A 401(k) plan overcontribution occurs when an employee contributes more money to their 401(k) than the annual limit set by the IRS. The maximum limit for 2023 is $23,000. Overcontributions are usually unintentional and can occur if you don’t check your account regularly or if you receive employer contributions that push you over the limit. It’s important to know the regulations of your 401(k) plan in order to avoid overcontribution and its associated penalties. Once you discover that you’ve made an overcontribution, you should contact the appropriate person in your company as soon as possible. Generally, employers will give employees options such as withdrawing excess contributions with earnings before filing a tax return or returning the funds with income taxes being paid on it. Depending on various factors such as income and other investments, there may be some tax benefits in repaying an excess contribution with earnings instead of just income taxes paid on it. Have questions about 401(k) Plan Overcontributions? Click here. Despite careful planning, 401(k) plan overcontributions can occur due to a variety of reasons. Here are some of the most common causes: When you switch employers, it’s essential to make sure that contributions properly reflect your new job and salary. If contributions are applied to an old employer’s plan or if more is contributed than what is allowed by law due to the salary from the new job, an overcontribution can occur. Different plans have different rules and regulations. Once you switch from one retirement plan to another, make sure that you understand all of the new rules and regulations to avoid inadvertently making an excess contribution. If you work multiple jobs with different retirement plans, it’s possible for the combined total of your contributions to exceed the annual legal limit. Be sure to keep track of how much money has been going into each plan so that you don’t go over the limit set by law. Overcontribution can also occur if your raise or bonus pushes your total annual contribution amount over the legal limit. When this happens, either reduce any subsequent contributions or contact the appropriate person in your company right away so they can help adjust the amount before filing a tax return. It's essential that anyone planning their retirement takes steps to ensure they remain compliant with all applicable laws when saving for their future. When an employee makes an overcontribution to their 401(k), there may be serious tax implications. The IRS imposes a 6% excise tax on excess contributions in addition to any income taxes owed on withdrawn earnings as a result of the overcontribution. In some cases, it may be more beneficial for you to keep the excess funds in your 401(k). For example, if you have already maxed out other retirement accounts, such as IRAs, keeping the funds in your 401(k) could be advantageous due to lower income tax rates and higher investment returns when compared to other retirement savings plans. However, it is necessary to consult with a trusted financial advisor before making decisions that could lead to significant taxation penalties. When an employee makes an overcontribution to their 401(k), there are a few steps that must be taken in order to avoid costly tax penalties. It's important to contact the appropriate person in your company right away so they can help adjust the amount before filing a tax return. To determine the exact amount of your overcontributions, you'll need to calculate the total of all contributions made by you and any employer contributions for that tax year as well as any earnings associated with those funds. To ensure accuracy, make sure that your most recent W-2 reflects all adjustments made before filing a return or amended return. Once you have identified the amount of your excess contribution, it’s time to file either a regular or amended return. If you didn't include it on your original return, then an amended one is required. When filing taxes next year, make sure to account for any excess contributions that were rolled over from previous years so there won't be any surprises during tax season. Before contributing again after making an excess contribution, double-check to make sure the contribution limits haven't changed since the last contribution period. This will prevent future unnecessary complications with potential IRS fines. When looking for other options to save for retirement beyond a 401(k) plan, there are several alternatives that have their own unique benefits and drawbacks. An IRA offers tax benefits such as the ability to deduct contributions from your taxable income and defer taxes on withdrawals until retirement. Additionally, IRAs may offer greater investment choices than 401(k)s and can also be used as part of estate planning. HSAs are savings accounts designed specifically to pay for medical expenses not covered by employer insurance plans or Medicare. Contributions to an HSA can be made with pre-tax dollars and grow tax-free, making them a great option for those who want more control over how they spend their healthcare dollars. An annuity is an insurance product that pays out a predetermined amount at a set interval, typically in monthly payments over the life of the contract. This can be beneficial for those who are conservative investors as annuities provide guaranteed income when used in combination with other investments or Social Security. Traditional brokerage accounts allow you to buy stocks, bonds, and mutual funds without getting any special tax breaks. The tradeoff is the fact that you have fewer restrictions on what you can do with your money, so it's crucial to understand the risks associated before investing heavily in this type of account. When it comes to 401(k) plan overcontributions, it's crucial to address the issue as soon as possible in order to avoid costly potential tax penalties. By understanding the tax implications and taking the necessary steps to correct an overcontribution, such as notifying your employer or plan administrator and filing a return or amended return, you can ensure that your retirement savings are secure and on track. With the help of a trusted financial advisor, individuals can navigate the complexities of 401(k) plans and make confident decisions that will benefit them in the long run.What Is a 401(k) Plan Overcontribution?

