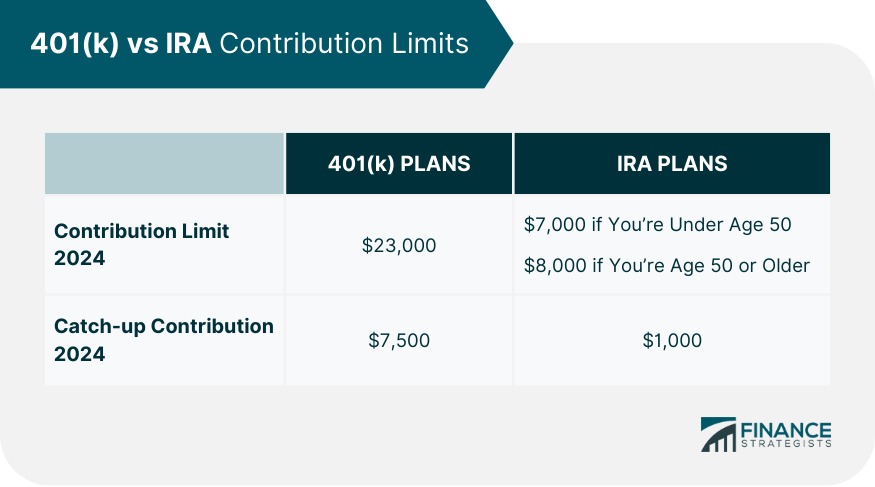

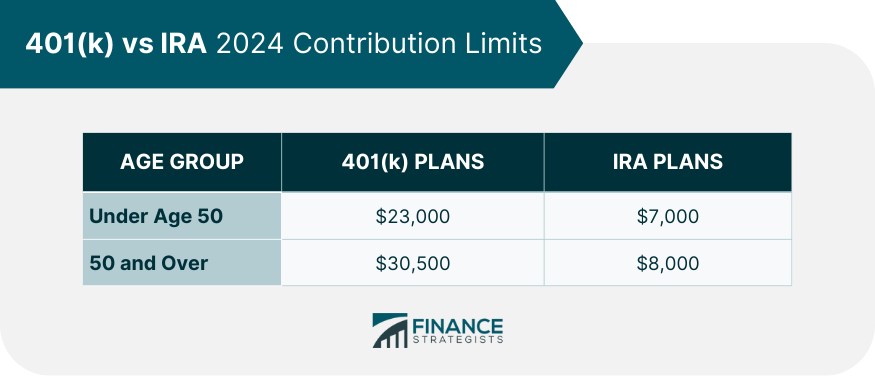

A 401(k) plan is a retirement savings account sponsored by an employer. Employees can choose to have a portion of their paycheck withheld and deposited into the account. The money in the account can be invested in various ways, including stocks, bonds, and mutual funds. It is a tax-deferral retirement savings account, which means that the money you contribute to the account is not subject to taxes until it is withdrawn. This can provide a significant tax advantage, especially if the 401(k) plan is funded with pre-tax dollars. It is named after the section of the Internal Revenue Code that governs it. 401(k) plans are also sometimes called "defined contribution" plans because the employer typically defines the amount of money that an employee can contribute. 401(k) plans are classified into two types based on how much control the investor has over how the funds are invested. The use of 401(k) retirement savings programs has grown dramatically since they were first established in the 1970s. Before major regulations were introduced in 2006, participation was around 60 percent, according to estimates. As of the late 2000s, nearly 90% of earners utilize these accounts to save for retirement, with almost 50 million workers and their employers making contributions totaling 3 trillion dollars. Several years later, its retirement assets increased even further, reaching $7.3 trillion in March 2022. A 401(k) account is appealing to both parties because it enables your employer to contribute to your retirement without having to take on pension liability. An employer will frequently match your contributions up to a certain percentage of your earnings or a maximum annual contribution based on your income. While they are more appealing to high-income earners, they also benefit the majority of workers. You will be investing a portion of your income into some sort of financial vehicle – most often a combination of them – as a contributor to one or more 401(k) accounts throughout your working life. This has resulted in a far greater proportion of Americans participating in the stock market than has previously been the case. Company plans sometimes let you benefit from a "group rate" that can reduce costs and give you access to exclusive funds. Even so, the majority of these services are not freely accessible to workers/investors. It is argued that for 401(k) accounts to remain affordable for wage earners in an era of falling wages, two conditions must be met: Both scenarios are unlikely, and the number of middle-class investors in the stock and mutual fund markets will likely depend on how severe the crisis is. Businesses will continue to provide 401(k) plans for those who are fortunate enough to keep their jobs (with and without matching funds). Even if they do not contribute, the majority of employees who earn more than the minimum wage expect their employers to at the very least pay to have the account set up on their behalf. The contribution may vary from year to year depending on the set limit by the Internal Revenue Service. In 2024, 401(k) contribution limits for individuals are $23,000. Additionally, individuals aged 50 or older are allowed to contribute an additional $7,500 each year as a catch-up contribution. This can result in sizable savings that can provide the majority of income over the course of retirement, which could last up to 30 or 40 years. Given that most people (according to researchers, represented by the lower 80% of earners) keep the majority of their equity in their house and liquid assets such as savings accounts, losses in these assets affect them (nearly) disproportionately. In 2008, the 401(k) account lost an average of 20-40% in value based on how actively the fund is invested in the stock market. In the first quarter of 2023, a drop of 4.5% was also reported. This has raised concerns on the security and flexibility of their retirement money, including 401(k) accounts, as a result of this drop in value. The definition of 401(k) plan has evolved over the last 50 years. What was once considered to be a novel idea for storing money into an uncertain future has grown into a well-established financial instrument, such as life insurance. The distinction between these two is how long you have to wait before withdrawing the funds saved - most individuals opt to take advantage of the money while they are still living. People have grown accustomed to assuming a relatively high rate of return and a higher retirement income due to the stock market's reasonable performance over a number of decades. When determining who should bear the brunt of the financial crisis that began in 2007 or whenever, there will presumably be a lot of second-guessing. People have long been aware of the high costs and management issues that came to light in the latter half of the 2000s, which were always a part of retirement savings banking alternatives, such as those that were most aggressively promoted and aided by ever more loose definitions of permitted financial plans. Unfortunately, this includes many people's 401(k) accounts. This article is intended to help allay people's concerns and offer them useful background knowledge as they attempt to figure out the best strategy to keep what investment money they have left. In recent years, this type of account has become far more common. Such funds give each investor some control over the type of stocks or funds in which their investment is invested. They are typically offered to professionals, but they are making inroads among lower-wage workers as well. These "self-directed" plans have slightly higher annual fees. Transaction fees apply to trades made on individual stocks. If you want to be actively involved in managing your finances, educate yourself on the subject matter. But do not try to overdo it since not everyone is cut out for this type of thing. You should be honest with yourself about whether or not you can handle complex financial gibberish. Over time, many financial professionals have noted the importance of focusing on long-term investments. Even during the worst of the Great Depression in the 1930s, investments in companies that survived were rewarded years after the crisis had ended. For instance, stock investments ought to exhibit long-term stability. If you manage your own 401(k) plan, sending in the quarterly paperwork may also be your responsibility. This task is commonly less appealing to investors and is often overlooked. However, if you take on this role yourself, you will likely be granted more options for management than those who have trustee-directed plans. The IRS designates a trustee as someone who is allowed to manage assets on somebody else's behalf. This does not just apply to the elderly – it is also how third-party companies handle 401(k)s. In addition to taking care of all the necessary paperwork and reporting, these organizations are responsible for making smart decisions about where to invest those funds, whether in banks or the stock market. All aspects of administering your 401(k) are overseen by a full trustee, who takes control of the process. Banks have performed this in the past, but it is increasingly done by private firms that specialize in delivering financial services. In reality, many of these accounts are handled by 401(k) suppliers that provide regular reporting on individual plans via online platforms. While other types of programs give you more control, they are also responsible for some of the financial problems that many savings plans have encountered since the economy fluctuated. As of the end of 2008, the performance of professional-managed plans was actually largely determined by the managers' willingness to invest in loans and loan packages related to real estate, assuming they even knew that is what they were doing. Often, your company