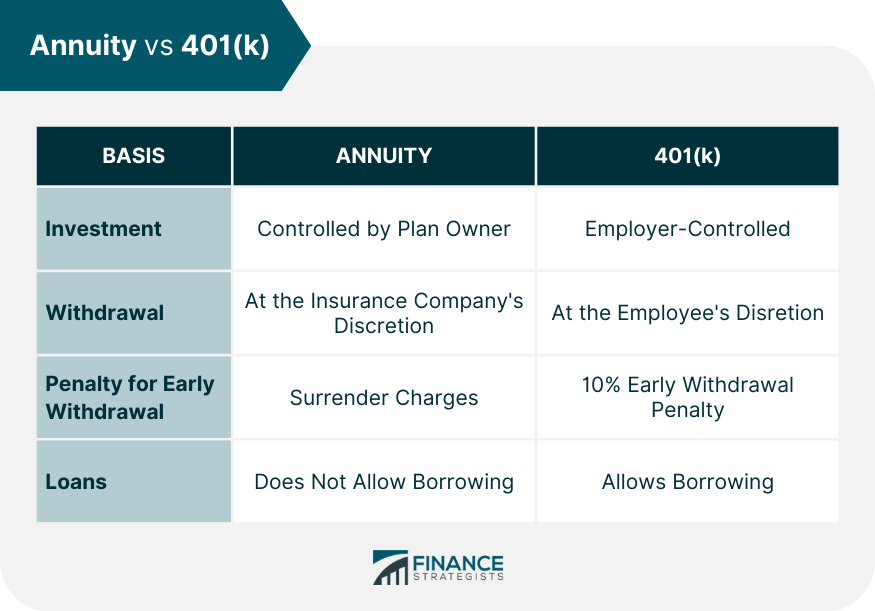

An annuity is a financial instrument that is used to generate income for an individual who has already retired. When investing in an annuity, the investor contributes money into an account that will be used to purchase retirement income products or annuities. To fund an annuity, the investor has two options: The more money that is contributed, the higher the monthly income will be for the individual in their retirement years. uity via installments, they must make sure to continue making payments until they reach retirement age and withdraw from the account. If this does not happen, then there will be no monthly income provided by the investment. Deciding between 401(k) Plans and Annuities? Click here. A 401(k) plan can be defined as an employer-sponsored program in which employees are offered the opportunity to contribute a percentage of their earnings before taxes. This money is then invested in different investment vehicles. Once the funds have been placed into this account, they will be able to grow tax-deferred over time until retirement when withdrawals are granted to the investor who set up the plan. In order to set up a 401(k) plan, an employee must contribute a certain percentage of their income before taxes into the account. The amount that can be contributed is dependent on how much money has been earned by the individual in a given year. An additional distinction is that with an annuity, the individual has to make investments with his/her own money while a 401(k) is set up by an employer. In terms of withdrawal, an annuity is often at the discretion of the insurance company while with a 401(k) plan, it is not. A 401(k) will make the employee pay for a 10% early withdrawal penalty if funds are withdrawn prior to reaching the age of 59.5 years. While for annuities, early withdrawal fees are being set by the insurance company. Both annuities and 401(k) plans are usually tied to an individual's tax bracket; however, the amount that can be sheltered in an annuity account for retirement purposes is capped. Furthermore, 401(k)s allow borrowing of funds while annuities don't. When it comes down to which product is better for retirement, there are many factors that could possibly be considered (and will depend on the situation of each person). For example, if an employee feels like they would like more freedom over their investment choices, then investing in something like a 401(k) might be preferred. However, since annuities do not require employees to contribute as many before-tax earnings into retirement accounts as does a 401(k) plan, individuals can have larger amounts available for use later in life. In the end, though, the best option will always depend on what works best for an individual's particular situation. If you are a business executive or a business owner, you may want to consider looking into annuity options as a way of securing your financial future and providing for your family both now and in the future. Regardless of what type of annuity is chosen, always remember to look at all the available options before making a final decision since different products will work for different people. Annuities can be used as part of an overall retirement strategy but never as the only option. Having other types of investments to distribute the money among can also help ensure that there will be enough funds available later on if circumstances change unexpectedly. Annuities and 401(k)s are both good ways of securing a retirement plan. Depending on your situation, you can choose from several different types of annuities–fixed annuities, variable annuities, index annuities–to get the most out of your investment. In addition to not having to pay taxes on the earnings from an annuity, you could receive a steady stream of payments for as long as you live. If you are interested in finding the right annuity and reviewing your options, you should talk to a financial advisor who can help you determine what is best for your specific financial situation. Differences Between Annuity and 401(k)

The major difference between annuities and 401(k) plans is that with an annuity, the individual invests his/her own money while a 401(k) comes from an employment source. Which Is Better for Retirement?

Final Thoughts

Annuity vs 401(k) FAQs

There are several benefits to getting an annuity, including a steady stream of income during retirement, access to a variety of different types of annuities, and the fact that they can be purchased with after-tax dollars.

In order to get started with an annuity, you will need to speak with a financial advisor who can help you determine which type of annuity is right for your specific needs.

The primary difference is that with a fixed annuity, the individual knows exactly what they are going to get in terms of income. Variable annuities are more likely to see retirement funds increase or decrease depending on investment gains or losses.

Whether you choose annuity or 401(k), really depends on your situation. For example, (k) might be better for people who want to have more control over their investment choices and prefer a diversified portfolio. On the other hand, an annuity could end up being a better option if someone is looking for guaranteed retirement income that does not fluctuate.

You can get an annuity from an insurance company. They may be willing to negotiate the interest rate or annuity payout. So, speak to an agent or insurance company representative about various annuities and request information on their retirement plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.