VA home loans, or Veterans Affairs home loans, are mortgage loans backed by the U.S. Department of Veterans Affairs (VA) designed to help eligible veterans, active-duty service members, and surviving spouses purchase or refinance a home. The purpose of VA home loans is to provide affordable and accessible homeownership opportunities to eligible borrowers while offering competitive interest rates and flexible loan terms. To be eligible for a VA home loan, applicants must meet specific military service requirements, which vary depending on the period of service, branch, and type of service (active duty, National Guard, or Reserve). The minimum active duty service requirement for VA home loan eligibility typically ranges from 90 days to 2 years, depending on the period of service and whether the applicant served during wartime or peacetime. Surviving spouses of service members who died in the line of duty or as a result of a service-connected disability may also be eligible for VA home loan benefits. To apply for a VA home loan, borrowers must obtain a Certificate of Eligibility (COE) as proof of their eligibility. The COE can be requested through the VA or by working with a VA-approved lender. One of the most significant benefits of VA home loans is the lack of a down payment requirement for most borrowers, enabling eligible applicants to purchase a home without saving a substantial amount for a down payment. VA home loans typically offer competitive fates compared to conventional mortgage loans, potentially saving borrowers thousands of dollars over the life of the loan. Unlike conventional and FHA loans, VA home loans do not require private mortgage insurance (PMI), reducing the monthly mortgage payment for borrowers. VA home loans have more lenient credit requirements than conventional loans, making homeownership more accessible to eligible borrowers with lower credit scores or past credit challenges. The VA limits the closing costs that lenders can charge borrowers for VA home loans, reducing the upfront expenses associated with purchasing or refinancing a home. Before applying for a VA home loan, borrowers must obtain a Certificate of Eligibility (COE) from the VA. The COE serves as proof of the borrower's eligibility for a VA home loan and can be requested online, by mail, or through a VA-approved lender. To begin the VA home loan process, borrowers should first get prequalified and preapproved by a VA-approved lender. Prequalification provides an estimate of the loan amount a borrower may qualify for, while preapproval is a more formal process that involves a lender reviewing the borrower's financial documents and verifying their eligibility for a VA home loan. Borrowers should research and compare multiple VA-approved lenders to find the best loan terms, interest rates, and fees for their financial situation. Working with a reputable and experienced lender who specializes in VA home loans is essential for a smooth and successful loan process. After the borrower has found a suitable property, the lender will order a VA appraisal to determine the home's value and ensure it meets the VA's minimum property requirements. It is also recommended that borrowers obtain a home inspection to identify any potential issues with the property before moving forward with the purchase. Once the appraisal and inspection processes are complete, and the borrower has been approved for the loan, the lender will schedule a closing appointment to sign the final loan documents. After the loan has closed, the borrower can take possession of the property. Purchase loans are the most common type of VA home loan, used by eligible borrowers to finance the purchase of a primary residence. The Interest Rate Reduction Refinance Loan (IRRRL) allows borrowers with existing VA home loans to refinance their mortgage to a lower interest rate or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage with minimal documentation and underwriting requirements. VA cash-out refinance loans enable borrowers to refinance their current mortgage, whether it's a VA loan or not, and access their home's equity as cash for purposes such as home improvements, debt consolidation, or other financial needs. In addition to home loans, the VA offers Adapted Housing Grants to help eligible disabled veterans modify their homes to meet their unique accessibility needs, such as wheelchair ramps, widened doorways, or other adaptations. While there is no maximum loan amount for VA home loans, there are limits on the amount of the VA's guaranty, which can affect the size of the loan a borrower can obtain without a down payment. These loan limits vary by county and are updated annually. The VA charges a funding fee on most VA home loans to help cover the program's cost. The funding fee varies based on factors such as the type of loan, the borrower's military status, and whether the borrower has previously used their VA home loan benefit. Some borrowers, such as disabled veterans or surviving spouses, may be exempt from paying the funding fee. Funding fees for VA home loans can be influenced by the borrower's down payment, previous use of VA loan benefits, and whether the loan is a purchase, refinance, or adapted housing grant. Borrowers should consult with their lender to understand the specific funding fee associated with their loan. Basic entitlement refers to the standard VA home loan entitlement, which is typically equal to 25% of the conforming loan limit for the borrower's county. This entitlement amount is used to calculate the maximum loan amount a borrower can obtain without a down payment. Bonus entitlement, also known as second-tier or additional entitlement, may be available to borrowers who have already used their basic entitlement but wish to obtain another VA home loan. The bonus entitlement allows borrowers to have more than one VA loan at a time or obtain a new VA loan after experiencing a foreclosure or short sale on a previous VA loan. In some cases, borrowers may be eligible to have their VA home loan entitlement restored, allowing them to utilize their VA loan benefits again. Entitlement restoration may be possible if the borrower has paid off their previous VA loan, sold the property, or met other specific requirements. Federal Housing Administration (FHA) loans are government-backed mortgages with more lenient credit and down payment requirements than conventional loans. FHA loans may be a suitable alternative for borrowers who do not qualify for a VA home loan or prefer a loan with fewer service-related requirements. U.S. Department of Agriculture (USDA) loans are government-backed mortgages designed to help low- to moderate-income borrowers purchase homes in rural areas. Like VA home loans, USDA loans offer competitive interest rates and require no down payment for eligible borrowers. However, USDA loans have income and property location requirements that may not align with every borrower's situation. Conventional loans are mortgages not backed by the federal government, and they typically have more stringent credit and down payment requirements than government-backed loans. Borrowers with strong credit and the ability to make a down payment may find conventional loans to be a suitable alternative to VA home loans, especially if they do not meet the VA's service requirements. Understanding the unique features, benefits, and requirements of VA home loans is crucial for potential borrowers considering this mortgage option. By carefully evaluating their eligibility, financial situation, and homeownership goals, borrowers can determine if a VA home loan is the right choice for their specific circumstances. By comparing VA home loans with alternative mortgage options and seeking guidance from qualified professionals, potential borrowers can make informed decisions that align with their financial goals and homeownership needs. Ultimately, understanding the various home financing options available can help borrowers make the best choice for their individual situation, providing a solid foundation for their future homeownership journey.What Are VA Home Loans?