Common Reasons for 401(k) Plan Overcontribution

Switched Employers

Switched Retirement Plans

Multiple Jobs With Multiple Retirement Plans

Received a Raise or Bonus

Tax Implications of 401(k) Plan Overcontribution

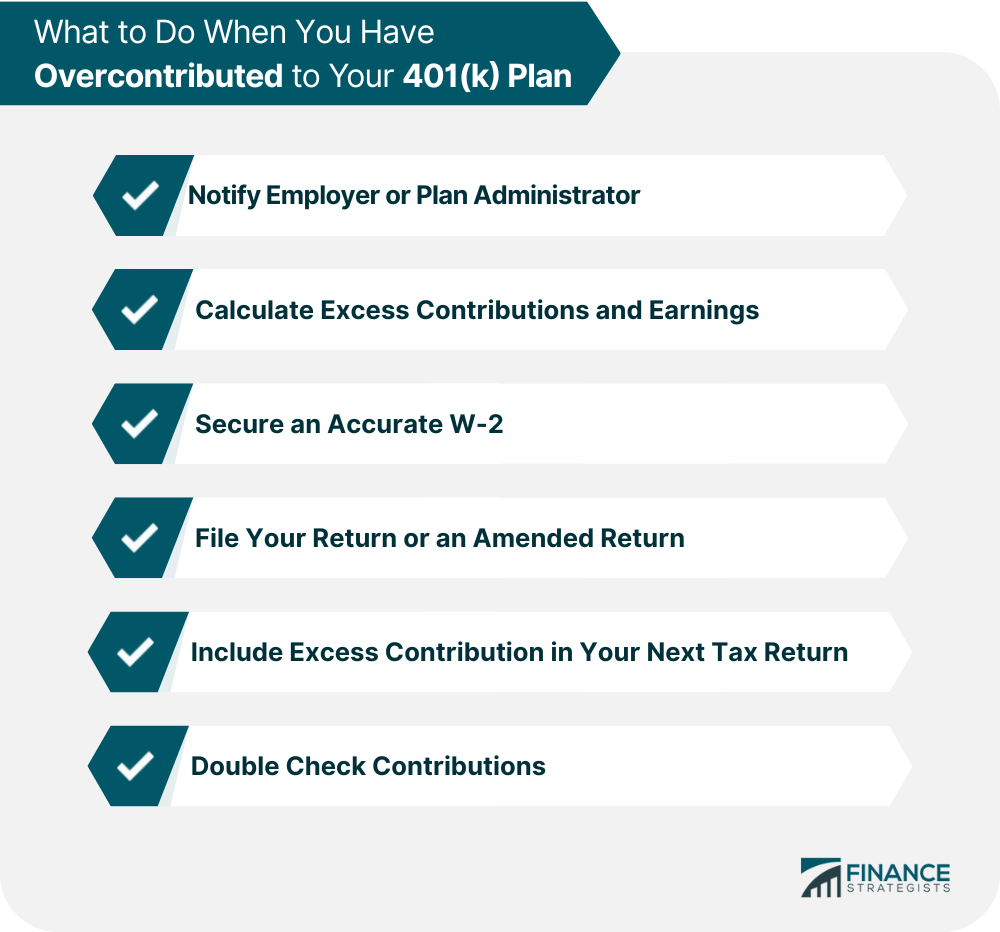

What to Do When You Have Overcontributed to Your 401(k) Plan

Notify Employer or Plan Administrator

Calculate Excess Contributions and Earnings

Secure an Accurate W-2

File Your Return or an Amended Return

Include Excess Contribution in Your Next Tax Return

Double Check Contributions

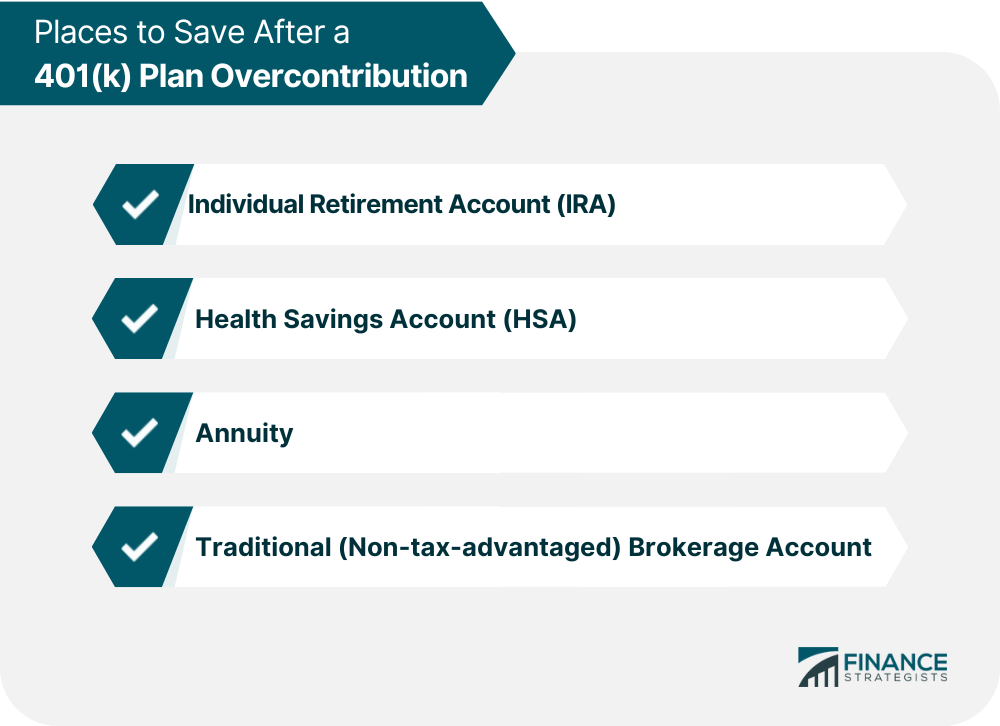

Places to Save After a 401(k) Plan Overcontribution

Individual Retirement Account (IRA)

Health Savings Account (HSA)

Annuity

Traditional (Non-tax-advantaged) Brokerage Account

Conclusion

401(k) Plan Overcontribution FAQs

A 401(k) plan is a tax-advantaged retirement savings account offered by many employers. Employees can contribute to their 401(k) plans before taxes, grow those funds without being taxed until withdrawals are made in retirement, and sometimes receive matching contributions from their employers.

If you have made an overcontribution to your 401(k), you must notify your employer or plan administrator as soon as possible and they will assist you with the process. Additionally, individuals should file a return or amended return if necessary to account for any earnings associated with the funds that have been removed. It's recommended that individuals seek assistance from a financial advisor who can help them understand their specific situation and take the appropriate corrective actions.

If an employee exceeds the annual contribution limits on their 401(k), they will be subject to paying taxes on the excess amount as well as possible penalties and fees. Also, they may need to file an amended return or face additional fines or legal action if they don’t report their excess contributions in time.

The best way to avoid making an overcontribution to your 401(k) plan is to track your contributions throughout the year and check with your employer or plan administrator periodically regarding how much you have contributed so far and what the limit is for that year.

To avoid future contributions from exceeding legal limits, it's crucial to stay informed about current tax laws and keep track of how much you're putting into your retirement accounts throughout each year. Additionally, individuals should consider setting up automatic reminders or alerts so they don't miss important contribution deadlines and put too much money into their accounts at once by accident. Taking small steps like these can go a long way in ensuring responsible retirement planning habits in the long run.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.