The default deferral rate is the percentage of an employee's income automatically contributed to their retirement savings account in a defined contribution plan, such as a 401(k), when they do not make an explicit choice regarding the contribution rate. In other words, if an employee does not specify a contribution rate, the plan sponsor will automatically enroll them in the plan with a specific contribution percentage. The default deferral rate is a crucial aspect of retirement plans as it helps employees save for their future without requiring them to make an active decision to enroll. This feature is particularly important because studies show that many employees fail to sign up for their employer's retirement plan due to inertia, a lack of information, or decision paralysis. As such, automatic enrollment with a default contribution rate has become a popular tool for increasing employee participation in retirement savings plans. Employers may consider the average age of their employees and whether they are more likely to be in the accumulation phase of their careers or closer to retirement. For instance, younger employees may benefit from higher default deferral rates to build a more substantial retirement nest egg, while older employees may prefer lower rates to manage their current expenses. Employers may also consider the income levels of their employees and the potential impact of a higher deferral rate on their take-home pay. Higher-income earners may be more comfortable with a higher default deferral rate, while lower-income earners may prefer a lower rate to maintain their cash flow. Employers may also consider their overall plan objectives and the desired outcomes of the default deferral rate. For instance, an employer may aim to maximize employee participation or encourage higher employee contributions to the plan. Finally, employers must comply with the legal requirements for their retirement plans. For instance, the Pension Protection Act of 2006 introduced several safe harbor provisions for default deferral rates, such as the Qualified Automatic Contribution Arrangement (QACA). Studies show that automatic enrollment with a default deferral rate can significantly increase employee participation in retirement savings plans. A study by the Employee Benefit Research Institute found that plans with automatic enrollment had an average participation rate of 86%, compared to 67% for plans without automatic enrollment. Furthermore, plans with automatic enrollment and a default deferral rate had an average participation rate of 90%. Automatic enrollment is a feature that allows employers to automatically enroll eligible employees in their retirement plan without requiring them to take any action. This feature is particularly important because studies show that many employees fail to sign up for their employer's retirement plan due to inertia, a lack of information, or decision paralysis. Automatic enrollment plans typically include a default deferral rate that is automatically applied to an employee's paycheck unless they choose to opt-out or adjust their contribution rate. The default deferral rate is typically a percentage of an employee's income, with 3% being the most common rate used by employers. Automatic escalation is a feature that automatically increases an employee's default deferral rate over time, usually annually or after a specified period. The goal of automatic escalation is to encourage employees to save more for retirement without requiring them to take an active role in managing their contributions. Automatic escalation is typically designed to be gradual, increasing the default deferral rate by 1% or 2% per year until it reaches a maximum level. The benefits of escalating default deferral rates are twofold. First, it allows employees to gradually adjust to a higher contribution rate, making it easier to manage their expenses. Second, it increases the likelihood that employees will reach their retirement savings goals by contributing more over time. The Pension Protection Act of 2006 (PPA) introduced several provisions that encourage employers to adopt automatic enrollment and default deferral rates in their retirement plans. These provisions include safe harbor rules for default investment options and default deferral rates, as well as requirements for employee notices and disclosures. The PPA also introduced the Qualified Automatic Contribution Arrangement (QACA), which is a type of automatic enrollment plan that provides employers with a safe harbor from certain legal requirements. To qualify for the safe harbor, a QACA must meet several conditions, including a default deferral rate of at least 3% and automatic escalation of contributions up to a maximum of 10%. The legislation and regulations surrounding automatic enrollment and default deferral rates have had a significant impact on retirement plan design. Employers are now more likely to adopt automatic enrollment features and default deferral rates, and they have more guidance on how to design these features to comply with legal requirements. Behavioral economics is the study of how psychological factors affect economic decision-making. Behavioral economists have found that individuals often make decisions that are not rational, but rather influenced by biases, heuristics, and other cognitive factors. Default options, such as default deferral rates, can have a significant impact on employee savings behavior. Studies show that employees are more likely to accept default options than to actively choose an alternative option. As such, default deferral rates can influence how much employees save for retirement, even if they do not actively choose their contribution rate. Employers can encourage higher employee deferral rates by implementing several best practices, including: Setting default deferral rates at a higher percentage, such as 6% or 8%. Offering automatic escalation features to gradually increase employee contributions over time. Providing education and resources to help employees understand the importance of retirement savings. Conducting regular plan reviews to ensure that the plan is meeting its objectives and that default deferral rates are appropriately set. Employee education and communication are critical components of successful retirement plan design. Employers should provide employees with clear and concise information about the plan, including how default deferral rates work, how to opt-out or adjust their contribution rate, and the potential impact on their retirement savings. Default deferral rates can have a significant impact on plan performance by increasing employee participation and contributions. Studies show that plans with automatic enrollment and default deferral rates have higher participation rates, higher contribution rates, and higher retirement savings balances compared to plans without these features. Employers can measure the success of their default deferral rate policies by tracking participation rates, contribution rates, and retirement savings balances over time. Employers can also conduct surveys and focus groups to gather employee feedback and identify areas for improvement. Default deferral rates are a crucial aspect of retirement planning as they help employees save for their future without requiring them to take an active role in managing their contributions. Automatic enrollment with a default deferral rate can significantly increase employee participation and contributions, leading to higher retirement savings balances. Employers and plan sponsors should consider several key factors when setting default deferral rates, including employee age, income, overall plan objectives, and legal requirements. Employers should also offer automatic escalation features and provide employee education and communication to encourage higher participation and contributions. Regular plan reviews and adjustments can ensure that default deferral rates are appropriately set and aligned with plan objectives.What Is the Default Deferral Rate?