manages the 401(k) program in-house. Plans like this tend to incorporate company stock options that give employees very little control over how their matching funds are invested or managed. If you are no longer employed by the company, you may still be required to keep your money in a losing stock if they continue managing it--even if the money could be turned into an IRA or similar type of investment vehicle. A Individual Retirement Account (IRA) is a kind of investment plan that allows you to take advantage of specific tax rules established by the US government when saving for retirement. The most significant difference between a 401(k) plan and an IRA is the amount of money that may be invested in the plan each year. It is important to note that IRA accounts are not usually funded by an employer. In the past few years, though, both the SIMPLE and SEP types of IRAs have become available to employees as a workplace-sponsored plan. The amount that an employee or employer can contribute to a 401(k) plan is changed every so often to accommodate for inflation, which is defined as the rate of rising prices in an economy. In the year 2024, the maximum annual limit on employee contributions for those under age 50 is $23,000 . However, individuals aged 50 and over are allowed to make a yearly catch-up contribution of $7,500 in addition to their normal contribution. On the other hand, your overall IRA contribution cap for 2024 is $7,000. You may, however, contribute up to $8,000 if you are 50 years of age or older. This represents your overall IRA contribution cap, which is valid for both traditional and Roth IRAs. Therefore, the maximum contribution you can make to all of your IRAs, including traditional and Roth accounts, is $7,000 or $8,000 overall. If you have multiple 401(k) tax-deferred investment plans active at the same time, do not worry--you only have one contribution limit. However, if you contribute to more than one account in a year, make sure that the total amount does not exceed your limit. Otherwise, the IRS will consider it taxable income and you will have to pay taxes on it when you file your annual return form. The amount of money that your employer can invest in addition to the money you put in from your own earnings is the most intriguing aspect of 401(k) plans for many people. As previously said, your employer is responsible for establishing the program. They also decide how much of your contribution they will match and what type of plan it will be. This does not mean that your employer is required to match your investment, only that they are allowed to do so up to a predetermined amount. Your employer matches half of whatever you contribute but no more than 3% of your total salary. To get the maximum amount of match, you have to put in 6%. So, for instance, if you make a large salary, the allowed percentage will be lower. Also, different plans may have lower employer contribution limits. Employer contributions might be made in the form of shares of corporate stock purchased for the 401(k) investment plan on rare occasions. This is like any other sort of stock purchase by a 401(k) fund manager, except that it may represent a lack of plan diversification. This type of agreement is generally thought to be more advantageous to younger employees who can make up market adjustments and losses than it is to older workers because they are able to benefit from market gains and earnings. For most people with a 401(k) plan, their monthly salary deductions amount to a significant sum in just a few years. However, when employees have the choice to save during a recession, many refuse it. Policies and rules can impact savings rates by making participation more or less attractive for various economic groups. The Employee Retirement Income Security Act (ERISA, section 404(c) in the IRS code) is the legislation that specifies how an employer must handle funds deducted from your pay. Under the rules, your employer must deposit your payroll deductions into an appropriate account within 15 days after you get paid. Your employer is not permitted to keep the money and invest it from a business account. Monies collected from several workers' contributions may be combined and sent to a single fund or program. For quite a while now, savings rates in the United States have been low due to consumer spending. In 2007, for example, accounts were only increasing by 20% annually despite Baby Boomers being nearly retirement age. On average, these individuals were contributing less than 8% of their gross income into a 401(k) plan. Gen X-ers did not fair much better; they are saving at just above 6%. Lastly, juniors' savings rates hovered around 5%. That is up from 2005, when the average savings rate of all employees was near to (or perhaps less than) zero. While regulations that apply and encourage low-income people to save for retirement in 401(k)s and other tax-deferred programs have been in place for several years before the economic crisis hit, these market issues and savings problems have little effect on many who earn hourly salaries or are self-employed. For anyone aiming to retire at 50, the market crash in 2008 set many people back. In order to make up for lost time, savers will have to increase their savings rate (the percentage of each check they put away). This is based on the stock markets bouncing back over time, but even young workers in their 20s will need to save more money to account for future inflation and taxes. The tax code changed in 1978, unintentionally prompting the creation of the 401(k) savings plan that has largely supplanted company-funded pensions. Intended to clarify the legal status of some extremely wealthy investors' existing saving plans, this minor rule adjustment sparked a decade-long financial industry and market boom in the 1990s. Since the 1980s, when the 401(k) plan was established in a single financial institution, these plans have evolved into a government-sponsored private investment intended to help employees save for retirement in order to augment their Social Security income. In the first six years of the program, several hundred thousand businesses provided plans as an incentive to their staff. These savings accounts were offered as an option benefit to individuals of all sorts of professions throughout the 1990s. In 1988, following a series of legislative actions designed to boost participation rates in 401(k) plans among US workers, the Congress passed a legislation that made employee contributions the default option for all firms offering such programs. Employees wanting to opt out of making 401(k) contributions have been required to fill out a form stating their wish to do so. The Federal Government has had a lot of impending and developing reasons to boost personal savings rates. One of the most significant economic challenges for the next decade is anticipated to be caused by retiring Baby Boomers. It is expected that discouraging dependance on federal cash as a sole source of income for older people will prepare US wage-earners for losing benefits. Social Security benefits, in combination with Medicare and Medicaid, are generally not considered adequate alone for sustaining one above the poverty level in retirement. While many persons over the age of 65 continue to work, however many of them are employed part-time on lower-paying jobs. The only way to protect yourself from old age is to save money while you are still working. Everyone should be aware of retirement savings in order to avoid inflation and market forces from robbing you of your carefully accumulated funds that should be paid with reasonable and consistent compounded returns. Although they did not come up with the concept themselves, the IRS and Congress understand the importance of keeping money moving into markets, as well as limiting their responsibility in the long run, if Social Security becomes