An unsecured business line of credit is a line of credit offered to businesses that is not secured by collateral. An unsecured LOC is the most common form of business line of credit. Unsecured lines of credit tend to be more expensive due to the comparatively higher risk. An unsecured business line of credit is a flexible funding method offered by banks or lending institutions to businesses. Being unsecured, it doesn't require collateral, meaning the lender won't claim any of your assets if you default on the repayment. In an unsecured business line of credit, the business can borrow, repay, and borrow again within the credit limit, much like a credit card. This revolving nature of the credit line provides businesses with constant access to funds, making it a practical choice for addressing short-term financial needs. It can be difficult to get an unsecured business line of credit as a startup. If you have limited credit history, banks may see you as too risky. However, there are many alternative lenders, such as online lenders, that have less strict credit requirements and can serve you as well as a bank. A no doc business line of credit is like a regular line of credit, but without requiring as many documents. No doc lines of credit are often unsecured, meaning they are not backed up by physical assets. Usually, a no doc LOC will be supported by the personal credit of the business operator. Securing an unsecured business line of credit involves meeting certain eligibility requirements. Credit score is a significant factor in qualifying for an unsecured business line of credit. Both personal and business credit scores may be evaluated. A high credit score signifies creditworthiness and reliability to lenders, increasing the chances of approval. It's essential to maintain good credit habits to ensure a favorable credit score. For business owners with a low credit score, improving this score should be a priority. Paying bills on time, reducing debt levels, and regularly checking credit reports for errors can help improve your credit score over time. Lenders often consider a business's financial health when deciding whether to extend credit. They may ask for financial statements such as balance sheets, income statements, and cash flow statements. These documents provide insights into the company's profitability, financial stability, and how efficiently it manages its resources. Regular and reliable revenue streams can increase your chances of securing an unsecured business line of credit. Lenders see a steady income as a sign that your business is likely to repay borrowed funds. The length of time you've been in business can also influence your eligibility. Most lenders prefer businesses that have been operational for a few years as it indicates stability and experience in managing finances. However, some lenders offer lines of credit to newer businesses, albeit often with higher interest rates or lower credit limits. If you're a new business owner, don't be discouraged. There are plenty of financing options available for newer businesses. You might consider other types of credit or loans that cater specifically to startups or new businesses. In addition to the general criteria, lenders may have specific requirements based on their risk assessment policies. For instance, some may require you to be in a specific industry or have a minimum annual revenue. It's important to research and understand these criteria to increase your chances of approval. Lenders might also look at your business plan, growth projections, and market conditions. Be prepared to provide this information and show how you intend to use the credit line to grow your business. Proper management of an unsecured business line of credit is crucial to avoid financial pitfalls. The credit limit is the maximum amount you can borrow against your line of credit. Understanding your credit limit is essential to prevent over-borrowing and to plan your business spending. It's important to remember that continuously maxing out your credit limit may negatively impact your credit score. You should also be aware that your lender can decrease your credit limit or even close your credit line if they perceive an increased risk, such as missed payments or a significant drop in your income. How you utilize and repay your credit line significantly impacts your financial health. It's essential to borrow only what you need and ensure timely repayments. Delayed or missed payments can lead to higher interest charges and harm your credit score. You should also aim to keep your credit utilization ratio—the amount of credit you're using compared to your credit limit—low. A lower utilization ratio is viewed positively by lenders and can help improve your credit score. Interest rates and fees associated with your unsecured business line of credit can add up over time. It's important to be aware of these costs and factor them into your budget. The interest rate may be fixed or variable, with variable rates potentially increasing over time. Fees may include annual fees, late payment fees, and transaction fees. Understanding these costs and keeping track of any changes can help you manage your line of credit