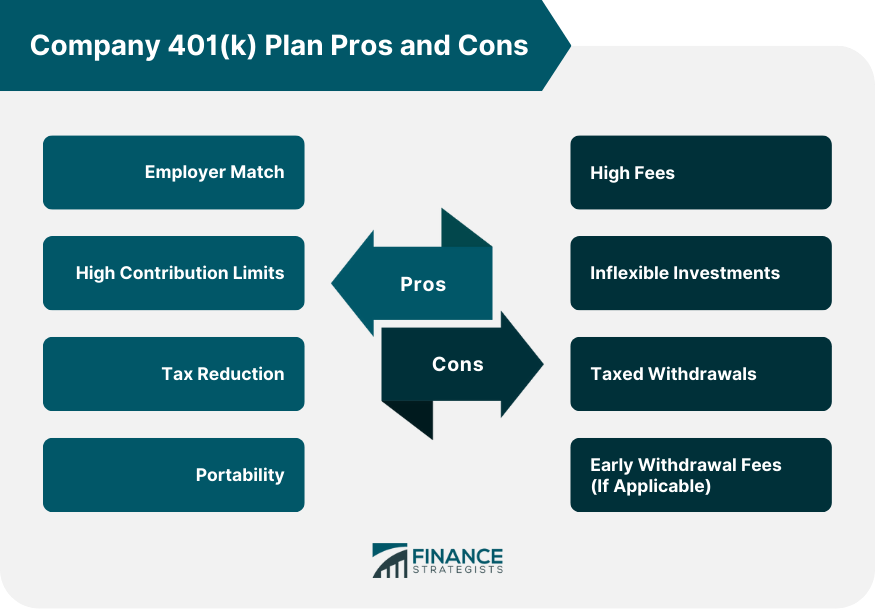

A 401(k) plan, refers to a defined-contribution retirement savings plan. In this setup, employees contribute a part of their pre-tax salary into a 401(k) account, which accrues interest over time. A 401(k) plan is often supplemented by employers who may match a portion of the employee's contributions, effectively amplifying their retirement savings. Notably, the funds within a 401(k) account are typically invested in a portfolio of assets, which could include stocks, bonds, mutual funds, or other investment vehicles. The responsibility for managing these investments lies primarily with the employees. However, employers or plan providers often provide an array of options and educational resources to guide employees in making informed investment decisions. Many employers will match a percentage of an employee's contribution to their 401(k) account, effectively adding free money to the employee's retirement savings. This practice can significantly boost the growth of the 401(k) account, greatly benefiting the employee. The specifics of the matching contributions vary by company. Some may offer a dollar-for-dollar match up to a certain percentage of the employee's salary, while others may match a percentage of the employee's contribution up to a certain limit. Regardless of the specifics, this matching practice effectively serves as an immediate return on the employee's investment. The contribution limit for employees under the age of 50 to a 401(k) plan is $23,000. Employees who are 50 years of age or older can contribute an additional $8,000 per year as a catch-up contribution. These limits are considerably higher than those for many other tax-advantaged retirement accounts, allowing for more substantial savings growth. The higher limits mean that employees can set aside a sizeable portion of their income for retirement, reducing the need to rely on Social Security benefits. Moreover, the high limits can be particularly beneficial for late-starters who need to save more aggressively to prepare for retirement. Contributions to a 401(k) plan are made with pre-tax dollars, meaning they are deducted from your income before taxes are calculated. This reduces your current taxable income, which may lower your overall tax bill. This immediate tax break can make a significant difference, especially for those in higher tax brackets. Moreover, the money within the 401(k) account grows tax-deferred. Taxes are not owed on the growth of the investments until you begin to make withdrawals in retirement. Depending on your tax situation in retirement, this could potentially result in substantial tax savings. A key feature of a 401(k) plan is the portability of funds. If you switch jobs, your 401(k) savings can move with you. You have the option to leave the money in your old employer's plan, roll it over into your new employer's plan, or transfer it into an Individual Retirement Account (IRA). This flexibility ensures continuity in your retirement savings. It means that even if your employment situation changes, your retirement savings need not be disrupted. This is particularly beneficial in the modern job market, where changing jobs multiple times throughout one's career is commonplace. While 401(k) plans offer numerous advantages, they also come with some drawbacks. One of the most significant is the potential for high fees. These can include administrative fees, investment fees, and individual service fees, which can eat into your retirement savings. Fees can vary significantly between plans, and it may not always be easy to determine what fees you're paying. Over the long term, even seemingly small fees can have a significant impact on your overall returns. As such, it's crucial to understand the fee structure of your 401(k) plan. While most plans offer a range of investment options, the selection is usually limited to the funds chosen by your employer or the plan provider. This can restrict your ability to fully diversify your portfolio or invest in specific sectors or securities that you favor. The quality of the available investment options can also be a concern. Not all 401(k) plans offer high-quality funds, and some may be laden with high fees. For individuals who wish to have full control over their investment decisions, these limitations could be a significant drawback. While 401(k) contributions are made pre-tax and grow tax-deferred, withdrawals in retirement are subject to income tax. The tax will be based on your income tax rate at the time of withdrawal. Depending on your income in retirement, this could mean paying a substantial amount in taxes. Furthermore, if you anticipate being in a higher tax bracket in retirement than you are while working, the tax-deferred nature of a 401(k) could actually be a disadvantage. In such a situation, you might end up paying more in taxes on your 401(k) withdrawals than you would have paid on the money if it were taxed when initially earned. One of the key features of a 401(k) plan is that it's designed for long-term savings, specifically for retirement. As such, taking money out of your 401(k) before reaching the age of 59.5 can trigger a 10% early withdrawal penalty, in addition to regular income tax. This can significantly reduce the amount of money you receive from the withdrawal. Moreover, not all 401(k) plans allow for early withdrawals or loans. Even when they are allowed, the conditions under which you can access your funds early are often limited to specific hardship circumstances. This lack of flexibility can be a disadvantage if you need access to your savings before retirement. Connect With a Vetted 401(k) Advisor. Click here. Determining whether a company 401(k) plan is right for you depends on various factors. Here are some key considerations to help you make an informed decision: If your company offers a 401(k) match, it can be a valuable benefit. Matching contributions essentially give you free money, making the 401(k) plan more appealing. Assess your long-term financial goals and the importance of retirement savings. A 401(k) plan provides an opportunity to save for retirement with tax advantages, which can help you build a substantial nest egg over time. Evaluate the investment options available within the 401(k) plan. Look for a diverse range of investment choices that align with your risk tolerance and investment objectives. Consider whether the contribution limits of a 401(k) plan align with your savings goals. These limits may vary each year, so staying informed about the current limits is important. Balancing these pros and cons is key to making the best decision about your participation in a 401(k) plan. The potential for employer-matched contributions, high contribution limits, reduction of current taxable income, and portability of funds are significant benefits that can help you build a substantial retirement nest egg. High fees, limited and potentially inflexible investment options, taxed withdrawals, and potential penalties for early withdrawal are aspects that could potentially reduce its effectiveness. Consider the quality and quantity of the investment options available, the fees associated with the plan, and the specifics of your employer's matching contributions. Furthermore, consider your tax situation both now and anticipated in retirement. The tax advantages of a 401(k) plan are significant, but they may not benefit everyone equally.What Is a Company 401(k) Plan?

