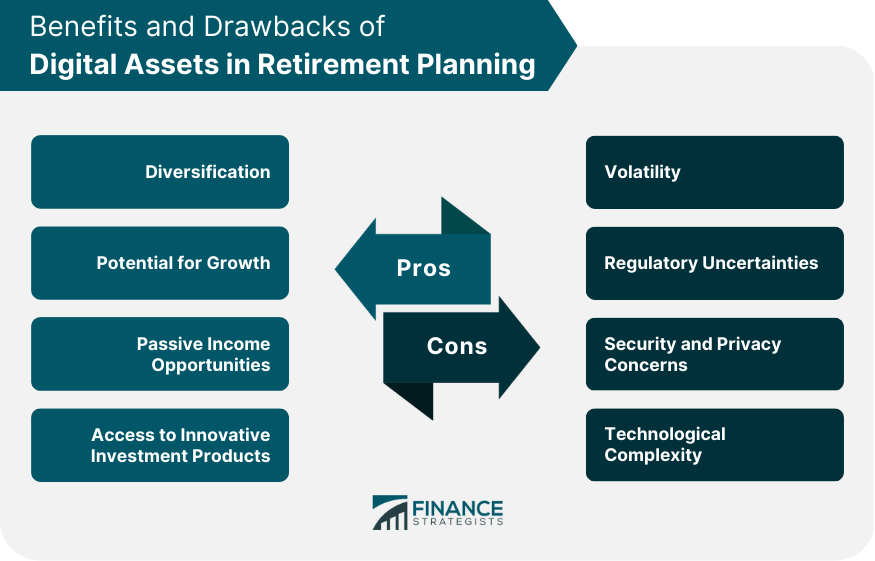

Benefits of Incorporating Digital Assets Into Retirement Planning

Diversification

Potential for Growth

Passive Income Opportunities

Access to Innovative Investment Products

Risks and Challenges of Digital Assets in Retirement Planning

Volatility

Regulatory Uncertainties

Security and Privacy Concerns

Technological Complexity

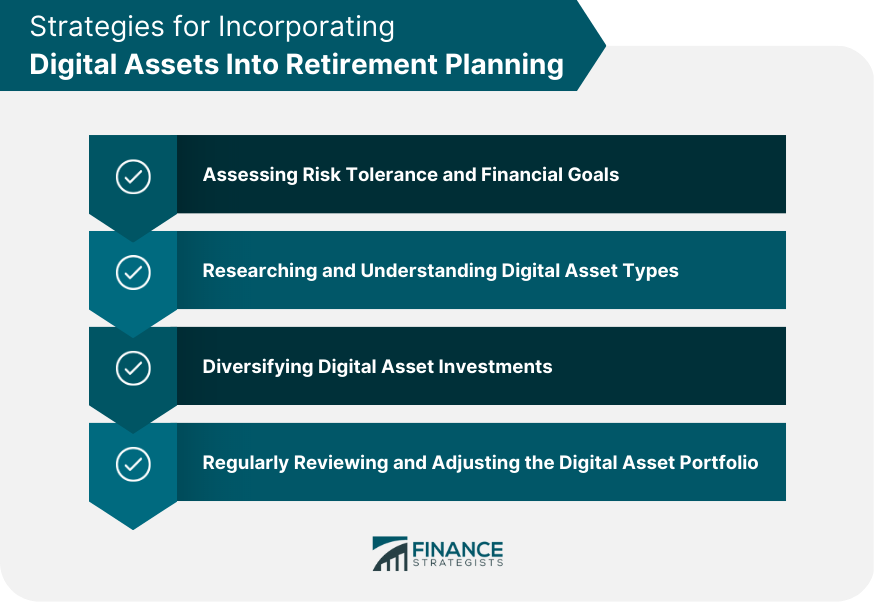

Strategies for Incorporating Digital Assets into Retirement Planning

Assessing Risk Tolerance and Financial Goals

Researching and Understanding Digital Asset Types

Diversifying Digital Asset Investments

Regularly Reviewing and Adjusting the Digital Asset Portfolio

Tax and Estate Planning Considerations for Digital Assets

Understanding Tax Implications

Estate Planning for Digital Assets

Ensuring Access to Digital Assets for Heirs and Beneficiaries

Seeking Professional Guidance for Digital Assets in Retirement Planning

Working With Financial Advisors

Collaborating With Tax Professionals

Consulting With Estate Planning Attorneys

Conclusion

Digital Assets in Retirement Planning FAQs

Digital assets are online or digital resources, such as cryptocurrencies, online investment accounts, social media profiles, and digital art, that may have value and need to be considered in retirement planning.

Including digital assets in retirement planning can help individuals ensure that their assets are properly accounted for and distributed in accordance with their wishes. It can also help prevent potential legal issues and ensure that beneficiaries have access to these assets in the event of incapacity or death.

Individuals can incorporate digital assets into their estate planning by creating a comprehensive inventory of their digital assets, specifying their wishes for how each asset should be handled, and designating a trusted individual to manage these assets in the event of incapacity or death.

Yes, there may be tax implications to holding or transferring digital assets in retirement planning. The tax treatment of digital assets may vary depending on the specific asset and the individual's tax situation. It is important to consult with a tax professional to understand the tax implications of holding or transferring digital assets.

Individuals can protect their digital assets from theft or loss by using strong passwords, regularly backing up their data, and keeping their devices and software up to date with the latest security measures. It is also important to work with a trusted financial advisor or attorney to ensure that digital assets are properly managed and protected in retirement planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.