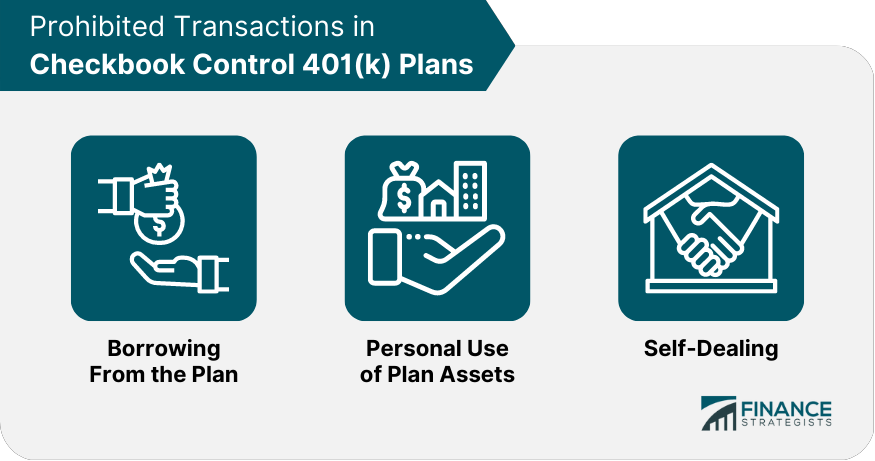

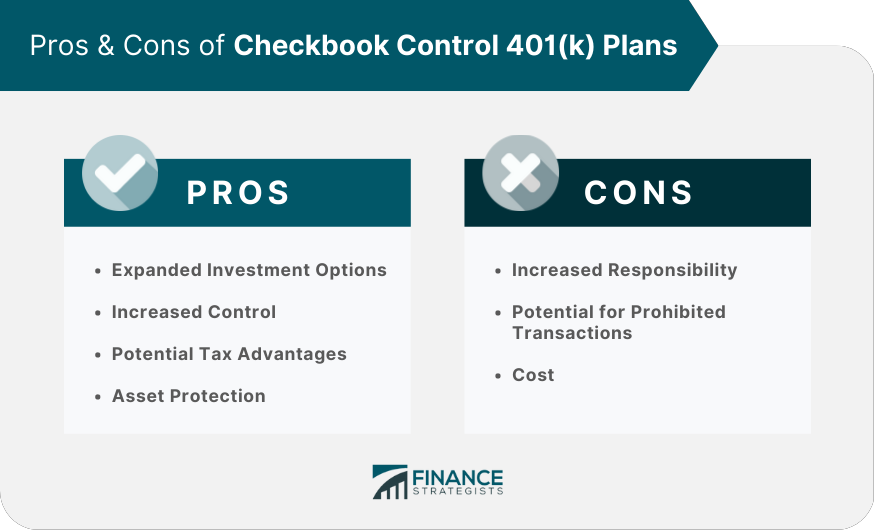

A checkbook control 401(k) plan, also known as a self-directed 401(k) plan, is a unique retirement savings vehicle providing account holders greater control and flexibility over their investments. These components work together to provide investors with the flexibility and control they need to manage their investments effectively. By offering the ability to make alternative investments, checkbook control 401(k) plans give investors the opportunity to diversify their portfolios, potentially yielding higher returns and reducing risk. To be eligible for a checkbook control 401(k) plan, an individual must meet the following criteria: Self-Employed or Business Owner: The individual must either be self-employed or own a small business with no full-time employees other than the owner and their spouse. Earned Income: The individual must have earned income from their self-employment or business activities. When selecting a provider for a checkbook control 401(k) plan, investors should consider factors such as: Experience and Expertise: The provider should have a strong background in setting up and administrating checkbook control 401(k) plans. Compliance Support: The provider should offer assistance with ensuring the plan meets all IRS regulations and requirements. Fees: Investors should compare the fees charged by different providers, including setup, ongoing administration, and transaction fees. Setting up a checkbook control 401(k) plan involves two main steps: The solo 401(k) trust serves as the foundation for the checkbook control 401(k) plan. To establish a solo 401(k) trust, investors must: Adopt a Written Plan Document: This document outlines the rules and provisions of the 401(k) plan. Obtain an Employer Identification Number (EIN): The EIN is required for tax reporting purposes. Set up a Trust Account: A bank or brokerage account must be opened under the trust's name to hold the plan's assets. After setting up the solo 401(k) trust, the next step is to create a limited liability company that the trust will own and control. This process involves: Choosing a State for LLC Formation: Investors should consider factors such as state fees, ongoing reporting requirements, and asset protection laws. Filing the Articles of Organization: This document is filed with the appropriate state agency to create the LLC. Obtaining an EIN for the LLC: Similar to the solo 401(k) trust, the LLC requires an EIN for tax reporting purposes. Opening a Bank Account for the LLC: A separate bank account should be opened under the LLC's name to manage the plan's investments. Checkbook control 401(k) plans allow investors to access traditional investment options, such as: Stocks Bonds Mutual funds In addition to traditional investments, checkbook control 401(k) plans provide access to a wide range of alternative assets, including: Promissory Notes Precious Metals Tax Liens Real estate is a popular investment choice for checkbook control 401(k) plan holders. Investments can be made in various types of properties, such as residential, commercial, and undeveloped land. The process for investing in real estate through a checkbook control 401(k) plan typically involves: Identifying the Investment Property: Investors should conduct thorough research and due diligence before selecting a property. Negotiating and Signing the Purchase Agreement: The purchase agreement should be made in the name of the LLC, with the solo 401(k) trust as the buyer. Funding the Purchase: The LLC's bank account should be used to fund the purchase, including any related expenses, such as closing costs and property taxes. In addition to real estate, checkbook control 401(k) plans can be used to invest in a variety of other alternative assets, such as: Private Businesses: Investments can be made in the form of private stock or membership interests in LLCs. Promissory Notes: Investors can lend money to individuals or businesses in exchange for a promissory note outlining the repayment terms and interest rate. Precious Metals: Investments can be made in physical gold, silver, platinum, and palladium coins and bars that meet specific purity requirements. Tax Liens: Investors can purchase tax lien certificates at local government auctions, potentially earning interest or acquiring the underlying property if the lien is not redeemed. Checkbook control 401(k) plans must adhere to Internal Revenue Service (IRS) regulations and requirements, including: Plan Document Updates: The plan document should be amended as necessary to comply with any changes in applicable laws or regulations. Annual Reporting: Form 5500-SF or Form 5500-EZ must be filed with the IRS annually