even less reliable. Tax deferrals are not always in a saver's best interests, but deferred cash that is also part of a high-yielding investment may outpace new taxes in the future and inflation. Getting matching contributions from your employer is always an effective motivation, which is why most individuals join 401(k) plans. The 401(k) is a flexible savings instrument that serves as a simple method to encourage new participants. For this group of individual savers, their collective contributions become IRS tax revenue when they withdraw. In essence, the IRS enables a vast network of employees and firms to invest tax dollars indirectly in the stock market for higher returns throughout the decade and beyond when the Baby Boom generation retires. The Social Security Retirement Act, established during Franklin D. Roosevelt's presidency, was designed to help individuals who did not have any savings in their later years and faced the threat of starvation. Although participation in the program is required by law, it was never intended to be used as a retirement plan – despite how it was marketed to the public under conservative opposition calling it “socialism”. The social security beneficiary age was set at 65 because, in 1936, it was the average age of death according to actuary tables. People who beat the odds and lived past 65 could retire. When passed, as a part of the larger New Deal stimulus package of regulations, this excluded a laundry-list of low-wage jobs from receiving benefits . Since then, life expectancy has increased by almost 20 years, and the proportion of contributors as compared to beneficiaries has decreased dramatically. For many decades, social security benefits have been threatened with extinction for future generations. Medicare and Medicaid were enacted in the mid-1960s as an amendment to Social Security by President Lyndon B. Johnson. Its roots may be traced back to a rise in old age poverty. Then, as now, prospective savings for an impending old age of infirmity were put at risk by banking and market instabilities. Given the cost of the program today, consider that by 2030, nearly twice as many people will be taking advantage of it. Some support for greater health care support is demonstrated by efforts to commercialize the medical benefits system in the early 2000. It is expected that changes in the way health care is paid and provided are likely over the next several years. Inflation affects all types of savings, regardless of the form they take. Any form of savings stored in a short-term account may be renegotiated at a dramatically higher rate. However, when inflation rises to extremely high levels, static investments lose a lot of value. In other words, maintaining appropriate levels and kinds of assets to ensure a comfortable retirement is quite difficult for anybody, which is why professional assistance might be so valuable. Retirees who live solely on their investments should carefully consider their alternatives when assessing inflationary risks linked with long-term investments. For employees approaching retirement age, many investment experts advocate limiting stock exposure while increasing short-term holdings. As of the mid-2000s, only about half of workers over 65 retired, despite the fact that part-time work is becoming more common. This is typically done to supplement Social Security and retirement savings income. Though many retirees own their own homes, the cost of living and utilities has a significant impact on lifestyle when funds are limited. There were a few modifications to the tax code during the recession of the early 1980s. The changes have become a significant component of retirement savings for millions of Americans. The first 401(k) program was named for the loophole in the tax code that it utilized. Ted Benna, a benefits consultant, is usually credited for creating it. Given the goal of creating a tax-advantaged savings plan for bank employees, he found a method to make it appealing to low-wage workers by incorporating an employer contribution. Since then, with congressional approval and IRS encouragement, other types of tax-deferred plans have been developed that are accessible to low and mid-level wage earners. Surprisingly, the bank for which this plan was created decided not to implement it because it had never been done before. Because of this, Benna's financial planning firm established its employees' first 401(k) plan, with a perfectly good plan that appealed to employees and encouraged investment. In addition to the 401(k), there are several different types of retirement plans that can assist workers save for retirement. While many of them are losing money, certain ones have performed better during the economic downturn than others. They all have their own approach to tax accounting and make use of some aspect of the financial markets. There are rules in place restricting who can provide these services and what investment parameters they must adhere to. IRA Plans IRA savings plans date back to the 1970s and have somewhat different rules than 401(k)s. These are subject to contribution limits and have lower maximum contributions. In 2024, earners under 50 may contribute up to $7,000. Those earners aged 50 and older can add a maximum of $1,000 per year as a “catch-up” contribution, bringing the maximum IRA contribution to $8,000. All IRAs must adhere to contribution limits; any surplus above these limits is taxed unless invested elsewhere. You may invest in stocks, bonds, and mutual funds. Since the late 1990s, other types of more volatile funds have been added to the list of available investment options, depending on how crafty your financial advisor is. While some plans are self-managed, others are under the control of a professional service. There are four primary sorts of IRA plans as of early 2009: The traditional IRA was established in the mid 1970s, when several banking regulations were altered because of recession to stimulate investment during the mid-1970s and early 1980s. Individuals can contribute pre-tax dollars in traditional IRAs. This can grow tax-deferred until retirement withdrawals occur at age 59 1/2 or later. The SECURE Act, which was passed at the end of 2019, removed age restrictions on traditional IRA contributions. Traditional IRA contributions are allowed regardless of age as long as the account holder has earned income. A Roth IRA is a type of individual retirement account that allows for tax-free growth and withdrawals in retirement. According to Roth IRA rules, you can withdraw your money whenever you want as long as you have owned your account for 5 year and are 59 1/2 or older. A SIMPLE IRA plan allows employees and employers to contribute to traditional IRAs established for employees. It is ideal as a start-up retirement savings plan for small businesses that do not currently sponsor a retirement plan. This plan is available to self-employed individuals, small-business owners, and any business with 100 or fewer employees. SEP IRA can be established by an employer or a self-employed person. The employer can deduct contributions made to a SEP IRA and makes discretionary contributions to each eligible employee's plan. Small businesses prefer SEP IRAs because of the eligibility requirements for contributors, which include a minimum age of 21, three years of employment, and a $650 minimum compensation. Furthermore, a SEP IRA allows employers to forego contributions during years when business is slow. Roth 401(k) Plans In 2006, the Roth 401(k) account was introduced in the retirement financial market. It was created by a provision of the Economic Growth and Tax Relief Reconciliation Act of 2001 and is modeled after the Roth IRA. It is an employer-sponsored investment savings account that allows employees to save for retirement with after-tax dollars. Withdrawals in this plan are tax-free and penalty-free, with the usual plethora of restrictions. The annual contribution limit for Roth 401(k) is identical with 401(k) plans at $23,000 in 2024. Additionally, for those 50 and older an additional catch-up plan of $7,500 is allowed. 