When considering insurance policies or investment products, it's essential to understand the fees and charges involved. One such cost is the surrender charge, which can have a significant impact on the overall value of your policy or investment. Surrender charges are fees imposed by insurance companies and financial institutions when policyholders or investors withdraw funds from their policies or investments before a predetermined period. These charges help insurance companies cover the costs of issuing and managing the policies or investments. In the case of life insurance policies, surrender charges are designed to discourage policyholders from canceling their coverage early. For investment products like annuities, surrender charges serve to ensure that investors commit to their investments for an agreed-upon duration. Knowing how surrender charges work can help policyholders and investors make informed decisions about their financial products. Understanding these charges can assist in determining the overall costs and potential benefits of a policy or investment. In addition, being aware of surrender charges can help you develop strategies to minimize or avoid these fees, which can ultimately affect your financial well-being. Surrender charges are commonly associated with specific types of life insurance policies and annuities. Understanding which products carry these charges can help you make informed decisions when selecting a policy or investment. There are several types of life insurance policies that typically involve surrender charges. These policies combine insurance coverage with investment components and are designed for long-term financial planning. Whole life insurance provides lifelong coverage with a guaranteed death benefit and a cash value component. The cash value accumulates over time, and policyholders may withdraw or borrow against it. Surrender charges are often applied if the policyholder decides to cancel the policy or withdraw funds from the cash value component before a specified period. Universal life insurance is a flexible type of permanent life insurance that combines a death benefit with a cash value account. Policyholders can adjust their premium payments and death benefits according to their needs. Similar to whole life insurance, surrender charges may apply if the policyholder cancels the policy or withdraws funds from the cash value account before a predetermined time frame. Annuities are financial products designed to provide a steady stream of income during retirement. They are often purchased with a lump-sum payment or through a series of payments over time. Surrender charges are common in annuity contracts, particularly if the investor withdraws funds before the end of the surrender period. Fixed annuities offer a guaranteed interest rate and a fixed stream of income during retirement. These annuities are often considered low-risk investments, as they provide a predictable return on investment. However, surrender charges may apply if the investor withdraws funds before the end of the surrender period specified in the contract. Variable annuities allow investors to allocate their funds among various investment options, such as stocks, bonds, and mutual funds. The income generated during retirement depends on the performance of these investments. Like fixed annuities, variable annuities may impose surrender charges if the investor withdraws funds before the end of the surrender period. Several factors can influence the amount and duration of surrender charges in life insurance policies and annuities. Understanding these factors can help you make more informed decisions when selecting a policy or investment product. The specific terms of a life insurance policy or annuity contract play a significant role in determining the surrender charges. These terms may include the surrender period, the percentage of the charge, and any applicable schedules or tables used to calculate the charges. It's essential to review the contract terms carefully to understand the potential costs associated with surrendering your policy or investment. The length of time you've held a policy or investment can significantly impact the surrender charges. Typically, surrender charges decrease over time and may eventually be eliminated after a certain period. Understanding how the duration of your policy or investment affects surrender charges can help you make informed decisions about withdrawals or cancellations. Insurance companies and financial institutions use different methods to calculate surrender charges. Knowing how these charges are calculated can help you anticipate the potential costs of early withdrawals or policy cancellations. Some surrender charges are calculated as a percentage of the policy's cash value or the amount withdrawn from an annuity. The percentage may decrease over time, usually on an annual basis, until the surrender charge is no longer applicable. This method of calculation is commonly used in whole life and universal life insurance policies, as well as in annuities. Surrender charge schedules are tables that outline the surrender charges for each year of the policy or investment. These schedules often show a declining surrender charge percentage over time, eventually reaching zero. By reviewing the surrender charge schedule, policyholders and investors can determine the exact costs associated with surrendering their policy or investment at any given time. There are several strategies policyholders and investors can employ to reduce or avoid surrender charges on their life insurance policies and annuities. Being aware of these strategies can help you make the best financial decisions for your unique circumstances. Many life insurance policies and annuity contracts include free withdrawal provisions, which allow policyholders or investors to withdraw a certain amount of money without incurring surrender charges. These provisions typically have limitations, such as a maximum withdrawal amount per year or a requirement that the policy or investment has been in force for a specific period. Taking advantage of free withdrawal provisions can help minimize or avoid surrender charges. When shopping for life insurance policies or annuities, it's essential to compare surrender charges among different products. Choosing a policy or investment with lower surrender charges or a shorter surrender period can help reduce the potential costs associated with early withdrawals or cancellations. Surrender charges can have tax implications for policyholders and investors. Understanding the potential tax consequences of surrender charges can help you make informed decisions about your financial products. In some cases, the surrender of a life insurance policy or an annuity can result in taxable income. When you withdraw funds from a policy or investment, the gains on the cash value or investment may be subject to income tax. The surrender charge may reduce the taxable portion of the withdrawal, but it's essential to consult with a tax professional to understand the specific tax implications for your situation. If you withdraw funds from an annuity before the age of 59½, you may be subject to a 10% early withdrawal penalty in addition to any applicable surrender charges and income taxes. This penalty can significantly increase the overall cost of early withdrawals, so it's crucial to consider the potential penalties when making decisions about your annuity. There are several alternatives to surrendering a life insurance policy or investment that can help you avoid or minimize surrender charges and potential tax consequences. Considering these options can help you make more informed decisions about managing your financial products. Many life insurance policies with a cash value component allow policyholders to take out loans against their policy's cash value. Policy loans can provide access to funds without incurring surrender charges or tax consequences, as long as the loan is repaid according to the policy's terms. However, it's essential to understand that unpaid loans can reduce the death benefit and may have other long-term consequences. A 1035 exchange is a tax-free transfer of funds from one life insurance policy or annuity to another, provided certain conditions are met. This option can be beneficial if you're looking to switch to a different policy or investment with more favorable terms, without incurring surrender charges or tax consequences. It's important to consult with a financial professional to ensure a 1035 exchange is the right choice for your specific situation. Instead of surrendering an annuity, you may choose to convert it into an income stream by selecting an annuity income option. These options typically include lifetime income, joint and survivor income, or period-certain income. By selecting an annuity income option, you can avoid surrender charges and potentially minimize tax consequences while receiving a steady stream of income during your retirement years. Understanding surrender charges is crucial for making informed decisions about life insurance policies and annuities. By familiarizing yourself with the types of products that carry these charges, the factors affecting them, and the strategies for reducing or avoiding them, you can better manage your financial future. Additionally, being aware of the tax implications and potential alternatives to surrendering a policy or investment can help you make the best choices for your unique circumstances.Definition of Surrender Charges

