Proprietary reverse mortgages, also known as private reverse mortgages or jumbo reverse mortgages, are financial products offered by private lenders that allow homeowners to convert a portion of their home equity into loan proceeds. These types of reverse mortgages are not insured by the federal government and are designed for borrowers with high-value homes. To qualify for a proprietary reverse mortgage, the youngest homeowner must be at least 62 years old, similar to the age requirement for HECMs. Proprietary reverse mortgages are typically designed for homeowners with high-value homes that exceed the maximum claim amount for HECMs. The borrower must also have a significant amount of home equity to qualify for a proprietary reverse mortgage. Eligible property types for proprietary reverse mortgages may include single-family homes, condominiums, and multi-unit properties, depending on the lender's guidelines. Some lenders may also allow proprietary reverse mortgages on second homes or investment properties. Although not federally mandated, many proprietary reverse mortgage lenders require borrowers to undergo a financial assessment and counseling to ensure they understand the conditions of the loan and can afford to maintain the property, pay property taxes, and keep homeowners insurance. Proprietary reverse mortgages can offer higher loan amounts compared to HECMs, providing borrowers with greater access to their home equity. Homeowners with higher-valued homes can benefit from proprietary reverse mortgages, as these loans are designed to accommodate properties that exceed the maximum claim amount for HECMs. Unlike HECMs, proprietary reverse mortgages do not require an upfront or ongoing government mortgage insurance premium, potentially reducing the overall cost of the loan. Proprietary reverse mortgage borrowers can choose from various disbursement options, including lump-sum payments, monthly payments, a line of credit, or a combination of these options, providing flexibility to meet individual financial needs. Proprietary reverse mortgages may not be as widely available as HECMs, as fewer lenders offer these types of loans. This may limit the options for borrowers seeking a private reverse mortgage. Interest rates and fees for proprietary reverse mortgages can be higher than those for HECMs, increasing the overall cost of the loan. Proprietary reverse mortgages are not subject to the same federal regulations and consumer protections as HECMs, which may leave borrowers more vulnerable to potential risks and predatory lending practices. Proceeds from a proprietary reverse mortgage may impact eligibility for certain government benefits, such as Medicaid or Supplemental Security Income (SSI). Additionally, borrowers should consult with a tax professional to understand the potential tax implications of a proprietary reverse mortgage. Potential borrowers should research and compare multiple proprietary reverse mortgage lenders to find the best loan terms, interest rates, and fees for their financial situation. It is essential to work with a reputable and experienced lender who specializes in proprietary reverse mortgages. Although not federally mandated, many proprietary reverse mortgage lenders require borrowers to undergo a financial assessment and counseling session with a qualified counselor. This process helps ensure that borrowers understand the loan terms, costs, and responsibilities associated with a proprietary reverse mortgage. Once the borrower has selected a lender and completed the required counseling, the lender will order a home appraisal to determine the property's value. The underwriter will then review the borrower's financial information, credit history, and property details to determine eligibility and loan terms. After the underwriting process is complete and the borrower has been approved for the loan, the lender will schedule a closing appointment to sign the final loan documents. Once the loan has closed, the borrower will receive the loan proceeds according to the chosen disbursement method. Repayment of a proprietary reverse mortgage is generally not required until a maturity event occurs. Common maturity events include the borrower's death, the sale of the home, or the borrower no longer using the property as their primary residence. At this point, the loan becomes due and payable. Like HECMs, most proprietary reverse mortgages are non-recourse loans, which means the borrower (or their heirs) will never owe more than the home's appraised value or sale price, whichever is lower, even if the loan balance exceeds this amount. The outstanding loan balance for a proprietary reverse mortgage will accrue interest over time. As a result, the longer the borrower keeps the loan, the larger the loan balance will be when it becomes due and payable. Upon the borrower's death or permanent departure from the home, the heirs have several options for repaying the proprietary reverse mortgage. They can repay the loan by selling the property, refinancing the loan into a traditional mortgage, or paying the loan balance in full with other funds. HECMs are the most common type of reverse mortgage and are federally insured by HUD. While HECMs are subject to strict lending guidelines and borrowing limits, they provide consumer protections and may be more suitable for borrowers with lower-valued homes or those seeking a more regulated loan product. Single-purpose reverse mortgages are offered by some state and local government agencies and non-profit organizations. These loans are designed for a specific purpose, such as home repairs or property tax payments, and may have lower costs and interest rates compared to other reverse mortgage options. When deciding between a proprietary reverse mortgage and other reverse mortgage options, borrowers should consider factors such as loan amount, property value, interest rates, fees, consumer protections, and personal financial goals. Consulting with a qualified reverse mortgage counselor can help borrowers make informed decisions about which loan type best meets their needs. Understanding the unique features, benefits, and drawbacks of proprietary reverse mortgages is crucial for potential borrowers considering this financial product. By carefully evaluating their financial situation and long-term goals, borrowers can determine if a proprietary reverse mortgage is the right choice for their specific circumstances. By comparing proprietary reverse mortgages with other reverse mortgage options and seeking guidance from qualified professionals, potential borrowers can make informed decisions that align with their financial goals and homeownership needs. Ultimately, understanding the various reverse mortgage options and their implications can help borrowers make the best choice for their individual situation, providing financial flexibility and security during their retirement years.What Are Proprietary Reverse Mortgages?