more effectively and avoid unexpected expenses. Maintaining a good credit score is critical for managing your line of credit. A good credit score can lead to better terms, such as higher credit limits or lower interest rates. Good credit habits, like making timely repayments and keeping a low credit utilization ratio, can help improve your score. It's also important to regularly check your credit report for any errors or discrepancies that could negatively impact your score. If you find any issues, contact the credit bureau to get them corrected. An unsecured business line of credit offers several advantages that can be beneficial for businesses. Unlike traditional loans, which provide a lump sum amount that you start paying interest on immediately, a line of credit allows you to borrow exactly what you need when you need it. This flexibility makes an unsecured business line of credit ideal for covering short-term expenses, managing cash flow gaps, or handling unexpected business costs. It can also help businesses seize growth opportunities without having to apply for a new loan each time. As an unsecured line of credit, it doesn't require any collateral. This is particularly beneficial for businesses that don't have valuable assets to put up as collateral or those that don't want to risk losing their assets in case of default. However, it's important to note that while you don't risk losing any assets, failing to repay the borrowed amount can lead to other consequences such as damage to your credit score and potential legal action by the lender. An unsecured business line of credit provides quick access to funds, often with a simple draw request. This makes it a valuable resource when unexpected expenses arise, or opportunities present themselves that require quick action. Quick access to funds can be a game-changer for businesses, helping them respond more effectively to market changes, supply chain disruptions, or sudden growth opportunities. Compared to other financing options like credit cards or payday loans, an unsecured business line of credit usually offers more cost-effective interest rates. Interest is only charged on the amount you draw, not the entire credit limit, making it a more affordable option for businesses. However, it's important to compare different lenders and understand all the associated costs to ensure you're getting the most cost-effective deal. While an unsecured business line of credit offers several advantages, it's important to be aware of the potential risks. These include variable interest rates, potential impact on credit score, default and its consequences, and the availability of alternative financing options. Unsecured business lines of credit often come with variable interest rates, which can increase over time. This can make it harder to budget for repayments and potentially increase the cost of borrowing. It's important to understand how your interest rate is calculated and whether it's fixed or variable. If it's variable, make sure you're prepared for potential increases in the interest rate and how this could impact your repayments. Missed or late payments, borrowing up to your credit limit, or having a line of credit decreased or closed by your lender can all negatively impact your credit score. Maintaining good credit habits, like making timely repayments and keeping your credit utilization ratio low, can help protect your credit score. If you fail to repay the borrowed amount, you can default on your unsecured business line of credit. This can lead to severe consequences such as damage to your credit score, increased interest rates, late fees, and potential legal action by the lender. In the case of default, your lender may also report the default to credit bureaus, leading to a negative mark on your credit report that can stay there for several years, making it more difficult to secure financing in the future. Depending on your business needs, financial situation, and credit score, other options may be more suitable. These may include secured lines of credit, term loans, equipment financing, invoice financing, or equity financing. Always consider your business needs and do thorough research before deciding on the most suitable financing option. An unsecured business line of credit is a tool that provides flexible, accessible financing that can support your business's growth and success. It offers numerous benefits, including flexible borrowing, no collateral requirement, quick access to funds, and cost-effective interest rates. However, to qualify, you'll need to meet certain eligibility criteria, such as credit score requirements, adequate business revenue, and time in business. Effectively managing your unsecured business line of credit is key to maintaining good financial health. This involves understanding your credit limit, employing smart utilization and repayment strategies, monitoring interest rates and fees, and maintaining a good credit score. It's important to be aware of the potential risks, such as variable interest rates, the impact on your credit score, default consequences, and the availability of alternative financing options.What Is an Unsecured Business Line of Credit?

