Cryptocurrency is a type of digital or virtual currency that uses cryptography for security and operates on a decentralized network called blockchain. It is not controlled by any central authority like a government or a central bank. Cryptocurrencies have gained popularity as an investment option due to their potential for high returns and unique features. However, they are also considered high-risk investments due to their volatile nature and various challenges. As the financial landscape evolves, cryptocurrency has started to emerge as a potential component in retirement planning for some investors. Bitcoin is the first and most well-known cryptocurrency. It is a decentralized digital currency that is not controlled by any central authority or government. Bitcoin has gained popularity as a potential store of value and a hedge against inflation. Ethereum is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications. Ethereum's native currency is called Ether (ETH), and it is used to power transactions on the Ethereum network. Stablecoins are cryptocurrencies designed to maintain a stable value by pegging them to a reserve of assets, such as a fiat currency or a commodity. They can provide lower risk exposure to the cryptocurrency market. Altcoins refer to any cryptocurrency other than Bitcoin. There are thousands of altcoins, each with unique features and varying levels of risk and potential returns. Including cryptocurrency in your retirement portfolio can help diversify your investment holdings. Cryptocurrency typically has low correlation with other traditional investment assets such as stocks and bonds. This means that if other assets in your portfolio are not performing well, cryptocurrency can potentially provide a hedge against market volatility. Cryptocurrency has been known to offer high returns in the past, and it has the potential to continue doing so in the future. As cryptocurrency gains more mainstream adoption, its value may continue to increase over time. Cryptocurrency is often seen as a store of value because it is not tied to any government or central bank. As a result, it is not subject to inflation or other economic factors that can reduce the value of traditional currency. Compared to traditional investment assets, cryptocurrency can have lower transaction fees. This can be especially beneficial for retirement planning, where minimizing fees is important to maximize long-term returns. Cryptocurrency can provide access to global markets that may be difficult to access through traditional investment assets. This can help retirees diversify their portfolio and potentially increase their returns. Cryptocurrency is highly volatile, and prices can fluctuate significantly in a short period of time. This volatility can make it difficult to predict future returns and may result in significant losses. Cryptocurrency investments are vulnerable to cyber attacks, such as hacking and theft. This risk is especially concerning for retirees who may have less experience with cybersecurity and may not be able to recover from financial losses caused by a cyber attack. Cryptocurrency is not regulated by any central authority or government, which can make it difficult to understand and manage risks. This lack of regulation also makes it difficult to enforce legal protections. Cryptocurrency is not widely accepted as a form of payment, which can make it difficult to liquidate investments when needed. This limited acceptance may also result in difficulty in finding buyers and sellers for the cryptocurrency, especially during market downturns. Cryptocurrency is a relatively new and complex investment asset that can be difficult to understand for retirees who are less familiar with technology and finance. This lack of understanding can lead to poor investment decisions and increased risk. Self-directed IRAs allow investors to hold alternative investments, including cryptocurrencies, within a tax-advantaged retirement account. SDIRAs come with unique risks and limitations, such as higher fees, limited custodian options, and strict IRS rules regarding prohibited transactions. Investment funds, such as exchange-traded funds (ETFs) or mutual funds, focused on cryptocurrencies can provide a more traditional investment vehicle for retirement planning. Direct cryptocurrency purchases involve buying and holding cryptocurrencies in a digital wallet. This option provides the most direct exposure to the cryptocurrency market but requires investors to manage their own security and understand the technical aspects of cryptocurrency transactions. Dollar-cost averaging involves investing a fixed amount of money in cryptocurrencies at regular intervals, regardless of price fluctuations. This strategy can help reduce the impact of volatility and lower the risk of poor market timing. A well-balanced retirement portfolio should include a mix of various asset classes. Allocating a small portion of a retirement portfolio to cryptocurrencies can provide diversification benefits while mitigating the overall risk. Retirement planning generally involves a long-term investment horizon. Investors should focus on a buy-and-hold strategy for cryptocurrencies rather than attempting to time the market through active trading. It is essential for retirees to manage their risk exposure when investing in cryptocurrencies. This can be achieved by investing only a small portion of the portfolio in cryptocurrencies, using stop-loss orders, and regularly reassessing one's risk tolerance and investment goals. Working with a financial advisor or other professional can help investors navigate the complexities of incorporating cryptocurrency into their retirement plans, ensuring they make well-informed decisions based on their specific needs and goals. Not all financial advisors are knowledgeable about cryptocurrencies. Investors should seek out professionals with experience and understanding of the cryptocurrency market to ensure they receive appropriate guidance. As the financial landscape continues to evolve, cryptocurrency is increasingly being considered as a potential component of retirement planning. While it offers potential benefits such as diversification and high returns, it also presents unique risks and challenges that must be carefully considered. Investors should weigh the potential benefits and risks of including cryptocurrencies in their retirement plans, carefully considering their risk tolerance, investment horizon, and overall financial goals. By employing a balanced approach and working with knowledgeable professionals, retirees can make informed decisions about whether and how to incorporate cryptocurrencies into their retirement portfolios.Cryptocurrency and Retirement: Overview

Types of Cryptocurrencies for Retirement Planning

Bitcoin (BTC)

Ethereum (ETH)

Stablecoins

Alternative Coins (Altcoins)