Setting Default Deferral Rates

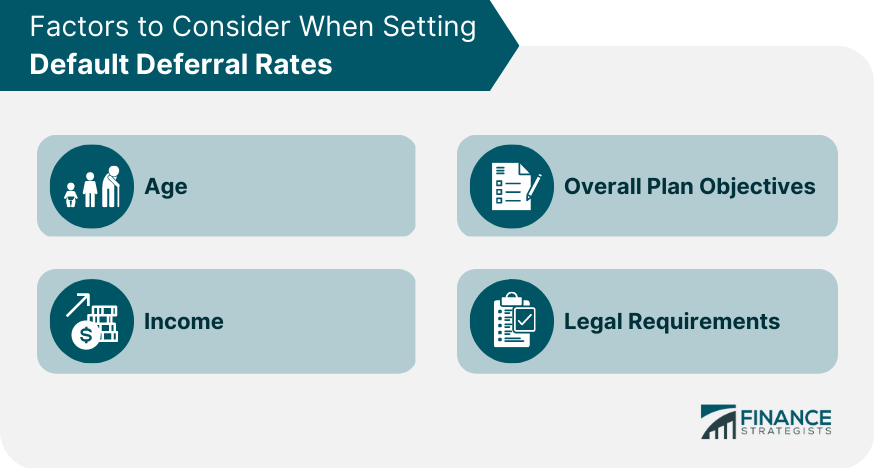

Factors to Consider When Setting Default Deferral Rates

Age

Income

Overall Plan Objectives

Legal Requirements

How Default Deferral Rates Impact Employee Participation

Default Deferral Rate and Automatic Enrollment

The Role of Automatic Enrollment in Retirement Plans

Default Deferral Rates in Automatic Enrollment Plans

Escalation of Default Deferral Rates

Automatic Escalation Features

Benefits of Escalating Default Deferral Rates

Legislation and Regulations

Pension Protection Act of 2006

Qualified Automatic Contribution Arrangements (QACAs)

Impact of Legislation on Default Deferral Rates

Behavioral Economics and Default Deferral Rates

The Role of Behavioral Economics in Retirement Savings

How Default Options Influence Employee Savings Behavior

Best Practices for Employers

Strategies for Encouraging Higher Employee Deferral Rates

Employee Education and Communication

Default Deferral Rates and Plan Performance

The Impact of Default Deferral Rates on Plan Performance

Measuring the Success of Default Deferral Rate Policies

Conclusion

Default Deferral Rate FAQs

The Default Deferral Rate (DDR) is a pre-selected contribution rate that is automatically applied to a participant's retirement account in the absence of an affirmative contribution election.

A Default Deferral Rate may be used in 401(k), 403(b), and 457(b) plans.

The purpose of the Default Deferral Rate is to encourage retirement savings and ensure that employees who do not make an affirmative election still participate in the plan.

The Default Deferral Rate is typically determined by plan administrators, who may consider various factors such as industry benchmarks and participant demographics.

Yes, participants can change their Default Deferral Rate or opt-out of automatic enrollment altogether. Most plans also allow for changes to the Default Deferral Rate on an annual basis.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.