Unsecured Business Line of Credit for Startups

Unsecured Business Line of Credit (No Doc)

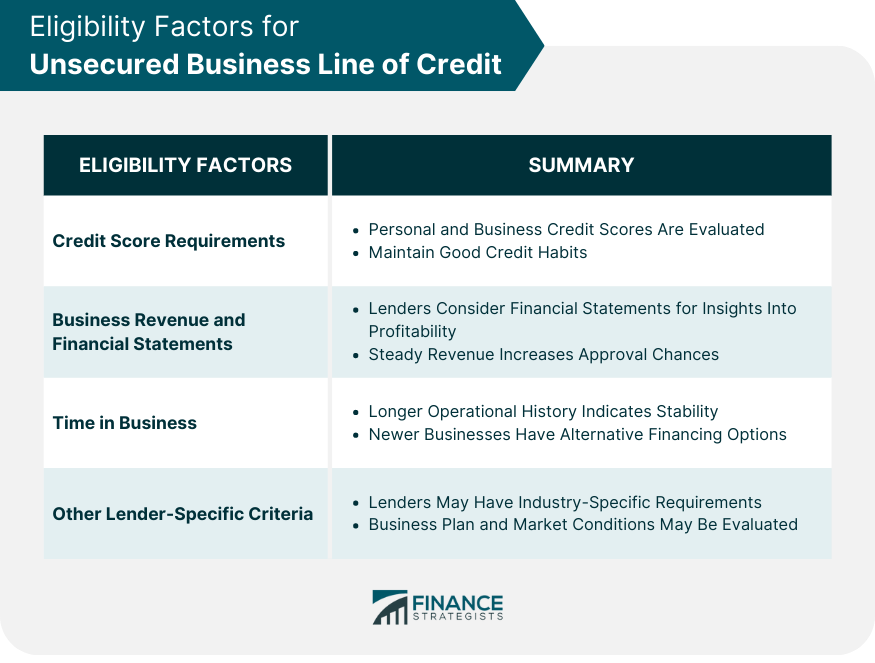

Eligibility for Unsecured Business Line of Credit

Credit Score Requirements

Business Revenue and Financial Statements

Time in Business

Other Lender-Specific Criteria

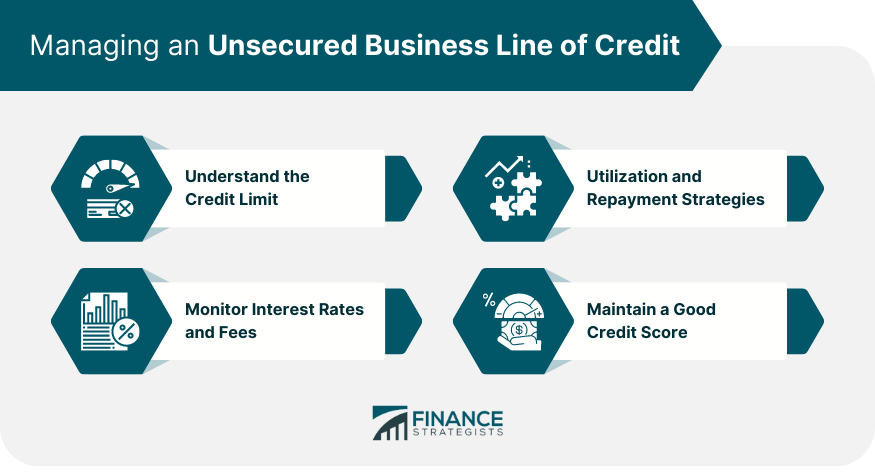

Managing an Unsecured Business Line of Credit

Understanding the Credit Limit

Utilization and Repayment Strategies

Monitoring Interest Rates and Fees

Maintaining a Good Credit Score

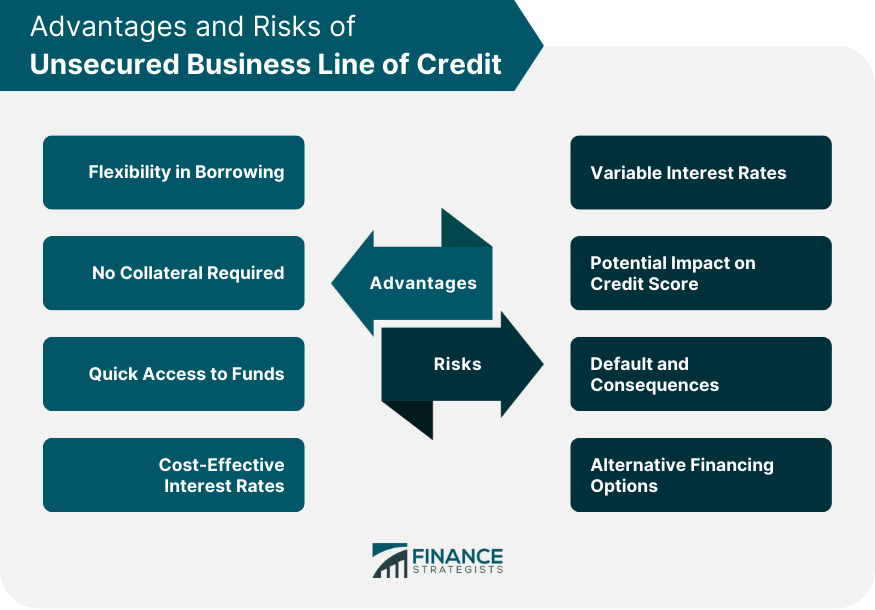

Advantages of Unsecured Business Line of Credit

Flexibility in Borrowing

No Collateral Required

Quick Access to Funds

Cost-Effective Interest Rates

Potential Risks of Unsecured Business Line of Credit

Variable Interest Rates

Potential Impact on Credit Score

Default and Consequences

Alternative Financing Options

Conclusion

Unsecured Business Line of Credit FAQs

An Unsecured Business Line of Credit is a loan that provides businesses with short-term financing or working capital, without the need for collateral.

The acronym LOC stands for Line of Credit.

A revolving line of credit is one which replenishes when the loan is paid off. An example of this is a credit card. A non-revolving line of credit closes once the loan is paid off, such as a student loan.

A loan is typically a lump sum whereas a line of credit is typically revolving which allows for the borrower to draw, repay, and again draw as needed.

Generally, an Unsecured Business Line of Credit requires a business to have been in operation for at least two years and possess healthy cash flow. Additionally, businesses may need to submit financial statements, tax returns, and other documents that establish their creditworthiness.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.