A home equity line of credit, or HELOC, is a line of credit that is secured by the equity in your home. It provides a revolving line of credit, similar to a credit card, where borrowers can access funds up to a predetermined limit. The amount of credit available is based on the difference between the current market value of the home and the outstanding mortgage balance. A line of credit is like a credit card, except that it usually has more stringent payment rules. A HELOC generally offers favorable terms in exchange for the added securitization. Typical requirements for a home equity line of credit are: Equity in for of at least 15% to 20% of home's total value Debt-to-income ratio between 40% and 50% Credit score of at least 620 Strong history of paying bills on time Individual requirements will vary by lender, but these are common qualifications. A home equity line of credit, or HELOC, is a line of credit that is secured by the equity in your home. The equity in your home is its value minus any amount owed. By securing the LOC with your home, you can generally get more favorable terms, but you risk losing your home if you default. A Home Equity Line of Credit (HELOC) works by allowing homeowners to borrow against the equity in their homes. During the draw period, typically lasting 5 to 10 years, borrowers can withdraw money as needed and make interest-only payments. After the draw period ends, the repayment period begins, during which borrowers must repay the principal along with interest over a set term, usually 10 to 20 years. HELOCs have variable interest rates tied to a benchmark, and the collateral for the loan is the borrower's home. One of the notable features of a Home Equity Line of Credit (HELOC) is that it typically comes with variable interest rates. Unlike fixed-rate loans, the interest rate on a HELOC can fluctuate over time, usually based on a benchmark such as the prime rate. As the benchmark rate changes, the interest rate on the HELOC will also adjust accordingly. It's important for borrowers to understand the potential impact of interest rate changes on their monthly payments and overall cost of borrowing. HELOC provides homeowners with access to funds through a line of credit. This means that borrowers can withdraw money from the available credit limit as needed, similar to how one would use a credit card. The flexibility to access funds on-demand can be advantageous for financing ongoing projects or expenses that arise over time, such as home improvements, education costs, or unexpected emergencies. HELOC operates as a revolving credit facility, similar to a credit card. It means that as borrowers repay the borrowed amount, the credit becomes available again, allowing them to reuse the funds if necessary. This revolving nature distinguishes HELOC from traditional loans where borrowers receive a lump sum upfront and make fixed monthly payments. With a HELOC, borrowers have the flexibility to borrow, repay, and borrow again within the predetermined draw period, offering greater financial flexibility. HELOCs are secured loans that use the borrower's home as collateral. Lenders typically require borrowers to have a certain amount of equity in their homes before approving a HELOC. Equity is calculated by subtracting the outstanding mortgage balance from the current market value of the property. The collateral requirement helps mitigate the lender's risk and allows them to offer more favorable interest rates compared to unsecured loans. HELOCs consist of two main periods: the draw period and the repayment period. The draw period is the initial phase of the loan, typically lasting 5 to 10 years. During this time, borrowers can access funds from the line of credit and usually make interest-only payments. After the draw period ends, the repayment period begins, which can last between 10 and 20 years. During this phase, borrowers can no longer withdraw funds and must start repaying the principal amount along with interest. Home equity line of credit (HELOC) interest is not tax deductible unless used for purposes that directly and substantially maintain or improve the borrower's home that was borrowed against. Pure cosmetic changes are likely not tax deductible. This has been the case since 2017, since the Tax Cuts and Jobs Act was passed. HELOCs offer borrowers flexibility in accessing funds and repaying the loan. Borrowers can withdraw money as needed during the draw period, giving them the ability to manage their expenses efficiently. Additionally, during the draw period, borrowers typically make interest-only payments, providing them with greater flexibility in managing their monthly cash flow. HELOCs often come with lower interest rates compared to other forms of credit, such as credit cards or personal loans. Since the loan is secured by the borrower's home, lenders are willing to offer more competitive rates. This lower interest rate can result in significant interest savings over the life of the loan, making HELOCs an attractive option for borrowers in need of financing. One of the potential benefits of a HELOC is the potential tax advantages. In some cases, the interest paid on a HELOC may be tax-deductible, depending on the purpose of the borrowed funds and local tax laws. Borrowers should consult with a tax professional to understand the specific tax implications and eligibility criteria for claiming these deductions. One of the key risks associated with a HELOC is the presence of variable interest rates. As the interest rates fluctuate, borrowers may experience changes in their monthly payments, potentially leading to higher repayment obligations. HELOCs provide homeowners with access to a significant amount of credit, which can tempt some borrowers to over-borrow and accumulate excessive debt. It is crucial for individuals to exercise responsible borrowing and carefully consider their repayment abilities before utilizing the full credit limit. A HELOC is secured by the borrower's home, which means that failure to repay the loan may put the homeowner's property at risk. If the borrower consistently falls behind on payments or fails to meet the terms of the agreement, the lender may initiate foreclosure proceedings, leading to the potential loss of the home. A Home Equity Line of Credit is a flexible financial product that allows homeowners to borrow against the equity in their homes. It provides a revolving line of credit, giving borrowers the ability to access funds as needed for various purposes. To qualify for a HELOC, borrowers typically need to meet eligibility criteria such as having sufficient home equity and a good credit score. The key features of a HELOC include variable interest rates, access to funds through a line of credit, a revolving credit structure, and collateral requirements. HELOCs offer several benefits, including flexibility in borrowing and repayment, lower interest rates compared to other forms of credit, potential tax advantages, and a diverse range of uses for the accessed funds. However, there are also risks to consider, such as potential rate increases, the potential for over-borrowing and debt accumulation, impact on home equity, and the importance of understanding the terms and conditions of the agreement.What Is a Home Equity Line of Credit?

