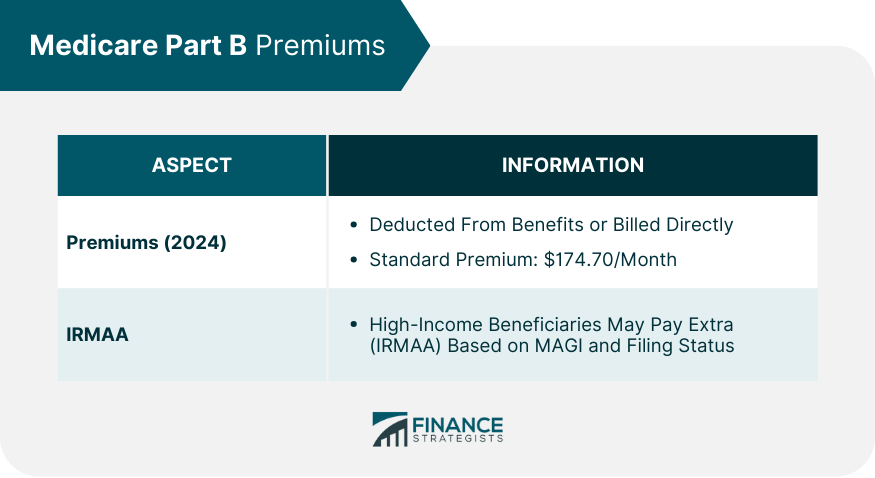

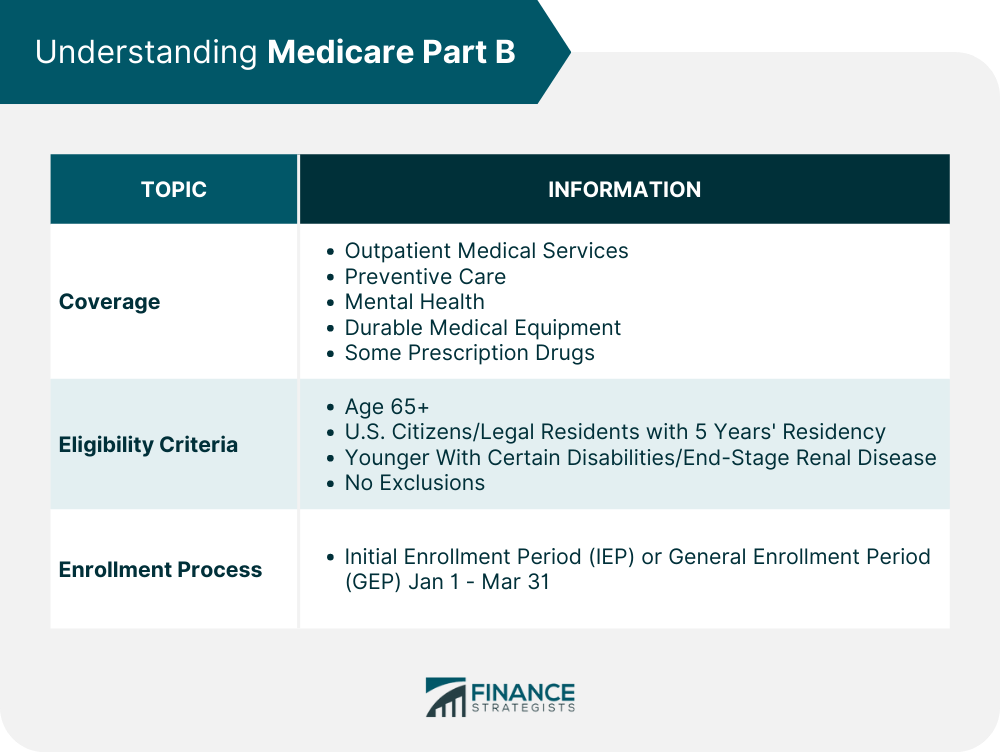

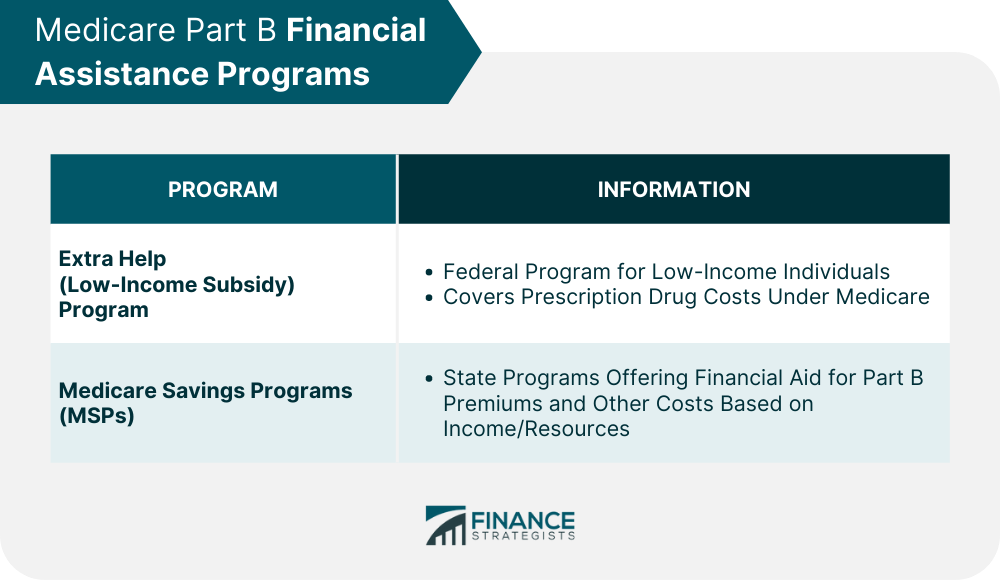

Medicare Part B, often known as medical insurance, is a part of the federal government's Original Medicare program. It offers coverage for a variety of outpatient medical services, such as doctor's visits, preventive care, diagnostic tests, and durable medical equipment. This component of Medicare is optional and carries a monthly premium. Essentially, Part B is designed to cover the medical costs that you would typically incur outside of a hospital setting. Medicare Part B requires a monthly premium, which is typically deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you don't receive these benefits, you'll get a bill. The standard premium amount changes each year, but in 2024, the standard premium for Medicare Part B is $174.70 per month. If your modified adjusted gross income (MAGI) is above a certain threshold, you might have to pay an Income-Related Monthly Adjustment Amount (IRMAA) in addition to your standard premium. This is essentially an extra charge that applies to high-income Medicare beneficiaries. The exact amount of your IRMAA will depend on your tax return from two years ago and your filing status. Medicare Part B has an annual deductible that beneficiaries must pay before Medicare begins to cover its share. Like the premium, this deductible can change from year to year. The annual deductible for Medicare Part B is $240. After you meet your deductible, you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment. This is known as your coinsurance. For some services, you may also have a copayment, which is a fixed amount you pay for each service or item. Medicare Part B covers a wide range of outpatient medical services. This includes but is not limited to office visits with doctors or other healthcare providers, and preventive services like screenings and vaccinations. Generally, individuals who are 65 years or older, U.S. citizens, or legal residents who have lived in the U.S. for at least five years are eligible for Medicare Part B. Younger individuals with certain disabilities or end-stage renal disease may also qualify. There is no health questionnaire or pre-existing condition exclusion, making it accessible to virtually all seniors who meet the age and residency requirements. The enrollment process for Medicare Part B often begins during your Initial Enrollment Period (IEP), a seven-month timeframe that starts three months before your 65th birthday, includes your birth month and ends three months after your birth month. You can also sign up during the General Enrollment Period (GEP) from January 1 through March 31 each year if you didn't enroll when you were first eligible. The annual Medicare Open Enrollment Period does not apply to Part B, it's typically for changing your existing Medicare coverage. The Extra Help