The interest rate for a Home Equity Line of Credit (HELOC) refers to the cost of borrowing money using the equity in your home as collateral. Essentially, it's the percentage of the outstanding loan balance that the borrower must pay to the lender, beyond the principal repayment. Unlike a standard loan, where you receive a lump sum upfront, a HELOC functions more like a credit card – it's a revolving line of credit from which you can borrow, repay, and borrow again, up to a predetermined limit. The interest rates for HELOCs are typically variable, which means they fluctuate in tandem with a baseline rate, like the prime rate. The rate you're offered may be the baseline rate plus a certain percentage, depending on your creditworthiness and other factors. As of June 2023, the average interest rate for a home equity line of credit (HELOC) is 8.3%. This is based on a survey of 10 large lenders. Your exact rate will depend on factors such as your credit score, the amount of equity in your home, and any money still owed on your house. Lenders use these to assess how much of a risk you pose as a borrower. A high credit score indicates a history of responsible credit management, making you a less risky borrower and thus often leading to more favorable interest rates. A credit score isn't the only aspect of your credit history that lenders examine. They may also look at the length of your credit history, the types of credit you've used, your payment history, and any public records such as bankruptcies or tax liens. This ratio, expressed as a percentage, compares the amount of money you're borrowing to the appraised value of your home. Generally, a lower LTV ratio suggests less risk for the lender, which can translate into a lower interest rate for you. If your LTV ratio is high, it means you're borrowing a larger proportion of your home's value, which could signify higher risk for the lender. As a result, you may face a higher interest rate. So, it's beneficial to have a significant amount of equity in your home before opening a HELOC. Finally, the broader economic and market conditions significantly influence HELOC interest rates. These can include the general state of the economy, central bank policies, inflation rates, and the housing market's health. For example, during periods of economic uncertainty or high inflation, lenders may raise interest rates to account for increased risk. Similarly, changes in the federal funds rate—an interest rate at which banks lend to each other overnight—often lead to changes in the prime rate, which is a common benchmark for HELOC rates. When following financial news, pay particular attention to any changes in these rates or any announcements from the central bank, as they can provide clues about potential shifts in HELOC rates. When seeking a HELOC, it's important to thoroughly research and compare different lenders. Each lender will offer different interest rates and terms based on their business model, risk tolerance, and market conditions. Online platforms, credit unions, traditional banks, and mortgage brokers all provide varied avenues for obtaining a HELOC. Reading lender reviews and seeking referrals can help you identify lenders who have a reputation for customer satisfaction. Additionally, consider the lender's responsiveness, transparency, and willingness to answer your questions. By gathering and comparing all this information, you can make an informed decision about which lender best suits your needs. Lenders often attract borrowers with promotional offers and introductory rates that are lower than their standard HELOC rates. These can be advantageous, but it's essential to understand their limitations. Such rates typically only last for a limited time, after which they revert to the lender's standard variable rate. Before committing to a HELOC based on a promotional rate, make sure you understand when this rate will end, what the rate will be afterward, and whether there are any conditions attached. HELOCs typically come with variable interest rates, but some lenders may offer a fixed-rate option, which can provide stability in a volatile rate environment. With a variable rate, your interest rate will fluctuate over time, typically in line with the prime rate. This means your payments can vary as well, which could impact your budget. Fixed-rate HELOCs, on the other hand, offer a constant interest rate throughout the draw period and repayment period, making budgeting easier. However, fixed rates are usually slightly higher than initial variable rates to