Eligibility Requirements for VA Home Loans

Military Service and Duration

Minimum Active Duty Service

Surviving Spouses

Certificate of Eligibility (COE)

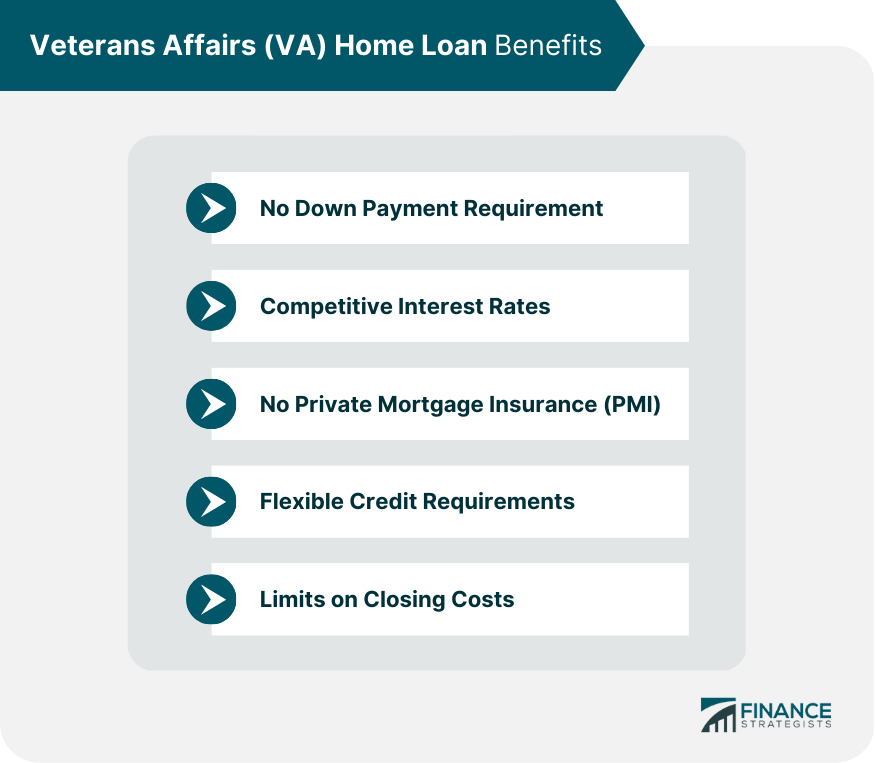

VA Home Loan Benefits

No Down Payment Requirement

Competitive Interest Rates

No Private Mortgage Insurance (PMI)

