Whole life insurance policies are designed to provide financial protection to the insured's beneficiaries upon their death. The policyholder pays premiums, and in return, the insurance company guarantees a death benefit payout to the designated beneficiaries. In addition to the death benefit, whole life insurance policies also accumulate cash value over time, which can be accessed during the policyholder's lifetime. Unlike whole life insurance, term life insurance provides coverage for a specified term, usually ranging from 10 to 30 years. If the insured dies within the term, the beneficiaries receive the death benefit. However, if the insured outlives the term, the coverage ends, and no benefits are paid. Term life insurance policies do not accumulate cash value and typically have lower premiums compared to whole life insurance. Whole life insurance policies guarantee a death benefit payout to the beneficiaries as long as the policyholder continues to pay the required premiums. This provides financial security for the insured's loved ones, regardless of when the insured dies. Whole life insurance policies have level premium payments, meaning the premium amount remains the same throughout the policyholder's life. This can make budgeting for insurance costs more manageable, as the premiums do not increase as the policyholder ages. A portion of the premiums paid into a whole life insurance policy goes toward building the policy's cash value. The cash value grows tax-deferred over time and can be accessed during the policyholder's lifetime for various purposes, such as paying for college tuition, funding retirement, or supplementing income. Some whole life insurance policies, particularly those issued by mutual insurance companies, may pay dividends to policyholders. Dividends are not guaranteed, but when paid, they can be used to reduce premiums, increase the death benefit, or add to the policy's cash value. Traditional whole life insurance policies have fixed premium payments and a guaranteed death benefit. The cash value grows at a guaranteed rate set by the insurer. In a single-premium whole life policy, the policyholder pays a lump sum upfront to fully fund the policy. This eliminates the need for ongoing premium payments and allows the cash value to grow more quickly. Limited-pay whole life policies have a shortened premium payment period, such as 10, 15, or 20 years, after which the policy becomes fully paid up and no further premiums are required. The death benefit and cash value accumulation features remain in effect for the insured's entire life. Modified premium whole life policies have lower initial premium payments that increase after a specified period, typically 5 to 10 years. This can make the policy more affordable in the early years but may result in higher premiums later in life. Indexed whole life policies link the growth of the cash value to a market index, such as the S&P 500. This can potentially result in higher cash value growth if the index performs well, but the policyholder also assumes the risk of lower growth if the index underperforms. Whole life insurance policies provide coverage for the insured's entire life, as long as premiums are paid. This ensures financial protection for the insured's beneficiaries, regardless of when the insured dies. The cash value component of whole life insurance can serve as a financial resource during the policyholder's lifetime. It can be accessed through loans or withdrawals for various purposes, such as funding retirement, paying off debt, or covering unexpected expenses. Whole life insurance policies offer several tax advantages, including tax-deferred growth of the cash value and tax-free death benefits for beneficiaries. Policy loans and withdrawals may also be tax-free, as long as they do not exceed the policy's cost basis. For individuals who struggle with saving money, whole life insurance can serve as a forced savings mechanism. Premium payments contribute to the policy's cash value, which grows over time and can be accessed later in life. Whole life insurance policies typically have higher premium payments compared to term life insurance policies. This can make it challenging for some individuals to afford the coverage they need. Whole life insurance policies can be more complex than term life insurance, with various features and options that may be confusing to some policyholders. Understanding the details of a whole life insurance policy is crucial to making an informed decision. With a whole life insurance policy, the policyholder commits to paying level premiums for their entire life. If financial circumstances change, the policyholder may find it difficult to continue making premium payments, potentially resulting in a lapse of coverage. Determining whether whole life insurance is the right choice depends on individual needs and financial goals. Some factors to consider when making this decision include: The need for lifelong coverage versus coverage for a specific term The ability to afford higher premium payments The desire to accumulate cash value as a financial resource The need for tax advantages offered by whole life insurance Before purchasing a whole life insurance policy, it is essential to carefully evaluate your financial situation and discuss your options with a qualified financial professional. This will ensure that you make the best decision for your needs and financial goals. Whole life insurance is a versatile financial product that provides lifelong coverage and additional benefits, such as cash value accumulation and tax advantages. However, it comes with higher premium payments and can be more complex than term life insurance. Therefore, it's essential to carefully consider your individual needs, financial goals, and circumstances before deciding whether whole life insurance is the right choice for you. When evaluating your life insurance options, it is crucial to consult with a qualified financial professional who can help you navigate the complexities of different insurance products and determine the most suitable coverage for your unique situation. By doing so, you can make an informed decision and secure the financial protection you need for yourself and your loved ones.What Is Whole Life Insurance?

