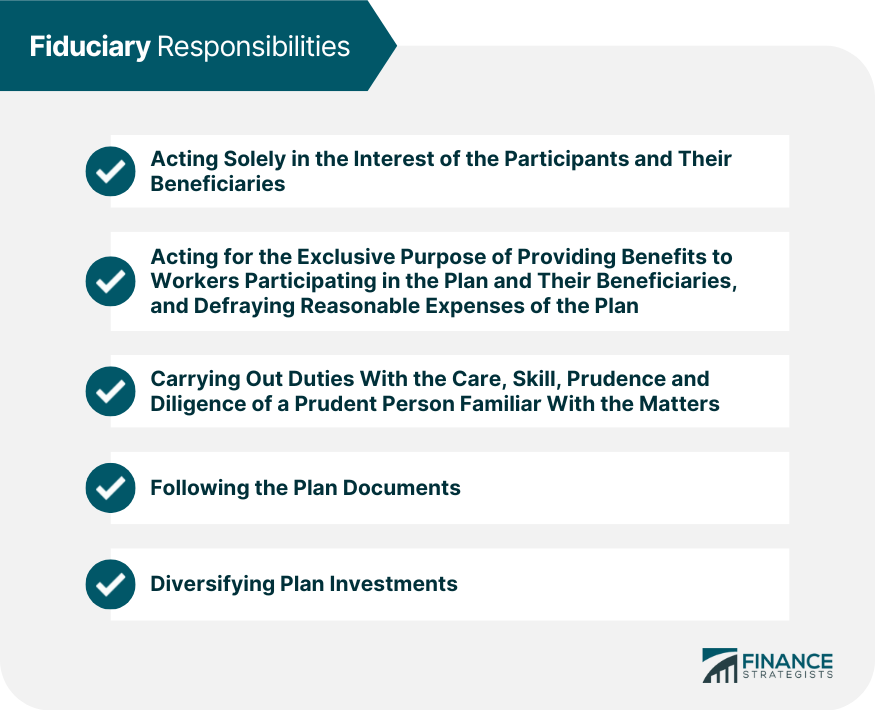

In general terms, a fiduciary is a person who owes a duty of care and trust to another and must act primarily for the benefit of the other in a particular activity. For retirement plans, the law defines the actions that result in fiduciary duties and the extent of those duties. Many of the actions needed to operate a qualified retirement plan involve fiduciary decisions - whether a business hires someone to manage the plan for it or does the plan management itself. Controlling the plan assets or using discretion in managing the plan makes the business or the entity it hires a plan fiduciary to the extent of that discretion or control. Fiduciary status is based on the functions performed for the plan, not a title. Employers should be aware that hiring someone to perform fiduciary functions is itself a fiduciary act. Fiduciaries are in a position of trust with respect to the participants and beneficiaries in the plan. A fiduciary's responsibilities include: The responsibility to be prudent covers a wide range of functions needed to operate a plan. Since the business must carry out these functions in the same manner as a prudent person, it may be in the business's best interest to consult experts in such fields as investments and accounting. In a nutshell, a fiduciary is required to act solely in the best interests of the plan and its participants and beneficiary irrelevant of all other factors, such as cost or compensation. For some functions, there are rules that help guide the fiduciary. For example, if a business's plan document provides for salary reductions from employees' paychecks for contributions to the plan, then the business must deposit these contributions as soon as it's reasonably possible to do so, but no later than the 15th business day of the month following the payday. If the employer can reasonably make the deposits sooner, it needs to make the deposits at that time. Plan participants can find out about the fiduciaries in their plan in the Summary Plan Description. If the participant doesn't have a copy of this handy, the employer's human resources department or office should be able to furnish a copy upon request. This is important for plan participants to know, because the plan's fiduciary or fiduciaries are responsible for all of the key decisions that were made when the plan was established, such as: Making sure that the plan investments are well-managed and reasonably priced. The officers and managers who act as fiduciaries must also monitor the investments, which means that they need to look at them periodically to make sure that they continue to be well-managed and reasonably priced. Selecting the service providers for the 401(k) plan. The most common service provider for a 401(k) plan is called a "record-keeper." The record-keeper usually provides the plan website, educational materials, information about the investments, executes the investment transactions, maintains accounting records for participant accounts, and so on. In many ways, the record-keeper is the heart-and-soul of the operation of the plan. So, it's important that the fiduciaries hire a record-keeper that can properly do those jobs. Also, the fiduciaries must make sure that the record-keeper costs are reasonable. As with investments, plan fiduciaries must regularly monitor, or oversee, the record-keeper to make sure that its services continue to be of good quality and reasonably priced. Fiduciaries have more than those two sets of duties. But, that's a good starting point. The law that governs the fiduciaries, known as ERISA, is demanding. If the fiduciaries don't act competently and knowledgeably, they can be sued for breach of their duties...and they sometimes are.

Have a question about 401(k) Plan Fiduciary? Click here.Fiduciary Responsibilities

Other Responsibilities

401(k) Plan Fiduciary FAQs

A 401(k) plan is a retirement plan offered by an employer designed to help employees save for retirement.

A 401(k) Plan Fiduciary is an individual or entity that has been given the legal responsibility to manage and administer a retirement plan in accordance with the Employee Retirement Income Security Act (ERISA). The fiduciary of a 401(k) plan takes on significant liabilities for ensuring the plan meets ERISA's standards for compliance.

Any person who has control over the management and/or administration of a retirement plan may be appointed as a fiduciary, such as an employer, company executive, financial advisor, consultant or third-party administrator.

The primary responsibility of a fiduciary is to manage and administer the plan for the exclusive benefit of participants and beneficiaries, by ERISA’s standards. This includes selecting prudent investments, monitoring investments and plan operations, ensuring proper administrative procedures are followed, as well as providing timely disclosure documents.

Yes, acting as a 401(k) Plan Fiduciary can be risky due to the personal liabilities associated with the position. A fiduciary may be held personally liable for losses resulting from a failure to follow ERISA's standards or any other breach of their duties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.