Company 401(k) Plan Pros

Employer May Match Contributions

High Contribution Limits

Contributions Reduce Current Taxable Income

Portability of Funds

Company 401(k) Plan Cons

Fees May Be High

Quality and Quantity of Investments May Be Inflexible

Withdrawals Are Taxed

May Be Fees for Early Withdrawal, If Even Possible

Is a Company 401(k) Plan Right for You?

Employer Match

Retirement Savings Goals

Investment Options

Contribution Limits

Conclusion

Company 401(k) Plan Pros and Cons FAQs

A 401(k) plan is a retirement savings scheme offered by employers to their employees, allowing them to set aside money from each paycheck and invest it in either stocks or bonds. The funds are then withdrawn upon retirement with favorable tax treatment.

Again, this depends on the individual’s situation and goals. In general, 401(k)s tend to have higher contribution limits and access to better employer-matching contributions. However, IRAs offer a greater degree of flexibility in terms of investment options and are not subject to the administration fees associated with 401(k) plans. Therefore, it is important to consider your individual circumstances before making an investment decision.

Yes, as with any investment, there are associated risks. Depending on the type of investments chosen, market fluctuations can lead to significant losses over time. Additionally, the funds in a 401(k) plan may not be accessible until retirement age unless certain criteria are met.

The primary benefit of investing in a 401(k) plan is that it allows you to save for retirement on a tax-deferred basis. This means that your contributions grow more quickly than they would with other types of accounts since you won't have to pay taxes on them until they are withdrawn in retirement. Additionally, employers often match employee contributions up to certain limits, providing an added incentive for saving for retirement.

Yes, if you withdraw money from your 401(k) plan before reaching the age of 59 and a half, you will face significant penalties in the form of taxes and fees. In most cases, it is best to leave funds in your 401(k) account until after retirement age so that you can maximize their growth potential and avoid these penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.