403(b) and 457 Plans Certain employers offer tax-deferred retirement savings programs known as 403(b) and 457(b) plans. Employers that offer 403(b) plans include public educational institutions (public schools, colleges, and universities), certain non-profits, and churches or church-related organizations. Meanwhile, employers that offer 457(b) plans include state and local governments, as well as certain non-profit organizations. Both plans, like 401(k) plans, allow you to contribute pre-tax money from your paycheck to your 403(b) or 457(b) plan in order to invest in specific investment products. These pre-tax contributions and investment earnings are not taxed until you withdraw the funds, which is usually after you retire. Unfortunately, as with any other investment plan like 401(K) that invests in a broad range of speculative markets, both are subject to market fluctuations, depending on how they are invested. As their performance is influenced by many of the same financial considerations and conditions, the same forces that affect any of the similar funds and "monetary devices" can largely be considered together. So if you want to analyze or change any of these tax-deferred or tax-sheltered investment plans, you should seek the advice of a financial professional. Despite the fact that 401(k) plans have become the de facto standard of retirement savings in the United States, there are still issues with 401(k) plans that investors at all income and participation levels should be aware of. Many employees are carefully considering and deciding what to do with their retirement investments following a substantial decline in many plans' value for the first time in many years. Given that the expected rate of saving is anticipated to drop during a lengthy recession, performance of 401(k) accounts and fund managers' capacity to be suitably defensive or reactive may be hampered by changing circumstances. Knowledge is a powerful weapon. It can be challenging to move your 401(k) plan to a new employer. Along with the complicated tax paperwork that needs to be organized and filed you will also have to coordinate actions with your former employers. When changing jobs, it is always advisable to consider the financial situation and your options to see if your money would be better off staying where it is. Naturally, doing all of this requires time and effort from a lot of people who are not used to investing either in speculative financial matters. That is the main reason why so many people have their investments managed by professionals. If your 401(k) earnings are not transferred on a regular basis, you may wind up with many different plans to various types of management. Depending on how the account was set up, your former employer(s) may be the only authorized management option available to you. Given that most people change jobs every few years, it affects a lot (if not most) investors. You may want to consolidate your plan (or plans) into a single IRA or withdraw the funds entirely. However, investors should be aware that there are penalties for early withdrawals from 401(k) plans. Early withdrawal penalties can be prohibitively high, since it is taxed as ordinary income typically at 20% plus an additional 10% IRS penalty. This option makes it infeasible for younger workers and those with a small amount in their retirement accounts. Many people did not realize until recently that even the best-managed 401(k) programs have significant administrative expenses and charges. Though these costs were previously masked to some extent when most 401(k) accounts were performing well, capital from these accounts has always been continuously leeched off by management companies. In fact, management firms that specialize in 401(k) and similar plans frequently take a sizable cut. Even self-directed accounts are subject to a variety of fees, especially if you do a lot of trading. Some fees are required to cover the costs of filing with the IRS and maintaining contact with investors. They are calculated based on your specific plan or your level of participation in a larger company account. Others are less conscientious. Ideally, you should search for an account that has no "loads" or sales commissions, management fees of less than 1%, a turnover rate of less than half their investments each year, and "12b-1" extremely low or non-existent marketing costs. These are the sorts of expenses that take up a lot of space in many accounts, especially sales commission expenses. 401(k) management fees have risen steadily since the early 2000s, as have several of the unpleasant problems with account transparency. Despite the fact that reporting is only required once a year, fees are sometimes not effectively communicated to investors or employer-customers. The majority of the costs are usually summed up together. While some larger companies and corporations make an effort to provide a more detailed statement for their employees, this can be difficult due to the ambiguity of the investor-statement reporting laws. The IRS' reporting practices are straightforward. Consider that these fees are deducted from your initial investment rather than your earnings. This minor distinction makes a disproportionately large difference in your long-term savings. The Department of Labor lobbied to pass legislation requiring individual fees to be clearly delineated in a separate 401(k) spreadsheet-like printout of the different fees that go into the typical monthly administrative cost, but it was declined. Since 2009, management companies have been required to list all of their fees on an annual statement. Many companies maintain a small portfolio of plan options for employees so some companies may not always be completely forthcoming about all of your 401(k) options. In smaller organizations that offer these options as compiled by in-house fund managers, this can become tedious and difficult to manage. When your 401(k) investments are in a situation where they are consistently losing money, keeping an eye on the money that is being taken directly off the top of your contributions can make a significant difference. It might mean the difference between retiring comfortably while you can still enjoy it or working well into your 70s. Since the middle of 2008, stock market indexes have dropped by between 40 and 55 percent in value. In fact, everything has seen a decline in economic activity not seen for more than seven decades. Investors looking for a sign of good news or something secure have remained disappointed throughout the first part of 2009, with no end in sight. There were numerous market issues, but the fact is that the majority of 401(k) plans are invested in financial instruments that are presently performing poorly. This is especially true to investors who aggressively invested in high-return/high-risk markets. Fundamental products are doing well, but they are not a diversified strategy. Nothing has changed since the financial crisis with 401(k) plans that was not true prior to the 2008 mortgage and banking collapse. The market fundamentalist attitude toward regulation, which emerged in order to protect only what might be confidently offered on the market, is now understood. The subsequent losses to 50 million retirement accounts are yet another painful reminder that there is no such thing as a free lunch. In the midst of 2007, the value of real estates began to fall. This was particularly true in once-hot markets like Southern California, Florida, and Nevada. But, it soon became evident in markets all throughout the United States then globally. While this could have been an unfortunate occurrence with no significant consequences, it resulted