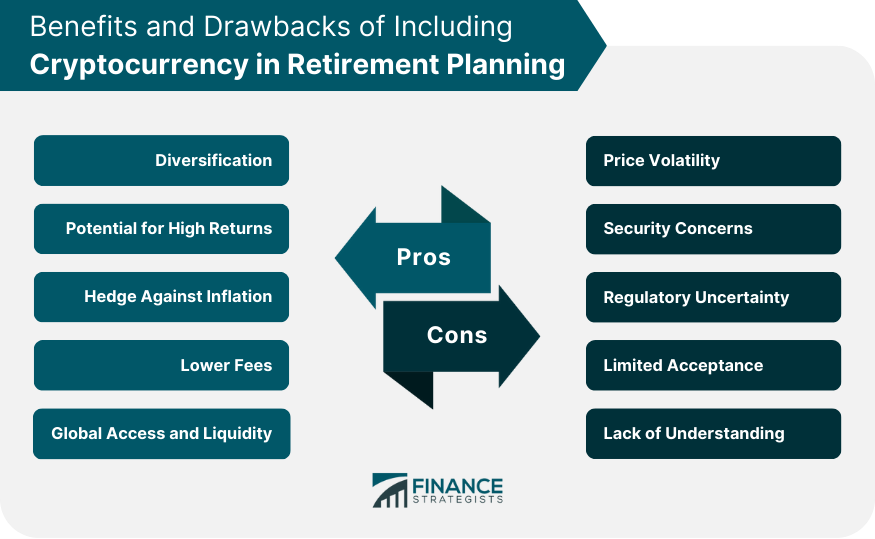

Benefits of Including Cryptocurrency in Retirement Planning

Diversification

Potential for High Returns

Hedge Against Inflation

Lower Fees

Global Access and Liquidity

Challenges of Cryptocurrency Investments for Retirees

Price Volatility

Security Concerns

Regulatory Uncertainty

Limited Acceptance

Lack of Understanding

How to Include Cryptocurrency in Retirement Planning

Self-Directed IRAs (SDIRAs)

Benefits of SDIRAs for Cryptocurrency Investments

Risks and Limitations of SDIRAs

Cryptocurrency Investment Funds

Direct Cryptocurrency Purchases

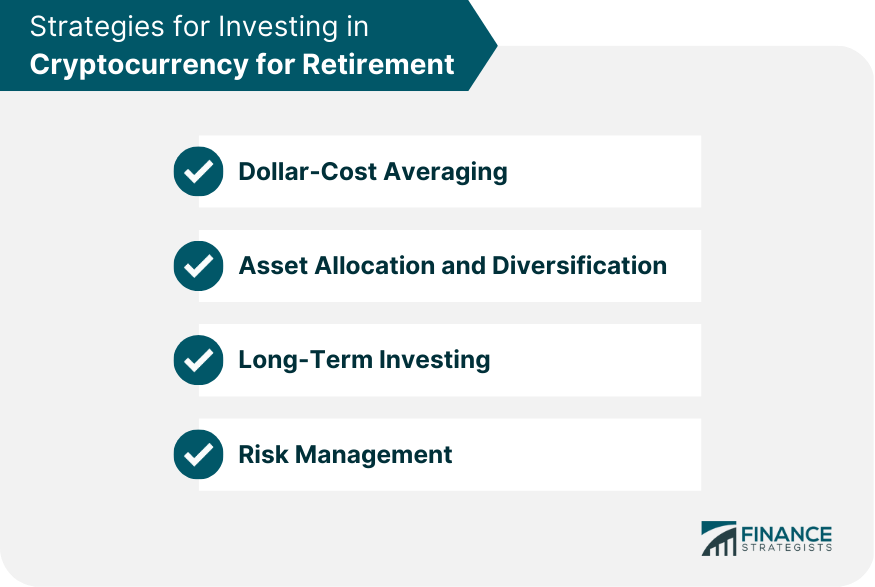

Strategies for Investing in Cryptocurrency for Retirement

Dollar-Cost Averaging

Asset Allocation and Diversification

Long-Term Investing

Risk Management

Working With Financial Professionals

Benefits of Professional Guidance

Finding a Crypto-Savvy Financial Advisor

Conclusion

Cryptocurrency and Retirement FAQs

Yes, cryptocurrency can be used for retirement savings through the use of self-directed IRA accounts, which allow individuals to invest in a range of alternative assets, including cryptocurrency.

Cryptocurrency can be a high-risk investment option for retirement savings, as the market is highly volatile and can experience rapid fluctuations. It is important to carefully evaluate the risks and benefits of cryptocurrency investments and work with a financial advisor to create a diversified retirement portfolio.

Some potential advantages of investing in cryptocurrency for retirement savings include the potential for high returns, diversification of investment portfolios, and the ability to invest in a rapidly growing and evolving market.

Retirees can protect their cryptocurrency investments by using secure storage options, such as hardware wallets or cold storage, regularly monitoring market conditions and performance, and being vigilant against potential fraud or hacking attempts. It is also important to work with a financial advisor who is experienced in cryptocurrency investments to ensure that all investment decisions are properly evaluated and managed.

Retirees can determine if cryptocurrency investments are right for their retirement portfolio by carefully evaluating their risk tolerance, investment goals, and financial situation, and working with a financial advisor who is experienced in cryptocurrency investments. It is important to conduct thorough research and due diligence before making any investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.