Traditional and Roth 401(k) plans are employer-sponsored retirement savings options. These plans are named after the provision of the U.S. Internal Revenue Code that created them. Both programs provide tax benefits, either currently or in the future. Traditional 401(k) plans offer current tax advantages. You do not have to pay income taxes on your contributions. Still, you must pay other payroll taxes, such as Social Security tax and Medicare. You will only have to pay income tax on traditional 401(k) funds once you withdraw them. Contributions to a Roth 401(k) are made after taxes. The tax benefit comes later, wherein gains can be withdrawn tax-free in retirement.

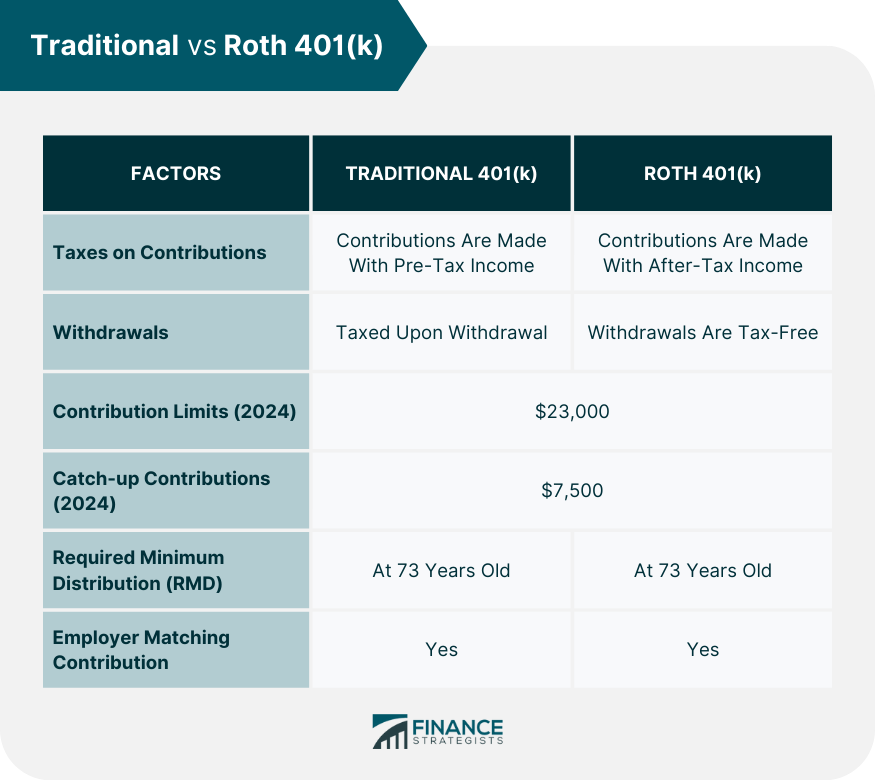

What Is a Traditional 401(k)? A traditional 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a percentage of their wages to a retirement fund on a tax-deferred basis. The contributions are made with pre-tax dollars, reducing the amount of taxable income in a given year and resulting in lower tax liability. Any earnings generated by investments are also tax-deferred until the money is withdrawn at retirement. You can start receiving eligible distributions from your plan when you are 59 1/2 years old. While ordinary income tax is due on those dividends, the 10% early withdrawal tax penalty is not. Employers typically match employee contributions up to a specific limit. This match is also part of the 401(k) holder's investment portfolio. It will accrue earnings over time, helping to maximize the plan's benefit. The Roth 401(k) is a retirement savings plan that allows workers to save after-tax income for later-life financial goals. Contributions to the account grow tax-free, and earnings are withdrawn without the tax for qualified expenses in retirement. Employers may provide this plan in addition to or as a substitute for traditional 401(k) plans. The employer can match any contributions you make to the plan. Roth 401(k) rules enable you to make "qualified" or penalty-free withdrawals of both contributions and earnings at any time after the age of 59 1/2 as long as you meet certain conditions. A Roth 401(k) plan can complement Social Security benefits and other savings accounts like regular IRAs and annuities. Although both plans offer tax advantages, some differences should be considered when deciding which plan is right for you. With a traditional 401(k), no taxes are paid on contributions at the time they are made, meaning they are taken out of your paycheck before taxes. With a Roth 401(k), contributions are made with post-tax money, meaning you have already paid taxes on the money when it goes into the account. With a traditional 401(k), withdrawals are taxed upon withdrawal. With a Roth 401(k), withdrawals are tax-free as long as they are taken after retirement or before retirement if they meet certain conditions such as the account must have been held for 5 years and withdrawals are made because of disability or death. The withdrawal rules for both traditional and Roth 401(k) plans are the same. Withdrawals made before age 59½ are subject to income tax and a 10% early distribution penalty. In 2024, both types of accounts have the same annual contribution limit of $23,000. If you are over 50, you may be eligible for a catch-up contribution of $7,500 for either type of 401(k) plan. This is on top of the regular annual contribution limit. Previously, with both the traditional 401(k) and Roth 401(k), you must begin to take required minimum distributions (RMDs) by April 1st, following the year you turn 72 years old. Section 107 of SECURE 2.0 raises