in the many individuals who were “accidentally” invested in real estate values that were primarily driven by market euphoria. These were undermined almost overnight when the magnitude of unsecured bad loans became apparent, wiping out a large portion of the value of the average person's largest investment asset. Even before the most dramatic stock market losses in October and November of 2008, the Wall Street Journal estimated that 401(k) plans had lost up to $2 trillion dollars. In early 2009, some of this value had been recovered, but the markets and all corresponding physical industries had been dealt a massive blow, which began when market forces caused a critical mass of mortgages to default. Because of the interconnectedness, everything just snowballed. The freezing of funds led to an uptick in rates for inter-bank lending, which impacted the economy by making it difficult for banks to lend. This then showed most obviously in the Baltic Dry Index and the TED-Spread. This meant that tangible things that usually keep the economy stable were not happening as often because people's money was not accessible. When individuals are unable to acquire money, they cease spending. The availability of capital has significantly decreased for all types of companies, from tiny shops to major corporations. Investments have been halted as a result of a lack of operating cash or the perception that they are “ safer” alternatives such as treasury bills and precious metals. These investments hold on to money more frequently for months or years at a time as opposed to the days and weeks of the capital market, making them less liquid than the large amounts of cash that move back and forth between banks, companies, and consumers. Spending decreases as it becomes more difficult for everyone to conduct business and employees are laid off, furthering the downward trend of the typical indicators. In the current financial and economic climate, stock prices and almost all of the investments made with 401(k) funds continue to depreciate, which prompts people who are aware of their retirement prospects to spend even less. Many 401(k) accounts were also invested in funds that were one step removed from some minor flaky real estate activities, which did little to help matters. Even well-known institutions, such as Bear Sterns, were allowed to fail after it was discovered that they had less actual liquidity on hand to meet investor demands. Other banks have been patched up, at least temporarily, with cash infusions worth hundreds of billions of dollars. Reduced wages have a domino effect on the amount of capital that businesses can access, which is related to the inability of businesses and individual lenders to obtain credit. Some economists refer to the current state of the economy as "stagflation," which occurs when there is persistent inflation and a significant increase in the size of the money supply. As a result, the number of investment options for the sizable sums of money that still need to be invested is reduced for the shock-weary investor or management company. The number of people investing will always be very high, even at very high unemployment rates, producing trillions of dollars in "working" money that keeps the economy humming. Less discretionary income, fewer significant purchases, and fewer taxes or investments as a percentage of gross income are all effects of lower wages. Sometimes overwhelmed municipalities and states will exacerbate the issue by sharply raising the costs associated with conducting business within their borders through higher business taxes and permit fees that unfairly target small, slick companies that are otherwise well-positioned to weather any recession. Whenever there is stagflation, interactions between the government at all levels can exacerbate the issue. Together, these factors produce extremely challenging conditions that an economy can be driven out of in a reasonable amount of time. Savings plans, such as the 401(k), are vulnerable to having their principal contributions eaten away during a long-term decline. However, assuming that these conditions can not last forever (and that they always give way to something else), stocks in companies that can stay in business throughout the crisis will eventually regain their value. The same can be said for almost any other type of fund, including banks. The strong will triumph. In the event of a protracted crisis, there is a very real and unsettling risk to 401(k) plans. Due to the fact that 401(k) programs are dependent on employment of some kind, a decline in employment affects the number of participants. The overall rate of savings declines, which may negatively affect the services provided by 401(k) baking products. This stifles a strong engine that drives investment capital into the markets. Additionally, persistent effects of unemployment on the economy as a whole generally slow down economic growth. With the exception of the riskier speculative markets, this typically has the effect of lowering investment yields in almost every sector. There are not many industries that thrive when unemployment is high, in fact. In the event of a job loss, withdrawals from 401(k) plans may affect unemployment insurance benefits. Depending on the state you reside in, it is not uncommon for your withdrawn investment "income" to lengthen the period of time you must wait before becoming eligible for benefits. There are many reasons to leave your retirement savings alone in a tough employment environment. These include the loss of capital investment, penalties for early withdrawal, and more. Other plans, even those with lower contribution caps, are more desirable because they permit the penalty-free withdrawal of a portion of earnings. Those who have both a Roth IRA and a traditional 401(k) set up can benefit from short-term cash withdrawals and long-term market rebuilding in the direction of a retirement that, hopefully, has not been pushed too far off your original timetable. There will undoubtedly be whole books written about the circumstances that contributed to the greatest loss of personal wealth that the majority of Americans have experienced in their lifetimes. In an effort to achieve the high growth rates seen throughout much of the 1990s and 2000s, a hugely interconnected string of ventures, including 401(k) accounts, were pushed a little too far. You do not have to just sit back and let your money take this kind of beating. Find safe options to help you keep as much of your hard-earned savings as you can by moving your retirement savings around a bit. Asking is frequently all you need to do when it comes to the specifics of self-directed fund management, but it helps to be aware of the appropriate questions to pose as well as the appropriate people to ask them of. When investors received their annual statements at the end of 2008, they were all shocked to learn how much money had been lost in their 401(k) plans over the previous year. In some instances, it was sufficient to cancel out all of their employer contributions made during the course of the plan. While thousands of medium-sized businesses and a good number of large ones completely went out of business as a result of the credit pressures at the heart of the most recent bear market, other people lost their jobs and their investments in company stock at the same time. 401(k) managers can benefit from certain funds that are focused on providing respectable returns in challenging markets. These funds can ensure even returns in the kind of erratic and decidedly bearish markets that have prevailed for a while. In other words, changes in the financial landscape have been brought about by the immediate effects of a bear market on retirement savings plans of all kinds. Undoubtedly, such behavior fueled market volatility throughout 2008 and into 2009. The question of whether to withdraw funds and