offset the risk lenders take on. Finally, while comparing HELOC rates, it's also important to consider other fees and charges. These can include annual fees, inactivity fees, cancellation fees, or transaction fees. All these costs can add up and affect the total cost of your HELOC. Some lenders may also charge an origination fee to cover the costs of processing your loan. These additional costs might not seem significant when compared to the total line of credit, but they can make a big difference in the overall affordability of your HELOC. Ensure you make all credit payments on time, maintain low balances on your credit cards, and avoid applying for unnecessary credit. Additionally, routinely check your credit report to ensure there are no errors that might negatively impact your score. Building a strong credit history takes time, but the potential benefits in terms of lower interest rates can be significant. Lenders view borrowers with high credit scores as less risky, and they typically offer them more competitive interest rates. Another strategy is to increase your home equity, either by accelerating your mortgage payments or through the natural appreciation of your property's value. More equity generally equates to a lower LTV ratio, making you a more attractive borrower and potentially leading to a lower interest rate. Improving your home, either through renovations or maintenance, can also help increase its market value. However, it's important to consider the cost of any improvements and whether they are likely to add value in the eyes of a future appraiser. Don't be afraid to negotiate with lenders to secure better terms. If you have a good credit score, a low LTV ratio, and a steady income, you're in a strong position to negotiate. Some lenders may be willing to reduce their interest rates or waive certain fees to secure your business. It's also a good idea to get pre-approved with a few different lenders so you can compare offers. Let each lender know you're shopping around – this could encourage them to offer you better terms. Once you've secured a HELOC, it's essential to regularly review your interest rate and compare it with the rates offered by other lenders. This will help you stay informed about the current lending market and understand whether your rate is competitive. Remember, the interest rate on your HELOC is typically variable, so it may change over time. Regularly reviewing your rate can help you identify any significant changes and decide whether it might be time to renegotiate your terms or consider other options. Some lenders offer a rate lock option on their HELOC products. This allows you to lock in a fixed interest rate on a portion of your balance for a set period. This can provide some certainty in an environment where rates are expected to rise, allowing for more predictable budgeting. However, there may be fees associated with this feature, and there could be restrictions on when and how often you can lock in a rate. Therefore, be sure to fully understand these details before deciding to utilize a rate lock option. If interest rates have significantly dropped or your creditworthiness has improved since you opened your HELOC, you may want to consider refinancing. This involves replacing your existing HELOC with a new one, ideally with a lower interest rate or more favorable terms. Alternatively, if you have multiple lines of credit or loans, you might consider consolidating them into a single loan. This could potentially lower your overall interest rate and simplify your monthly payments. However, this strategy requires careful consideration, as there can be costs involved, and it might not be beneficial in all circumstances. The HELOC interest rate is the cost of borrowing against the equity in your home. Factors such as credit score, loan-to-value ratio, and market conditions influence the rates offered by lenders. To secure favorable rates, it is important to improve creditworthiness, increase home equity, and negotiate with lenders for better terms. Monitoring and managing HELOC interest rates is an ongoing process. Regularly reviewing and comparing rates ensures that you stay informed about competitive offers. Utilizing rate lock options can protect you from potential rate increases. Additionally, refinancing or consolidating HELOCs can be considered to lower rates. By being proactive in monitoring rates, borrowers can take advantage of opportunities to save money and optimize their financial situation.Overview of Interest Rates for Home Equity Line of Credit