the statutory minimum distribution age to 73 on January 1, 2023. Employers may match your contributions to either type of 401(k) plan. When choosing which type of account best suits your needs, it is important to consider the matching contribution. Deciding which one is right for you will depend on two factors: your present tax situation and whether your tax rate after retirement is likely to be higher or lower. The higher your tax rate in retirement, the more favorable a Roth 401(k) is likely to be since Roth distributions are tax-free. Those who contribute the maximum amount to their 401(k) allowed by the IRS each year are strong Roth prospects because they are more likely to have more significant savings in retirement, which can benefit from tax-free withdrawals from a Roth. On the other hand, if you are now in a low tax bracket, consider a Roth now. Lowering your gross income will not provide as substantial a tax benefit as it may later if you find yourself in a higher tax bracket. A Roth contribution, because it is deducted from your paycheck, will likely cut your take-home pay more than the equivalent of a traditional 401(k) contribution. A traditional 401(k) may be the way to go if you want to save and take home as much money as possible. Diversifying contributions to both a traditional and a Roth 401(k) can help maximize your tax advantages while building substantial retirement savings. Before deciding which plan is right for you, consider getting assistance on retirement planning to optimize your pre-retirement and post-retirement savings. A tax-advantaged method of increasing retirement savings is available through an employer-sponsored traditional 401(k) or Roth 401(k) plan, which also has the potential for matching contributions. The main distinction between a Roth 401(k) and a traditional 401(k) is when you pay taxes. A traditional 401(k) permits you to make pre-tax contributions, but you must pay income tax on payouts in retirement. Roth 401(k)s are funded with after-tax dollars that can be withdrawn tax-free when you reach retirement age. Before investing, it is crucial to understand how both options compare and how they will affect your retirement strategy and tax status. Traditional vs Roth 401(k): Overview

What Is a Roth 401(k)?

Comparison Between Traditional and Roth 401(k)

Taxes on Contributions

Withdrawals

Contribution Limits

Catch-up Contributions

Required Minimum Distribution (RMD)

Employer Matching Contribution

Traditional vs Roth 401(k): Which Is Right For You?

The Bottom Line

Traditional vs Roth 401(k) FAQs

Your employer must offer a 401(k) plan for you to participate. You will need to enroll and decide how much of your salary you would like to contribute each pay period.

A 401(k) can provide tax advantages, help build retirement savings, and may offer employer-matching contributions.

The current annual contribution limit is $23,000, with an additional catch-up contribution of $7,500 if applicable.

Yes, investing in a Roth 401(k) still carries the risk of loss, depending on your investments. However, contributions to a Roth 401(k) are not taxed when withdrawn, so you can keep what remains even if the account balance has declined.

Depending on your employer's plan options, it is possible to do both traditional and Roth 401(k) plans. When deciding which plan is best for you, you should consider factors such as taxes, withdrawal requirements, and eligibility for catch-up contributions. Consult a financial professional to get advice tailored to your individual needs

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.