program, also known as the Low-Income Subsidy (LIS), is a federal program that helps eligible low-income individuals pay for prescription drugs. This program can help cover the costs of Medicare prescription drug coverage, including premiums, deductibles, and coinsurance. Medicare Savings Programs (MSPs) are state programs that provide financial assistance to individuals with limited income and resources. They can help pay your Medicare Part B premiums and, in some cases, may also pay for Part B deductibles, coinsurance, and copayments. If you don't sign up for Medicare Part B when you're first eligible and you don't qualify for a Special Enrollment Period, you may have to pay a late enrollment penalty for as long as you have Part B coverage. This penalty is typically 10% of the standard premium for each full 12-month period that you could have had Part B but didn't sign up for it. The Part B late enrollment penalty is calculated by multiplying the standard premium by 10% for each full 12-month period that you were eligible but didn't enroll. The resulting amount is then added to your monthly premium. This extra amount must be paid for as long as you have Part B coverage. Many preventive services, such as screenings for heart disease, diabetes, and certain types of cancer, are covered by Medicare Part B at no cost to you. By utilizing these services, you can often catch health issues early when they're easier and less costly to treat. Medicare Supplement Insurance (Medigap) is sold by private companies and can help pay some of the health care costs that Original Medicare doesn't cover, like coinsurance and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. With the rise of telemedicine, many Medicare beneficiaries can now access healthcare services from the comfort of their homes, often at a lower cost than traditional in-person visits. Similarly, wellness programs, like those that offer nutrition counseling or fitness classes, can help improve your overall health and potentially reduce your need for more costly healthcare services down the line. Medicare Part B, or medical insurance, is a vital aspect of Original Medicare, covering outpatient services and medical equipment. It requires a monthly premium, which may be supplemented by an Income-Related Monthly Adjustment Amount (IRMAA) for high-income individuals. Beneficiaries are responsible for an annual deductible and coinsurance for most services. Financial assistance programs like Extra Help and Medicare Savings Programs can aid low-income beneficiaries with their Part B costs. To reduce expenses, beneficiaries should utilize preventive services, consider Medigap policies, and explore cost-effective healthcare options such as telemedicine and wellness programs. Being well-informed empowers Medicare beneficiaries to optimize their healthcare budget and access the best possible medical care.What Is Medicare Part B?