Types of Insurance and Investment Products With Surrender Charges

Life Insurance Policies

Annuities

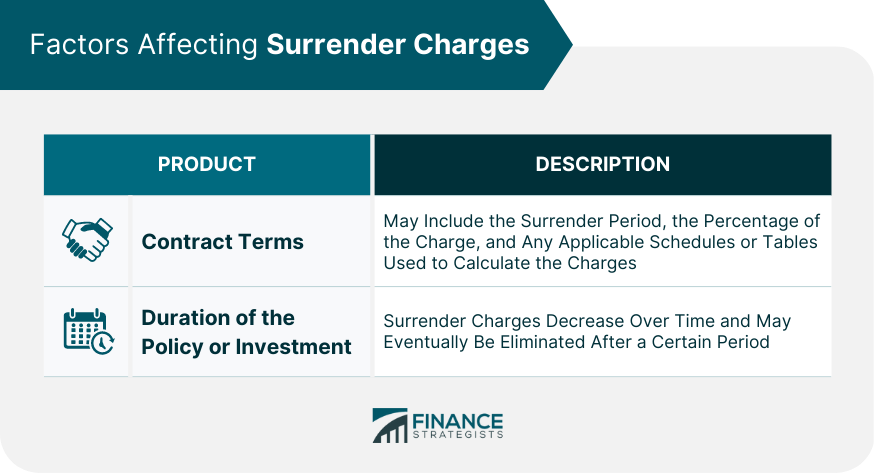

Factors Affecting Surrender Charges

Contract Terms

Duration of the Policy or Investment

Calculation of Surrender Charges

Percentage-Based Surrender Charges

Surrender Charge Schedules

Strategies for Reducing or Avoiding Surrender Charges

Utilizing Free Withdrawal Provisions

Selecting Policies or Investments With Lower Surrender Charges

Tax Implications of Surrender Charges

Income Tax Consequences

Potential Penalties for Early Withdrawals

Alternatives to Surrendering a Policy or Investment

Policy Loans

1035 Exchanges

Annuity Income Options

Conclusion

Surrender Charges FAQs

Surrender charges are fees imposed by an insurance company or financial institution for withdrawing funds from an annuity or life insurance policy before the end of its term.

Surrender charges vary depending on the type of policy, the length of time the policy has been in effect, and the amount of money being withdrawn. Typically, the charge decreases over time.

Surrender charges can often be avoided by waiting until the end of the policy term to withdraw funds. Additionally, some policies may offer a limited number of penalty-free withdrawals.

Surrender charges are commonly associated with specific types of life insurance policies and annuities.

In some cases, it may be possible to negotiate the surrender charge with the insurance company or financial institution. However, this depends on the policy and the specific circumstances surrounding the withdrawal.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.