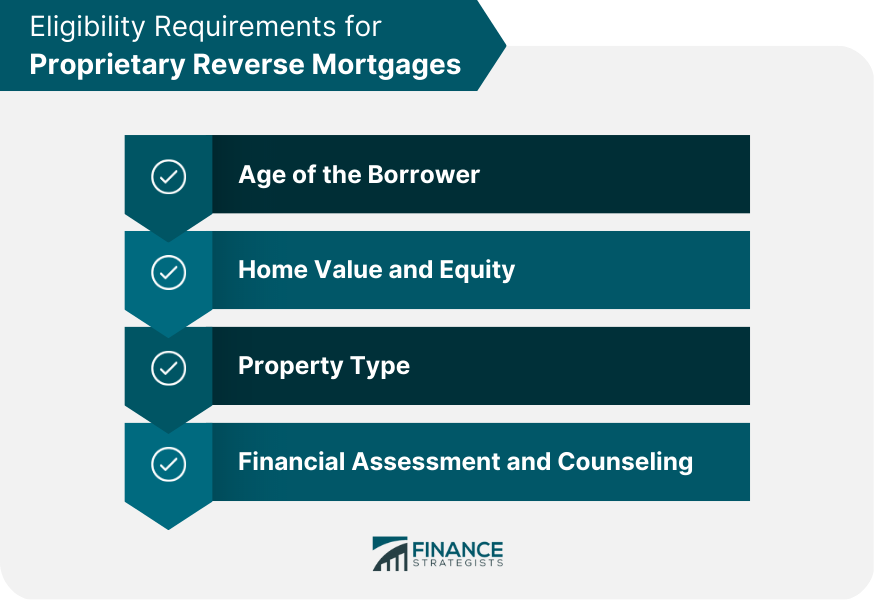

Eligibility Requirements for Proprietary Reverse Mortgages

Age of the Borrower

Home Value and Equity

Property Type

Financial Assessment and Counseling

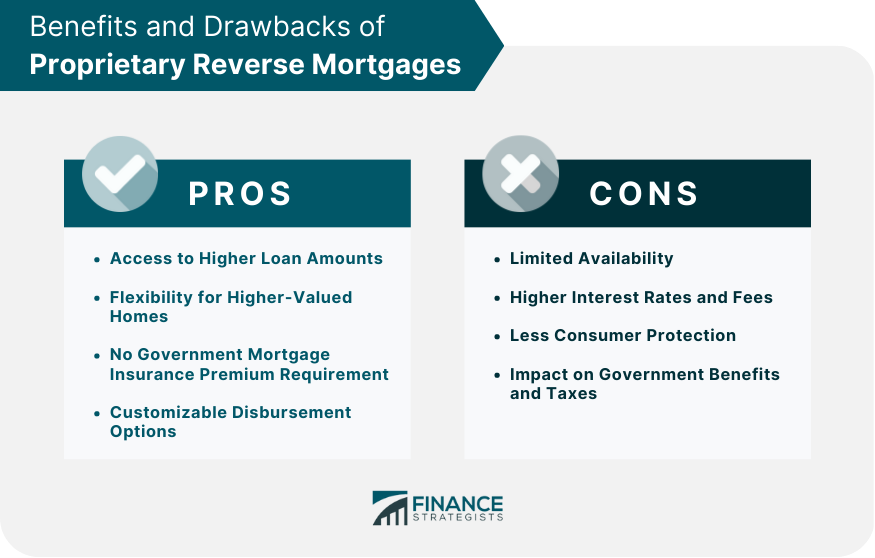

Benefits of Proprietary Reverse Mortgages

Access to Higher Loan Amounts

Flexibility for Higher-Valued Homes

No Government Mortgage Insurance Premium Requirement

Customizable Disbursement Options

Potential Drawbacks of Proprietary Reverse Mortgages

Limited Availability

Higher Interest Rates and Fees

Less Consumer Protection

Impact on Government Benefits and Taxes

Application Process for Proprietary Reverse Mortgages

Selecting a Lender

Undergoing Financial Assessment and Counseling

Appraisal and Underwriting

Closing the Loan and Disbursement of Funds

Repayment of Proprietary Reverse Mortgages

Repayment Triggers

Non-recourse Nature of the Loan

Loan Balance and Interest Accrual

Options for Heirs

Comparing Proprietary Reverse Mortgages With Other Reverse Mortgage Options

Home Equity Conversion Mortgages (HECMs)

Single-Purpose Reverse Mortgages

Factors to Consider When Choosing a Reverse Mortgage Type

Conclusion

Importance of Understanding Proprietary Reverse Mortgages

Making Informed Decisions on Reverse Mortgage Options

Proprietary Reverse Mortgages FAQs

A proprietary reverse mortgage is a type of reverse mortgage that is not insured by the federal government. It is offered by private lenders and is designed to help homeowners convert their home equity into cash.

Like a traditional reverse mortgage, a proprietary reverse mortgage allows homeowners to receive payments from their home equity without having to make monthly mortgage payments. The loan is typically repaid when the homeowner moves out of the home, sells the home, or passes away.

Eligibility for a proprietary reverse mortgage varies depending on the lender, but typically homeowners must be at least 62 years old, own their home outright or have a significant amount of equity, and live in the home as their primary residence.

The amount of money you can receive from a proprietary reverse mortgage depends on several factors, including the value of your home, your age, and the equity you have in the property. It is important to work with a reputable lender to determine how much you can borrow and what the terms of the loan will be.

One risk of a proprietary reverse mortgage is that the loan may have higher interest rates and fees than a traditional reverse mortgage. Additionally, because the loan is not insured by the federal government, there may be less consumer protections in place. It is important to carefully consider the terms of the loan and work with a reputable lender to ensure that you are making the best decision for your financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.