accept an early withdrawal penalty, in one form or another, is perhaps the most frequent one that most people who have lost money in their retirement accounts have. When things are tough and there is a mail reminder that you have several thousands of dollars that may get you through the next few months, it is difficult not to give in. Even if your investments in a 401(k) plan are just taking a beating, you might consider withdrawing from it entirely rather than renegotiating its type. Financial experts typically advise keeping retirement funds in a savings or investment account because taking them out to pay a mortgage, student loans, or other expenses is not the best use of investment capital funds. From a long-term perspective, it can occasionally be best to let your credit score slightly decline. To some extent, these funds can be compared to the potential income they could have by the time you retire. After accounting for wage and price inflation, money that is put in by you or your employer and stays there the longest is actually worth more. Employers may require you to contribute to the plan for a set number of years in some cases. Before you can receive the company contribution or stock in addition to your regular wage, it must be "vested," which can take anywhere from 2 to 6 years on average. If you try to leave the program before that time, you will forfeit those extra contributions. This is frequently worth far more than the penalties and taxes associated with such a withdrawal. As a result, the terms of withdrawing your 401(k) are also influenced by what you intend to do with the money once it has been removed from its original fund. Contribution deductions are important for people who may end up owing taxes, but large losses across an individual or organization's portfolio may render deduction opportunities moot for some. If you deplete your 401(k) account before age 59 1/2, you will pay a 10% penalty to the IRS in addition to income taxes on the withdrawals. Although there are certain exceptions (e.g., intense financial hardship or disability), these usually come with their own baggage of headaches and paperwork. So unless absolutely necessary, it is best not to cash out that retirement nest egg early. There are strategies to withdraw little portions of money from a fund over time, but they need the aid of a professional to set you up with "substantially equal payments." You may withdraw funds from your 401(k) in the same manner as an annuity, but without incurring the penalty. If you do not mind taking the penalty on a percentage of the money, you could take out a loan from your employer on your 401(k) balance. You are allowed to withdraw up to half of your savings, which would be $50,000 maximum. During the mid-2000s when things were going relatively well, nearly 20% of earners took loans. However, if you can not pay back this loan and lose your job before it is paid off, you will be in big trouble. If possible given their circumstances, anyone who believes their job security is questionable should only borrow as little as possible from this source. Consider a 401(k) loan to be the last and least desirable option. Typically, businesses will restrict access to this sort of lending to specific categories of need as defined by the IRS. Funerals, storm damage repair, avoiding foreclosure or eviction, educational expenses, and medical bills are just a couple of the difficulties for which money may be readily accessible through your tax-deferred plan in the form of a loan. Aside from penalties, you also must pay taxes on the money before the 10% is deducted. This can be substantial, but it may not be paid for up to a year. If this places you in a higher tax bracket, it may be in your best interest to consider investing in other tax-sheltered savings plans. You may get a CD at a local bank, but interest rates have plummeted to near-zero as of early 2009 due to stimulus initiatives. Roth IRAs, in particular, are a popular investment choice for people who have extra cash after they have met their basic financial needs. However, for most individuals, any kind of savings that outperforms inflation over its existence is at least a safe investment. The word "stable" is subjective when the market is constantly changing. We can make assumptions about what will remain stable during a recession by observing past performance or current trends. Many investors consider bonds to be a very safe haven during economic downturns. This does not include certificates of deposits (CDs) or the enormous amount of "commercial paper" that many individuals have become acquainted with for the first time in 2008. In contrast to stocks, the other type of security, bondholders lend money rather than invest it. As a result, bankruptcy laws favor lenders rather than part-owners (as in the case of stocks). In the event of bankruptcy, you will be able to liquidate your assets before other creditors. Although some experts believed that dividends in the most stable firms might be secure for 401(k) investments because of natural economic growth. And also, the severity of the current financial crisis has made this market significantly riskier than it has been in a long time, with few firms capable of generating dividend profits to share in either stock offerings or cash payments. One needs to be sure they do not trade stability for actually falling behind the rate of inflation, which is a losing proposition as far as the relative value of that “money”. In early 2008, when the inflation rate was around 3%, many 401(k) funds had returns at the same rate. After administrative costs and other fees, many people (including a disproportionate number of older workers) were losing money on their plans but were unaware because they had not liquidated them yet. Your ability to re-invest your 401(k) savings is, in part, limited by the action (or lack thereof) of your current or previous employer. There are several different aspects to consider when establishing the appropriate balance of safety and return for one of the most volatile decades-long markets that has ever existed. The expense ratio is the company's cost of managing a fund in relation to the amount of money you have in your account. These firms may charge an amount per year or a flat fee for their services. Some of the fees that companies charge are justifiable, including ones for preparing your IRS filing paperwork. But others are excessive – like adding monthly fees on top of what other businesses would include in their operating budget, such as advertising charges. To make matters worse, the industry often uses confusing language to hide these types of fees. Investment management and advisory fees pay the big Wall Street salaries that now seem ludicrous. Given that the government is presently heavily invested in those businesses, there is no clear indication yet how the incoming administration will deal with the ability of funds to charge such fees. With a greater focus on customer/investor rights, confidence may be restored and the system resurrected with a little more balance for consumer/ investor rights. In conclusion, you may be defrauded by monthly fees that have nothing to do with maintaining a stable 401(k) fund; in order to make an informed decision, you will need to figure out what the charges are first. That should be simpler from 2009 forward. With the aid of a competent financial advisor, you can retire and withdraw at least some of your 401(k) penalty-free when you are 55. The prospect of retirement may be enticing to boomers who are in their 50s. Early retirement for boomers has the additional benefit of allowing younger employees without easy access to their contributions to take advantage of open positions. If you need money before then, you will have to wait until you are 59 1/2. You do not have to withdraw money from your 401(k) account when you reach that age; it