if the plan's assets exceed $250,000 at the end of the plan year. Nondiscrimination Testing: Solo 401(k) plans, including checkbook control 401(k) plans, are generally exempt from nondiscrimination testing, as they do not cover any employees other than the owner and their spouse. Investors must avoid engaging in prohibited transactions, which are transactions between the plan and a disqualified person that could result in tax penalties. Disqualified persons include the plan participant, their spouse, children, and other close relatives, as well as entities controlled by these individuals. Examples of prohibited transactions include: Borrowing From the Plan: The plan participant cannot take a loan from the plan's assets. Personal Use of Plan Assets: The plan participant and disqualified persons cannot use plan assets for personal purposes, such as living in a plan-owned property. Self-Dealing: The plan participant and disqualified persons cannot engage in transactions that benefit them personally, such as receiving compensation for managing plan assets. Checkbook control 401(k) plans are subject to the same annual contribution limits as other 401(k) plans. For 2024, the total contribution limit is $23,000, which includes both employee deferrals and employer contributions. Participants aged 50 or older can make additional catch-up contributions of $7,500. Plan participants must begin taking required minimum distributions (RMDs) from their checkbook control 401(k) plans starting at retirement age. The RMD amount is calculated based on the account balance and the participant's life expectancy, as determined by the IRS's Uniform Lifetime Table. Expanded Investment Options: Checkbook control 401(k) plans allow investors to access a wider range of investments, including alternative assets. Increased Control: Investors have direct control over their investments and can make decisions without the involvement of third-party custodians or administrators. Potential Tax Advantages: Earnings from investments in a checkbook control 401(k) plan can grow tax-deferred or tax-free, depending on the account type. Asset Protection: Checkbook control 401(k) plans can offer some protection against creditors and lawsuits. Increased Responsibility: Investors manage their investments and ensure compliance with IRS rules and regulations. Potential for Prohibited Transactions: Engaging in prohibited transactions can result in severe tax penalties and disqualification of the plan. Cost: Setting up and maintaining a checkbook control 401(k) plan can be more expensive than a traditional 401(k) plan due to the additional fees and expenses associated with establishing an LLC and managing investments. When considering whether a checkbook control 401(k) plan is the right choice, investors should weigh the advantages and disadvantages, as well as their individual financial goals and risk tolerance. Factors to consider include: Investment Experience and Knowledge: Investors should have a strong understanding of the investments they plan to make, particularly when it comes to alternative assets. Time Commitment: Managing a checkbook control 401(k) plan can be time-consuming, particularly if investing in alternative assets that require ongoing oversight and management. Risk Tolerance: Alternative investments can carry higher risk levels than traditional investments. Investors should assess their risk tolerance before venturing into alternative assets. Checkbook control 401(k) plans offer a unique opportunity for investors seeking greater control and flexibility over their retirement savings. By providing access to alternative investments and allowing direct management of assets, these plans can help investors diversify their portfolios and potentially achieve higher returns. However, checkbook control 401(k) plans also come with increased responsibilities and risks. Investors must be prepared to devote time and effort to managing their investments and ensuring compliance with IRS rules and regulations. Additionally, they should carefully consider their investment knowledge, experience, and risk tolerance before deciding if a checkbook control 401(k) plan is the right choice for their retirement savings strategy. Checkbook control 401(k) plans can be a valuable tool for financially savvy investors seeking to diversify their retirement savings and take a more active role in managing their investments. By carefully evaluating the benefits and drawbacks, investors can decide whether this type of plan is suitable for their financial goals and circumstances. A retirement planning expert can help them navigate these complexities and guide them toward a successful financial future.What Is a Checkbook Control 401(k) Plan?