Average Interest Rates for Home Equity Line of Credit

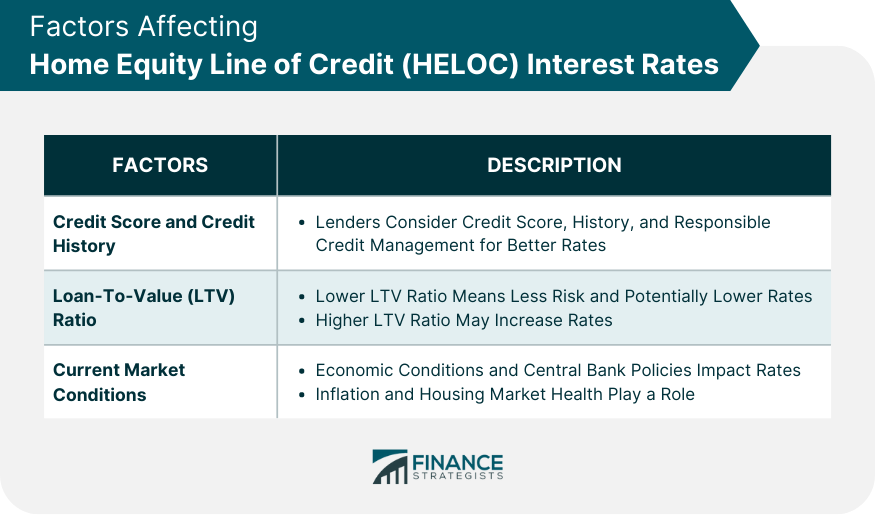

Factors Affecting HELOC Interest Rates

Credit Score and Credit History

Loan-to-Value (LTV) Ratio

Current Market Conditions

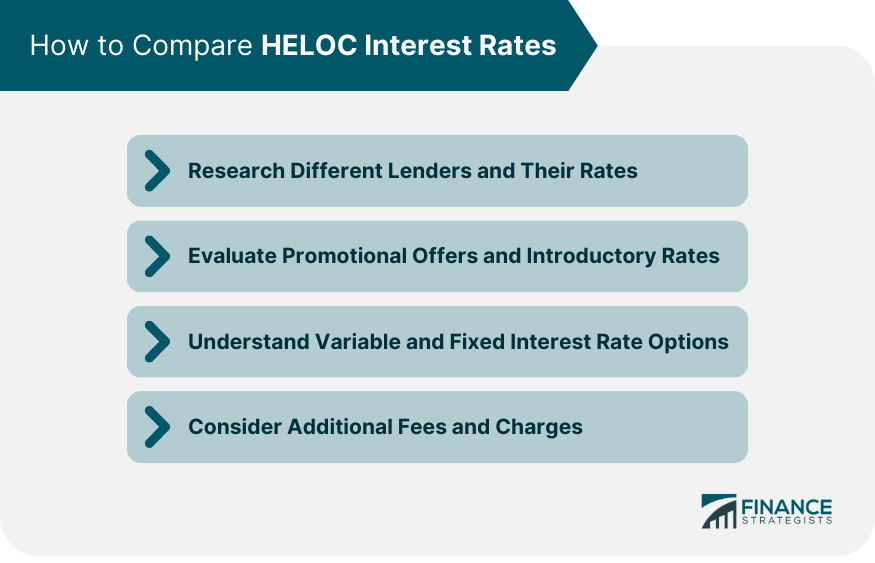

How to Compare HELOC Interest Rates

Researching Different Lenders and Their Rates

Evaluating Promotional Offers and Introductory Rates

Understanding Variable and Fixed Interest Rate Options

Considering Additional Fees and Charges

Strategies to Secure Favorable HELOC Interest Rates

Improving Credit Score and Creditworthiness

Increasing Home Equity Through Property Value Appreciation

Negotiating With Lenders for Better Terms

Monitoring and Managing HELOC Interest Rates

Regularly Reviewing and Comparing Rates

Utilizing Rate Lock Options

Refinancing or Consolidating HELOCs to Lower Rates

The Bottom Line

Home Equity Line Of Credit Interest Rates FAQs

A Home Equity Line of Credit (HELOC) is a type of revolving loan which allows homeowners to access and use the equity they've built in their home as collateral for borrowing money at an adjustable interest rate.

The interest rate on a HELOC is typically variable, meaning it can change over time based on market conditions and other factors. The current index that governs the amount of interest charged will be disclosed during the application process.

Most lenders do not charge an annual fee for opening and maintaining a HELOC. However, some lenders may charge a fee for closing the loan or increasing your credit limit.

The repayment period for a HELOC can vary depending on the lender and the terms of the loan. Generally speaking, most lenders offer repayment periods ranging from 5 to 25 years with an interest-only period of 10 years or less.

Factors such as market conditions, individual financial history, term length, and amount borrowed may all play a role in determining HELOC interest rates. Additionally, many banks will also consider any existing balances owed on other mortgages or loans when setting interest rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.