The business line of credit interest rate refers to the cost of borrowing money through a line of credit specifically designed for businesses. A line of credit is a flexible financing option that allows businesses to access funds up to a predetermined limit, similar to a credit card. The interest rate for a business line of credit may be as low as the prime rate plus 1.25% for SBA lines of credit, as low as 7% at traditional banks, and from 14% all the way up to 90% for some online lenders. The interest rate for a business line of credit can vary based on several factors, including the creditworthiness of the borrower, economic conditions, industry risk, and the specific terms of the line of credit. Monitoring the interest rate can help businesses manage their cash flow effectively and ensure they can afford the interest payments while utilizing the line of credit for short-term financing requirements. Lenders assess the borrower's credit history, credit score, and overall financial health to gauge the level of risk involved. A borrower with a high credit score and a strong repayment history is likely to receive a lower interest rate, as they are considered less risky. During periods of economic stability and low inflation, interest rates tend to be lower, making borrowing more affordable for businesses. Conversely, during economic downturns or high inflation, interest rates may be higher to compensate for the increased risk and inflationary pressures. Different industries pose varying levels of risk to lenders, which can influence the interest rate on a business line of credit. Industries that are considered volatile or have a higher likelihood of economic downturns may face higher interest rates. Lenders factor in industry-specific risks when determining the appropriate interest rate for a business line of credit. Generally, longer-term loans or higher loan amounts may have higher interest rates, as they expose lenders to increased risk over an extended period or with larger sums. Short-term loans or smaller credit limits may attract lower interest rates as they are perceived as less risky for lenders. Unlike a traditional loan that gives you a lump sum of money up front, a line of credit allows you to borrow only what you need, when you need it, up to a predetermined limit. This type of credit operates much like a credit card, giving businesses the freedom to manage their cash flow effectively and respond to financial emergencies promptly. Consequently, businesses can better adapt to varying operational costs and market conditions. Because interest is only charged on the amount you draw, not the entire credit line, savvy business owners can minimize interest expenses by borrowing judiciously. Moreover, lines of credit often come with lower interest rates compared to other forms of credit, such as credit cards, making them a cost-effective borrowing option for many businesses. Whether it's for purchasing inventory, covering unexpected expenses, or bridging a cash flow gap, a line of credit can offer a financial lifeline that keeps business operations running smoothly. The ability to draw funds as needed provides businesses with the liquidity necessary for growth and stability. Because the amount you borrow can fluctuate, so too can your interest payments. This variability can make budgeting more challenging and potentially lead to unexpected financial strain if not properly managed. Moreover, if your line of credit has a variable interest rate, your interest costs can increase if market rates rise. Despite the potential for lower interest costs, some business lines of credit can come with higher interest rates, particularly for businesses with lower credit scores or shorter credit histories. Additionally, some lines of credit may include additional fees, such as annual fees or draw fees, which can add to the total borrowing cost. Therefore, it's essential to understand all the terms and conditions associated with a line of credit before proceeding. With easy access to funds, some business owners may be tempted to borrow more than necessary, leading to higher interest costs and potential financial difficulties down the road. To mitigate this risk, businesses should use lines of credit responsibly and only borrow what they need. Maintaining a strong credit score is one of the most effective strategies for obtaining a favorable interest rate on a business line of credit. Lenders view a high credit score as an indication of financial responsibility and lower risk, which can lead to better loan terms. Make sure to pay all your bills on time, keep your debt levels low, and regularly check your credit report for errors. Building a good relationship with your lenders can also help secure a favorable interest rate. Lenders may offer better terms to borrowers they know and trust. Communicate openly, fulfill your financial obligations, and demonstrate your business's financial stability and growth potential. Don't settle for the first offer you receive. Instead, shop around and compare loan terms from different lenders. Each lender may offer different interest rates and terms, so it's worth your time to find the best deal for your business. Consider not only the interest rate but also other factors such as fees, repayment terms, and the flexibility of the credit line. Finally, don't be afraid to negotiate the terms of your line of credit. If you've done your homework and have offers from multiple lenders, you may have leverage to negotiate a lower interest rate or better terms. Remember, lenders are competing for your business, so don't hesitate to advocate for the best deal possible for your business. The business line of credit interest rate refers to the cost associated with accessing funds through a line of credit designed for business purposes. The interest rate is influenced by several factors, including the creditworthiness of the borrower, economic conditions, industry risk, and the loan term and amount. Understanding the business line of credit interest rate is essential as it enables businesses to evaluate the cost of borrowing and make informed financial decisions. While it offers benefits such as flexibility in borrowing and lower interest costs, drawbacks include uncertainty in interest payments and the potential for higher rates. To obtain favorable rates, businesses can employ strategies such as maintaining a strong credit score, building relationships with lenders, shopping around for offers, and negotiating terms. Careful consideration of the interest rate and its impact on financial obligations can contribute to responsible borrowing and overall financial health.What Is a Business Line of Credit Interest Rate?