is simply made available without penalty or obligation until death. Even if you have only recently started your 401(k) plan, it is usually better to keep your money invested for the long term - and something is always better than nothing. Furthermore, the penalties are so severe that you will be wasting many times over the future value of your contributions with each portion of early investment money stolen before it has a chance to "maturity." One of the benefits of 401(k) plans for older individuals is the opportunity to contribute larger amounts each year in an attempt to "make up" payments that were missed in the past. This might be owing to a time of non- or self-employment. It may also be due to withdrawing funds from an old savings account or making contributions for retirement too late in life to realize all of the advantages from a long-term investment. Many older workers will want to choose an investment that allows easy access to their earnings, as they often have more difficulty finding employment. This liquidity is typically accompanied by lower returns, but the risk is also generally lower. Short-term CDs and annuities are two such options for “storing” funds during retirement. If you are over 50 and looking to invest, it is wise to speak with a professional first. This way, you can avoid any difficult circumstances should your savings not manifest later in life. With so much on the line, now is not the time for errors in management--especially if you have managed to save up. The consultation fee is well worth it. To do well and endure the economic storm that has apparently been unleashed on the markets and funds that 401(k) savings are invested in, you must make some decisions about how your funds will be invested in both the short- and long-term. It would be prudent to develop a strategy for overcoming the time-consuming challenges linked with analyzing and changing your savings rate or method. The first thing you should do is discover exactly what is going on. You should have statements and contracts relating to the agreements you signed, as well as prior-year tax returns. To figure out where your money is going, use a computer program or a pen and paper. As of 2009, the amount of information on your 401(k) report summary will be greater, including a more detailed account of the costs you pay to maintain it. Inquire about any line items that are unclear and double-check with your own research. You may occasionally wait months for your fund reports to arrive. Even if you are charged an additional fee to receive a new statement, you are entitled to one. To make an informed decision about whether your fund sub-components are suitable candidates for weathering a bear market, you will need up-to-date information on your fund's performance and diversification. Investment funds can change rapidly, especially in a volatile market. Be sure your reports include historical data and some sort of standard to compare performance against that makes sense. This will help you understand how the fund is performing over time and make more informed decisions about investing. Although historical performance does not indicate future returns, it offers insight into how the fund's investors believe it will be managed. Always check more than one source for information on past performance, making sure that data for highs and lows across many years is included as well as an average number. These are the primary reasons for why you should invest in a Roth IRA: All of these have distinct return profiles, with equities typically being the highest earners and both bonds and money market funds considered to be a good choice. CDs or savings accounts with guaranteed interest are the lowest yielding investments, however they are usually quite secure. It is possible that you will not have access to all of these alternatives when picking a plan, and the management choices available to you may be less than optimal. If you have better options, please do not hesitate to contact your human resources department. Employers simply want to make their workers happy and are glad to let you do the job on your own time, especially if it can save them money as well. It is possible that a large number of individuals requesting the same modifications to your company's financial planning may be required to make anything happen. It is often a smart idea to write out a letter with your own plan of action plainly described. You can then talk to other employees and get them to sign a petition after that. The letter should be polite yet businesslike, as well as succinctly stating goals and ways to achieve them. Novices messing with their accounts is one of the most frequent causes of 401(k) maladministration. After a plan is put in place according to market circumstances, you should be able to go a long way before needing to adjust anything. If you keep in mind how your present activities might influence your planned investment's expected duration, it will be simple to avoid the most common blunders. The worst thing you can do with an existing IRA is to withdraw funds before retirement. This is the final option for these savings, as they are difficult to replace later in your career. At all costs, you should avoid taking this path. The IRS has some of the most stringent requirements in terms of what you must do to qualify for their matching funds, but many firms have far more stringent standards. One typical error is not saving enough money, which lowers or eliminates your employer's contribution amount. Before you sign on, double-check the firm's withdrawal criteria. This policy should be clearly stated in your strategy; if it is not, ask for clarification. If you have made a mistake and do not realize it, act swiftly to correct it. In a difficult job climate, it can be nearly as bad to take loans on your 401(k) as simply cashing it out and reinvesting elsewhere. The restrictions on what you are allowed to withdraw funds for can be exacting. In addition to the amount of principal removed from your account, there is an interest rate (slightly above the prime rate) that you will be responsible for paying back. The majority of 401(k) plan losses in 2008 were caused by aggressive investing. When several plans fell at the same time, some investors focused on unsecured debt or "junk" bonds, which made them fall even more. Despite the fact that few predicted the severity of the economic downturn, even fewer investors and financial experts had ever seen anything comparable in their careers. Regardless, like with all forms of investing, if you invest aggressively in high-yield vehicles, there's a greater chance you'll lose money. IRAs are a popular destination for extra or old 401(k) money. For employees under 50, however, a new 401(k) plan is usually recommended. Some businesses demand you to move assets out of their plan as soon as you leave employment there, while others will allow you to keep your money and/or stock holdings in their program indefinitely. Rollovers can be either direct or indirect, and they may go from one job plan to the next. Simply signing the required documentation is enough for a direct rollover, and no taxes are due. The latter might be unnecessarily complicated in some cases. If you do not deposit the cash promptly enough after receiving a check to perform the rollover yourself, you could face a significant tax burden, so be careful and quick when dealing with non-direct rollovers. You will also need an additional 20% deposit money on hand for manual rollovers. Your employer is legally obligated to send this money as a safety measure in case you do not make the additional 10% payment that is due within 60 days. You will get your deposit back after filing a specific form with your tax return. Unfortunately, many people have lost 30% of their funds because of this rule- which equates to a triple tax.401(k) Plan Definition