Flexible Credit Requirements

Limits on Closing Costs

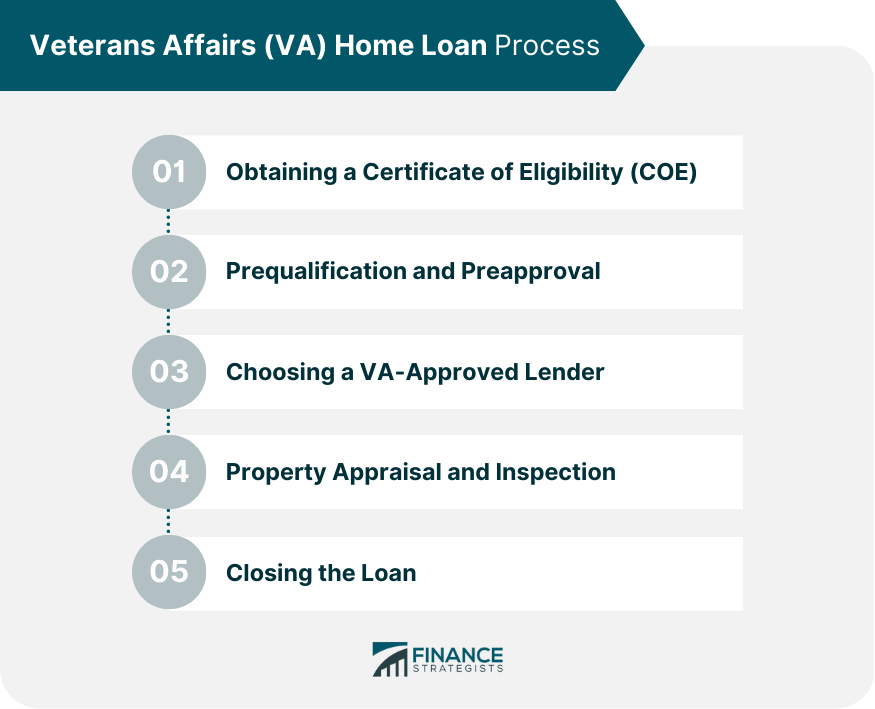

VA Home Loan Process

Obtaining a Certificate of Eligibility (COE)

Prequalification and Preapproval

Choosing a VA-Approved Lender

Property Appraisal and Inspection

Closing the Loan

VA Home Loan Types

Purchase Loans

Interest Rate Reduction Refinance Loan (IRRRL)

Cash-Out Refinance Loans

Adapted Housing Grants

VA Home Loan Limits and Funding Fees

Loan Limits

Funding Fees and Exemptions

Factors Affecting Funding Fees

Understanding VA Loan Entitlements

Basic Entitlement

Bonus Entitlement

Entitlement Restoration

VA Home Loan Alternatives

FHA Loans

USDA Loans

Conventional Loans

Conclusion

Importance of Understanding VA Home Loans

Making Informed Decisions on Home Financing Options

VA Home Loans FAQs

A VA home loan is a mortgage loan guaranteed by the United States Department of Veterans Affairs (VA). It is designed to help active-duty military members, veterans, and eligible surviving spouses purchase or refinance a home.

Eligibility for a VA home loan varies depending on the length and type of military service. Generally, active-duty military members, veterans, and certain surviving spouses are eligible. The VA provides a detailed list of eligibility requirements on their website.

To apply for a VA home loan, you must first obtain a Certificate of Eligibility (COE) from the VA. You can apply online or through a lender that participates in the VA Home Loan program. You will need to provide documentation such as proof of military service, income, and credit history.

The VA loan guarantee is a promise from the VA to reimburse the lender if the borrower defaults on the loan. This guarantee encourages lenders to offer favorable terms to veterans and active-duty military members, such as lower interest rates and reduced down payment requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.