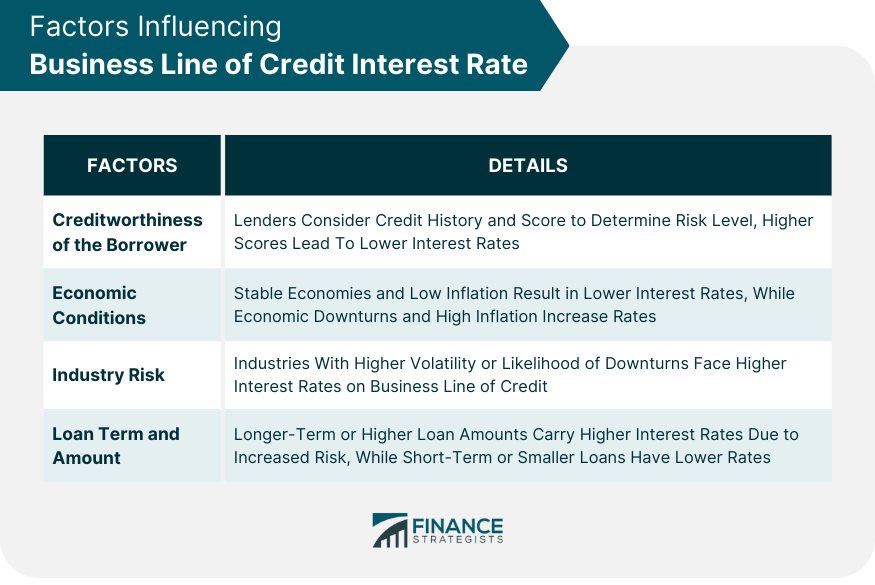

Factors Influencing Business Line of Credit Interest Rate

Creditworthiness of the Borrower

Economic Conditions

Industry Risk

Loan Term and Amount

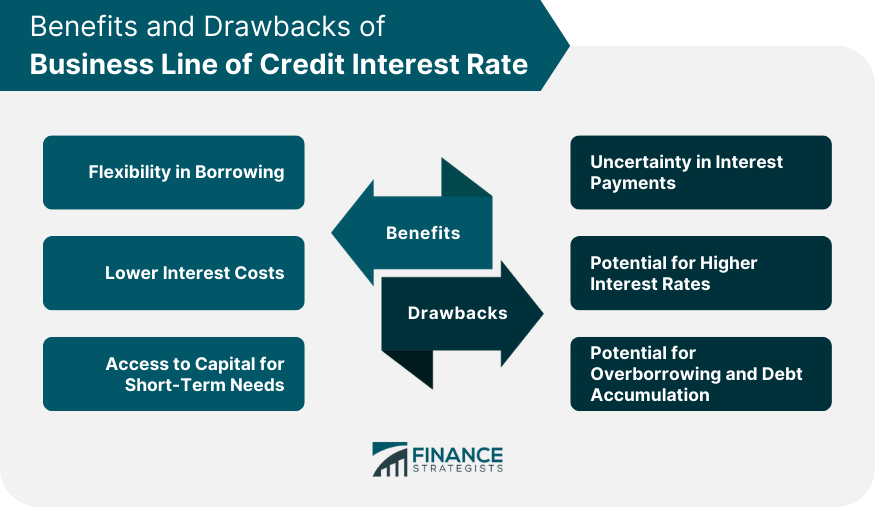

Benefits of Business Line of Credit Interest Rate

Flexibility in Borrowing

Lower Interest Costs

Access to Capital for Short-Term Needs

Drawbacks of Business Line of Credit Interest Rate

Uncertainty in Interest Payments

Potential for Higher Interest Rates

Potential for Overborrowing and Debt Accumulation

Strategies for Obtaining Favorable Business Line of Credit Interest Rates

Maintain a Strong Credit Score

Build a Good Relationship With Lenders

Shop Around and Compare Offers

Negotiate the Terms

Final Thoughts

Business Line of Credit Interest Rate FAQs

The current interest rate for a business line of credit can vary depending on the size and type of business, as well as other factors such as creditworthiness. Generally, interest rates are around 4-6%, but some businesses may qualify for lower or higher rates.

Both fixed and variable interest rates are available for business lines of credit, depending on the lender. Generally, businesses that can qualify for lower rates will have access to fixed interest rate options.

Factors that can affect the interest rate of a business line of credit include the size and type of business, creditworthiness, industry risk factors, duration of the loan, and other variables.

Yes, interest paid on a business line of credit may be tax deductible. However, it is important to consult with a tax advisor or accountant to determine if the interest is eligible for any deductions.

Generally speaking, most lenders offering business lines of credit will have a minimum interest rate. This rate may vary depending on the size and type of business, as well as other factors such as creditworthiness. To determine the minimum interest rate for a particular lender, it is best to contact them directly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.