Have questions about 401(k) Plans? Click here.401(k) Background

Participant-Directed 401(k) Plans

Trustee-Directed 401(k) Plans

Difference Between 401(k) And IRAs

Contribution Limits

Employer Contributions

Payroll Deductions and Savings Rates

The History of 401(k) Plans

Reasons for Supplemental Retirement Savings

Federal Laws and Provisions Establishing 401(k) Status

Similar Affordable Plans

Issues With 401(k) Plans

Transferring 401(k) Earnings

Hidden Costs

Common Transparency Issues

What Happened to the 401(k) Plans in 2008

The Real Estate Market Collapse

The Credit Crunch

Stagflation

Workloss

401(k) Plans Options

How Bear Markets Affect Retirement Savings Accounts

Early Withdrawal Conditions

Penalties

Taxes

Reinvesting in Stable Funds

Expense Ratios

Age-Related Factors to Consider

Young Investors

Older Investors

A Plan for Stabilizing Your 401(k) Retirement Savings

Reading and Understanding the Summary Annual Report

Request for Updated Materials

Historical Performance Analysis

Approaching Your Employer With Better 401(k) Options

Recruiting Fellow Employees to Help

Common 401(k) Management Errors to Avoid

401(k) Plan FAQs

A 401(k) plan is a retirement savings account that is sponsored by an employer. Employees can choose to have a portion of their paycheck automatically deposited into the account. The money in the account can then be invested in a variety of different assets, such as stocks, bonds, and mutual funds. Employers may also offer a matching contribution, which can provide a significant boost to the account balance.

There are several benefits of a 401(k) plan. First, the money in the account grows tax-deferred, meaning that you will not have to pay taxes on any of the gains until you withdraw the money in retirement. Second, 401(k) plans often offer a matching contribution from the employer, which can further accelerate the growth of the account balance. Finally, 401(k) plans offer a wide variety of investment options, allowing employees to tailor their portfolio to their individual needs and risk tolerance.

There are several penalties for early withdrawal from a 401(k) plan. First, you will generally have to pay taxes on the money that you withdraw. Second, you may also be subject to a 10% early withdrawal penalty. Finally, if you withdraw money before you reach age 59 1/2, you may be required to pay an additional 10% penalty.

A rollover is a process whereby you move money from one retirement account to another. Rollovers can be either direct or indirect. A direct rollover occurs when the money is transferred directly from one account to the other. An indirect rollover occurs when you receive a check from one account and then deposit the money into the other account.

The tax consequences of a rollover will depend on the type of rollover that is performed. A direct rollover is typically tax-free, while an indirect rollover may be subject to taxes and penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.