Medicare Part B Premiums Cost

Standard Premium Rates for Medicare Part B

Income-Related Monthly Adjustment Amount (IRMAA) for High-Income Beneficiaries

Medicare Part B Deductibles and Copayments

Annual Deductible for Medicare Part B

Copayment and Coinsurance Details for Various Services Covered Under Part B

Understanding Medicare Part B

Coverage

This also covers mental health care, physical therapy, and durable medical equipment like wheelchairs or walkers. Additionally, Part B covers some prescription drugs that you would receive in a hospital outpatient setting or a doctor's office.Eligibility Criteria

Enrollment Process

Financial Assistance Programs

Introduction to Extra Help (Low-Income Subsidy) Program for Prescription Drug Coverage

Medicare Savings Programs (MSPs) for Assistance With Part B Premiums and Other Costs

Late Enrollment Penalties

Tips for Reducing Medicare Part B Costs

Utilize Preventive Services

Consider Medigap (Medicare Supplement) Policies

Explore Alternative Healthcare Options

Conclusion

How Much Is Medicare for Part B? FAQs

Medicare Part B costs, including premiums and deductibles, can change each year. The Centers for Medicare & Medicaid Services (CMS) usually announce the costs for the upcoming year in the fall.

IRMAA stands for Income-Related Monthly Adjustment Amount. If your income is above a certain limit, you'll pay an extra amount in addition to your Medicare Part B premium. This extra amount is the IRMAA.

Yes, you can refuse Medicare Part B coverage. When you're first eligible for Medicare, you can choose to only accept Part A, which usually doesn't require a monthly premium. However, keep in mind that if you refuse Part B initially and then decide to get it later, you may have to pay a late enrollment penalty.

Some prescription drugs are covered under Medicare Part B, typically those you wouldn't usually give to yourself, like drugs given in a doctor's office or hospital outpatient setting.

Medicare Part A is hospital insurance and covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B, on the other hand, covers outpatient care, doctor's services, preventive services, and medical equipment. Together, Parts A and B make up Original Medicare.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.