Home Equity Line of Credit Requirements

How Does a Home Equity Line of Credit Work?

Features and Characteristics of a Home Equity Line of Credit

Variable Interest Rates

Access to Funds Through a Line of Credit

Revolving Credit Structure

Collateral Requirement

Draw Period and Repayment Period

Is Home Equity Line of Credit Tax Deductible?

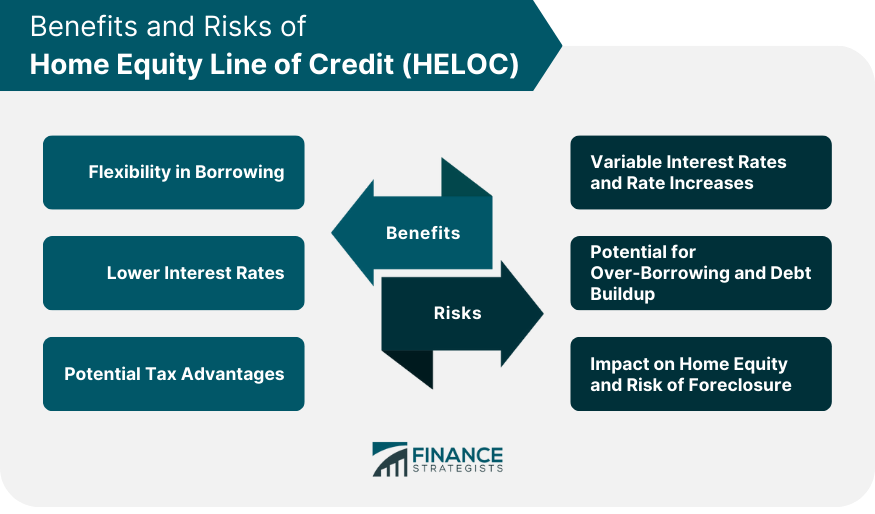

Benefits of Home Equity Line of Credit

Flexibility in Borrowing and Repayment

Lower Interest Rates Compared to Other Forms of Credit

Potential Tax Advantages

Risks of Home Equity Line of Credit

Variable Interest Rates and Potential Rate Increases

Potential for Over-Borrowing and Debt Accumulation

Impact on Home Equity and Risk of Foreclosure

The Bottom Line

Home Equity Line of Credit FAQs

A HELOC is a form of revolving credit that allows homeowners to borrow money against the value of their homes. It typically features a variable interest rate and payments may be made over time, based on the borrower’s ability to pay.

Qualifying for a HELOC requires that you have enough available equity in your home to cover the loan amount, and also show proof of sufficient income to make payments on the loan. Additionally, lenders will want to review your credit history and score to determine if you are approved for the loan.

Common uses for funds borrowed through a HELOC include home improvement projects, debt consolidation, college tuition payments, and financing large purchases.

The main advantage of using a HELOC is that it can be used like any other form of revolving credit and allows homeowners to access their equity without having to sell or refinance their homes. Additionally, interest rates are usually lower than other forms of borrowing because your home is used as collateral for the loan.

Yes, most lenders will charge closing costs when opening up a HELOC. These costs may include application fees, an appraisal fee, and other associated closing costs. It is important to review these fees before committing to a loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.