A checkbook control 401(k) plan typically consists of two main components: a solo 401(k) trust and a checkbook-controlled limited liability company (LLC).

This type of plan allows participants to invest directly in alternative assets, such as real estate and private business ventures, in addition to traditional assets like stocks and bonds. Establishing a Checkbook Control 401(k) Plan

Eligibility Criteria for Checkbook Control 401(k) Plans

Choosing a Plan Provider for Your Checkbook Control 401(k)

Setting up the Checkbook Control 401(k) Plan Structure

Creating a Solo 401(k) Trust

Establishing a Checkbook-Controlled LLC

Investment Options in Checkbook Control 401(k) Plans

Traditional Investment Options in Checkbook Control 401(k)

Alternative Investment Options in Checkbook Control 401(k)

Investing in Real Estate With Checkbook Control 401(k) Plans

Other Alternative Assets in Checkbook Control 401(k) Plans

Rules and Regulations Governing Checkbook Control 401(k) Plans

IRS Compliance for Checkbook Control 401(k) Plans

Prohibited Transactions in Checkbook Control 401(k) Plans

Contribution Limits for Checkbook Control 401(k) Plans

Required Minimum Distributions (RMDs) for Checkbook Control 401(k)

Advantages and Disadvantages of Checkbook Control 401(k) Plans

Pros of Checkbook Control 401(k) Plans

Cons of Checkbook Control 401(k) Plans

Is a Checkbook Control 401(k) Plan Right for You?

Key Takeaways

Checkbook Control 401(k) Plans FAQs

Checkbook Control 401(k) Plans are self-directed retirement plans that allow account holders to invest in a wide range of assets, including traditional and alternative investments.

To establish a Checkbook Control 401(k) Plan, you must meet eligibility criteria, choose a plan provider, and set up a plan structure including a Solo 401(k) Trust and a Checkbook-Controlled LLC.

Checkbook Control 401(k) Plans offer a variety of investment options, including traditional assets such as stocks and bonds, as well as alternative assets like real estate, precious metals, and private equity.

The main advantages of a Checkbook Control 401(k) Plan are increased investment flexibility and control, the ability to invest in alternative assets, and potentially lower fees than traditional retirement plans.

Yes, there are rules and regulations that govern Checkbook Control 401(k) Plans, including IRS compliance requirements, prohibited transactions, and contribution limits. Working with a retirement planner expert is important to ensure you comply with these rules.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.