Features of Whole Life Insurance

Guaranteed Death Benefit

Level Premium Payments

Cash Value Accumulation

Dividends

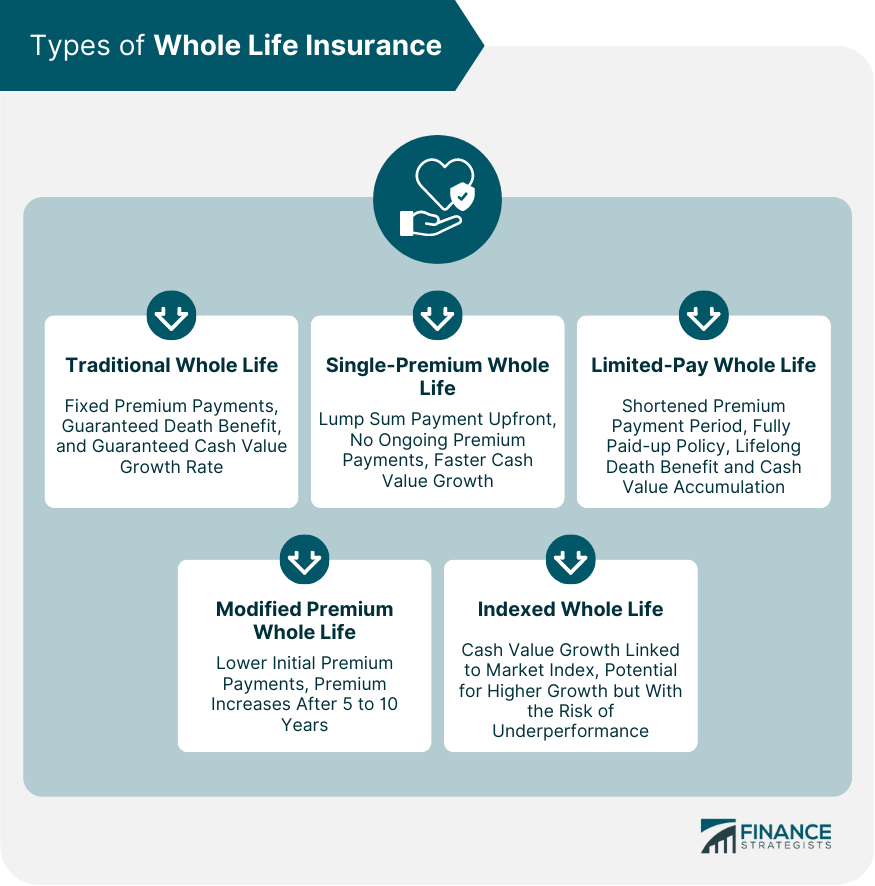

Types of Whole Life Insurance

Traditional Whole Life

Single-Premium Whole Life

Limited-Pay Whole Life

Modified Premium Whole Life

Indexed Whole Life

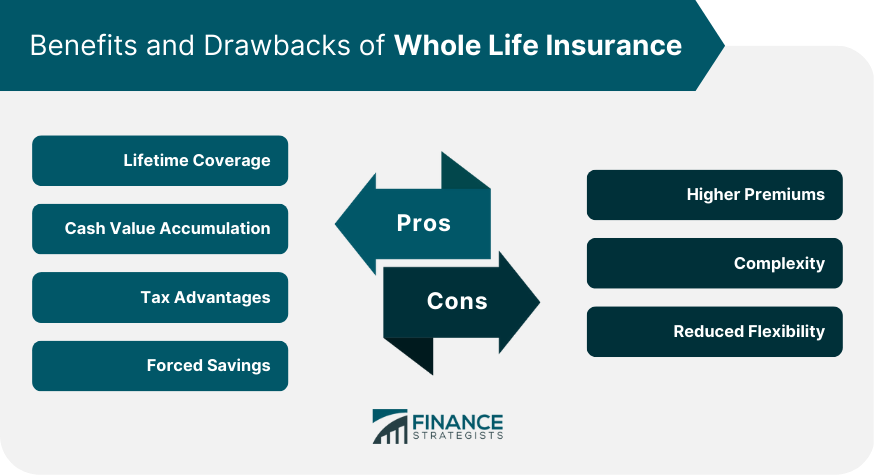

Advantages of Whole Life Insurance

Lifetime Coverage

Cash Value Accumulation

Tax Advantages

Forced Savings

Disadvantages of Whole Life Insurance

Higher Premiums

Complexity

Reduced Flexibility

Is Whole Life Insurance Right for You?

Final Thoughts

Whole Life Insurance FAQs

Whole life insurance is a type of permanent life insurance policy that provides coverage for the policyholder's entire lifetime, as long as premiums are paid. Whole life insurance policies also accumulate a cash value over time, which can be accessed through loans or withdrawals.

Term life insurance provides coverage for a specific period of time, typically 10 to 30 years, and does not accumulate a cash value. Whole life insurance, on the other hand, provides coverage for the policyholder's entire lifetime and builds a cash value over time.

The primary benefit of whole life insurance is its permanence - the policy provides coverage for the policyholder's entire lifetime, as long as premiums are paid. Whole life insurance policies also build cash value over time, which can be accessed to cover unexpected expenses or provide a source of income in retirement.

Whole life insurance policies tend to have higher premiums than term life insurance policies due to the permanent coverage and cash value accumulation. Additionally, the investment component of whole life insurance policies may not provide the same level of returns as other investment options.

Whole life insurance may be a good choice for individuals who want permanent life insurance coverage and the ability to build cash value over time. However, it may not be the best choice for those who prioritize low-cost insurance coverage or prefer a more straightforward life insurance policy. It's important to consult with a financial professional to determine if whole life insurance is the right choice for your individual needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.